- Home

- »

- Medical Devices

- »

-

Tumor Ablation Market Size & Share, Industry Report, 2033GVR Report cover

![Tumor Ablation Market Size, Share & Trends Report]()

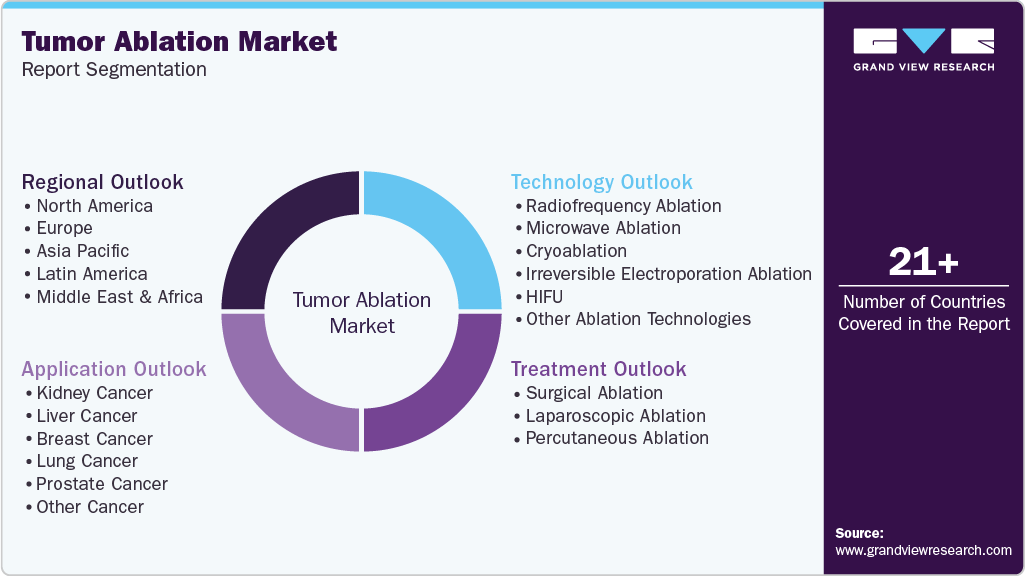

Tumor Ablation Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Radiofrequency Ablation, Microwave Ablation, Cryoablation, HIFU), By Treatment, By Application (Kidney Cancer, Liver Cancer, Breast Cancer), By Region, And Segment Forecasts

- Report ID: 978-1-68038-746-9

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tumor Ablation Market Summary

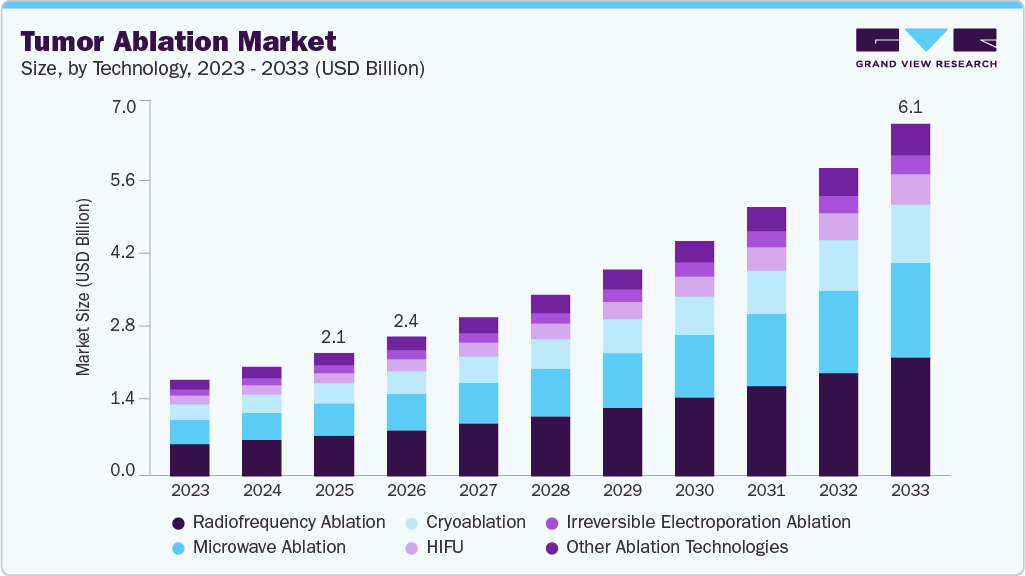

The global tumor ablation market size was estimated at USD 2.14 billion in 2025 and is projected to reach USD 6.10 billion by 2033, growing at a CAGR of 14.1% from 2026 to 2033. Ablation is a treatment that destroys tumors without removing them.

Key Market Trends & Insights

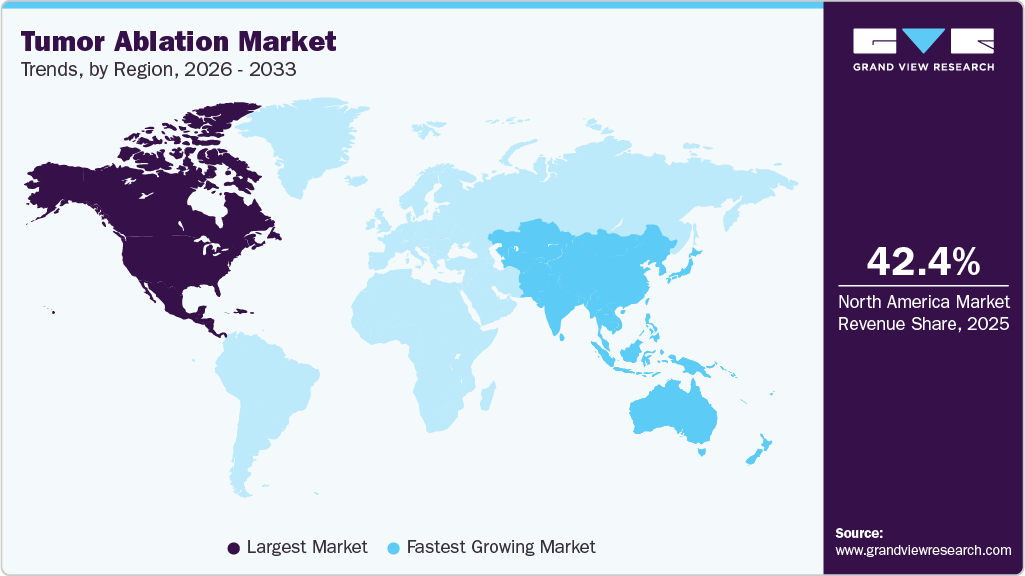

- North America's tumor ablation market held the largest share of 42.4% of the global market in 2025.

- The U.S. tumor ablation industry is expected to grow significantly over the forecast period.

- By technology, the radiofrequency ablation segment held the highest market share of 32.9% in 2025.

- By treatment, the percutaneous ablation segment held a leading market share in 2025.

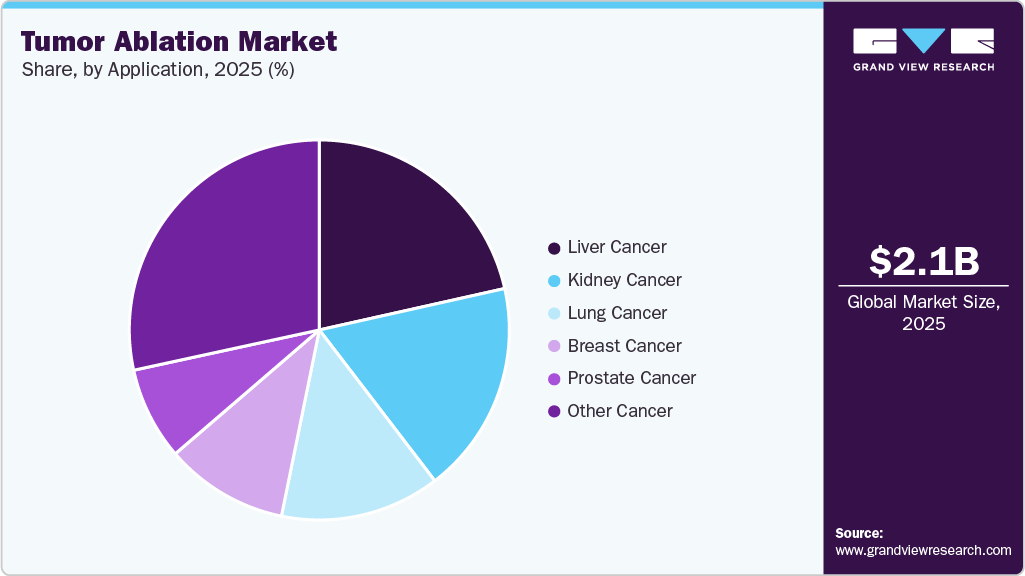

- By application, the liver cancer segment held a leading market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.14 Billion

- 2033 Projected Market Size: USD 6.10 Billion

- CAGR (2026-2033): 14.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

This technique is useful in patients with a few small tumors and, at times, when surgery is not an option. Moreover, patients getting this type of treatment do not need to stay in the hospital, thereby increasing the adoption rate of ablation systems among individuals. Rise in the prevalence of various types of cancers, such as those of breast, colon, prostate, and lung, is anticipated to boost the demand for ablation technologies for the treatment of tumors in the kidney, soft tissue, liver, and bone. Cancer is considered a universal healthcare problem, as it is one of the leading causes of death. For instance, according to the National Center for Health Statistics, in 2023, almost 1,958,310 new cancer cases and 609,820 cancer deaths were estimated in the U.S.Moreover, the increase in the geriatric population in the Asia Pacific region, especially in countries with large untapped opportunities, such as Japan, India, and China, is expected to drive the market over the forecast period. Furthermore, elderly people (aged ≥65) are currently the fastest-growing group among the general population in the U.S. According to the U.S. Census Bureau’s 2017 National Population Projections, by 2060, nearly one in four U.S. citizens is likely to be an older adult. According to the same source, by 2030, all baby boomers are expected to be older than 65.

Technological advancements in ablation devices have facilitated accuracy, portability, and cost-effectiveness, encouraging market players to launch and improve advanced devices constantly. Irreversible electroporation, High-intensity focused ultrasound (HIFU), cryoablation, and image-guided equipment are some of the major examples of technological advancements in the market. Alterations in existing technologies and the introduction of novel ablation techniques make it possible to treat larger & more complex tumors in other organs. Furthermore, developments in intraprocedural imaging aim to increase treatment quality and minimize complications. Hence, advancements in intraprocedural imaging have improved treatment preparation and offer accurate assessment of the ablation zone during treatment.

Several market participants aim to develop and launch novel ablation devices to maintain strong positions in the market, and several ablation systems are receiving regulatory approval from the U.S. FDA. For instance, in September 2022, the U.S. FDA granted 510(k) clearance to Stryker’s OptaBlate bone tumor ablation system (OptaBlate), according to a statement from Stryker. With the inclusion of OptaBlate technology in its portfolio, company’s Interventional Spine (IVS) portfolio now offers a full range of therapeutic options for metastatic vertebral body fractures, expanding on its core capabilities in vertebral augmentation and Radiofrequency Ablation (RFA).

Moreover, demand for minimally invasive procedures is increasing as they result in lower trauma to the patient and facilitate quicker recovery compared to invasive procedures. No incision is required in a tumor ablation procedure, making it noninvasive. Another factor driving the demand for minimally invasive surgeries is the risk of infection during open surgeries. Noninvasive methods decrease hospital stays by saving time and medical costs. Furthermore, a rise in the aging population and the prevalence of obesity is expected to boost market growth. According to the World Health Organization (WHO), 1 in 6 people worldwide will be 60 years or above by 2030. Thes efcators are collectively contributing to the growth of tumor ablation market.

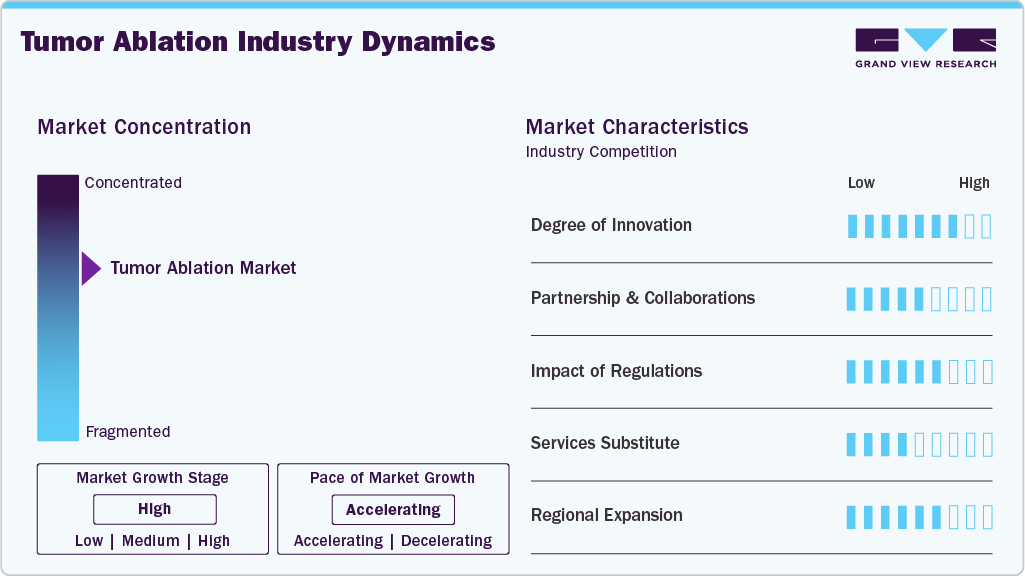

Market Concentration & Characteristics

The tumor ablation market is moderately concentrated, with leading companies such as Medtronic, Boston Scientific, Johnson & Johnson (Ethicon), and Bioventus Inc. (Misonix Inc.)holding a significant share of the market. These players offer advanced ablation technologies, including radiofrequency ablation (RFA), microwave ablation (MWA), cryoablation, and irreversible electroporation, enabling precise tumor targeting, reduced procedure time, and improved patient outcomes. The market is continuously evolving due to technological advancements in energy delivery systems, image-guided ablation, and minimally invasive treatment approaches. In addition, the rising prevalence of cancer, growing preference for minimally invasive oncology procedures, and increasing adoption of ablation for liver, lung, kidney, and bone tumors are driving market growth and encouraging new entrants to introduce specialized and application-specific ablation solutions.

The tumor ablation market is undergoing major innovations and advancements such as fusion imaging, 3D visualization, and navigation software further assist clinicians in planning and executing procedures, particularly in anatomically challenging locations such as the liver, kidneys, and lungs. For instance, in June 2022 Boston Scientific launched a technology named DirectSense technology. This technology is beneficial for monitoring the effect of radiofrequency for cardiac procedures and may be later employed for tumors.

Partnering and collaboration play a major role in the tumor ablation market, enabling companies to gain access to advanced technologies, novel energy-based platforms, and image-guided treatment solutions. For instance, in October 2025 Medtronic partnered with Techsomed Ltd., a medical AI-powered software company specializing in image-guided therapy, to bring together Techsomed’s BioTracel)360 software and Medtronic. Similarly, in March 2023, The company announced a new partnership with AddLife in Ireland, the UK, & Nordics. Under the new partnership, AddLife can distribute AngioDynamic's oncology and surgical portfolio in Nordics, Ireland, and the UK.

The regulatory environment for tumor ablation devices aims to protect patients and ensure effectiveness, reflecting the high risks associated with these medical tools. Regulatory approvals play a critical role in market access and adoption. For instance, in March 2024, Medtronic received U.S. FDA clearance for their OsteoCool 2.0 bone tumor ablation system. This clearance has been initiated as a limited market release and a broad U.S. launch had been planned for 2025.

Product substitutes in the tumor ablation market include surgical tumor resection, radiation therapy, chemotherapy, immunotherapy, and targeted drug therapies, which are widely used in cancer treatment. In early-stage or localized tumors, surgery is often preferred due to its curative potential, while radiation therapy serves as a non-invasive alternative for inoperable cases. Systemic therapies such as chemotherapy and immunotherapy are commonly chosen for advanced or metastatic cancers. These alternatives can limit the adoption of tumor ablation, especially where long-term clinical evidence, reimbursement support, or physician familiarity with ablation technologies remains limited.

Regional expansion in the tumor ablation market is gaining momentum across all major regions, driven by increasing awareness of minimally and non-invasive cancer treatment options, rising cancer incidence, and improving healthcare infrastructure. Companies are actively expanding their geographic presence through distribution agreements, partnerships, and local collaborations to strengthen market access. For instance, in February 2022, The Mermaid Medical and Canyon Medical signed a 3-year exclusive contract for the distribution of microwave ablation in Spain, the UK, and the Netherlands. Such strategic initiatives enable faster market penetration, improve product availability, and support the adoption of advanced tumor ablation technologies across Europe and other high-growth regions.

Technology Insights

The radiofrequency ablation segment dominated the market in 2025 and accounted for the largest share of 32.9% of the overall revenue. Radiofrequency Ablation (RFA) is a minimally invasive cancer treatment that employs heat and electrical energy to destroy cancer cells. Radiologists use imaging tests to guide a small needle through the skin or an incision and into the cancer tissue. High-frequency radiation enters the needle and heats the tissue around it, killing the cells in the area. Recent studies have also indicated that RFA is an effective approach for papillary thyroid carcinoma, particularly in low-risk settings. In the experience of many centers and practitioners, there is a high tumor volume reduction with little or no complications. So, RFA has emerged as a safe, minimally invasive alternative to surgery, particularly when performed in an experienced center. Beyond oncology, sacroiliac joint, back, and neck pain are managed with RFA in an outpatient setting. Technology offers several benefits, including reduced dependence on opioids or analgesics, faster recovery, and longer-lasting pain relief compared to steroid injections.

The microwave ablation segment is expected to witness the fastest CAGR of 14.9% over the forecast period. Microwave ablation involves electromagnetic waves for tumor destruction, with the device having a frequency of at least 900 MHz. It has various advantages over other techniques in terms of effectiveness in destroying tumor cells. The benefits of this technology include consistency in high temperature, larger tumor ablation volume, lesser ablation time, reduced pain, and optimal heating of the cystic mass. Such advantages are expected to boost the segment growth. The increasing acceptance is further supported by technological advancements and clinical evidence to support various techniques. For instance, the recently released IntelliBlate system from Varian, in Europe, provides integrated image-guided microwave ablation for soft tissue tumors to improve precision and treatment effect. Microwave ablation has also been recognized as a reliable and effective global standard for treating colorectal liver metastases, with studies such as the COLLISION trial demonstrating outcomes comparable to surgical resection while reducing hospital stays and complications.

Treatment Insights

The percutaneous ablation segment dominated the market and held the largest revenue share in 2025. Percutaneous tumor ablation, a minimally invasive medical therapy, eliminates the need for open surgery by treating tumors from outside of the body through the skin. This method uses different energy sources, such as heat or cold, to destroy or shrink tumor tissue. Percutaneous ablation frequently employs image guidance methods such as ultrasound, CT scans, or MRI to target the tumor precisely. The thermal ablation of localized solid tumors is currently feasible using various percutaneous image-guided techniques. These therapeutic methods use high-intensity ultrasound, laser, microwave, and radiofrequency as their thermal sources. Recent clinical evidence now confirms the role of percutaneous thermal ablation in breast cancer. The THERMAC trial is a phase 2 randomized study in postmenopausal women with early-stage, estrogen receptor-positive, HER2-negative breast cancer that evaluated three percutaneous thermal techniques: radiofrequency ablation (RFA), microwave ablation (MWA), and cryoablation (CA). Cryoablation demonstrated a complete ablation rate of 94% without reported adverse events, while microwave ablation had a complete ablation rate of 72% accompanied by some complications.

The laparoscopic ablation segment is expected to witness the fastest CAGR over the forecast period. The advantages such as less postoperative discomfort, shorter hospital stays, and speedier recovery times drives the growth of segment. Different techniques can be employed for tumor ablation, such as RFA, cryoablation, microwave, and laser ablation. This approach offers less pain, shorter hospital stays, and faster recovery times than traditional surgery. This technique is more suitable for smaller and easily accessible tumors. Recent clinical experience by PubMed Central highlights laparoscopic ablation as an effective cancer treatment. A prospective study conducted at a high-volume Scandinavian center demonstrated that ultrasound-guided laparoscopic microwave ablation achieved complete tumor ablation in all patients treated, with most patients experiencing minimal complications. Only a few cases required conversion to open surgery. These factors contributes to the growth of segment.

Application Insights

The liver cancer segment dominated the industry and held the largest revenue share in 2025. Liver cancer is considered the most common type of cancer. Globally, around 800,000 people are diagnosed with the disease every year, and it accounts for more than 700,000 deaths each year. The American Cancer Society predicts that there will be about 42,240 new cases of liver cancer diagnosed in the U.S. in 2025 (28,220 in men and 14,020 in women). In total, 30,090 people will die due to this illness (19,250 men and 10,840 women). Hence, the adoption of tumor ablation techniques is increasing and is expected to drive the growth of market.

The lung cancer segmentis anticipated to grow at fastest CAGR over the forecast period. The increasing incidence of lung cancer, especially Non-Small Cell Lung Cancer (NSCLC), is driving the growth of this segment. Radiofrequency ablation is extensively used in NSCLC. It involves the usage of a needle or probe that is used to destroy target/tumor cells using heat. Local anesthesia is sometimes used in cases of expected pain/trauma. Currently, radiofrequency ablation is used as a third-line therapy in stage I NSCLC cancer patients (with tumor size <3 cm). However, owing to the growing incidence of lung cancer, the number of eligible lung cancer patients for radiofrequency ablation is expected to increase significantly. According to the American Cancer Society, in the U.S., there are anticipated to be 226,650 new cancer cases (110,680 in men and 115,970 in women) and 124,730 (64,190 in men and 60,540 in women) cancer deaths in 2025.

Regional Insights

North America tumor ablation market and accounted for the largest revenue share of 42.4% in 2025. This is owing to the government support for quality healthcare, high purchasing power, availability of reimbursement, and growing cancer cases in the U.S. as well as Canada. For instance, in the U.S., the Patient Protection and Affordable Care Act (PPACA), also known as ObamaCare, promotes quality & affordability of health insurance and reduces the cost of healthcare for individuals & government. In addition, precision medicine initiatives are helping in formulating tailored strategies to target unique characteristics of diseases. Such government initiatives are helping improve the overall healthcare system, which is expected to boost the tumor ablation procedures market.

The U.S. tumor ablation market is experiencing steady growth, driven by high healthcare expenditure, increasing demand for tumor ablation technologies, growing incidence of cancer, and growing awareness regarding early disease diagnosis. For instance, according to the American Cancer Society, in 2023, approximately 1,958,310 new cancer cases are expected to be diagnosed in the U.S. and approximately 609,820 patients will die due to the same. Therefore, various initiatives undertaken by the American Cancer Society to create awareness about cancer types are expected to drive the adoption of diagnostic and treatment procedures for these diseases. The death rate in cancer patients continue to decline in 2023. Cancer survival rate has also improved over the past few years, reflecting the quality of healthcare in the U.S., which is expected to contribute to market growth. In addition, rising geriatric population and growing incidence of obesity have increased the risk of cancer, which is anticipated to fuel adoption of cancer treatment & diagnosis.

Europe Tumor Ablation Market Trends

The European tumor ablation market is being reshaped by growing initiatives & awareness campaigns on early disease diagnosis and its treatment, greater extent of public funding in Europe’s healthcare system, increasing incidence of cancers, and rising life expectancy. Growing prevalence of cancer in Europe is expected to drive the market. According to WHO, Europe accounts for nearly a quarter of total cancer cases worldwide, with 3.7 million new patients every year. Among all types of cancers, stomach, lung, liver, breast, and colon cancers have caused the highest number of deaths every year. This increasing prevalnce of cancer is expected to drive the market growth in the region.

The UK tumor ablation market is steadily growing. High per capita income, presence of an established healthcare system, a significant number of healthcare professionals, proper access to healthcare services, availability of advanced devices, and favorable reimbursement policies are among the major factors driving the tumor ablation market in the UK. Furthermore, presence of well-trained & skilled surgeons, technological advancements, favorable government initiatives, rising healthcare expenditure, and high adoption of minimally invasive surgeries are expected to contribute to market growth.

The Spain tumor ablation market experiencing significant growth in global tumor ablation market. Spain has a favorable healthcare system that encourages several players to enter the country, propelling market growth. According to WHO, compared to other OECD European countries, the Spanish healthcare system is more advanced and promotes the adoption of innovative technologies among practitioners. This is expected to increase the adoption of tumor ablation devices in the country.

The Germany tumor ablation market is steadily growing. The growth is driven by factors such as technological advancements, high government spending on healthcare, and standardized procedures to treat cancers. The country’s cancer screening program follows a decentralized system, wherein mid to lower-level managers make most of the decisions. The program involves maintenance of stringent quality standards by medical specialists. Germany has an established healthcare system with trained medical surgeons. This is expected to contribute to the growth in number of tumor ablation procedures in the country.

Asia Pacific Tumor Ablation Market Trends

Tumor ablation are gaining traction in the Asia-Pacific region. The region is an emerging market for tumor ablation and is expected to grow at the fastest rate due to increasing disposable income, improving healthcare infrastructure, and rapidly growing economic conditions in the emerging markets of Japan, China, & India. The introduction of advanced technology, such as multi-needle electrodes, with higher accuracy and cost-effectiveness as well as portability, is expected to serve the market as a driver due to customizability. The large population with low per capita income in the Asia Pacific led to a high demand for affordable treatment options. Multinational companies are looking to invest in developing economies, such as India and China, to create a strong position in the market.

China tumor ablation market is benefits from increasing cancer cases and growing preference for safe & effective surgical ablation procedures. Many studies in China are adopting tumor ablation procedures as an alternative treatment to conventional surgical treatments, which is expected to boost market growth. In 2024, China accounted for nearly 11-16% of fatalities caused by malignant tumors of the female reproductive system due to its significant population size and increasing aging population. Thus, with increasing cases of cancer in the country, the need for better diagnostics and therapeutics is expected to boost the adoption of tumor ablation devices. In addition, favorable reimbursement scenarios and approval of new products are expected to drive the market.

South Korea tumor ablation market is driven by government support for the healthcare and life sciences industries. Investments in R&D, as well as funding initiatives, encouraged the adoption of advanced technologies, such as minimally invasive tumor ablation surgeries. The increasing prevalence of cancer is expected to drive demand for tumor ablation devices. In addition, several strategic initiatives by market players in the country are contributing to the market growth. For instance, in September 2024, Archimed announced acquisition of Jeisys a South Korea based energy-based devices (RF, HIFU and related systems) manufacturer, to expand the geographical presence. This shiows increasing demand for tumor ablation devices across the country.

India tumor ablation market is driven by heavy burden of chronic diseases, including cancer, rising government initiatives to screen & diagnose cancer, and benefits of tumor ablation procedures. According to the data published by government of India ministry of health and family welfare department of health and family welfare, published in March 2025, in India, there were over 1.5 million cancer incidences. The standardized incidence rate for every 100,000 individuals was 18, while the prevalence rate over 5 years, across all age groups, and was 42.82 per 100,000 individuals. According to the National Cancer Registry Programme, cervical cancers were the most frequent among women. Cervical cancer contributed to 6% to 29% of all cancer cases in women in India. These factors are expected to drive the market growth. However, medium to high costs associated with tumor ablation surgery may limit market growth.

Latin America Tumor Ablation Market Trends

A significant rise in medical tourism is expected to accelerate the growth of the tumor ablation market across Latin America. Availability of advanced surgical procedures at a reduced cost compared to North America & Europe is making Latin America more attractive for medical tourism. Furthermore, governments of various countries are constantly working to improve the healthcare infrastructure. As a result, patients from developed countries, such as Canada, the U.S., and Germany, prefer Latin America for receiving treatments. Therefore, the anticipated increase in patients traveling to Latin America is expected to boost the demand for tumor ablation in the region.

The Brazil tumor ablation market is growing. According to WHO, among the Latin American countries, Brazil has the best healthcare system with cost-effective treatment options. Brazil has 43 Joint Commission International (JCI) accreditations for hospitals and institutions. According to the International Medical Travel Journal, private healthcare spending in Brazil is about 60% higher than in most Latin American countries. These factors have helped Brazil increase its share in the tumor ablation market.

Middle East & Africa Tumor Ablation Market Trends

The demand for tumor ablation in the Middle East is growing steadily due to high spending capacity & living standards, presence of well-established medical infrastructure, and increasing number of cases. The high cancer prevalence, coupled with an increasing preference for early disease diagnosis, is expected to drive market growth. In addition, growing government initiatives to increase reimbursement coverage are expected to boost market penetration during the forecast period.

The Saudi Arabia tumor ablation market growth is driven by increase in the demand for minimally invasive surgical procedures and advancements in tumor ablation devices. The growing incidence of cancer can be attributed to major changes in socioeconomic factors. Individual lifestyle is being modified amid societal change and Westernization, including factors such as processed food consumption & sedentary lifestyle. These lifestyle changes are likely to be responsible for the increase in the incidence of several diseases, including cancer. However, due to low awareness, the adoption of ablation devices is less in the country, which may restrict the market growth.

Key Tumor Ablation Company Insights

The tumor ablation market is highly competitive and has several key players. The major market players are focused on expanding their geographical presence, forming partnerships to enhance clinical outcomes and patient care through advanced ablation technologies taking advantage of important cooperation activities, and exploring mergers and acquisitions.

Key C-Reactive Protein Testing Companies:

The following are the leading companies in the tumor ablation market. These companies collectively hold the largest Market share and dictate industry trends.

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson Service Inc. (Ethicon, Inc.)

- AngioDynamics

- Bioventus Inc. (Misonix Inc.)

- EDAP TMS

- Chongqing Haifu Medical Technology Co., Ltd

- Mermaid Medical

- HealthTronics, Inc.

- H.S. Hospital Service S.p.A.

Recent Development

-

In June 2025, Medtronic received the FDA 510(k) clearance for Visualase V2 MRI-Guided Laser Ablation System, that uses minimally invasive laser technology for patients with epilepsy, brain tumors, and radiation necrosis.

-

In April 2023, AngioDynamics announced that it expanded its partnership with Cardiva for the complete distribution of AngioDynamic's vascular access portfolio in Portugal and Spain, which was initiated in 2012. The extended partnership will boost the company's global product reach.

Tumor Ablation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.42 billion

Revenue forecast in 2033

USD 6.10 billion

Growth rate

CAGR of 14.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, treatment, application,region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway: Japan; China India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; Boston Scientific Corporation; Johnson & Johnson Service Inc. (Ethicon, Inc.); AngioDynamics; Bioventus Inc. (Misonix Inc.); EDAP TMS; Chongqing Haifu Medical Technology Co., Ltd; Mermaid Medical; HealthTronics, Inc. ; H.S. Hospital Service S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tumor Ablation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. Forthis study, Grand View Research has segmented the global tumor ablation market report based on technology, treatment, application, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiofrequency Ablation

-

Microwave Ablation

-

Cryoablation

-

Irreversible Electroporation Ablation

-

HIFU

-

Other Ablation Technologies

-

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Surgical Ablation

-

Laparoscopic Ablation

-

Percutaneous Ablation

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Kidney Cancer

-

Liver Cancer

-

Breast Cancer

-

Lung Cancer

-

Prostate Cancer

-

Other Cancer

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Thailand

-

Australia

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tumor ablation market size was estimated at USD 2.14 billion in 2025 and is expected to reach USD 2.42 billion in 2026.

b. The global tumor ablation market is projected to grow at a compound annual growth rate (CAGR) of 14.1% from 2026 to 2033, reaching USD 6.10 billion by 2033.

b. North America dominated the tumor ablation market with a share of 42.4% in 2025. This is attributable to government support for quality healthcare, high purchasing power parity, availability of reimbursements, and the increasing prevalence of cancer.

b. Some key players operating in the tumor ablation market include Medtronic plc; Boston Scientific Corporation; Johnson & Johnson Service Inc. (Ethicon, Inc.); AngioDynamics; Bioventus Inc. (Misonix Inc.); EDAP TMS; Chongqing Haifu Medical Technology Co., Ltd; Mermaid Medical; HealthTronics, Inc. ; H.S. Hospital Service S.p.A.

b. Key factors that are driving the tumor ablation market growth include the rising prevalence of cancer and the high demand for safer therapeutic options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.