- Home

- »

- Advanced Interior Materials

- »

-

Tungsten Market Size, Share & Trends, Industry Report 2033GVR Report cover

![Tungsten Market Size, Share & Trends Report]()

Tungsten Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Powder, Mill Products, Tungsten Carbide Components), By End Use (Aerospace & Defense, Construction, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-454-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tungsten Market Summary

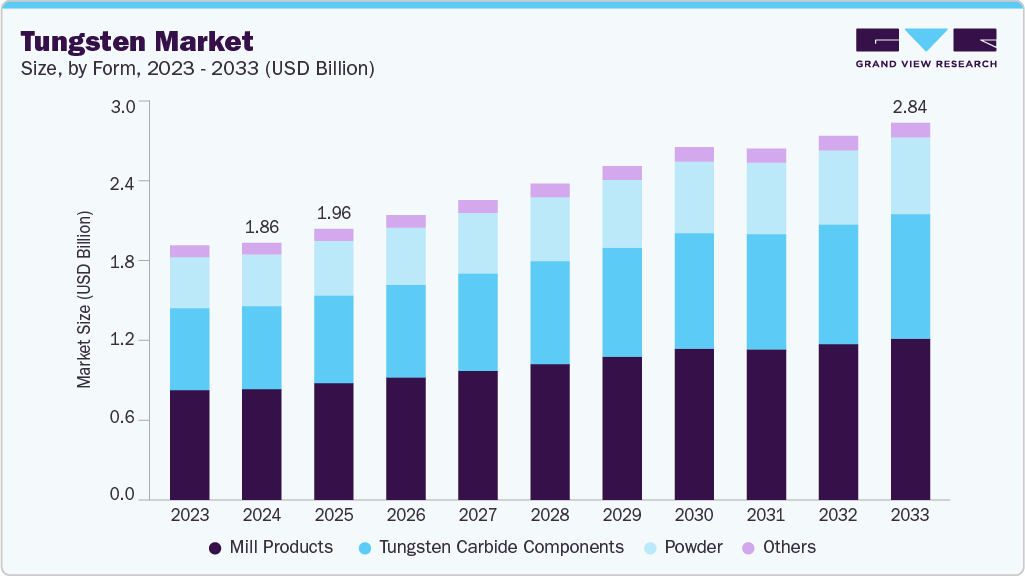

The global tungsten market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 2.84 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The strong growth is largely driven by the critical use of tungsten in hard metals and tooling applications.

Key Market Trends & Insights

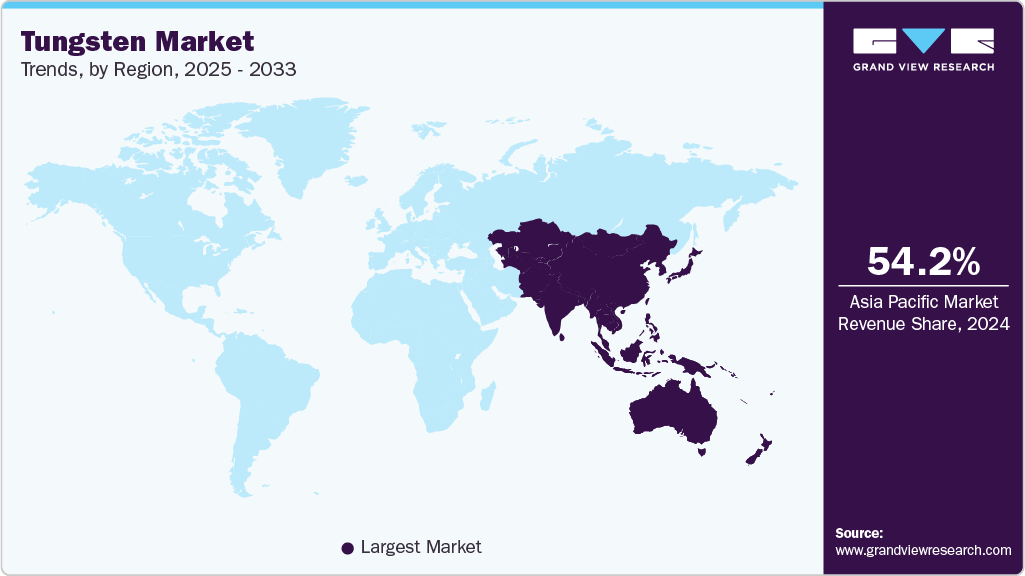

- Asia Pacific dominated the tungsten market with the largest revenue share of 54.1% in 2024.

- The tungsten market in the U.S. is expected to grow at a substantial CAGR of 3.9% from 2025 to 2033.

- By form, the mill products segment accounted for the largest market revenue share of over 43.0% in 2024.

- By end use, the electronics & robotics segment is anticipated to register the fastest CAGR of 4.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2033 Projected Market Size: USD 2.84 Billion

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

Tungsten carbide, a compound made by combining tungsten with carbon, is one of the hardest known materials and is widely used in manufacturing cutting tools, drill bits, mining equipment, and industrial machinery. These tools are essential in the automotive, aerospace, construction, and general manufacturing sectors.Its superior density, hardness, and high melting point make tungsten indispensable in the defense and aerospace sectors. In 2024, increased global defense spending, particularly by the U.S., China, and India, amplified the demand for tungsten-based armor-piercing projectiles, missile components, and aircraft counterweights. For instance, India's Ministry of Defence allocated higher funds for indigenous ammunition production, which includes tungsten carbide-based penetrators. Similarly, the aerospace sector in 2025 saw a surge in aircraft manufacturing, with Boeing and Airbus increasing deliveries, further boosting demand for tungsten alloys in control surfaces, engine components, and balance weights.

In the automotive industry, especially in high-performance and electric vehicles, tungsten usage is expanding due to its exceptional thermal and wear resistance. In 2024, global electric vehicle (EV) production reached 17.3 million units, marking a 25% increase compared to the previous year. China remained dominant, accounting for over 70% of global EV production, with around 12.4 million electric cars manufactured. This surge significantly boosted the need for tungsten-based components such as electrodes for precision welding, electrical contacts, and vibration-damping parts. Notably, Tesla expanded its use of tungsten alloys in motor assemblies and battery connectors. In 2025, luxury and performance vehicle manufacturers, including Porsche, BMW, and NIO, further integrated tungsten-heavy materials into brake systems and turbochargers to meet the growing demand for high-performance EVs across Europe and East Asia.

Tungsten is also vital for manufacturing drill bits, wear parts, and cutting tools used in mining and oil & gas exploration. In 2024, with oil prices stabilizing and exploration activities picking up, tungsten carbide tools saw a revival in demand, especially in North America and the Middle East. For example, Saudi Aramco's intensified deep drilling activities relied on advanced tungsten-based tools to withstand extreme temperatures and pressures. In 2025, the mineral exploration boom in South America, particularly for lithium and copper, further lifted demand for these durable tools used in rock fragmentation and ore extraction.

Carbide tools dominate the cutting tools industry due to their superior hardness and wear resistance. The resurgence of industrial manufacturing in 2024, especially in countries like China, Germany, and Vietnam, spurred tooling demand. For instance, China's push toward advanced manufacturing under its "Made in China 2025" policy led to increased consumption of tungsten-based inserts and end mills. In 2025, additive manufacturing also began using tungsten powders for precision components, further diversifying applications and adding a new growth dimension to the market.

Drivers, Opportunities & Restraints

The tungsten market is primarily driven by its critical role in industrial applications due to its exceptional properties like high density, hardness, and resistance to heat and corrosion. One of the main growth drivers is the rising demand for tungsten in the aerospace and defense sectors, where it is used to produce high-performance alloys, armor-piercing ammunition, and turbine components. Additionally, the growing consumption of tungsten in electronics and electrical applications, particularly semiconductors, filaments, and electrodes, is accelerating due to the global shift toward miniaturized and energy-efficient devices. The construction and mining sectors also contribute to demand through increased use of tungsten carbide in cutting tools, drills, and wear-resistant machinery.

Significant opportunities exist in the recycling of tungsten, especially in Europe and North America, where sustainability efforts and critical raw material recovery are prioritized. Recycling reduces dependency on primary sources, especially considering tungsten’s concentration in limited mining regions such as China. Moreover, emerging uses of tungsten in energy storage technologies, particularly in batteries and fuel cells, are expanding its market potential in the green energy sector. Technological advancements in additive manufacturing and 3D printing also open doors for tungsten powder applications, creating new pathways for market growth. Increasing emphasis on domestic sourcing and government-backed critical mineral strategies further supports investment opportunities in global tungsten exploration and development projects.

Despite its promising outlook, the tungsten industry faces several restraints. The market is highly concentrated, with China dominating global production and exports, leading to supply chain risks and price volatility. This dependency poses geopolitical concerns for other countries, particularly during trade disruptions. Environmental problems associated with tungsten mining, including habitat disruption and the use of hazardous chemicals, can also limit mining activities and trigger regulatory hurdles.

Form Insights

Mill products held the revenue share of 43.1% in 2024. The mill products segment in the tungsten market held a revenue share of 43.1% in 2024. The segment is witnessing steady growth due to its essential role in high-performance industrial and engineering applications. Mill products refer to semi-finished tungsten materials like rods, bars, plates, sheets, wires, and electrodes, which are widely used across industries for their high strength, durability, and heat resistance. These products are especially important in aerospace, electronics, automotive, and oil & gas sectors, where components are exposed to extreme conditions. The ability of tungsten to retain its strength at high temperatures and its excellent thermal conductivity make mill products highly valuable for tools, structural parts, and heat-resistant components.

Tungsten carbide components is anticipated to register the fastest CAGR over the forecast period. Tungsten carbide components are experiencing strong market growth primarily due to their unmatched hardness, wear resistance, and durability. These components are widely used in industries that involve abrasive environments or high-stress operations, such as mining, oil & gas, metalworking, and construction. Products like drill bits, cutting tools, nozzles, and wear plates made from tungsten carbide significantly outperform traditional steel-based tools in terms of lifespan and performance. As industrial operations become more demanding and efficiency-focused, the shift toward tungsten carbide components becomes more apparent, driving the segment’s steady expansion across global markets.

End Use Insights

Automotive held the revenue share of 25.4% in 2024. The automotive segment of the tungsten industry held a revenue share of 25.4% in 2024. It is a major end use industry for tungsten, driven by the metal’s superior properties such as high density, hardness, heat resistance, and wear durability. Tungsten-based products, particularly tungsten carbide components, are integral to automotive manufacturing processes, especially for tools used in machining, cutting, and shaping vehicle parts. As global vehicle production continues to rise steadily, particularly in emerging economies like India, Mexico, and Indonesia, the demand for tungsten tooling and parts used in engine components, transmission systems, and turbochargers has significantly increased. The push for improved vehicle performance and durability further enhances tungsten’s relevance in this sector.

The electronics & robotics segment is anticipated to register the fastest CAGR over the forecast period. Tungsten is employed in smartphones, laptops, tablets, and display panels in consumer electronics. For instance, tungsten is a key material in electrodes for LCDs and OLEDs and in X-ray targets for imaging devices. The proliferation of smart devices and increasing Internet of Things (IoT) penetration drive demand for more robust and compact electronic components, further accelerating the need for tungsten-based materials. With over 1.4 billion smartphones shipped globally in 2024, the rising production volume continues to fuel demand for high-performance materials like tungsten that support heat management and miniaturization.

Regional Insights

The Asia Pacific tungsten market held the largest revenue share of 54.2% in 2024. Ongoing infrastructure development and smart city projects primarily drive the growth. As urbanization accelerates across emerging economies such as India, Vietnam, and Indonesia, substantial investments are being made in roads, bridges, railways, and smart urban infrastructure. These developments require durable, high-performance materials, and tungsten, known for its exceptional hardness and high melting point, is increasingly used in construction tools, electrical systems, and structural applications supporting these transformative projects.

North America Tungsten Market Trends

The North America tungsten industry experienced substantial growth. With the increasing shift towards electric vehicles in the region, the demand for tungsten is also increasing. In 2024, the U.S. electric vehicle market continued its upward trajectory, with EVs (battery electric vehicles and plug-in hybrids combined) accounting for approximately 8.1% to 9.9% of all new light-duty vehicle sales, up from 7.8% in 2023. According to the U.S. Department of Energy and Argonne National Laboratory, over 1.3 million EVs were sold yearly, with BEVs representing the majority. The U.S. and Canadian governments are offering incentives to boost EV production and adoption, directly supporting the market growth. As vehicle production increases, so will the need for reliable, high-performance materials like tungsten.

U.S. Tungsten Market Trends

The U.S. tungsten industry is witnessing robust growth, largely driven by rising concerns over national security and supply chain vulnerabilities. The country has relied heavily on China for its tungsten needs for years, as China dominates global production. However, the Biden administration's recent geopolitical tensions and the 25% tariff on Chinese tungsten imports have accelerated the U.S. government's efforts to diversify sources and reduce this dependence. Measures such as the Department of Defense's plan to phase out procurement of Chinese and Russian tungsten by 2027 and support for allied mining operations in Canada and South Korea reflect a shift toward ensuring a more secure and independent supply chain. These policy changes are directly boosting demand for domestic and allied tungsten sources.

Europe Tungsten Market Trends

The tungsten industry in Europe is witnessing steady growth due to the continent's increased focus on securing critical raw materials. Tungsten has been classified as a strategic material by the European Union because of its importance in various industries and the risks associated with import dependency, especially from China, which dominates global production. To reduce this reliance, the EU supports domestic mining projects and streamlines regulations to promote local production. For example, efforts to revive tungsten mining in countries like the UK, Spain, and Austria reflect this policy shift. These initiatives are expected to increase Europe's self-sufficiency and stabilize the tungsten supply.

Latin America Tungsten Market Trends

The Latin America tungsten industry is anticipated to grow significantly over the forecasted period. As economies like Brazil and Mexico recover from recent downturns and invest in infrastructure development, the need for wear-resistant tools, high-strength alloys, and drilling components is surging, sectors where tungsten plays a critical role. Additionally, the shift toward energy transition and renewable projects, particularly geothermal and wind energy, is increasing the use of tungsten-based components due to their high temperature and corrosion resistance. Combined with a growing focus on industrial self-reliance, these trends are expected to drive robust growth of the regional market.

Middle East & Africa Tungsten Market Trends

The tungsten industry in Middle East & Africa (MEA) is witnessing growth primarily due to increasing infrastructure development, industrial diversification, and mining sector investments across key countries such as South Africa, Saudi Arabia, and the UAE. With its established mining base, South Africa is exploring opportunities to expand into strategic and rare metals, including tungsten, to support domestic use and export potential. Meanwhile, the Gulf countries are rapidly diversifying their economies under national transformation plans (such as Saudi Arabia’s Vision 2030), boosting demand for high-performance materials in defense, oil & gas, and heavy manufacturing sectors, key end use areas for tungsten-based products.

Key Tungsten Company Insights

Some of the key players operating in the market include China Minmetals Corporation and Kennametal Inc.

-

China Minmetals Corporation is a major Chinese state-owned enterprise founded in 1950 and headquartered in Beijing. Directly controlled by the State Council’s SASAC, it has grown into a global metals and minerals powerhouse in over 30 countries, with 38 mines (15 overseas). In the metals and minerals segment, China Minmetals is a world leader in tungsten, owning some of the largest tungsten reserves globally. Its diversified portfolio covers non-ferrous and ferrous metals, copper, nickel, zinc, iron, antimony, molybdenum, tungsten, chromium, manganese, and more, accounting for roughly 70% of China’s strategic mineral catalogue.

-

Kennametal Inc. is a U.S.-based global manufacturing company that produces advanced tooling and industrial materials. Its key products include metal-cutting tools, wear-resistant components, ceramics, and coatings, which are sold under its core brand, as well as WIDIA and Stellite. Kennametal is also recognized for its commitment to innovation and sustainability, often receiving industry recognition for ethical practices, worker safety, and product development.

Key Tungsten Companies:

The following are the leading companies in the tungsten market. These companies collectively hold the largest market share and dictate industry trends.

- China Minmetals Corporation

- Cleveland Tungsten, Inc.

- Almonty Industries Inc.

- TUNGSTEN WEST

- Kennametal Inc.

- Sandvik AB

- Element Six UK Ltd.

- Buffalo Tungsten Inc.

- BETEK GMBH & CO. KG

- EQ Resources Limited

Recent Development

-

In November 2024, Kazakhstan inaugurated its first tungsten processing plant in the Almaty Region, marking a significant advancement for the country's mining industry and enhancing its role in the global rare earth metals market. The USD 300 million facility is expected to create up to 1,000 jobs for local specialists. At full capacity, it will process 3.3 million tons of ore annually, producing tungsten concentrate with a purity of 65%.

Tungsten Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.96 billion

Revenue forecast in 2033

USD 2.84 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil

Key companies profiled

China Minmetals Corporation, Cleveland Tungsten, Inc., Almonty Industries Inc., TUNGSTEN WEST, Kennametal Inc., Sandvik AB, Element Six UK Ltd., Buffalo Tungsten Inc., BETEK GMBH & CO. KG, EQ Resources Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tungsten Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global tungsten market report based on form, end use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Mill Products

-

Tungsten Carbide Components

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Construction

-

Automotive

-

Mining & Energy

-

Electronics & Robots

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global tungsten market size was estimated at USD 1.86 billion in 2024 and is expected to reach USD 1.96 billion in 2025.

b. The global tungsten market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 2.84 billion by 2033.

b. The automotive segment dominated the market with a revenue share of 25.4% in 2024.

b. Some of the key players of the global tungsten market are China Minmetals Corporation, Cleveland Tungsten, Inc., Almonty Industries Inc., TUNGSTEN WEST, Kennametal Inc., Sandvik AB, Element Six UK Ltd., Buffalo Tungsten Inc., BETEK GMBH & CO. KG, EQ Resources Limited, and others.

b. The global tungsten market's growth is the increasing demand for hard metals and alloys in automotive, aerospace, defense, and industrial machinery applications due to tungsten’s exceptional hardness, high melting point, and durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.