- Home

- »

- Advanced Interior Materials

- »

-

Global Automotive Turbochargers Market Size Report, 2020-2027GVR Report cover

![Automotive Turbochargers Market Size, Share & Trends Report]()

Automotive Turbochargers Market (2020 - 2027) Size, Share & Trends Analysis Report By Fuel Type, By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-689-9

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Turbochargers Market Summary

The global automotive turbochargers market size was valued at USD 13.81 billion in 2019 and is expected to reach USD 27.33 billion by 2027, growing at a compound annual growth rate (CAGR) of 8.9 % from 2020 to 2027. The emerging trend of light-weighting engines in commercial vehicles is leading the shift toward direct gasoline engines, thereby positively influencing the growth of vehicular turbo.

Key Market Trends & Insights

- Europe held the largest revenue share of around 50% in 2019.

- Based on vehicle type, the passenger vehicle segment dominated the overall market with a value share of over 60% in 2019.

- Based on fuel type, the gasoline segment is expected to remain the most dominant category with over 50% market share in 2019.

Market Size & Forecast

- 2019 Market Size: USD 13.81 Billion

- 2027 Projected Market Size: USD 27.33 Billion

- CAGR (2020-2027): 8.9%

- Europe: Largest market in 2019

Owing to the rising imposition of stringent automotive emission norms across the globe, Original Equipment Manufacturers (OEMs) are employing engine-downsizing strategies to optimize the fuel efficiency of vehicles. This trend is expected to fuel the demand for turbochargers since they play a key role in curbing vehicle emissions and enhance fuel efficiency.

Turbochargers play a key role in boosting fuel efficiency up to 20% in automotive while maintaining the output as well as torque through the delivery of highly pressurized air into the engines. In addition, it supports in increasing the power output through the recovery of thermal energy discharges from the engine.

The use of turbos in the automotive engine facilitates acceleration by light pedal action and allows driving with modest engine loads. In addition, it acts as one of the major components in reducing the particulate matter emission, thereby leading a cleaner exhaust. The aforementioned characteristics lead to lower fuel consumption and minimal environmental impact.

Mature market coupled with a rapid transition to hybrid vehicles amid stringent regulations is expected to restrict the growth of the existing conventional turbocharger market. However, the key participants are in the process of developing superior turbos for fuel cell and electric vehicles, thereby creating a huge potential addressable market over the forecast period.

Key industry players are employing several growth strategies such as strength procurement through reinforcement of centralized purchasing and global supply chain to accelerate cost reductions. Furthermore, they are also looking forward to shifting from ‘local production for local consumption’ concept to global production approach to strengthening the foothold in the market.

Vehicle Type Insights

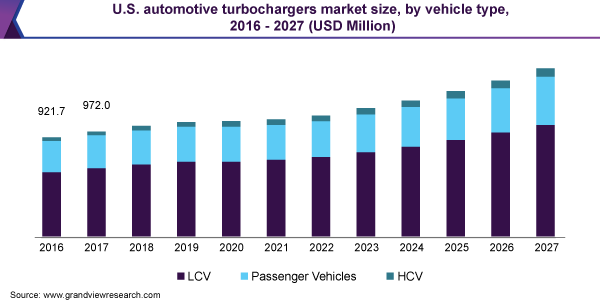

Based on vehicle type, the automotive turbochargers market can be segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The passenger vehicle type turbochargers dominated the overall market with a value share of over 60% owing to a large population of passenger vehicles across the globe.

Several top players have commercialized fuel cell vehicle turbochargers, which contributes to enhancing power generation efficiencies through the delivery of clean air to fuel cell batteries. The aforementioned development is further expected to be pushed by the growth of fuel cell technology in the passenger vehicles market, thereby driving the turbocharger market growth.

The commercial vehicles are majorly diesel-powered and most of them are equipped with turbochargers, thereby making the diesel types turbochargers a mature segment. Thus, amid stringent emission regulations, commercial vehicle manufactures are rapidly shifting toward gasoline engines to curb emission and maintain regulatory norms.

The heavy commercial vehicles segment is also expected to register a notable growth at a CAGR of 9.1% over the forecast period. The heavy commercial vehicles account for a larger share of the turbochargers aftermarket owing to a higher replacement rate since they are exposed to extreme working conditions, thereby driving the overall market growth.

Fuel Type Insights

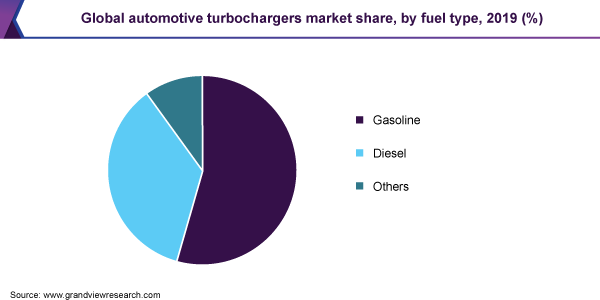

The gasoline fuel type segment is expected to remain the most dominant category with over 50% market share in 2019. It is likely to expand at a CAGR of 8.7% over the forecast period. The rapid adoption of Turbocharged Gasoline Direct Injection Engines (TGDI) in gasoline vehicles is expected to drive the aforementioned segment demand.

OEMs are rapidly shifting from diesel to gasoline engines to curb the particulate matter level in exhaust gases in the automotive. This, in turn, will support OEM to maintain the emission standards imposed by the regulatory bodies. The aforementioned factors are expected to restrict the growth of diesel engine turbochargers market to an extent.

The other fuel type is also one of the most emerging categories in the market for automotive turbochargers that is likely to expand at a CAGR of 15.1% from 2020 to 2027. Rising penetration of alternate fuel vehicles owing to advantages such as cleaner sources of energy, better fuel efficiency, and lower cost as compared to conventional fuel is expected to drive the growth.

Top players in the industry have developed electrical assist turbos that are expected to enhance systems and fuel efficiencies in electric vehicles, with the combination of motor and turbos. Thus, the aforementioned product development is expected to be supplemented by the growing trend of electric vehicles, thereby driving the overall market growth.

Regional Insights

Europe held the largest revenue share of around 50% in 2019. European countries such as Germany, France, Italy, and Spain have been home to the top automotive brands in the world. Thus, the region dominated the overall market and is also expected to witness a high growth potential over the forecast period. However, Europe is one of the most affected regions by the COVID-19 pandemic especially the countries such as Italy and Spain. Moreover, the U.K. is expected to witness sluggish growth on account of the summed up impact of COVID-19 and Brexit. Thus, the contingency pertaining to recovery time from the pandemic impact is expected to restrict regional growth.

Asia Pacific is expected to witness a rapid CAGR of 11.1% over the forecast period, supplemented by rising automotive production levels in countries like China, India, and the South East Asian economies. However, the contingency regarding the automotive manufacturing trends in the region post COVID19 pandemic is expected to negatively impact the overall market growth. China dominated the overall demand for turbochargers across the region owing to mass production levels of automotive in the country. In addition, China is also one of the earliest countries to recover from COVID-19 and restart manufacturing. Hence, it is expected to witness higher demand for turbochargers over the forecast period.

Key Companies & Market Share Insights

Key industry participants are focusing on the development of key elements of turbocharger including a compressor with improved efficiency, a bearing with reduced mechanical loss through optimization of load and a turbine with improved performance in the low-speed ratio region. These developed elements are supplied to automotive manufacturers as samples. The top players are continuously developing the production automation process and novel manufacturing techniques to produce high-quality products. They are installing equipment for durability and performance tests of turbochargers under extreme pressures and temperature circumstances. In addition, they are employing efforts for new product development through collaboration with the corporate research and development department. Some of the prominent players in the automotive turbochargers market include:

-

Honeywell (U.S.)

-

BorgWarner (U.S.)

-

MHI (Japan)

-

IHI (Japan)

-

Continental (Germany)

-

Bosch Mahle (Germany)

-

Cummins (U.S.)

-

ABB (Switzerland)

Automotive Turbochargers Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 14.41 billion

Market volume in 2020

50.2 million units

Revenue forecast in 2027

USD 27.33 billion

Volume forecast in 2027

84.9 million units

Growth Rate

CAGR of 8.9% (revenue-based) from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in Million Units, Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fuel, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Southeast Asia; Brazil; Argentina

Key companies profiled

Honeywell (U.S.); BorgWarner (U.S.); MHI (Japan); IHI (Japan); Continental (Germany); Bosch Mahle (Germany); Cummins (U.S.); ABB (Switzerland)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global automotive turbochargers market report on the basis of fuel type, vehicle type, and region:

-

Fuel Type Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Gasoline

-

Diesel

-

Other

-

-

Vehicle Type Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Passenger Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South East Asia

-

-

Central & South America (CSA)

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global automotive turbochargers market size was estimated at USD 13.81 billion in 2019 and is expected to reach USD 14.41 billion in 2020.

b. The global automotive turbochargers market is expected to grow at a compound annual growth rate of 8.9% from 2020 to 2027 to reach USD 27.33 billion by 2027.

b. Europe dominated the automotive turbochargers market with a share of 50.6% in 2019. This is attributable to the presence of several top automotive brands coupled with prevalent stringent emission standards in the region.

b. Some key players operating in the telemedicine market include Continental AG; Honeywell; Mitsubishi Heavy Industries; Borgwarner; IHI; Cummins; Bmts Technology; ABB; Delphi Technologies; Precision Turbo & Engine INC.; Kompressorenbau Bannewitz GmbH; Calsonic Kansei; Turbo Dynamics Ltd.; Weifang Fuyuan Turbocharger Co., Ltd.; and Ningbo Motor Industrial Co., Ltd.

b. Key factors driving the automotive turbochargers market growth include rising adoption Turbocharged Gasoline Direct Injection Engines; enforcement of stricter emission standards; development of electrical assist turbochargers and fuel cell vehicle turbochargers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.