- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Turkey Dietary Supplements Market Size, Share Report, 2030GVR Report cover

![Turkey Dietary Supplements Market Size, Share & Trends Report]()

Turkey Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-688-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Turkey Dietary Supplement Market Summary

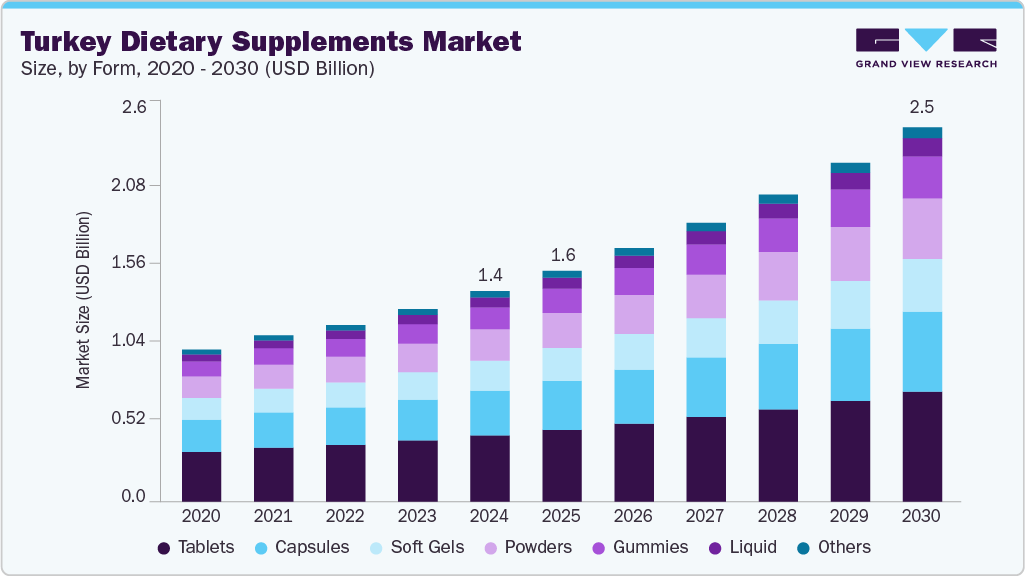

The Turkey dietary supplements market size was estimated at USD 1.43 billion in 2024 and is projected to reach USD 2.54 billion by 2030, growing at a CAGR of 10.1% from 2025 to 2030. The demand for natural, plant-based, and clean-label supplements is surging as consumers become more conscious of their nutritional needs.

Key Market Trends & Insights

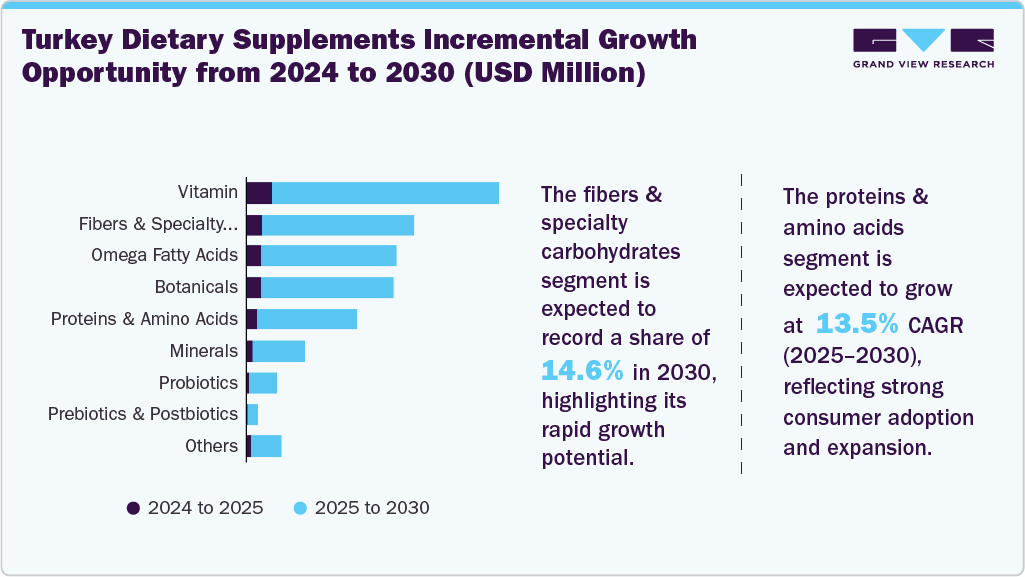

- By ingredient, the vitamin segment held the highest market share of 31.3% in 2024.

- Based on form, the tablets segment held the largest market share in 2024.

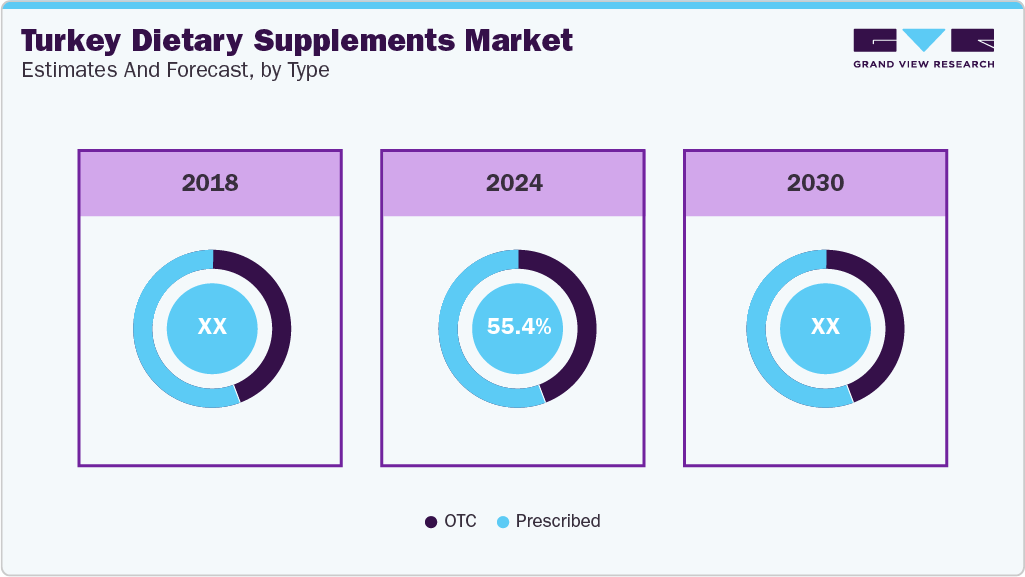

- By type, the prescribed segment held the highest market share of 55.4% in 2024.

- By application, the immunity segment held the largest market share in 2024.

- Based on end use, the adults segment held the highest market share of 62.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.43 Billion

- 2030 Projected Market Size: USD 2.54 Billion

- CAGR (2025-2030): 10.1%

Popular product formats include tablets, powders, and capsules, with preferences often shaped by convenience and cost. While pharmacies and health stores remain key distribution channels, online platforms are rapidly gaining traction due to their accessibility and broader product variety. The dietary supplements market in Turkey has evolved significantly, blending its rich heritage in herbal remedies and dairy probiotics with modern regulatory frameworks and global trends. The sector has embraced regulations aligning with European standards, fostering the growth of functional foods and dietary supplements.

Rising health consciousness, demand for clean-label ingredients, and personalized nutrition are accelerating market growth. Ongoing R&D and innovations have led the nutraceutical industry in Turkey to increasingly integrate local herbal sources in dietary supplements, positioning the country as a promising hub for high-quality, science-backed nutritional solutions. For instance, at Gulfood 2025, growing global interest and active business meetings highlighted Turkey’s role as a center for innovation in nutritional ingredients. The event also highlighted Turkey’s goal to become a leading regional source for clean-label and high-quality nutrition products. These discussions underscored Turkey’s ambition to become a regional hub for clean-label and high-quality nutritional products.

Consumer Insights

Turkish consumers of nutraceuticals are primarily women, older adults, and individuals with higher education and income levels. Their preferences are strongly influenced by health concerns, especially diet-related issues and chronic conditions. Consumers favor products with clean, natural, and halal-certified ingredients, avoiding those with artificial additives or GMOs. Dairy-based functional foods such as yogurt and kefir are particularly popular due to their familiarity and trust. There is an increasing need for consumer education to enhance the understanding and adoption of dietary supplements.

The use of dietary supplements varies by age, with higher consumption observed among middle-aged and older adults, who are more focused on managing chronic conditions, boosting immunity, and supporting overall wellness. Younger adults show growing interest in dietary supplements, especially fitness-related and beauty-enhancing supplements, though their usage remains comparatively lower. Higher education and income levels significantly influence purchase behavior. Rising cultural acceptance of traditional herbal remedies has led to their integration into modern supplement formats.

According to the paper titled ‘Reasons, associated factors, and attitudes toward breastfeeding mothers’ use of complementary medicine products: a study from Turkey published in the International Breastfeeding Journal (2025), around 75% of breastfeeding mothers in Turkey reported using at least one complementary medicine product (CMP), with the most common being vitamin D, iron supplements, and herbal remedies such as fennel. Usage was more common among mothers with university education, those employed, and those with a healthcare background. The main reasons for use were to stay healthy (60.2%) and to support immunity (59.3%). While most mothers viewed CMPs as helpful, about 14% experienced side effects, and although physicians were the most trusted source of information, over 85% of participants expressed a need for more guidance on safe use during breastfeeding.

Ingredients Insights

Vitamins dominated the Turkey dietary supplements industry and accounted for a share of 31.3% in 2024, owing to the demand for essential nutrients to support general health and immunity. Consumers in Turkey are increasingly aware of the benefits of vitamins, particularly in preventing deficiencies and promoting long-term wellness. A study conducted in 2024 in the Journal of Surgery and Medicine on vitamin D levels in Niğde, Turkey, found significant seasonal and gender differences. Vitamin D deficiency was more common in women (70.3%) than men (29.7%), with levels highest in summer and lowest in April. Levels also slightly declined with age. The study highlights vitamin D insufficiency as a major public health issue, especially for women and older adults, and recommends expanding supplementation programs to include adolescents and adults.

The proteins and amino acids segment is expected to grow at the fastest CAGR from 2025 to 2030. Turkey’s growing fitness culture and the rising adoption of active lifestyles, especially among younger consumers, are likely to contribute to the market growth in the coming years. In addition, rising health awareness has highlighted the need for balanced nutrition among children, especially with increasing rates of nutrient deficiencies. In 2024, VEGGY Kids, launched a plant-based product line in Turkey designed specifically for children, offering nutritious alternatives such as mini burgers, nuggets, and meatballs made with a triple protein blend of pea, lentil, and wheat. These products are fortified with essential nutrients, including calcium, iron, vitamin D, B12, folic acid, and fiber, making them a protein-rich, well-rounded dietary option. The range supports healthy growth and development in children while appealing to parents seeking clean-label, preservative-free, non-GMO meals. Launched across over 25,000 retail stores in Turkey, the brand has quickly gained attention domestically and internationally.

Form Insights

Tablets dominated the market and accounted for the largest revenue share in 2024, owing to their convenience, portability, and cost-effectiveness. Consumers favor tablets for their longer shelf life, precise dosing, and strong association with medical reliability, making them especially popular among urban, health-conscious, and budget-aware segments. Consumer behavior shows a rising demand for multivitamins, immune boosters, and bone-health supplements in tablet form, especially among adults and seniors, who prefer tablets for their familiarity and extended shelf life.

The gummies segment is expected to record the fastest CAGR from 2025 to 2030. In Turkey, gummies are popular due to their flavored, chewable vitamins and minerals, particularly plant-based and sugar-reduced options, across pharmacies, supermarkets, and e-commerce platforms. The convenience, appeal to children and adults, and the growing availability of vegan and clean-label formulations have made gummies a popular supplement choice alongside traditional tablets. TopGum Industries Ltd., a company active in the Turkish supplement market, introduced its latest product, IronGum, in 2024. This vegan, sugar-free gummy delivers high-dose iron and vitamins C and B12, targeting consumers seeking an effective yet palatable alternative to traditional iron supplements. Enriched with prebiotic fiber (FOS), IronGum also supports digestive health, offering a clean-label solution tailored to modern wellness needs in Turkey.

Type Insights

The prescribed segment dominated the market in 2024. Prescribed dietary supplements are safer and more accurate in managing health conditions. Doctors recommend them based on individual needs to avoid side effects or drug interactions. Hospitals are closely monitored to ensure safe use of supplements, proper dosage, and high-quality care, especially for seriously ill patients, which helps improve recovery and treatment results. The use of prescribed dietary supplements is becoming more structured in hospitals. Aging population, increasing prevalence of lifestyle-related diseases, and a strong preference for physician-guided health decisions have further fueled the demand for prescribed supplements.

The OTC segment is expected to grow over the forecast period, owing to easy availability of OTC supplements in pharmacies and supermarkets, allowing consumers to make quick and informed choices. Factors such as aging population, urbanization, and changing lifestyles have heightened the demand for accessible health solutions such as multivitamins, probiotics, and herbal remedies. The global and local brands are leveraging aggressive marketing and influencer-driven campaigns to boost visibility and trust in OTC products.

Application Insights

The immunity segment dominated the Turkish dietary supplements industry, with the largest revenue share of 14.4% in 2024. Immunity has become a key focus in Turkey's dietary supplement market, driven by post-pandemic health awareness and a shift toward preventive care. The immunity segment continues to be one of the strongest growth areas within the country's supplement landscape, supported by increased consumer reliance on natural and functional products. In January 2025, Bursa Technical University in Turkey announced that it is preparing to develop a new dietary supplement supporting gut and immune health. The process combines the natural benefits of honey with probiotic bacteria to help balance the gut and strengthen the immune system. Such initiatives contribute to Turkey's growing immunity supplement segment using locally sourced, natural ingredients and also support the efforts to promote health through innovative, science-based products.

The prenatal health segment is expected to record the fastest CAGR from 2025 to 2030. The growing focus on maternal and fetal well-being is enhancing healthcare awareness and government-led nutrition programs. Increased awareness of the importance of prenatal nutrition, especially the role of supplements such as folic acid, iron, calcium, and DHA, has led more women to seek targeted products even before conception. In October 2024, Mate & Me introduced the first-ever prenatal gummies, redefining how couples approach fertility and preconception health. The gummies are designed to support both male and female nutritional needs during the fertility journey. The Him formula contains 8 essential nutrients, including CoQ10, zinc, selenium, and vitamins C, D3, and E, to promote sperm health and male fertility. The Her version features 13 vitamins and minerals such as folate, choline, iron, B6, B12, and iodine to support maternal health, fetal brain development, and neural tube formation. The gummies are free from artificial additives, gluten, GMOs, and allergens.

End Use Insights

The adult segment accounted for the largest market share of 62.2% in 2024, with increasing use of dietary supplements for meal replacement, muscle building, and beauty enhancement. Busy lifestyles and fitness trends drive demand for protein powders and weight-control products, while young women favor supplements with biotin and collagen for hair and skin. This growth is fueled by rising health awareness, urbanization, and the influence of social media and online shopping.

In 2024, at a fair in Istanbul, Vitago introduced sugar-free chewable gummies, collagen and glucosamine shots, marking a significant development in Turkey’s adult dietary supplement market. This convenient daily shot blends collagen peptides with glucosamine, MSM, and hyaluronic acid to support joint flexibility, muscle recovery, and skin health.

The infant segment is anticipated to grow at the fastest CAGR during the forecast period, driven by nutrient gaps in infant formulas and complementary foods, prompting parents to rely on products such as vitamin D, iron, multivitamins, and omega-3. Vitamin D drops are widely used, especially in the first few months after birth. Parents with higher education and income levels are likelier to choose supplements based on pediatric recommendations or media influence. Egao Kids Vitamin D₃ Drops is a liquid supplement designed specifically for infants. It is lactose-free and gluten-free, supporting bone development, immune health, and muscle function during early growth. It is widely available in pharmacies and online platforms across Turkey, reflecting the rising demand for targeted, high-quality infant nutrition solutions.

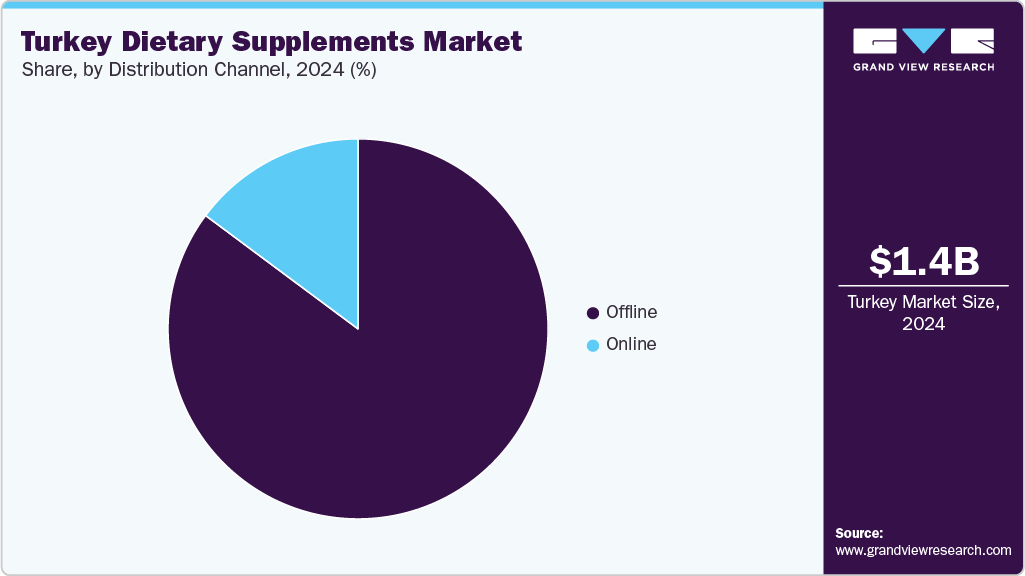

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. Offline channels, particularly pharmacies and drugstores, remain the most trusted and widely preferred channels for purchasing supplements. These channels offer professional guidance and are known for product reliability. The growing elderly population and the focus on preventive healthcare further drive the sales of supplements through these channels, especially for immunity, bone health, and overall wellness.

The online distribution segment is projected to record the fastest CAGR from 2025 to 2030. The surge in sales through the online distribution segment reflects Turkey’s increasingly digital consumer landscape and the convenience-driven mindset of modern shoppers. Hepsiburada, one of Turkey's largest e-commerce platforms with over 100,000 third-party sellers and 12 million users, continues to dominate the country’s online retail landscape. It has become one of the major channels for the sale of dietary supplements, including vitamins, protein powders, herbal products, and wellness formulas.

Online platforms offer a wide product variety, competitive pricing, and the convenience of fast delivery and user reviews, making them an increasingly preferred option for purchasing health-related products. Their influence reflects the growing role of digital marketplaces in Turkey’s expanding dietary supplement sector.

Key Turkey Dietary Supplements Company Insights

Some of the key companies operating in Turkey dietary supplements industry include Amway Corp, Herbalife Nutrition Ltd., and Zade Yağları.

-

Abdi İbrahim Pharmaceutical Industry offers a wide range of nutraceuticals focused on immunity, bone, and general health. The company is expanding into MENA markets through pharmacies and wellness programs. It leverages strong R&D and regional partnerships to expand its presence in the consumer health sector.

-

Pharmanatura is a Turkish e-commerce platform offering vitamins, minerals, and herbal supplements. In 2024-2025, it expanded its product range and user interface to meet the growing demand. The platform promotes preventive health through digital content and is exploring strategic partnerships. It caters to health-conscious consumers across Turkey.

Key Turkey Dietary Supplements Companies:

- Amway Corp

- Herbalife Nutrition Ltd.

- Orzaks İlaç ve Kimya Sanayi

- Zade Vital

- Abdi İbrahim Pharmaceutical Industry and Trade Inc.

- pharmanatura.com.tr

Recent Developments

- In 2024, Baybay by Ena Farma launched Baybay Immun, a new-generation natural support supplement for children’s immune systems. Made with acerola extract, black elderberry, thyme and licorice root extracts, the product is tailored for increasing the immunity of children.

Turkey Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.57 billion

Revenue forecast in 2030

USD 2.54 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel

Key companies profiled

Amway Corp; Herbalife Nutrition Ltd.; Orzaks İlaç ve Kimya Sanayi; Zade Yağları.; Abdi İbrahim Pharmaceutical Industry and Trade Inc.; pharmanatura.com.tr

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Turkey Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Turkey dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.