- Home

- »

- Advanced Interior Materials

- »

-

Two-Wheeler Tires Market Size, Share, Industry Report, 2033GVR Report cover

![Two-Wheeler Tires Market Size, Share & Trends Report]()

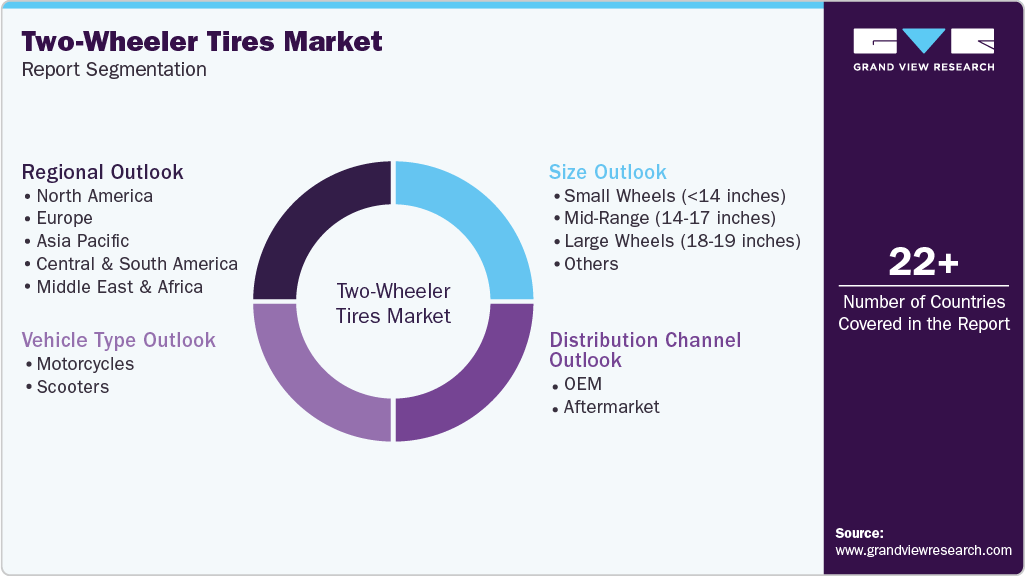

Two-Wheeler Tires Market (2025 - 2033) Size, Share & Trends Analysis Report By Distribution Channel (OEM, Aftermarket), By Vehicle Type, By Size (Small Wheels (<14 inches), Mid-Range (14-17 inches), Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-775-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Two-Wheeler Tires Market Summary

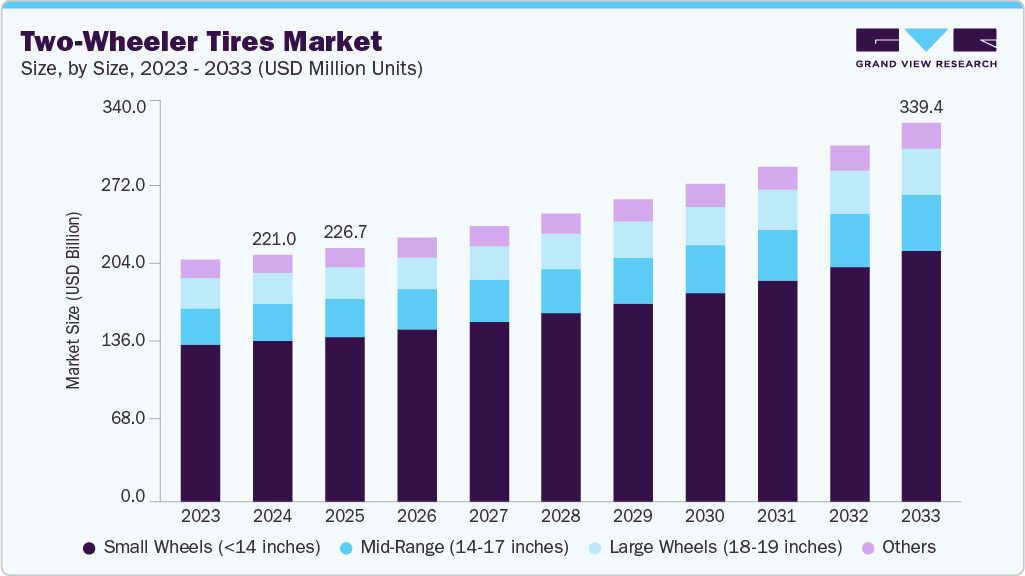

The global two-wheeler tires market size was estimated at USD 221.0 million units in 2024 and is expected to reach USD 339.4 million units by 2033, expanding at a CAGR of 5.2% from 2025 to 2033, driven by the rapid growth in motorcycle and scooter ownership, particularly across emerging economies.

Key Market Trends & Insights

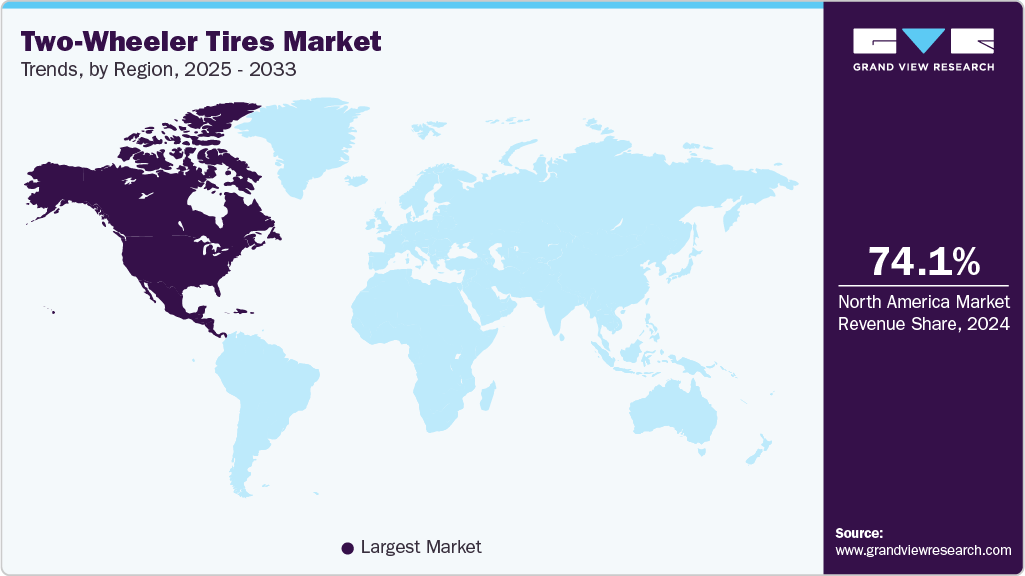

- Asia Pacific dominated the two-wheeler tires market with the largest revenue share of 74.1% in 2024.

- By distribution channel, the aftermarket segment is expected to grow at fastest CAGR of 5.2% over the forecast period.

- vehicle type, the scooters segment is expected to grow at fastest CAGR of 5.5% over the forecast period.

- By size, the mid-range (14-17 inches) segment is expected to grow at fastest CAGR of 5.4% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 221.0 Million Units

- 2033 Projected Market Size: USD 339.4 Million Units

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

Rising urbanization, coupled with increasing traffic congestion, has made two-wheelers a preferred mode of personal transportation due to their affordability and convenience. Growing disposable incomes and the availability of cost-effective financing options are further boosting vehicle sales, consequently stimulating tire demand. Additionally, the expansion of e-commerce platforms and logistics services has increased the use of motorcycles for last-mile delivery. This surge in commercial usage is prompting tire manufacturers to develop durable and high-performance products suited for intensive daily operations.

Technological advancements in tire design and manufacturing are another key factor propelling market growth. Innovations such as tubeless tires, radial construction, and silica-based rubber compounds are enhancing performance, fuel efficiency, and safety. Manufacturers are investing in research and development to create tires that provide better grip, longevity, and puncture resistance. Moreover, the integration of smart tire technologies, including pressure monitoring systems and wear sensors, is improving vehicle maintenance and safety standards. These advancements are reshaping consumer preferences and driving demand for premium-quality two-wheeler tires across both developed and developing regions.

The growing emphasis on environmental sustainability and fuel efficiency is significantly influencing the global two-wheeler tires market. Governments worldwide are implementing stricter emission regulations, prompting manufacturers to develop eco-friendly tires with low rolling resistance. These tires not only enhance mileage but also reduce carbon emissions, aligning with global sustainability goals. The increasing adoption of electric two-wheelers has further created demand for specialized tires designed to support higher torque and battery efficiency. Consequently, tire producers are expanding their product portfolios to cater to the evolving requirements of the electric mobility ecosystem.

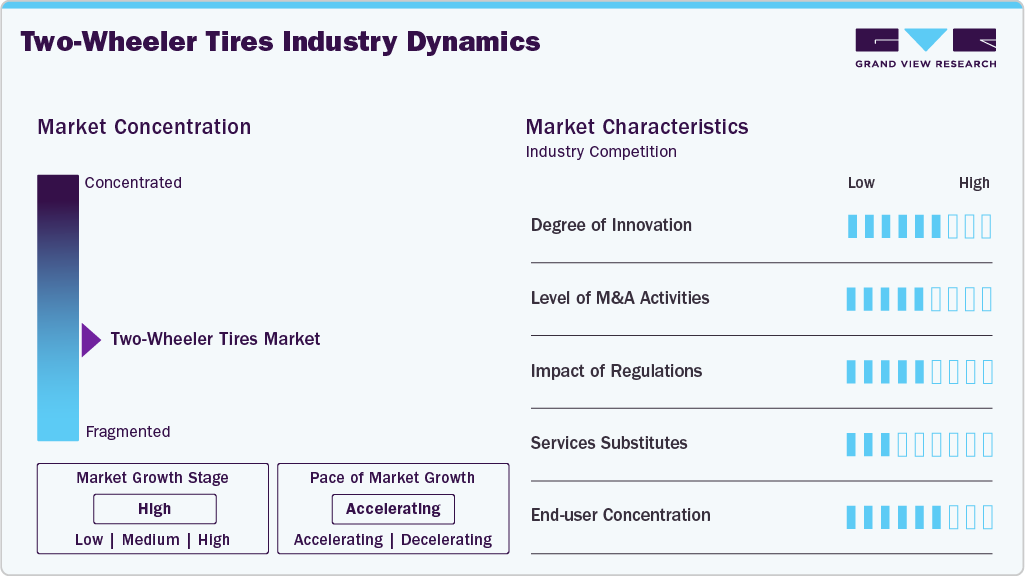

Market Concentration & Characteristics

The global two-wheeler tires market is characterized by moderate market concentration, with several established manufacturers holding significant shares alongside a growing presence of regional players. The degree of innovation remains high, as companies continuously invest in advanced rubber compounds, tread designs, and tire construction technologies to enhance performance, fuel efficiency, and durability. Strategic mergers, acquisitions, and collaborations are frequent, enabling firms to expand their production capabilities and strengthen distribution networks. Technological innovation is particularly evident in the development of tires compatible with electric two-wheelers and smart tire systems, reflecting the industry’s adaptation to evolving mobility trends.

Regulatory frameworks exert a strong influence on market dynamics, especially with governments enforcing stringent safety, quality, and environmental standards. Tire manufacturers are compelled to comply with emission reduction goals and recycling mandates, prompting a shift toward sustainable raw materials and low rolling resistance products. Service substitutes in the market remain limited, as tire performance directly affects vehicle safety and efficiency, making high-quality tire replacement essential. End-user concentration is notably high among daily commuters, fleet operators, and delivery service providers, driving consistent demand across both OEM and aftermarket segments. This balanced mix of innovation, regulation, and consumer reliance underpins the market’s steady growth and competitive evolution.

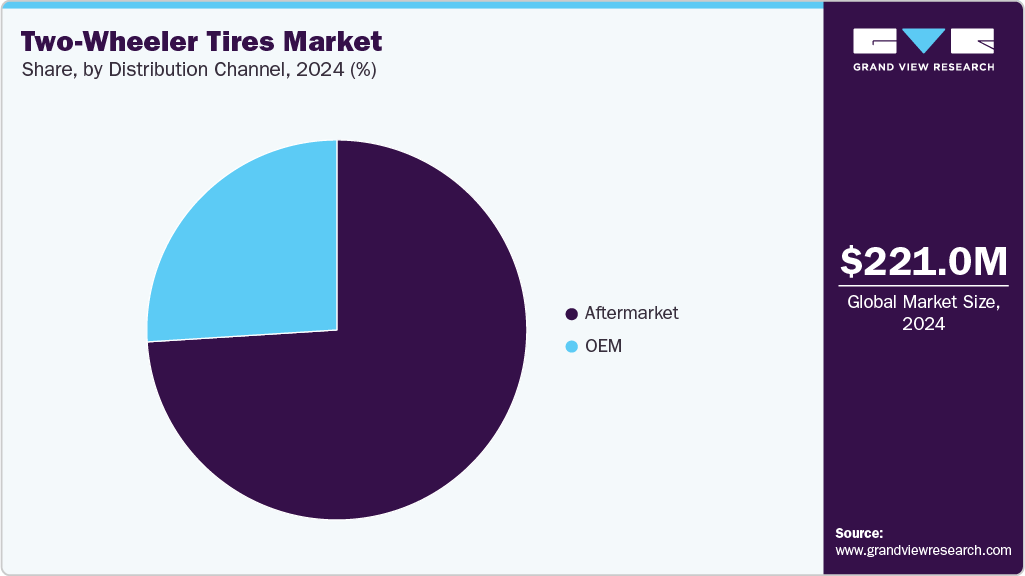

Distribution Channel Insights

Aftermarket segment led the market and accounted for the largest revenue share of 74.0% in 2024, driven by the growing need for replacements due to tire wear, punctures, and performance upgrades. Rising two-wheeler usage, particularly in densely populated urban areas, increases tire wear and accelerates replacement cycles. Consumers are increasingly preferring branded and high-performance tires for safety, reliability, and improved mileage. The expansion of service centers and online retail platforms has made tire availability more convenient. Additionally, maintenance culture and awareness about road safety are contributing to the steady growth of the aftermarket segment.

OEM segment is expected to grow significantly at CAGR of 5.1% over the forecast period, driven by the increasing production of motorcycles and scooters by global and regional manufacturers. Tire manufacturers collaborate closely with OEMs to provide tires optimized for specific models, ensuring performance, durability, and safety. The launch of new two-wheeler models, including electric variants, is creating consistent demand for original equipment tires. Strict safety regulations and quality standards further enhance OEM tire adoption. Strategic partnerships and long-term supply contracts with vehicle manufacturers also strengthen the segment’s growth prospects.

Vehicle Type Insights

Motorcycles segment dominated the market and accounted for the largest revenue share of 73.9% in 2024, driven by the rising popularity of sport, cruiser, and touring motorcycles worldwide. Consumers increasingly demand tires that provide superior grip, handling, and stability across various road conditions. Performance-oriented motorcycle tires are gaining traction due to the growing interest in recreational riding and long-distance touring. Technological advancements in tread patterns, rubber compounds, and puncture resistance are also boosting adoption. Moreover, the expanding electric motorcycle market is creating opportunities for specialized tires tailored for higher torque and efficiency.

Scooters segment is expected to grow at fastest CAGR of 5.5% over the forecast period, driven by widespread use of scooters as a primary urban transportation mode, especially in Asia Pacific and Latin America. Scooters are preferred for short distance commuting due to their compact size, fuel efficiency, and ease of maneuverability. Rising disposable incomes and the increasing adoption of electric scooters are further enhancing tire demand. Manufacturers are developing tires with better wear resistance and puncture-proof properties to cater to daily city commuting. Additionally, government initiatives promoting eco-friendly mobility are supporting the growth of the scooter tire segment.

Size Insights

Mid-range (14-17 inches) segment dominated the market and accounted for the largest revenue share of 64.9% in 2024, driven by popularity of commuter motorcycles and mid-sized scooters. These tires are favored for their balance of stability, comfort, and affordability, making them ideal for daily use in urban and semi-urban areas. Rising middle-class income levels and increasing two-wheeler ownership are boosting demand for mid-range tires. Technological improvements in tread design and compound materials enhance fuel efficiency and lifespan. The segment also benefits from strong aftermarket demand, as replacement cycles for these sizes are frequent.

Small wheels (<14 inches) segment is expected to grow significantly at CAGR of 5.1% over the forecast period, driven by compact scooters, mopeds, and electric two-wheelers used in urban environments. The segment’s growth is supported by increasing traffic congestion, which encourages the use of smaller, agile vehicles. Manufacturers are focusing on developing tires that provide better grip, durability, and puncture resistance for daily commuting. Rising awareness about safety and the growing trend of last-mile delivery services also contribute to tire demand. Additionally, the expansion of electric scooter adoption is accelerating the small wheel tire market globally.

Regional Insights

The Asia Pacific dominated two-wheeler tires market, and held 74.1% revenue share in 2024, driven by high concentration of motorcycle and scooter users across the region. Rising urbanization, coupled with growing middle-class income levels, has made two-wheelers a primary mode of transportation. Increasing e-commerce and food delivery services are further fueling tire demand, especially for commuter and utility models. Governments are also promoting electric mobility, which is encouraging the development of specialized tires for electric scooters and motorcycles. Local manufacturers are strengthening their production capabilities to meet the surging replacement demand. Continuous product innovation and affordability remain the key growth drivers across this highly dynamic regional market.

China Two-Wheeler Tires Market Trends

In China, the two-wheeler tires market is primarily driven by its massive construction sector, backed by government stimulus and ongoing industrial expansion. The country continues to invest heavily in new infrastructure projects-including high-speed rail, airports, power plants, and logistics parks generating consistent demand for anchoring systems. Furthermore, China's shift toward high-rise construction and sustainable green buildings is fostering demand for advanced, corrosion-resistant, and load-bearing fasteners. Domestic manufacturers are also investing in innovation to comply with new national codes and to reduce reliance on imports, boosting local distribution channel and technological capabilities.

North America Two-Wheeler Tires Market Trends

The North America two-wheeler tires market is driven by the increasing popularity of motorcycles for recreational and sports activities. Rising consumer preference for adventure and cruiser bikes has led to greater demand for high-performance and durable tires. The growing culture of long-distance touring and off-road biking further stimulates sales of specialized tire categories. In addition, manufacturers are focusing on introducing technologically advanced tires with superior grip and wear resistance. Expanding e-commerce platforms have also made tire replacement and customization more accessible to consumers. The region’s emphasis on safety and quality standards continues to shape tire innovation and material development.

The China two-wheeler tires market is primarily influenced by the strong demand for premium motorcycles and the thriving aftermarket segment. The rise in leisure riding, coupled with the increasing number of motorcycle enthusiasts, has boosted sales of performance-oriented tires. Major tire manufacturers are investing in R&D to develop products optimized for diverse road conditions and temperature variations. The presence of established brands and a robust distribution network support steady market expansion. Furthermore, the trend toward motorcycle customization encourages frequent tire replacements and upgrades. Sustainability-focused regulations are also pushing manufacturers to introduce eco-friendly tire compounds with improved fuel efficiency.

Europe Two-Wheeler Tires Market Trends

The Europe two-wheeler tires market is fueled by the rising demand for premium motorcycles and the region’s growing electric mobility initiatives. Stringent emission norms and sustainability regulations are driving manufacturers to produce low rolling resistance and eco-friendly tires. The popularity of motorcycle tourism in countries like Italy, France, and Spain has boosted demand for performance and touring tires. Advancements in tire technology, including enhanced tread patterns and silica-infused compounds, are improving safety and fuel efficiency. Additionally, the growing trend of urban commuting using electric scooters is expanding tire replacement needs. The region’s focus on road safety and innovation continues to influence market competitiveness.

The Germany two-wheeler tires market is driven by the country’s strong engineering base and thriving motorcycle manufacturing industry. German consumers show a preference for high-quality, performance-oriented tires suited for sports and touring bikes. The country’s advanced infrastructure and safety standards encourage continuous innovation in tire composition and tread design. Tire producers are integrating advanced materials to improve traction and durability under diverse weather conditions. Moreover, Germany’s growing electric mobility sector is generating new opportunities for tire producers catering to electric motorcycles and scooters. The emphasis on sustainability and low-emission mobility further reinforces the adoption of next-generation tire technologies.

Latin America Two-Wheeler Tires Market Trends

The Latin America two-wheeler tires market is growing steadily, driven by the rising demand for affordable personal transportation. Countries such as Brazil, Mexico, and Argentina are witnessing increased motorcycle ownership due to economic and urban mobility factors. Expanding delivery and logistics sectors are also boosting tire consumption, particularly in the replacement segment. Local tire manufacturers are investing in cost-efficient production to cater to diverse consumer needs. Moreover, infrastructure development and improving road conditions are enhancing two-wheeler usage in urban and semi-urban areas. Government efforts to promote vehicle safety standards are encouraging the adoption of branded, durable tire products.

Middle East & Africa Two-Wheeler Tires Market Trends

The two-wheeler tires market in the Middle East & Africa is driven by the growing use of motorcycles for personal transport and commercial delivery services. Rapid urbanization and population growth are contributing to higher two-wheeler adoption in both developed and emerging economies within the region. Hot climatic conditions are encouraging demand for tires with superior heat resistance and longevity. International tire brands are expanding their regional presence through strategic partnerships with local distributors. Moreover, the increasing popularity of electric scooters in metropolitan areas is creating new demand for specialized tires. Economic diversification and infrastructure expansion continue to support market growth across this region.

Key Two-Wheeler Tiers Company Insights

Some of the key players operating in market include Michelin Group, Bridgestone Corporation

-

Michelin Group, headquartered in France, is a global leader in tire manufacturing, offering high-performance two-wheeler tires for motorcycles and scooters. The company focuses on innovative tread designs and advanced rubber compounds to enhance grip, durability, and fuel efficiency. Michelin’s product portfolio includes sport, touring, and commuter tires, catering to a diverse range of consumer needs.

-

Bridgestone Corporation, based in Thailand, provides premium two-wheeler tires designed for safety, performance, and longevity. The company emphasizes technological advancements such as multi-compound construction and optimized tread patterns. Bridgestone serves both OEMs and the aftermarket segment, addressing motorcycles, scooters, and electric two-wheelers.

Continental AG, Pirelli & C. S.p.A.are some of the emerging market participants in two-wheeler tires market.

-

Continental AG, a German multinational, specializes in high-quality tires that offer superior traction and stability. The company focuses on innovative materials and tread technologies to improve ride comfort, safety, and wear resistance. Continental’s two-wheeler tire range includes sport, touring, and urban mobility solutions.

-

Pirelli & C. S.p.A., an Italian tire manufacturer, is renowned for performance-oriented motorcycle and scooter tires. The company invests heavily in R&D to develop tires optimized for speed, grip, and handling under diverse conditions. Pirelli’s offerings cater to sport, racing, and commuter segments, emphasizing advanced compounds and tread patterns.

Key Two-Wheeler Tiers Companies:

The following are the leading companies in the two-wheeler tiers market. These companies collectively hold the largest market share and dictate industry trends.

- Michelin Group

- Bridgestone Corporation

- Continental AG

- Pirelli & C. S.p.A.

- Apollo Tyres Ltd.

- JK Tyre & Industries Ltd.

- Maxxis International

- CEAT Limited

- TVS Srichakra Limited

Recent Developments

- In December 2024, CEAT completed the acquisition of the Camso off-the-road tire and tracks business from Michelin in an all-cash deal valued at approximately USD 225 million. The acquisition includes global ownership of the Camso brand and two advanced manufacturing plants located in Sri Lanka.

Two-Wheeler Tires Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 226.7 million units

Revenue forecast in 2033

USD 339.4 million units

Growth Rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million units and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution Channel, vehicle type, size, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Thailand; Vietnam; Indonesia; Malaysia

Key companies profiled

Michelin Group; Bridgestone Corporation; Continental AG; Pirelli & C. S.p.A.; Apollo Tyres Ltd.; JK Tyre & Industries Ltd.; Maxxis International; CEAT Limited; TVS Srichakra Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Two-Wheeler Tiers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global two-wheeler tires market based on distribution channel, vehicle type, size, and region.

-

Distribution Channel Outlook (Revenue, USD Million Units, 2021 - 2033)

-

OEM

-

Aftermarket

-

-

Vehicle Type Outlook (Revenue, USD Million Units, 2021 - 2033)

-

Motorcycles

-

Scooters

-

-

Size Outlook (Revenue, USD Million Units, 2021 - 2033)

-

Small Wheels (<14 inches)

-

Mid-Range (14-17 inches)

-

Large Wheels (18-19 inches)

-

Others

-

-

Regional Outlook (Revenue, USD Million Units, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Thailand

-

India

-

Vietnam

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global two-wheeler tires market size was estimated at USD 221.0 million units in 2024 and is expected to reach USD 226.7 million units in 2025.

b. The two-wheeler tires market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 339.4 million units by 2033.

b. Aftermarket segment led the market and accounted for the largest revenue share of 74.0% in 2024, driven by the growing need for replacements due to tire wear, punctures, and performance upgrades.

b. Some of the prominent companies in the two-wheeler tires market include Michelin Group, Bridgestone Corporation, Continental AG, Pirelli & C. S.p.A., Apollo Tyres Ltd., JK Tyre & Industries Ltd., Maxxis International, CEAT Limited, TVS Srichakra Limited

b. Key factors driving the two-wheeler tires market include rising two-wheeler ownership, growing demand for electric mobility, technological advancements in tire materials and design, expanding aftermarket services, and increasing focus on safety and fuel efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.