- Home

- »

- Pharmaceuticals

- »

-

Type 2 Diabetes Mellitus Treatment Market Report, 2030GVR Report cover

![Type 2 Diabetes Mellitus Treatment Market Size, Share & Trends Report]()

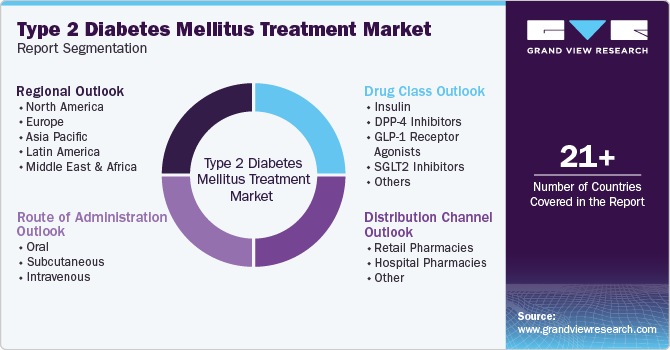

Type 2 Diabetes Mellitus Treatment Market Size, Share & Trends Analysis Report By Drug Class (Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists), By Route of Administration (Oral, IV), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-430-4

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

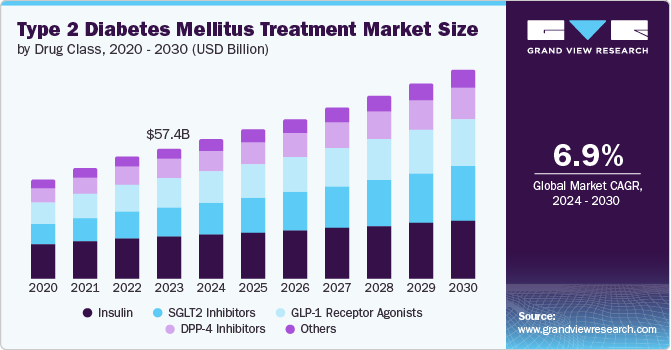

The global type 2 diabetes mellitus treatment market size was estimated at USD 57.47 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The growth for Type 2 diabetes mellitus (T2DM) treatment market is driven by the rising prevalence of diabetes, increasing healthcare expenditure, advancements in treatment options, and supportive government initiatives. Type 2 diabetes, the most common form, arises when the body becomes insulin-resistant or produces insufficient insulin. According to the World Health Organization (WHO), the prevalence of diabetes has surged globally, impacting 422 million people, primarily in low- and middle-income countries. Responsible for 1.5 million deaths annually, diabetes cases continue to rise steadily worldwide.

The global type 2 diabetes mellitus treatment market is significantly driven by the increasing prevalence of diabetes. The International Diabetes Federation (IDF) reported that around 537 million adults (aged 20-79) had diabetes globally in 2021, with projections rising to 643 million by 2030 and 783 million by 2045. According to the Centers for Disease Control and Prevention (CDC), Type 2 diabetes accounts for about 90-95% of all diabetes cases. Surge in cases is primarily due to factors such as sedentary lifestyles, unhealthy diets, obesity, and an aging global population. As obesity rates rise, particularly in developed and emerging economies, the incidence of T2DM is also expected to increase, thereby driving the demand for effective treatment options.

Advances in medical research and technology have led to the development of innovative therapies for T2DM significantly expanding the treatment landscape. New drug classes, such as GLP-1 receptor agonists (e.g., semaglutide, liraglutide) and SGLT2 inhibitors (e.g., empagliflozin, dapagliflozin), have revolutionized T2DM management by controlling blood sugar while offering benefits such as weight loss and cardiovascular protection. Supported by extensive clinical trials and regulatory endorsements, the rise of combination therapies, which target multiple mechanisms, further enhances glycemic control and reduces hypoglycemia risks, driving market growth.

Government initiatives and regulatory frameworks are crucial in shaping T2DM treatment market. Many countries are implementing national health policies to address the growing diabetes epidemic. In the U.S., the CDC has introduced programs such as the National Diabetes Prevention Program (NDPP) to encourage lifestyle changes that can prevent or delay T2DM. Globally, the World Health Organization launched the Global Diabetes Compact, aiming to enhance diabetes prevention and treatment through collaboration among governments, health organizations, and the private sector.

The updated 2021 Diabetes Prevention and Recognition Program (DPRP) Standards by CDC expanded risk reduction strategies by integrating A1c levels and physical activity benchmarks. Moreover, the Prevent T2 curriculum, revised in August 2021, placed a stronger emphasis on nutrition and weight loss, prioritizing culturally relevant and healthy eating patterns in both English and Spanish versions. In June 2023, the CDC launched the targeted strategy to promote health equity for high-risk populations facing or at risk of diabetes funding initiative. This five-year cooperative agreement aims to prevent or delay Type 2 diabetes in adults with prediabetes while improving self-care, quality of care, and early complication detection for those with diabetes. These initiatives underscore ongoing efforts to combat T2DM through comprehensive prevention, treatment, and a focus on health equity.

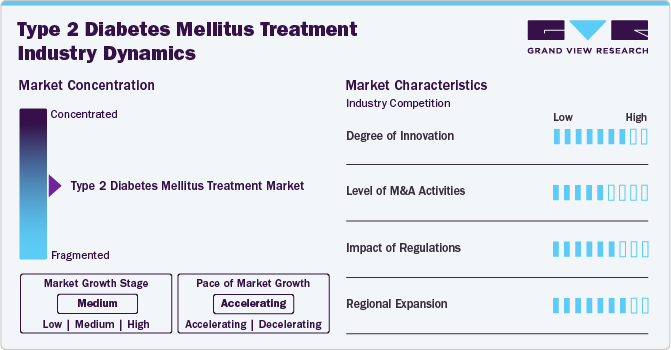

Market Concentration & Characteristics

Degree of innovation in the type 2 diabetes mellitus treatment market is high with the development of novel therapies like GLP-1 receptor agonists and SGLT2 inhibitors. These innovations have transformed treatment by offering improved glycemic control, weight loss, and cardiovascular benefits, which are essential as the global diabetes burden grows. For instance, in June 2023, Pfizer Inc. announced its commitment to advancing a late-stage oral glucagon-like peptide-1 receptor agonist (GLP-1-RA) candidate into further clinical development. This innovative therapy aims to address obesity and diabetes in adults, reflecting Pfizer's intentions to expand treatment options for these prevalent conditions.

The level of M&A activity in the T2DM market is significant as pharmaceutical companies seek to strengthen their portfolios and access innovative technologies. For instance, in August 2023, global pharmaceutical company Lupin announced the strategic acquisition of the diabetes brands ONDERO and ONDERO MET from Boehringer Ingelheim International GmbH. This initiative underscores Lupin's commitment to expanding its footprint in the diabetes care market and enhancing its portfolio with established, high-potential products.

Regulations and regulatory bodies significantly impact the T2DM treatment landscape. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) facilitate faster access to innovative treatments through programs such as Breakthrough Therapy Designation and Fast Track. In December 2023, comprehensive "Standards of Care in Diabetes-2024” were released by the American Diabetes Association (ADA)" offering updated, evidence-based guidelines for managing type 1, type 2, gestational diabetes, and prediabetes. These guidelines cover diagnosis, treatment strategies, and methods to prevent or delay diabetes and its complications, including cardiovascular disease and obesity. In addition, global initiatives such as the World Health Organization's Global Diabetes Compact promote comprehensive strategies to combat diabetes, shaping national policies and encouraging the adoption of new treatments.

Regional expansion is another key driver, particularly in emerging markets where the prevalence of diabetes is rising rapidly. As pharmaceutical companies seek to address the rising global diabetes burden, they are strategically expanding their presence in emerging markets to capitalize on new opportunities and meet the evolving needs of diabetes patients worldwide. For instance, in April 2024, Sanofi launched its diabetes medication Soliqua in India, following the receipt of marketing authorization from the Central Drugs Standard Control Organization (CDSCO). This introduction marks a significant expansion of Sanofi's diabetes care offerings in the Indian market.

Drug Class Insights

In 2023, the insulin segment accounted for the largest revenue share of 32.8% owing to the escalating global prevalence of type 2 diabetes, with millions of new cases annually. Advances in insulin formulations, including ultra-fast-acting variants and biosimilars, have enhanced treatment efficacy and accessibility. For instance, in July 2021, the FDA approved Semglee (insulin glargine-yfgn) as the first interchangeable biosimilar insulin product. This approval allowed Semglee to be both biosimilar and interchangeable with Lantus (insulin glargine), its reference product. Semglee is indicated for improving glycemic control in both adults and pediatric patients with Type 1 diabetes and in adults with Type 2 diabetes.

The SGLT2 inhibitors segment is experiencing the fastest CAGR of 9.2%. This growth is attributed to their multifaceted benefits, including effective blood glucose reduction and substantial cardiovascular and renal protection, which address prevalent comorbidities linked with type 2 diabetes. Their efficacy in reducing hemoglobin A1c levels and aiding in weight loss has made them a popular choice among both patients and healthcare providers. In addition, the expanding body of clinical evidence supporting their long-term benefits and safety profile contributes to increased adoption.

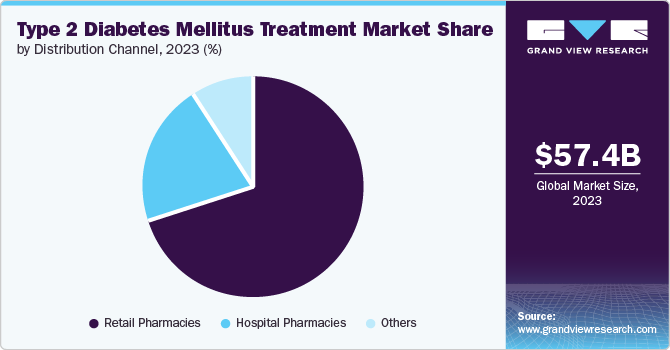

Distribution Channel Insights

The retail pharmacies segment held the largest revenue share of around 70.0% in 2023. As the primary point of access for patients, retail pharmacies offer convenience, accessibility, and a wide range of medications, making them the preferred choice for most individuals managing chronic conditions. The dominance of retail pharmacies is also bolstered by the increasing availability of a diverse array of T2DM treatments, including oral antidiabetic drugs, injectables, and combination therapies. Retail pharmacies provide easy access to these medications, ensuring that patients can adhere to their prescribed regimens without significant barriers. In addition, retail pharmacies have expanded their role beyond just dispensing medications to include patient education and support services. Many pharmacies now offer diabetes management programs, which include blood glucose monitoring, medication counseling, and lifestyle advice, thereby enhancing patient engagement and adherence.

Other distribution channels such as online pharmacies, long-term care pharmacies and specialty pharmacies is experiencing the fastest-CAGR of 8.5% over the forecast period. This growth is driven by a combination of factors, including the rise of e-commerce, the aging population, and the increasing complexity of diabetes treatment. The evolution of digital health solutions and e-commerce has significantly impacted the healthcare landscape, particularly in the distribution of medications. Online pharmacies have emerged as a vital component of this digital transformation, offering patients a convenient and efficient way to access their medications.

The management of T2DM is becoming increasingly complex, particularly with the advent of new and advanced therapies. Specialty pharmacies are at the forefront of this shift, focusing on providing high-cost, high-complexity medications that require specialized handling and administration. These pharmacies are uniquely positioned to manage the distribution of advanced therapies, such as GLP-1 receptor agonists, insulin analogs, and other biologics that are increasingly being used to treat diabetes.

Route of Administration Insights

The oral segment accounted for the largest revenue share of 57.4% in 2023. The increasing prevalence of T2DM, primarily fueled by rising obesity rates, sedentary lifestyles, and unhealthy diets, has led to a higher demand for effective and convenient treatment options. Oral antidiabetic drugs (OADs) are favored due to their ease of administration, better patient compliance, and ongoing advancements in drug formulations. The development of newer classes of OADs, such as SGLT-2 inhibitors and GLP-1 receptor agonists, has significantly improved glycemic control and cardiovascular outcomes, which are crucial for diabetes management. Furthermore, healthcare initiatives and guidelines, such as those by the European Association for the Study of Diabetes (EASD) and the American Diabetes Association (ADA), increasingly recommend early initiation of OADs, especially in patients with cardiovascular risk factors. For instance, the ADA's 2023 Standards of Medical Care in Diabetes emphasize the importance of individualizing treatment, including the early use of combination oral therapies, which aligns with the growing preference for these medications.

The subcutaneous route of administration is anticipated to achieve the highest CAGR of 9.4% during the forecast period. The growing recognition of the limitations of oral therapies has spurred the adoption of subcutaneous treatments, particularly injectable therapies such as GLP-1 receptor agonists and insulin analogs. Subcutaneous therapies are becoming increasingly preferred due to their ability to provide better glycemic control, particularly in patients who fail to achieve adequate control with oral medications alone. The efficacy of GLP-1 receptor agonists in not only managing blood glucose levels but also in promoting weight loss and reducing cardiovascular risks.

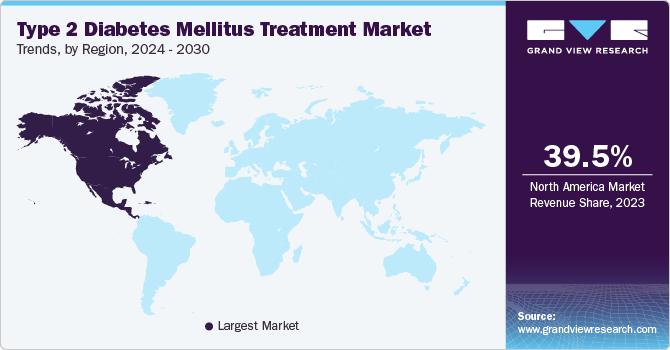

Regional Insights

North America dominated the type 2 diabetes mellitus treatment market with a share of 39.54% in 2023. The type 2 diabetes mellitus treatment market in North America is driven by the high prevalence of diabetes, increasing healthcare expenditure, and the adoption of advanced treatment options. In 2021, the International Diabetes Federation (IDF) estimated that approximately 51 million adults in North America were living with diabetes, with a significant proportion having type 2 diabetes. Government initiatives aimed at diabetes prevention and management, such as the CDC's National Diabetes Prevention Program (NDPP), also contribute to market expansion by increasing awareness and early intervention efforts. For instance, in July 2024, a new public service announcement campaign was launched by the Hawaiʻi State Department of Health (DOH), aimed at encouraging individuals with prediabetes to adopt healthier habits to prevent Type 2 diabetes.

The campaign promotes taking the Prediabetes Risk Assessment and consulting with a healthcare provider for further testing if necessary. For those with elevated blood glucose levels indicating prediabetes, engaging in a lifestyle change program, such as the Beat Diabetes Prevention Program, is recommended. Such programs have been shown to significantly reduce the risk of progressing to Type 2 diabetes.

U.S. Type 2 Diabetes Mellitus Treatment Market Trends

The T2DM treatment market in the U.S. is characterized by its advanced healthcare infrastructure, high prevalence of diabetes, and significant pharmaceutical innovations. According to a CDC report released in May 2024, approximately 38 million Americans are living with diabetes, equating to about 1 in 10 people. 20% of these individuals are unaware of their condition. Additionally, around 98 million American adults, or over one-third, have prediabetes. Of these, more than 80% are unaware that they have this precursor to diabetes. The report highlighted a significant gap in awareness and diagnosis, underscoring the need for increased screening and education to address the growing diabetes crisis. In addition, the U.S. government’s commitment to healthcare spending, alongside public health initiatives such as Medicare and Medicaid, ensures broader access to T2DM treatments, further driving market growth.

The type 2 diabetes mellitus treatment market in Canada is shaped by the country’s universal healthcare system, which ensures equitable access to diabetes care and medication. According to the Diabetes Canada, approximately 3.8 million Canadians are living with diabetes and is projected to increase to 4.9 million by 2030. The market benefits from government initiatives such as Diabetes Canada’s advocacy for better diabetes care and the implementation of national guidelines for diabetes management.

Europe Type 2 Diabetes Mellitus Treatment Market Trends

The type 2 diabetes mellitus treatment market in Europe is growing rapidly due to the increasing prevalence of diabetes, an aging population, and strong governmental support for healthcare. Europe has one of the highest diabetes prevalence rates, with the IDF estimating over 60 million adults with diabetes in the region in 2021. The European Medicines Agency (EMA) plays a key role in the approval and regulation of new diabetes treatments, ensuring that European patients have access to the latest therapies. Government-funded healthcare systems across Europe provide widespread access to diabetes care, and national diabetes strategies, such as the UK’s NHS Long Term Plan and Germany’s Disease Management Programs, focus on improving outcomes for people with T2DM.

The T2DM treatment market in the UK is bolstered by a strong national healthcare system (the NHS) and government initiatives aimed at reducing diabetes incidence and improving care for those with the condition. The UK has seen a rise in cases, according to the Diabetes UK, with over 5 million people are affected as of 2023. The NHS Long Term Plan, which includes a significant focus on diabetes prevention and management, has been instrumental in driving market growth. The UK government’s investment in public health campaigns, such as Change4Life, and the implementation of the NHS Diabetes Prevention Programme (NHS DPP), which targets individuals at high risk of developing T2DM, have also been key drivers.

The T2DM treatment market in France is strongly supported by the country’s comprehensive healthcare system and a high level of government involvement in chronic disease management. According to the study published by National Library of Medicines, around 3.5 million people in France were treated for Diabetes in 2020, predominantly type 2. France has one of the most extensive healthcare systems in Europe, with universal coverage that ensures all citizens have access to diabetes care. The French government has implemented national strategies, such as the "Plan National Diabète," which focuses on improving the quality of diabetes care and reducing the burden of the disease.

Asia Pacific Type 2 Diabetes Mellitus Treatment Market Trends

The T2DM treatment market in Asia Pacific region is experiencing rapid growth due to a combination of rising diabetes prevalence, increasing healthcare expenditure, and expanding access to medical care. The region is home to more than 230 million adults with diabetes. Rapid urbanization, changes in diet and lifestyle, and increasing obesity rates are contributing to the surge in diabetes cases. Countries such as India and China are witnessing particularly high growth in diabetes prevalence, driving demand for effective treatments. Governments across the region are increasingly focusing on public health initiatives to combat diabetes, including large-scale screening programs and the promotion of healthier lifestyles.

The type 2 diabetes mellitus treatment market in India is characterized by rapid growth driven by the high prevalence of diabetes, increasing healthcare infrastructure, and proactive government initiatives. According to a 2023 study by the Indian Council of Medical Research, India has one of the largest diabetes populations globally, with approximately 100 million adults affected as of 2023. The Indian government’s National Programme for Prevention and Control of Cancer, Cardiovascular Diseases, Diabetes, and Stroke (NPCDCS) aims to enhance diabetes care through public awareness, early detection, and improved treatment access.

The type 2 diabetes mellitus treatment market in China is significantly influenced by the country’s growing diabetes epidemic, increasing healthcare investments, and government initiatives aimed at improving diabetes management. China has the highest number of people with diabetes in the world, with over 140 million adults affected, according to the IDF. The rapid increase in diabetes prevalence is driven by factors such as urbanization, sedentary lifestyles, and dietary changes. In response, the Chinese government has implemented various policies to address the diabetes crisis, including the Healthy China 2030 plan, which emphasizes chronic disease prevention and control. The National Medical Products Administration (NMPA) has also accelerated the approval process for new diabetes medications, allowing for quicker access to innovative treatments.

Latin America Type 2 Diabetes Mellitus Treatment Market Trends

The type 2 diabetes mellitus treatment market in Latin America is expanding due to increasing diabetes prevalence, rising healthcare awareness, and improved access to medical care. According to IDF Diabetes Atlas, this region is home to over 32 million people with diabetes. Countries such as Brazil and Mexico have some of the highest diabetes prevalence rates in the region, driven by factors such as poor dietary habits, physical inactivity, and obesity. Regulatory bodies such as Brazil’s National Health Surveillance Agency (ANVISA) and Mexico’s Federal Commission for the Protection against Sanitary Risks (COFEPRIS) are playing key roles in ensuring the availability and safety of new diabetes medications in the region.

The T2DM market in Brazil is driven by a high prevalence of diabetes, government initiatives, and increasing access to healthcare services. Brazil has one of the highest numbers of people with diabetes in Latin America. The Brazilian government has recognized diabetes as a public health priority and has implemented various initiatives to address the growing burden of the disease. The Brazilian Ministry of Health’s National Program for Diabetes and Hypertension aims to improve diabetes care through increased access to medications, early diagnosis, and patient education. Additionally, Brazil’s participation in global clinical trials and its robust pharmaceutical industry are contributing to the availability of innovative diabetes treatments.

Middle East & Africa Type 2 Diabetes Mellitus Treatment Market Trends

The type 2 diabetes mellitus treatment market in the Middle East and Africa is witnessing significant growth driven by increasing diabetes prevalence, rising healthcare investments, and government-led public health initiatives. Countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in healthcare infrastructure, including the establishment of specialized diabetes centers and the adoption of advanced treatment options. For instance, in November 2023, Kenya's Ministry of Health (MoH) initiated a four-year project titled ‘Integrating Diabetes and Hypertension Prevention and Control into Primary Health Care.’ This initiative is designed to enhance healthcare delivery across Kenya's 47 counties by incorporating comprehensive prevention and management strategies for diabetes and hypertension into primary health care services. The project aims to improve health outcomes and accessibility, addressing these critical chronic conditions more effectively at the grassroots level.

The T2DM market in Saudi Arabia is characterized by a high prevalence of diabetes, substantial government investment in healthcare, and a focus on improving diabetes care. According to the study published by National Library of Medicine in May 2024, Saudi Arabia has one of the highest rates of diabetes in the Middle East, with nearly 7 million people affected and around 3 million having pre-diabetes. The Saudi government has recognized the growing diabetes burden and has implemented the National Diabetes Prevention and Control Program, which aims to reduce the prevalence of diabetes through public health campaigns, early screening, and improved access to treatment. The Saudi Food and Drug Authority (SFDA) plays a key role in the regulation and approval of new diabetes treatments, ensuring that the latest therapies are available to patients.

Key Type 2 Diabetes Mellitus Treatment Company Insights

The type 2 diabetes mellitus market is dominated by several major pharmaceutical companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative treatment options. They also expanded their product portfolios through strategic collaborations, mergers, and acquisitions.

Key Type 2 Diabetes Mellitus Treatment Companies:

The following are the leading companies in the type 2 diabetes mellitus treatment market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Daiichi Sankyo Co. Ltd

- Eli Lilly and Co.

- Merck & Co. Inc

- Novartis AG

- Novo Nordisk AS

- Sanofi SA

- Takeda Pharmaceutical Co. Ltd

Recent Developments

-

In June 2024, China’s National Medical Products Administration granted approval for Novo Nordisk’s insulin icodec injection for treating Type 2 diabetes in adults. This decision permits insulin icodec to be introduced into the Chinese market, providing a novel treatment option for managing Type 2 diabetes and expanding the range of available therapies for patients in China.

-

In January 2024, Glenmark Pharmaceuticals Ltd., a leading global research-driven pharmaceutical company, launched its biosimilar version of the popular anti-diabetic drug Liraglutide in India. Marketed under the brand name Lirafit, this new biosimilar has been approved by the Drug Controller General of India (DCGI), expanding the availability of affordable diabetes treatment options in the country.

-

In May 2022, the U.S. Food and Drug Administration (FDA) granted approval for Mounjaro (tirzepatide), an injection developed by Eli Lilly, for enhancing blood sugar control in adults with Type 2 diabetes (T2D).

Type 2 Diabetes Mellitus Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 61.4 billion

Revenue forecast in 2030

USD 91.9 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, route of administration, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AstraZeneca PLC; Boehringer Ingelheim International GmbH; Daiichi Sankyo Co. Ltd; Eli Lilly and Co.; Merck & Co. Inc; Novartis AG; Novo Nordisk AS; Sanofi SA; Takeda Pharmaceutical Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Type 2 Diabetes Mellitus Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global type 2 diabetes mellitus treatment market report based on drug class, route of administration, distribution channel, and region.

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin

-

DPP-4 Inhibitors

-

GLP-1 Receptor Agonists

-

SGLT2 Inhibitors

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Subcutaneous

-

Intravenous

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Hospital Pharmacies

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global type 2 diabetes mellitus treatment market was valued at USD 57.47 billion in 2023 and is expected to reach USD 61.46 billion in 2024.

b. The global type 2 diabetes mellitus treatment market is expected to grow at a CAGR of 6.9% from 2024 to 2030 to reach USD 91.97 billion by 2030.

b. In 2023, the insulin segment accounted for the largest revenue share of 32.8% owing to the escalating global prevalence of type 2 diabetes, with millions of new cases annually, fuels the demand for insulin

b. Some of the prominent players in the global diabetes mellitus, type 2 treatment market are AstraZeneca PLC, Boehringer Ingelheim International GmbH, Daiichi Sankyo Co. Ltd, Eli Lilly and Co., Merck & Co. Inc, Novartis AG, Novo Nordisk AS, Sanofi SA, Takeda Pharmaceutical Co. Ltd

b. This growth is driven by the rising prevalence of diabetes, increasing healthcare expenditure, advancements in treatment options, and supportive government initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."