- Home

- »

- Renewable Energy

- »

-

U.S. Solar PV Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Solar PV Market Size, Share & Trends Report]()

U.S. Solar PV Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Non-residential, Utility), By State, And Segment Forecasts

- Report ID: 978-1-68038-406-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Solar PV Market Size & Trends

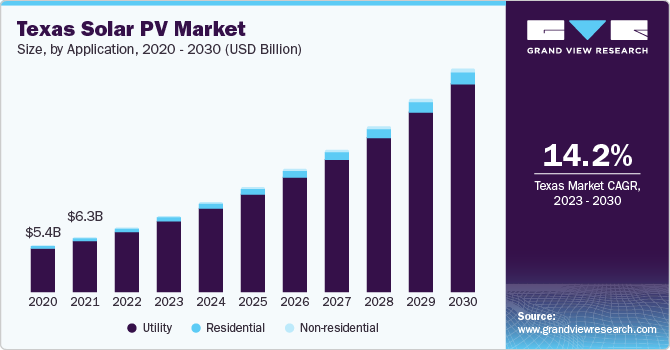

The U.S. solar PV market size was estimated at USD 29.68 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 13.7% from 2023 to 2030. Favorable policies and incentive schemes at the state and federal levels coupled with decreasing prices of solar panels are expected to boost the market of solar PV in the U.S. The energy generation market has witnessed growth in terms of the installed capacity of solar power, in the past few years on account of the growing environmental concerns coupled with the pressure to reduce the harmful effects of greenhouse gasses. This has been a major factor in the expansion of solar PV in the utility sectors.

The U.S. solar PV segment is driven by supportive policies as well as plans coupled with high interest from private companies to enter into the market. Solar PV plants in the country have increased owing to the stringent government regulations regarding emissions. The power scenario in the country has been witnessing a change with the increased adoption of renewable power sources compared to coal-based and gas power generation.

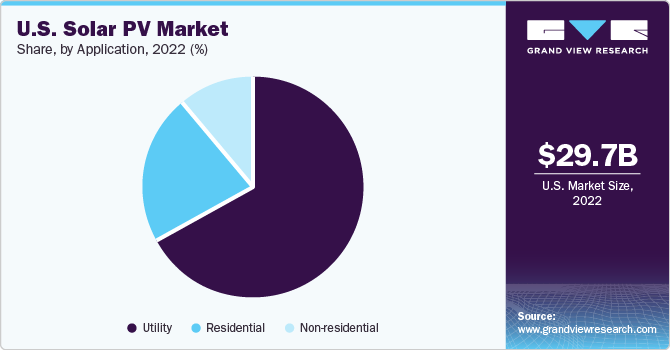

The increasing volatility of the prices of fossil fuels has created a need for investment in renewable energy to stabilize power generation costs. Sustainable sources of power such as solar are efficient in generating consistent power and new solar installations have become cheaper than coal and gas, which have made them more preferable to other sources. The states such as California and Texas have provided a large amount of incentive schemes for the promotion of solar power in the states. For instance, in the last decade, California has invested USD 80.8 billion in solar technology and created incentive schemes and tax benefits for residents who install solar panels.

Application Insights

In terms of application, the utility segment held the largest revenue share of 66.68% in 2022. Shifting consumer preference towards renewable energy generation considering environmental protection is expected to augment the market growth. Increasing consumer awareness regarding environmental protection is expected to result in the development of sustainable energy and reduced carbon emissions, which is expected to augment the market growth.

The residential segment is anticipated to grow at the fastest CAGR of 13.9% in the forecast period. Increasing adoption of renewable energy sources on the residential level is expected to boost the demand for solar PV in the U.S. from 2023 to 2030. Favorable policies and incentive schemes at the federal as well as state levels have increased the penetration of residential solar PV in the country. The commercial segment is anticipated to grow at a stable CAGR over the forecast period. Many industries have opted to generate power in-house through solar PV panels as grid-based energy prices have increased over the past year.

Key Companies & Market Share Insights

Key participants in the industry are focusing on technological advancements and innovation to minimize the cost of solar PV. In addition, industry players are practicing several strategic initiatives to expand their foothold in the renewable energy market over the coming years. For instance, in April 2022, Primenergy announced the construction of the largest solar PV plant in the U.S. The project will be located in Nevada and will generate 690MW of electricity. The plant is expected to be operational by 2023.

Key U.S. Solar PV Companies:

- First Solar

- SunPower

- Suniva

- 1Soltech

- Sharp

- Alps Technology

- Advance power

- Auxin solar

- BORG Inc.

- Pionis Energy

U.S. Solar PV Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.6 billion

Revenue forecast in 2030

USD 96.6 billion

Growth rate

CAGR of 13.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in MW, revenue in USD million/billion; and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, state

Country scope

U.S.

State scope

California; Arizona; New Jersey; North Carolina; Nevada; Massachusetts; Hawaii; Colorado; New York; Texas; Florida; Georgia; Utah; Virginia; South Carolina; Maryland; New Mexico; Oregon; Indiana; Minnesota; Pennsylvania

Key companies profiled

First Solar; SunPower; Suniva; 1Soltech; Sharp; Alps Technology; Advance power; Auxin solar; BORG Inc.; Pionis Energy

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solar PV Market Report Segmentation

This report forecasts revenue & volume growth at country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the U.S. solar PV market report based on application and state:

-

Application Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

Utility

-

-

State Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

-

California

-

Arizona

-

New Jersey

-

North Carolina

-

Nevada

-

Massachusetts

-

Hawaii

-

Colorado

-

New York

-

Texas

-

Florida

-

Georgia

-

Utah

-

Virginia

-

South Carolina

-

Maryland

-

New Mexico

-

Oregon

-

Indiana

-

Minnesota

-

Pennsylvania

-

Frequently Asked Questions About This Report

b. The U.S. solar PV market is expected to witness a compound annual growth rate of 13.7% from 2023 to 2030 to reach USD 96.6 billion by 2030.

b. Utility applications dominated the market and accounted for over 66.68% of the revenue in 2022. Shifting consumer preference towards renewable energy generation on account of environmental protection is expected to augment utility applications.

b. Some key players operating in the U.S. solar PV market include First Solar, SunPower, Suniva, 1Soltech, Alps Technology, Advance Power, Auxin Solar, BORG Inc., Pionis Energy, Green Brilliance, Lumos, and Itek Energy.

b. Key factors that are driving the market growth include subsidies and favorable regulatory framework which are anticipated to drive market growth over the forecast period. Furthermore, a sharp decline in equipment cost owing to rise in installations particularly in California and Texas is expected to continue over the forecast period.

b. The U.S. solar PV market size was estimated at USD 29.68 billion in 2022 and is expected to reach USD 96.63 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.