- Home

- »

- Medical Devices

- »

-

UK Dental Implants Market Size And Share Report, 2030GVR Report cover

![UK Dental Implants Market Size, Share & Trends Report]()

UK Dental Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Titanium, Zirconia), And Segment Forecasts

- Report ID: GVR-4-68040-200-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Dental Implants Market Size & Trends

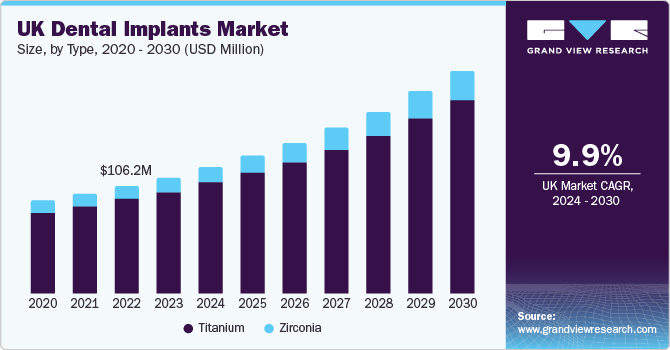

The UK dental implants market size was estimated at USD 114.81 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2024 to 2030. The curbing of aesthetic procedures during the COVID-19 pandemic led to a post-pandemic boom in the market. A 2021 report on the Adult Oral Health Survey stated that one in 10 survey respondents did not receive dental treatment due to the global lockdowns. The closure of dental clinics during COVID-19 lockdowns created a significant backlog, thus propelling overall market growth for dental treatment, including dental implants in the post-pandemic world.

Dental implants act as a long-term replacement to preserve adjacent teeth, and implantation is the only restorative solution that conserves, stimulates, and mimics natural bone. Hence, it is evident that, with the growing incidence of facial injuries owing to road accidents and sports-associated injuries as well as reliability of the procedure, are driving the UK dental implants market growth.

The introduction of software solutions to aid the molding process, previously covered by die casting, is also driving the favorability for dental implants. CAD/CAM-based dental restorations and prosthetics are relatively more precise and can be produced or designed in a day, whereas conventional techniques involve using temporary restorations for several weeks as the final restoration gets designed.

The increasing preference to zirconia implants, coupled with the ongoing research on PEEK polymers as a superstructure in orthodontics has significantly aided market investment. In addition, the gradual increase in healthcare expenditure in the UK, as assessed by the World Bank, has led to better access to dental procedures for UK citizen.

Market Concentration & Characteristics

The market growth is moderate and the pace of growth is accelerating. The UK market for dental implants is characterized by a high degree of innovation owing to the rising technological developments in the field and the increasing prevalence of oral conditions. According to the World Dental Federation, globally, nearly 30.0% of individuals aged 65 to 74 have no natural teeth, and this burden is expected to increase with a rapidly aging population.

Computer-aided design and manufacturing (CAD/CAM) techniques as well as additively manufactured dentures are being adopted by major industry players. The integration of cutting-edge techniques such as nanotechnology and plasma integration in osseointegration, bioactive materials that aid tissue regrowth, and smart technology to implant miniature sensors in implants are expected to revolutionize the market growth further.

Key players in the UK dental implants market are leveraging multiple strategies for lucrative growth opportunities. Moreover, to promote the reach of their offerings and increase their product capabilities, major players have resorted to acquisition of companies leading in a technology in the market. For instance, in May 2023, Zimmer Biomet Holdings, Inc. acquired OSSIS, a medical device producer specializing in personalized 3d-printed implants.

The medical devices regulatory framework in the UK has witnessed a dramatic change since Brexit and COVID-19 pandemic outbreak. Thus, regulations set by the Medicines and Healthcare products Regulatory Agency (MHRA) as well as the EU Medical Device Regulation (MDR) influence the market growth. With market participants spearheading varied research initiatives, these regulations ensure that the manufacturing, structure, and quality of dental implants are maintained. For instance, in September 2022, RevBio received approval from the MHRA to begin with a clinical trial focused on testing an optimized formulation of their dental bone adhesive biomaterial.

The use of dental bridges and dentures has decreased, and denturists as well as oral surgeons favor the use of dental implants due to their technological advancements and efficient technique. With new and existing market players investing in innovative product development, the market is characterized by high product expansion. For instance, in February 2021, Dental Beauty Partners announced their expansion in the UK to enhance their product portfolio and provide high-quality dental care services.

The UK dental implants industry has witnessed geographic expansions internally. Moreover, the favorability of the UK market has led to investments from European market players in the UK. Key implant manufacturers, such as Institut Straumann and Dentsply Sirona, with major market shares in the region, have undertaken initiatives such as collaborating with DSOs for the distribution of dental equipment.

Type Insights

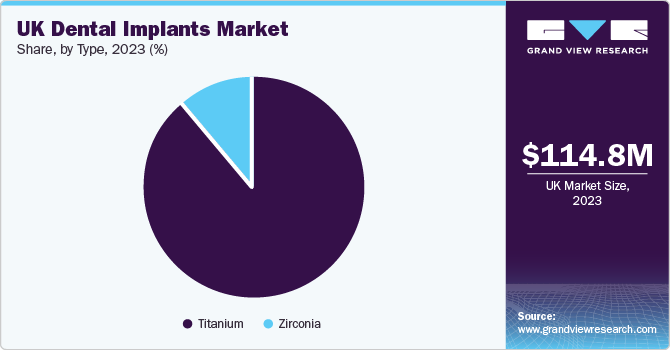

The titanium segment led the dental implants market with a revenue share of 89.0% in 2023 and is anticipated to grow significantly from 2024 to 2030. Titanium implants are preferred due to their high fatigue resistance and low wear & tear with motion. Moreover, as titanium does not release any ions or reacts with bone and tissue constituents, they are highly compatible with the human anatomy. For instance, in May 2022, Osstem Implant introduced the KS implant system, offering improved fatigue fracture toughness and a diverse implant portfolio, thus contributing to the enhancement of dental implant technology.

Zirconia is the fastest growing segment and is expected to register a staggering CAGR from 2024 to 2030. Zirconia implants provide the same compatibility and durability as titanium implants. However, their favorability arises from their esthetic appeal and bacterial resistance. Thus, they mimic natural teeth perfectly and reduce tooth sensitivity after an implant procedure. Major market players offer zirconia implants due to their enhanced structure. For instance, in March 2022, Neodent, a leading dental implant company under the Straumann Group, launched Zi, a zirconia implant. Zi is a metal free solution that allows for immediate positioning with high end aesthetics owing to the modern and naturally tapered design.

Key UK Dental Implants Market Company Insights

The market is fragmented, with prominent players accounting for a large percentage of the market. Some of the key players operating in the UK dental implants market include Straumann Holding AG; Nobel Biocare Services AG (Danaher Corporation); Dentsply Sirona Inc; and Zimmer Biomet Holdings, Inc. These companies are collaborating with regional players to expand their services geographically.

Market players have resorted to varied strategic initiatives for sustained growth, such as mergers, collaborations, product development, and expansion in UK. For instance, global players in the market are collaborating with local, private Dental Service Organizations (DSOs) to provide better dental service and cater to a larger audience.

Key UK Dental Implants Companies:

The following are the leading companies in the UK dental implants market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these UK dental implants companies are analyzed to map the supply network.

- Straumann Holding AG

- Nobel Biocare Services AG

- Dentsply Sirona Inc

- Zimmer Biomet Holdings, Inc.

- Osstem Implant Co Ltd

- Kyocera Corporation

- BioHorizons IPH, Inc.

- Bicon, LLC

- Dentium Co., Ltd.

- ARCH Medical Solutions Corp

Recent Developments

-

In January 2024, DENTSPLY Sirona launched a new digital denture manufacturing product that is expected to enable practices and labs to advance in digital denture manufacturing with the Primeprint Solution. This system allows for the production of high-impact, printable denture bases, thus contributing to the growth and advancement of dental practices and labs.

-

In August 2021, Dentex Health acquired a leading Cornish dental services centre, the Martin Docking Limited and Dental Precision, which offers dental treatment & care services. The acquisition was expected to help achieve future growth and ensure continuity of patient care.

-

In June 2021, IDH Group, a dental service provider, was acquired by Paloma Capital Partners, a UK-based private equity firm that has held a minority stake in the business since 2011.

-

In August 2022, Portman Dental Care, based in Cheltanham, completed its merger with Dentex Health, a London-based dental clinic operator. With this merger, they have created one of the largest privately focused dental groups in the UK and one of Europe’s largest dental care platforms.

-

By April 2021, Clyde Dental Practice, a Scottish company with 46 dental clinics around the region, had acquired McIntyre, Corbet & Associates, Fairmilehead Dental Practice, Short’s Dental, Stewarton Street Dental Practice, F J Murphy BDS MJD, Dental Care Perth Limited, Sandgate Dentistry, and Grays Dental Practice. These acquisitions were expected to expand its regional footprint.

UK Dental Implants Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 220 million

Growth rate

CAGR of 9.9% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type

Country scope

UK

Key companies profiled

Straumann Holding AG; Nobel Biocare Services AG (Danaher Corporation); Dentsply Sirona Inc; Zimmer Biomet Holdings, Inc.; Osstem Implant Co Ltd; KYOCERA Medical Corp; BioHorizons IPH, Inc.; Institut Straumann AG; Bicon, LLC; Leader Italy; Anthogyr SAS; DENTIS; DENTIUM Co., Ltd.; T-Plus Implant Tech. Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Dental Implants Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK dental implants market report based on type:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium

-

Zirconia

-

Frequently Asked Questions About This Report

b. The UK dental implant market is estimated at USD 114.81 million in 2023 and is expected to reach USD 124.6 million in 2024.

b. The UK dental implant market is expected to grow at a CAGR of 8.5% from 2024 to 2030 to reach USD 220.0 million in 2030.

b. Titanium led the dental implants market with a revenue share of 89.0% in 2023 and is anticipated to grow significantly over the forecast period.

b. Some of the key players operating in the UK dental implants market include Straumann Holding AG; Nobel Biocare Services AG (Danaher Corporation); Dentsply Sirona Inc; and Zimmer Biomet Holdings, Inc.

b. The curbing of aesthetic procedures during the COVID-19 pandemic has led to a post-pandemic bloom in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.