- Home

- »

- Nutraceuticals & Functional Foods

- »

-

UK Dietary Supplements Market Size, Industry Report, 2033GVR Report cover

![UK Dietary Supplements Market Size, Share & Trends Report]()

UK Dietary Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Ingredient (Proteins & Amino Acids, Prebiotics & Postbiotics, Fibers & Specialty Carbohydrates), By Type, By Form (Tablets, Powder), By End User, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-657-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Dietary Supplements Market Summary

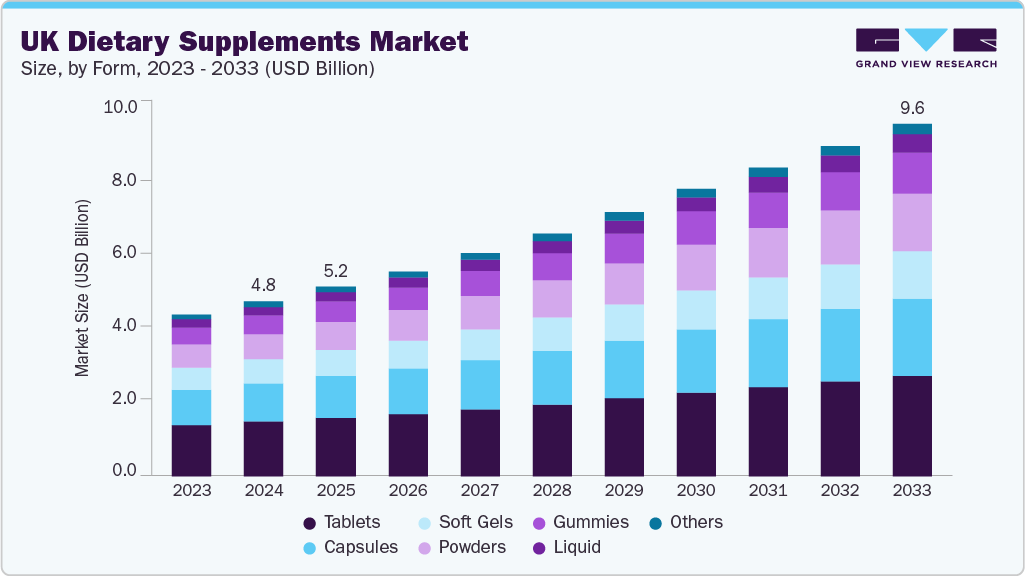

The UK dietary supplements market size was estimated at USD 4.79 billion in 2024 and is projected to reach USD 9.65 billion by 2033, growing at a CAGR of 8.1% from 2025 to 2033. The market is experiencing steady growth, driven by increased health awareness, an aging population, and a prevalence of chronic conditions such as obesity, diabetes, and cardiovascular disease.

Key Market Trends & Insights

- By ingredient, the vitamin supplements segment led the UK dietary supplements market with a revenue share of 37.4% in 2024.

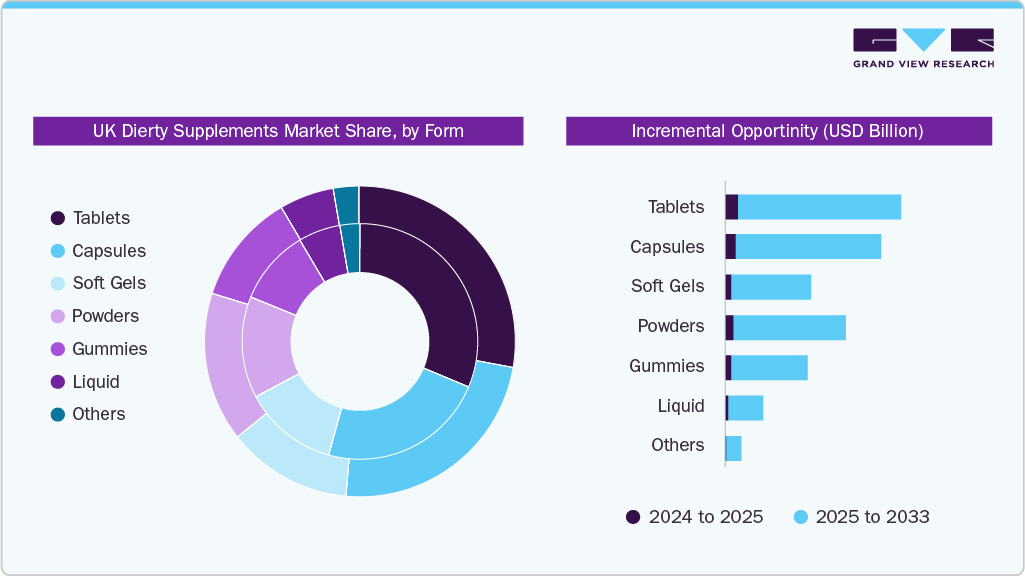

- By form, the powdered supplements segment led the market and is expected to witness a CAGR of 9.4% from 2025 to 2033.

- By type, the OTC supplements segment dominated the UK dietary supplements market with a share of 73.3% in 2024.

- By application, the prenatal health supplements segment led the UK dietary supplements industry and is expected to witness a CAGR of 12.0% from 2025 to 2033.

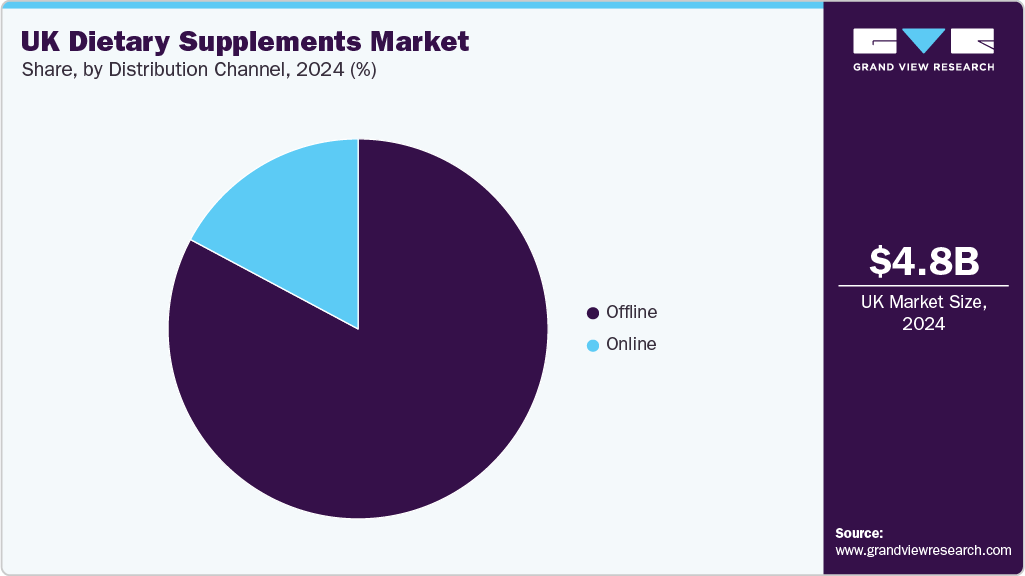

- By distribution channel, the offline channels segment led the market with a revenue share of 82.8% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 4.79 Billion

- 2033 Projected Market Size: USD 9.65 Billion

- CAGR (2025-2033): 8.1%

British consumers are becoming more proactive about their health, with a noticeable shift toward preventive wellness and nutritional support. Public health campaigns by the NHS and government recommendations, such as vitamin D supplementation for everyone during the winter months, have also played a key role in shaping consumer behavior. Additionally, the UK’s growing interest in fitness, plant-based lifestyles, and clean-label products is fueling demand for supplements that support holistic and long-term health.Consumers in the UK dietary supplements industry are becoming increasingly aware of healthy lifestyles and are taking more responsibility to ensure the well being of both their mental and physical health. The perception of being healthy has also changed significantly among UK consumers.

UK consumers now perceive health in terms of preventing illness rather than treating it. As a result, Europe has been experiencing high demand for dietary supplements over the years. Increasing stress levels and the presence of an aging population are some of the other factors fueling the demand for dietary supplements in this country.

Dietary supplements manufacturers are focusing on innovating their product offerings to cater to a varied set of consumers in the UK. For instance, Yakult Honsha, a Japan-based supplement manufacturing company, has been developing strains (patented) of microorganisms to stay ahead of the competition in the UK dietary supplements market. Such efforts are likely to contribute to the growth of the dietary supplements industry in the foreseeable future.

Similarly, in January 2025, Germany’s leading sports nutrition brand ESN launched in the UK, expanding its global presence with high-quality protein powders and supplements. Founded in 2007 by athletes, ESN emphasizes science-backed products and has partnered with UK athlete Michael Sandbach. The brand has established UK offices and a warehouse for smooth operations.

The rising home healthcare expenditure has been contributing significantly to the demand for dietary supplements, most notably digestive capsules and tablets, among baby boomers in the UK In addition to the prevalence of chronic diseases in the country, the presence of geriatric population has been driving the sale of dietary supplement capsules and tablets in the country.

Furthermore, the recent ban on animal killings in the country is expected to contribute to the demand for probiotics and prebiotics over the forecast period while restricting the demand for animal-based digestive enzyme supplements.

The majority of dietary supplement sales in the UK occur in supermarkets/hypermarkets/ food stores. Drug stores & pharmacies are among the other popular distribution channels for dietary supplements in the country, with a sizable number of independent pharmacies dominating the market.

Community pharmacies are popular in the UK as they help product manufacturers and suppliers market their products based on the requirements and sales trends in select local areas. While players such as Boots Pharmacy and LloydsPharmacy dominate the large multiple sector (pharmacies), PCT Healthcare Ltd, HI Weldrick Ltd, and Dudley Taylor Pharmacies Ltd dominate the small multiple sectors in the country. From a marketing standpoint, the distribution of dietary supplements through these pharmacies in the UK has helped manufacturers realize wider profit margins over the years.

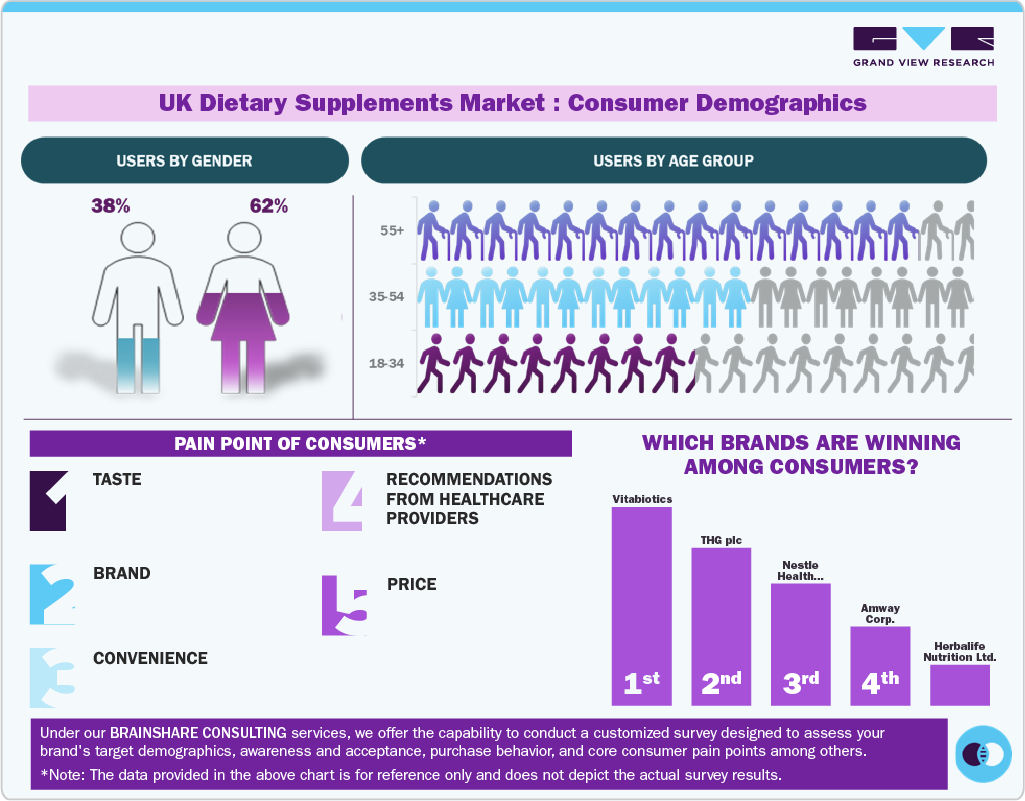

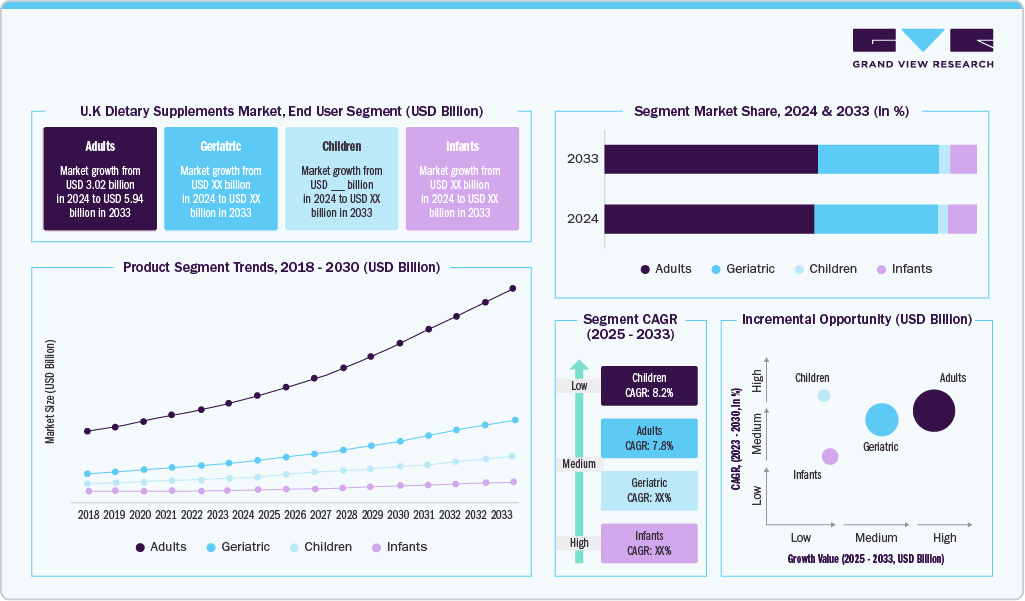

Consumer Insights for UK Dietary Supplements

The UK dietary supplements market is heavily influenced by age demographics, with the adult segment (18-64 years) accounting for the largest share of consumption. Young adults (18-34 years) are the most experimental and trend-driven group, often attracted to innovative formats like gummies, powders, and functional beverages. They are also more inclined toward vegan, organic, and plant-based supplements, aligning with broader lifestyle choices such as clean eating and fitness. In contrast, middle-aged consumers (35-54 years) prioritize supplements that support energy, heart health, joint care, and stress management. Older adults (55+) form a growing segment due to the UK's aging population, focusing on supplements for bone health, cognitive function, vision, and immunity.

Gender plays a distinct role in supplement consumption patterns. Women in the UK show higher usage rates of dietary supplements, especially those related to skin, hair, hormonal balance, prenatal health, and immunity. Women are also more likely to engage in preventive health routines and prefer clean-label, natural, and sustainably sourced products. Men, on the other hand, tend to prioritize fitness-related supplements, such as protein powders, amino acids, testosterone boosters, and energy-enhancing formulas. However, male interest in general wellness supplements like omega-3s, multivitamins, and cognitive enhancers is also on the rise.

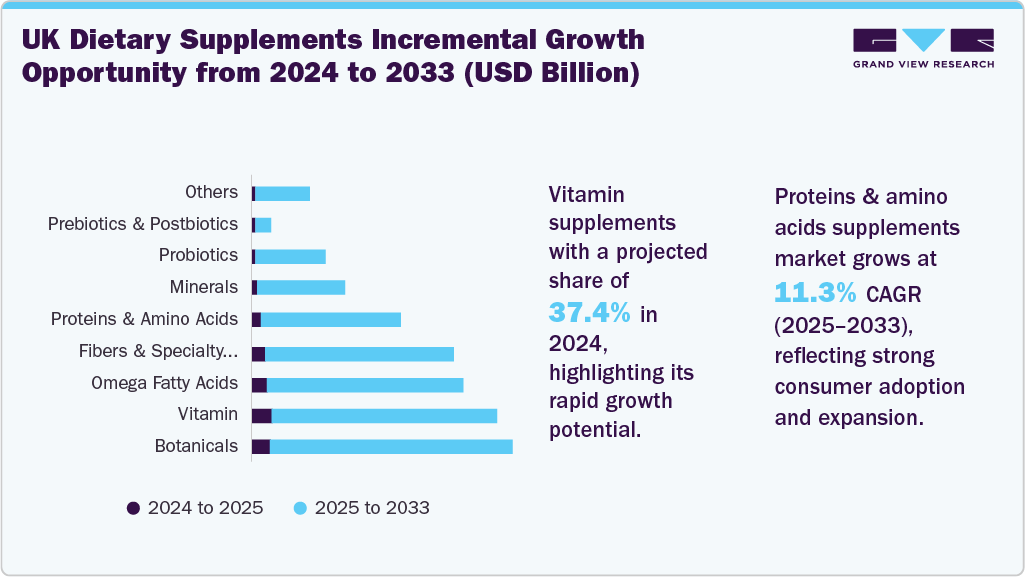

Ingredients Insights

Vitamin supplements accounted for a share of 37.4% of the UK revenues in 2024, making them the leading product category. Their popularity is largely due to their essential role in maintaining general health, preventing deficiencies, and supporting immunity. Vitamins D, C, and B-complex are among the most widely used, especially given the UK’s climate and relatively low year-round sun exposure. Government-backed health guidelines promoting regular vitamin D intake have significantly contributed to this segment’s dominance.

The demand for products with protein & amino acids is expected to grow at a CAGR of 11.3% from 2025 to 2033, driven by the rise in gym memberships, at-home fitness routines, and a strong cultural emphasis on physical well-being. These supplements are no longer used solely by athletes; a growing number of health-conscious individuals, including older adults aiming to preserve muscle mass, are integrating protein powders and amino acids into their daily nutrition. The increasing popularity of plant-based and vegan protein options, such as pea and hemp protein, is further boosting demand in line with the UK’s expanding vegan population.

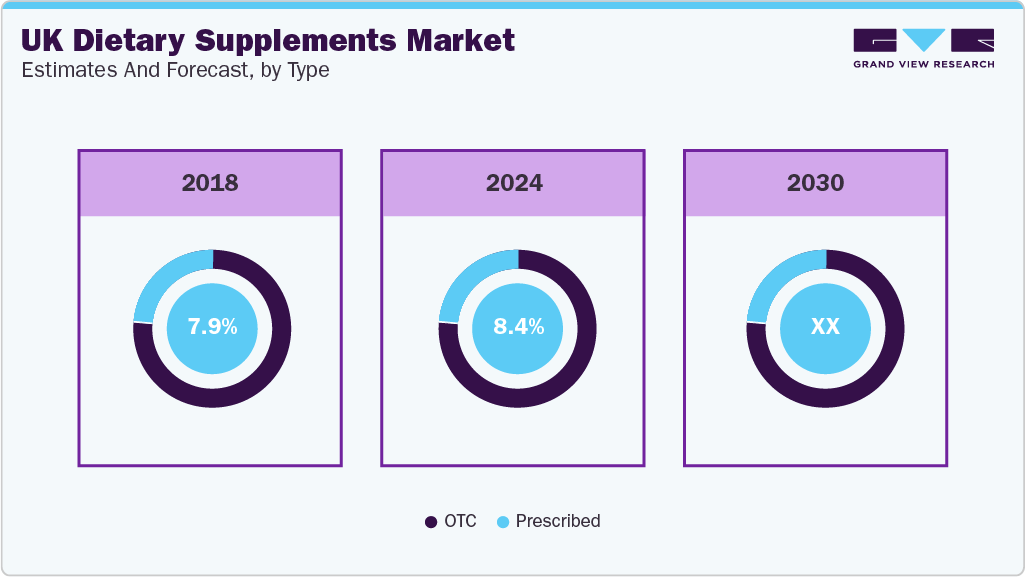

Type Insights

Over the counter (OTC) dietary supplements accounted for the largest revenue share of 73.3% in 2024. OTC dietary supplements are easily available in pharmacies, supermarkets, and online stores, making it convenient for consumers to purchase them without needing a prescription or a visit to a healthcare provider.

The demand for prescribed dietary supplements is projected to grow at a CAGR of 8.7% from 2025 to 2033. Prescribed dietary supplements target specific health conditions or deficiencies, ensuring patients get the exact nutrients they need in the right doses.

Form Insights

The tablet supplements segment accounted for the largest revenue share of 31.3% in 2024, continuing to be the most common format in the UK dietary supplements industry. Tablets are widely available across major retailers, including Boots, Holland & Barrett, Tesco, and independent pharmacies. Their affordability, long shelf life, and precise dosing make them a convenient and trusted option for consumers of all ages, especially for daily multivitamins and mineral-based supplements.

The powdered supplements segment is projected to grow at a CAGR of 9.4% from 2025 to 2033, supported by increasing consumer demand for functional, customizable, and easy-to-integrate health solutions. Powders are especially popular in the sports nutrition and wellness segments, including protein shakes, collagen mixes, greens blends, and electrolyte supplements. The format’s versatility-allowing it to be added to drinks, smoothies, or food-makes it ideal for busy UK consumers who prefer flexible health routines.

Application Insights

Dietary supplements for immunity accounted for a share of 12.6% of the UK revenue in 2024, reflecting sustained interest following the COVID-19 pandemic. The British public continues to prioritize immune health, especially during cold and flu season. Products containing elderberry, zinc, echinacea, and vitamins C and D have become household staples. Increased awareness of the link between gut health and immunity has also led to higher demand for probiotic supplements.

Dietary supplements for prenatal health are projected to grow at a CAGR of 12.0% from 2025 to 2033, as more expectant mothers in the UK prioritize high-quality prenatal nutrition. The NHS and healthcare professionals widely recommend supplements containing folic acid, iron, vitamin D, and DHA to support both maternal health and fetal development. The availability of clean-label, vegan-friendly, and allergen-free prenatal formulas is also expanding, appealing to health-conscious UK parents.

End User Insights

Adult consumers accounted for a revenue share of 63.1% of the UK dietary supplements market in 2024, making them the primary user base. This segment includes both younger adults focused on energy, mental clarity, and fitness, as well as older adults seeking joint, heart, and cognitive health support. The diversity of product offerings for adult health, ranging from daily multivitamins to targeted supplements for sleep, immunity, and digestive wellness, drives continued demand across age groups.

Dietary supplements for infants are projected to grow at a CAGR of 9.2% from 2025 to 2033, as UK parents become more focused on early-stage nutrition and immunity. NHS guidelines recommending vitamin D for infants, along with growing demand for infant probiotics and DHA supplements, are propelling this category forward. Parents are increasingly seeking high-quality, safe, and certified infant supplements to support gut health, brain development, and immune function.

Distribution Channel Insights

Offline channels accounted for 82.8% of the UK dietary supplements revenue in 2024, led by widespread distribution through pharmacies, supermarkets, and health food stores such as Holland & Barrett, Boots, and Tesco. In-person shopping remains strong due to consumer trust, on-the-spot advice from pharmacists, and convenience. The physical retail space continues to play a vital role in building product awareness and driving impulse purchases.

Online supplement sales in the UK are projected to grow at a CAGR of 9.5% from 2025 to 2033, supported by the increasing popularity of digital health platforms, convenience, and access to a wider product range. E-commerce channels, including Amazon UK, brand-owned websites, and online wellness retailers like THG plc and Vitabiotics, are attracting a younger, tech-savvy audience. Subscription models, personalised supplement packs, and targeted digital marketing are further accelerating growth in the online channel.

Key UK Dietary Supplements Company Insights

The UK dietary supplements market is becoming increasingly competitive, with both established brands and emerging players focusing on product innovation, quality assurance, and strategic pricing to gain market share. To stay ahead, companies are investing in advanced manufacturing, automation, and skilled talent to meet regulatory standards and drive efficiency. This is accelerating innovation across the market while raising entry barriers.

At the same time, rising awareness of chronic health issues like obesity, diabetes, and nutrient deficiencies is shifting consumer demand toward preventive and personalized nutrition. There is growing interest in plant-based, allergen-free, and clean-label supplements, especially among younger, health-conscious consumers looking for targeted health solutions.

The UK is also emerging as a hub for nutraceutical innovation, with over 198 active startups including Allplants, OptiBiotix Health, Nourished, bioniq, and Second Nature. Of these, 56 are funded, and 30 have reached Series A or beyond. Many focus on microbiome science, clean supplements, and personalized nutrition, often founded by alumni from Cambridge, King’s College London, and UCL, helping shape the future of the UK’s supplement industry.

Key UK Dietary Supplements Companies:

- Vitabiotics

- Haleon

- THG plc

- Healthspan

- Holland & Barrett

- Nestle

- Bayer AG

- Glanbia plc

- Pfizer Inc.

- Archer Daniels Midland Company

Recent Developments

-

In January 2025, The UK’s first frozen oral nutritional supplement range, icesupp, was launched to help people struggling to eat due to illness, especially cancer patients. Created by Amy Smith and Robert Upton after Amy’s father found traditional thick supplements unpalatable during cancer treatment, icesupp combines nutritional benefits with the soothing, easy-to-consume form of an ice lolly. Developed with Reading University and healthcare experts, the 100% plant-based supplements contain fruit, pea protein, vitamins, and minerals, delivering 5g of protein, 2.5g fiber, and 150 calories per 86ml pouch.

-

In October 2023, Purina launched PRO PLAN supplements in the UK to support pet health areas like mobility, immunity, skin, and relaxation. These daily supplements complement regular meals and target the growing demand for natural, effective pet nutrition. Designed for all life stages, they emphasize palatability and long-term wellbeing, responding to rising pet supplement use and premiumization trends.

-

In May 2024, Bayer launched a One A Day social media campaign featuring former NFL star Julian Edelman to combat wellness misinformation. The campaign started running across major social platforms, including Instagram, Facebook, and TikTok. Its primary objective was to inspire individuals to share honest accounts of their wellness experiences, countering the often unrealistic or pseudoscientific claims in online wellness spaces.

UK Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.19 billion

Revenue forecast in 2033

USD 9.65 billion

Growth rate

CAGR of 8.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredients, type, form, application, end user, distribution channel, product-form, product-end user, product-application

Country scope

UK

Key companies profiled

Vitabiotics; Haleon; THG plc; Healthspan; Holland & Barrett; Nestle; Bayer AG; Glanbia plc; Pfizer Inc.; Archer Daniels Midland Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the UK dietary supplements market report based on product, type, form, application, end user, distribution channel, product-form, form-end user, form-application, and region:

-

Ingredients Outlook (Revenue, USD Billion, 2021 - 2033)

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Protein & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

OTC

-

Prescribed

-

-

Form Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tablets

-

Capsules

-

Softgels

-

Powder

-

Gummies

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Others

-

-

Online

-

-

Product-Form Outlook (Revenue, USD Billion, 2021 - 2033)

-

Vitamin

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Multivitamin

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin A

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin B

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin C

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin D

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin K

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin E

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Mineral

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Calcium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Potassium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Magnesium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Iron

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Zinc

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others (selenium, chromium, copper)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Botanicals

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Protein & amino acids

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Collagen

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Fibers & Specialty Carbohydrates

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Omega Fatty Acids

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Probiotics

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Prebiotics & Postbiotics

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

Form-End User Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tablets

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Capsules

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Softgels

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Powders

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Gummies

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

Others

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

-

Geriatric

-

Children

-

Infants

-

-

-

Form-Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tablets

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Capsules

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Softgels

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Powders

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Gummies

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Liquid

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Others

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.