- Home

- »

- Next Generation Technologies

- »

-

U.K. HR Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![U.K. HR Analytics Market Size, Share & Trends Report]()

U.K. HR Analytics Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Employee Engagement & Development, Payroll & Compensation, Retention), By Service, By Deployment, By Enterprise-size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-045-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

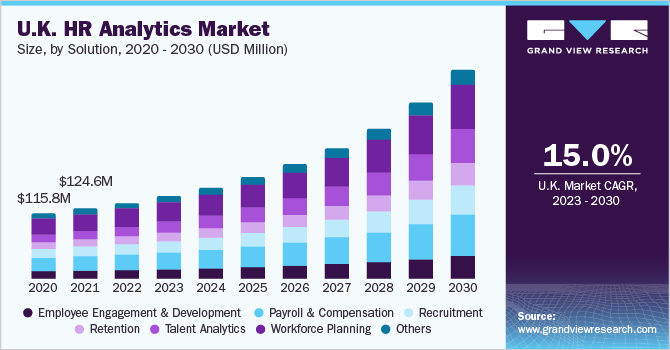

The U.K. HR analytics market size was evaluated at USD 200.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.0% from 2023 to 2030. The U.K. Human resource (HR) analytics market’s growth can be attributed to the growing need to improve talent retention using emerging technologies such as analytics, & the Internet of Things (IoT), and employing skilled talent. These HR analytics solution & services allow HR professionals to efficiently employee management for higher Return on Investment (ROI). The outbreak of COVID-19 has positively influenced the U.K. HR analytics industry since early 2021. While companies are opting for remote working, HR professionals are improvising continuously to adapt themselves to this new working style, supporting the growth of the market.

The technological advancements in cloud services are creating robust opportunities for the market. The companies are adopting various business strategies to improve their cloud-based HR analytics solutions portfolio to boost their market revenues. For instance, in May 2022, IBM Corporation partnered with Ernst & Young Global Limited to assist businesses in addressing workforce challenges post-COVID-19 pandemic.

Both companies established Talent Center of Excellence (COE), which will develop hybrid cloud-based AI solutions for HR and payroll transformation services. Further, in February 2020, MicroStrategy Incorporated partnered with Yellowbrick Data, Inc. to integrate MicroStrategy Analytics in Yellowbrick Data Warehouse. The partnership will allow their clients to make faster data-driven decisions and improve their data management on multiple cloud platforms.

Advances in the field of artificial intelligence, machine learning, and predictive analytics have resulted in the integration of HR solutions with analytics. Startups are developing mobile applications and collaboration software that can provide employers and employees the flexibility required to access information on the go. On the other hand, predictive analytics helps derive inferences regarding continuous employee progress through various charts and infographics. These benefits would further supplement the growth of the U.K. HR analytics industry during the forecast period.

The integration of AI tools in HR analytics solutions simplifies the HR function, offers 24/7 support, and eliminates human error. Key market players are focusing on developing AI-based HR analytics solutions to improve their brand value and revenue streams. For instance, in October 2022, UiPath, an enterprise automation software company, and Lenovo, a consumer electronics company, unveiled new solutions to accelerate digital transformation in the HR industry.

By coupling Lenovo’s digital workforce with UiPath’s automation & AI technology, HR professionals automated various departmental processes, including document uploading and HR onboarding identification through Optical Character Recognition (OCR) technology. These initiatives would further supplement the growth of the U.K. HR analytics industry during the forecast period.

Although several HR analytics solution companies provide support and training, organizations face issues in effective change management with the latest HR analytics systems. As technologies continue to advance, employees are particularly finding it challenging to be acquainted with and cope with the new systems' latest features. In addition, employees consider it an additional task to learn the newly implemented software.

HR analytics solution providers are trying to ease the situation by offering complete support for the implementation of new systems. They are also providing technical assistance to all employees before, during, and after the implementation of the new systems to ensure a seamless and efficient transition process. These factors would further supplement the growth of the U.K. HR analytics industry during the forecast period.

Solution Insights

The workforce planning segment accounted for the largest revenue share of 23.5% in 2022. Workforce planning software helps companies to carry out succession planning, strategic analysis, and employment cost models. It also helps them to carry out predictive analysis for forecasting the demand for the type of workforce required. Furthermore, the software enables companies to analyze the risk of knowledge gaps in employees who are assigned critical job roles.

Workforce planning processes enable organizations to keep operational costs under control and improve operational efficiency across businesses. Moreover, it can help organizations maintain business standards and regulatory compliances by designing a workflow process that ensures that all fundamental activities and outcomes are tracked and escalated.

The talent analytics segment is anticipated to grow at a CAGR of 16.7% during the forecast period. Companies increasingly opting for talent analytics tools to sort the profiles of prospective candidates and analyze the performance of their existing employees. The integration of talent analytical tools enables businesses to take better decisions. High competition across industries is driving the demand for effective recruiting solutions.

Organizations often find it challenging to acquire the best talent and hire the right fit for the company. Further, The use of social media platforms for hiring the best talents is on the rise. and many popular applications and social media platforms are working with talent management software providers to meet business needs. These benefits would further supplement the growth of the segment during the forecast period.

Service Insights

The training & consulting segment accounted for a market share of 37.0% in 2022. Organizations have begun to use virtual platforms to train their employees, which has significantly increased the demand for training and consulting in HR analytics solutions. These services enable organizations to develop, design, implement, support, maintain, and operate technology or any related applications or tools associated with a new Human Resource Management Solution (HRMS).

Furthermore, HRM software solutions can be managed centrally and supervised by managers to assess and train employees, even when working remotely. HRM software not only increases productivity by automating manual tasks and decreasing error rates but also assists in assessing operational trends within an organization. These benefits are expected to drive the growth of the segment during the forecast period.

The support & maintenance segment is anticipated to grow at a CAGR of 18.6% during the forecast period. The successful implementation of HR analytics solutions requires the careful consideration of several factors, such as understanding the technicalities of the software, maintaining and repairing tools during breakdowns, importing/exporting data seamlessly, and regularly updating the software.

Lack of attention to these factors can lead to a reduction in productivity. Support and maintenance services facilitate project scoping and planning, and help manage administration practices that make business operations more efficient. Furthermore, the growing adoption of cloud-based services among organizations has also prompted the growth of this segment.

Deployment Insights

The on-premise segment accounted for a market share of 52.6% in 2022. On-premise deployment provides organizations with greater flexibility and control over their IT infrastructure. Furthermore, such type of deployments is replaceable and offer users the flexibility to customize operations and enhance plugins when required. On-premise deployment reduces reliance on the internet while also protecting data from potential losses and fraud.

Moreover, it removes the need for onsite staff to have an internet connection to access it, making it completely accessible without the need for a secure connection. These benefits are expected to drive significant demand for on-premise deployment during the forecast period.

The cloud segment is anticipated to grow at a CAGR of 18.4% during the forecast period. Organizations seeking business continuity, enhanced scalability, and cost-efficiency are likely to turn to cloud-based HR analytics solutions. Cloud-based HR analytics solutions facilitate higher control over operations across multiple business channels. In recent years, human resource solution providers started introducing integrated talent management systems, such as applicant tracking, recruiting, and learning management systems.

Advanced systems allowed employers to bridge the gap between the existing employee skillsets and the required skillsets for organizational development and progress. These benefits are expected to drive significant demand for hosted deployment during the forecast period.

Enterprise-size Insights

The large enterprise segment accounted for a market share of 64.0% in 2022. Large organizations are rapidly evolving and altering their entire ecosystems as part of their digital transformation journeys. Large businesses are adopting HR analytics software to strengthen their growth prospects and accelerate enterprise acceleration in the rapidly changing market conditions.

HR analytics solutions assist large enterprises in designing growth roadmaps and implementing strategies more efficiently and effectively. These software solutions also help the management in goal setting, planning and feedback, skill development, and performance analysis. These benefits are expected to drive significant demand for HR analytics solutions for large enterprises during the forecast period.

Small & Medium Enterprises (SMEs) is anticipated to grow at a CAGR of 16.6% during the forecast period. The demand for HR software in small & medium enterprises is anticipated to grow owing to the benefits of these solutions, such as ease in performing regular business operations and reduced time required for performing traditional activities.

Moreover, the implementation of these systems allows SMEs to focus on strategic decision-making and derive insights using analytical tools, which help organizations set future goals. As a result, SMEs are focusing on using HR analytics solutions to control their solutions across several geographies and manage multiple employees.

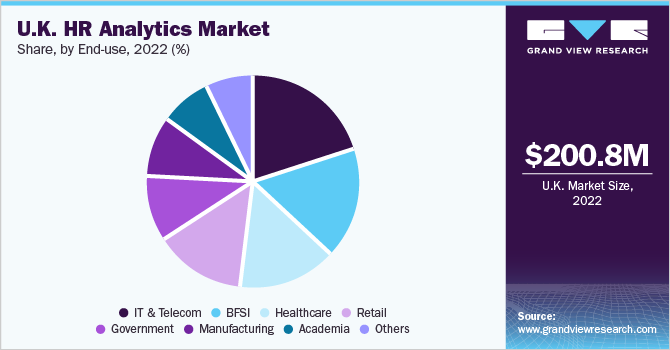

End-use Insights

The IT & telecom segment accounted for the largest market share of 20.0% in 2022. As HR functions are evolving from both technology and analytics perspectives, HR in the IT & telecom organizations is leveraging data analytics to manage the end-to-end lifecycle of the talent by identifying competency gap analysis, learning opportunities, competitive benchmarking, workforce patterns, and talent needs.

Furthermore, AI, ML, and Natural Language Processing (NLP) are enabling organizations to analyze their data not only in a linear way but also historically using several tools and algorithms to efficiently address various business challenges. These factors are expected to further drive the demand for HR analytics in the IT & telecom sector over the forecast period.

The retail segment is expected to grow at the highest CAGR of 17.2% during the forecast period. According to a survey conducted in October 2022 by SD Worx, Europe’s leading HR and payroll service provider, around 60% of U.K. organizations were observed using HR and people analytics to gain data-driven insights into multiple areas, such as employee turnover and staff shortages.

For instance, in April 2020, ASDA, a supermarket chain in the U.K., selected Workday, an enterprise cloud application platform for finance and human resources, to enhance its employee experience and support the global workforce with the help of Workday Learning, Workday Absence Management, Workday Compensation, Workday Benefits, Workday Human Capital Management (HCM), and Workday Prism Analytics.

The adoption of such solutions enables companies to improve employee engagement, facilitate employee onboarding, and increase workforce efficiency. Such developments are expected to drive the demand for HR analytics solutions in the retail sector over the forecast period.

Key Companies & Market Share Insights

The key players include SAP SE; IBM Corporation; Oracle Corporation; Salesforce, Inc.; and Workday, Inc. Market players are observed to invest resources in research & development activities to support growth and enhance their internal business operations. The report will include company analysis based on their financial performances, product benchmarking, key business strategies, and recent strategic alliances.

Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market shares.

For instance, in May 2022, IBM Corporation announced the partnership with Ernst & Young (EY)Global Limited to assist businesses in addressing workforce challenges post-COVID-19 pandemic. Both companies established Talent Center of Excellence (COE), which will develop hybrid cloud-based AI solutions for HR and payroll transformation services. Some prominent players in the U.K. HR analytics market include:

-

Crunchr

-

IBM Corporation

-

Infor

-

Microstrategy Incorporated

-

One Model, Inc.

-

Oracle Corporation

-

Sage Group plc

-

SAP SE

-

UKG Inc.

-

Visier, Inc.

-

Workday Inc.

-

Zoho Corporation Pvt. Ltd.

U.K. HR Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 220.7 million

Revenue forecast in 2030

USD 588.4 million

Growth rate

CAGR of 15.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise-size, end-use

Key companies profiled

Crunchr; IBM Corporation; Infor; MicroStrategy Incorporated; One Model, Inc.; Oracle Corporation; Sage Group plc; SAP SE; UKG Inc.; Visier, Inc.; Workday, Inc.; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.K. HR Analytics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.K. HR analytics market report based on solution, service, deployment, enterprise-size, and end-use:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Employee Engagement & Development

-

Payroll & Compensation

-

Recruitment

-

Retention

-

Talent Analytics

-

Workforce Planning

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Implementation & Integration

-

Support & Maintenance

-

Training & Consulting

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise-size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academia

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others (Non-profit Organizations, Media & Entertainment, Transport & Logistics, Hospitality, and Energy & Utilities, among others)

-

Frequently Asked Questions About This Report

b. The U.K. HR analytics market size was estimated at USD 200.8 million in 2022 and is expected to reach USD 220.7 million in 2023.

b. The U.K. HR analytics market is expected to grow at a compound annual growth rate of 15.0% from 2023 to 2030 to reach USD 588.4 million by 2030.

b. The workforce planning segment accounted for the largest market share of 23.5% in 2022. Workforce planning software helps companies to carry out succession planning, strategic analysis, and employment cost models. It also helps them to carry out predictive analysis for forecasting the demand for the type of workforce required.

b. Some key players operating in the U.K. HR analytics market include Crunchr, IBM Corporation, Infor, Microstrategy Incorporated, One Model, Inc., and Workday Inc.

b. The U.K. HR analytics market growth can be attributed to the growing need to improve talent retention using emerging technologies such as analytics, & Internet of Things (IoT) and employ skilled talent is anticipated to drive the U.K. HR analytics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.