- Home

- »

- Next Generation Technologies

- »

-

HR Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![HR Analytics Market Size, Share & Trends Report]()

HR Analytics Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Recruitment, Retention), By Deployment (Hosted, On-premise), By Enterprise Size, By End-use (Government, Healthcare, Retail), By Service, And Segment Forecasts

- Report ID: GVR-4-68038-242-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hr Analytics Market Summary

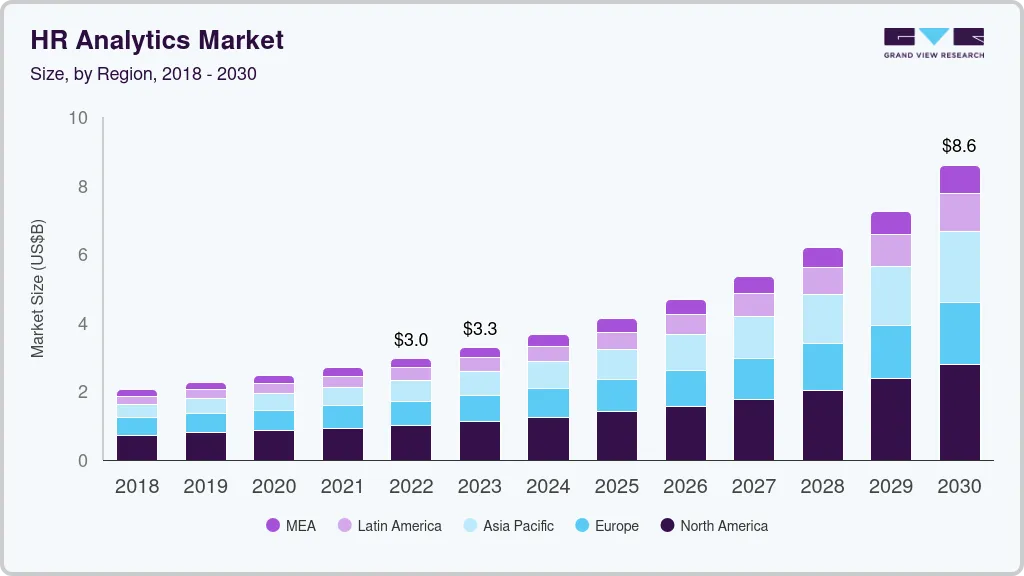

The global hr analytics market size was estimated at USD 2.95 billion in 2022 and is projected to reach USD 8.59 billion by 2030, growing at a CAGR of 14.8% from 2023 to 2030. The growing need to efficiently use human resources and minimize the operational costs of an enterprise, as well as gain real-time observation of employee behaviors, are the key factors driving the growth of the market.

Key Market Trends & Insights

- North America accounted for a market share of 34.5% in 2022.

- Asia Pacific is expected to grow at a CAGR of 16.8% over the forecast period.

- By solution, the workforce planning segment accounted for the largest market share of 28.8% in 2022.

- By service, the implementation and integration segment accounted for the largest share of 37.1% in 2022.

- By deployment, the on-premise segment accounted for the largest market share of 57.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.95 Billion

- 2030 Projected Market Size: USD 8.59 Billion

- CAGR (2023-2030): 14.8%

- North America: Largest market in 2022

Even though the COVID-19 pandemic has changed the business landscape, the use of HR analytics solutions to make data-driven conclusions has become critical for monitoring and measuring organizational and employee productivity. It has triggered a significant paradigm shift, requiring organizations to handle social distancing, and deploying remote working, which has become vital to addressing the crisis with resiliency and maintaining long-term company viability.

Thus, COVID-19 is expected to permanently shift working patterns as companies are forced to embrace remote working, increasing demand for workforce management solutions. The growing need to employ skilled talent and improve employee retention using innovative technologies, such as the Internet of Things (IoT) and analytics, is expected to drive market growth. For instance, in April 2020, ASDA, a supermarket chain in the UK, selected Workday, an enterprise cloud application platform for HR and finance, to boost its employee knowledge and support the global workforce with the help of workday absence management, workday human capital management (hcm), workday compensation, workday prism analytics, workday benefits, and workday learning.

Adopting solutions enables companies to improve employee engagement, facilitate employee onboarding, and increase workforce efficiency. Furthermore, these solutions enable HR professionals to attract and retain employees, resulting in improved productivity, a better work environment, and a higher Return on Investment (ROI) for the organization. The demand for effective workforce management and recruitment is propelling the market forward. Several companies use third-party talent acquisition solutions. As a result, vendors are increasingly adopting new technologies. Organizations are turning to technology-based solutions and services to meet their talent acquisition requirements.

Most of these solutions are cognitive, based on mobile and cloud technology. Cognitive technologies that collect data from social networks and then provide actionable insights include Artificial Intelligence (AI), Natural Language Processing (NLP), Robotic Process Automation (RPA), and predictive algorithms. The use of these technologies assists organizations in making better decisions and maximizing their capital, which is accelerating the growth of the market. Technological advancements in Machine Learning (ML), big data analytics, AI, and the IoT are expected to boost market growth. These technologies correlate and integrate data to provide relevant, actionable, and timely insights to improve performance, ultimately leading to better decisions and actions.

For instance, ML enables employers to predict which candidates will perform best, assisting HR management in recruitment and retention processes. Furthermore, it connects and integrates data to deliver relevant, actionable, and timely insights to improve performance, ultimately leading to better decisions and actions. These benefits will supplement the market growth during the forecast period. Modern technological advancements, such as predictive analytics, big data, and AI, are making it easier to integrate Human Resource Management (HRM) solutions with analytics.

Simultaneously, startups are developing collaboration software and mobile applications that would allow employees and employers to access critical information on the go. Furthermore, the use of predictive analytics is beneficial in developing inferences about continuous employee progress via several charts and infographics. Several HRM solution providers, such as Workday, Inc., SAP SE, and Zoho Corporation Pvt. Ltd., are focusing on developing technological trends and designing their software solutions with clients' changing needs in mind. The development of such innovative solutions is anticipated to drive market growth during the forecast period.

Solution Insights

The workforce planning segment accounted for the largest market share of 28.8% in 2022. The segment growth can be attributed to the rising need for connected and unified enterprise as well as integrated workforce management systems across diverse locations. Organizations can improve employee performance, productivity, and satisfaction by implementing this solution. Furthermore, workforce optimization can be achieved while simplifying remote working with the implementation of workforce planning solutions and services. These advantages drive the interest of organizations in implementing such solutions to improve workforce operations.

The talent analytics segment is expected to grow at a CAGR of 16.9% during the forecast period. The increasing use of data for workforce planning, the increased need to identify talent gaps from performance data, and the growing demand for automation and the digitalization of manual talent analytics tools all contribute to the segment's growth. The talent analytics solution enables organizations to align their goals with talent acquisition activities, which results in increased company performance. Furthermore, the integration of talent analytics solutions enables companies to make improved decisions and hence the segment is expected to witness significant growth over the forecast period.

Service Insights

The implementation and integration segment accounted for the largest share of 37.1% in 2022. The segment growth can be attributed to the increased organizational demand to improve the services of their existing systems, increased automation, and adoption of cloud computing. These services make it simple for organizations to implement HR analytics and ensure that solutions integrate easily with their external and internal systems, allowing them to get the most out of their IT infrastructure investments. Furthermore, these services enable businesses to access and visualize data, which is then used in decision-making processes. These factors will further drive the growth of the segment during the forecast period.

The support & maintenance segment is anticipated to grow at a CAGR of 17.9% over the forecast period. Technology is rapidly changing, necessitating system upgrades regularly. HR analytics solutions must be kept up to date with changing technologies, and organizations require vendor support in the event of technical issues. Furthermore, these solutions also require to be updated in line with the advancements in technology and organizations need strong vendor support for troubleshooting and technical problems. As a result, over the forecast period, support and maintenance services are expected to gain traction.

Deployment Insights

The on-premise segment accounted for the largest market share of 57.8% in 2022. On-premise deployment provides organizations with greater flexibility and control over their IT infrastructure. Furthermore, they are replaceable and offer the tractability to customize operations and enhance plug-ins when required. The on-premise deployment reduces reliance on the internet while also protecting data from potential losses and fraud. Moreover, it eliminates the requirement for onsite staff to have an internet connection to access it, making it completely accessible without the need for a secure connection. These benefits are expected to drive the significant demand for on-premise deployment during the forecast period.

The hosted segment is expected to grow at a CAGR of 17.7% over the forecast period. The increasing data connectivity through multi-cloud environments, advancements in information-sharing technologies, and the cost benefits of cloud-based analytics solutions drive the segment's growth. Several organizations are eager to have their solutions deployed in the cloud as it provides multiple benefits, such as capacity flexibility, scalability, cost efficiency, and enhanced collaboration. SAP’s SuccessFactors Workforce Analytics, for instance, enables HR professionals, analysts, and business partners to influence business decisions through data-driven insights and an evidence-based approach to HR. These benefits will supplement the growth of the segment during the forecast period.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of 57.9% in 2022. Due to their big workforce, large-scale businesses are frequently confronted with a huge amount of employee data. HR analytics help analyze such vast information with reduced operational costs. These technologies also enable businesses to manage massive employee databases and provide real-time access to employee data from anywhere in the world. Furthermore, many large corporations are implementing big data analytics to boost revenues, improve analytical abilities, and easily access employee information. As a result, large enterprises are implementing HR analytics solutions and contributing to market growth.

The Small & Medium Enterprises (SMEs) segment is anticipated to grow at a CAGR of 16.5% over the forecast period. SMEs face more resource constraints as compared to larger companies, as they require better strategies to overcome the challenges of cost optimization on their assets and requirements. Thus, SMEs are focusing on adopting HR analytics solutions to control their assets across multiple geographies and manage multiple employees. Furthermore, managers can represent employee sentiment, engagement, and productivity with the deployment of real-time HR analytics solutions. Simultaneously, they can build on their present strengths with the purpose of enhancing workplace culture and employee satisfaction in the long run. These benefits will further fuel the segment's growth during the forecast period.

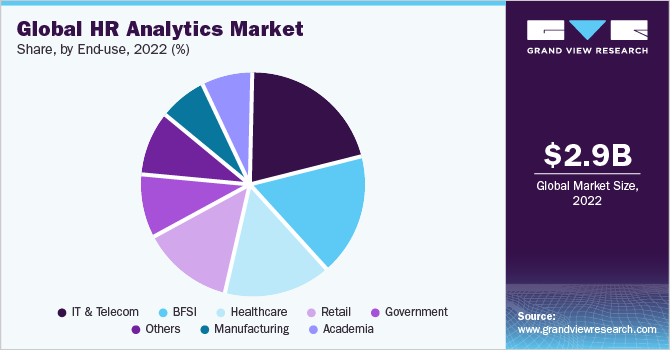

End-use Insights

The IT & telecom segment held a revenue share of 21.1% in 2022 as it caters to a large workforce and has the technical infrastructure required to deploy analytics solutions. Furthermore, large organizations have a global footprint, and it is difficult to manage the globally dispersed workforce, resulting in a high demand for efficient HR analytics solutions. For instance, several IT services companies, such as Turing, Video Husky, and Firstbase, use Deel, a global payroll and compliance provider that allows anyone, anywhere to be hired and paid. In addition, organizations can use Deel to manage their payroll services and create legal contacts in over 150 countries through a tech-enabled self-service process.

The deployment of such types of solutions in the industry will further drive the market growth. The retail segment is expected to grow at a CAGR of 17.3% over the forecast period. The adoption of such solutions enables companies to improve employee engagement, facilitate employee onboarding, and increase workforce efficiency. Furthermore, these solutions allow HR professionals to retain and attract employees, concluding in a maximized ROI, improved productivity, and a better work environment for the organization. Such developments are expected to drive the demand for HR analytics solutions in the retail sector over the forecast period.

Regional Insights

North America accounted for a market share of 34.5% in 2022 due to the increased adoption of cloud infrastructure by major organizations, as well as the increased productivity and labor efficiency with the help of HRM solutions for attendance & time tracking, payroll management, and talent management. Developed countries in the region, such as the U.S. and Canada, have aggressively financed digital solutions and technologies for effective business operations. For instance, in June 2022, Visier Inc. (Canada), an HR analytics solution provider, announced a partnership with SYMPLR, a healthcare operations solutions company, to embed its people analytics skills in the latter company’s recruiting solution to create a talent analytics feature. These developments will further boost the regional market growth during the forecast period.

Asia Pacific is expected to grow at a CAGR of 16.8% over the forecast period. The growing start-up culture, combined with the aim to boost company & employee performance & productivity, and government initiatives toward the adoption of cloud technologies will drive the regional market. Furthermore, organizations in the region are adopting HR analytics to develop a data-driven talent strategy. For instance, in October 2020, Tata Consultancy Services launched TCS Workforce Analytics, an AI-based unified system of insights and engagement for managers and employees, which enhanced workforce experience and productivity. The solution was designed to help enterprises with the talent management challenges of the digital era. These developments will further boost the regional market during the forecast period.

Key Companies & Market Share Insights

Companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. to broaden their product offering. For instance, in February 2022, Crunchr raised undisclosed funding to expand its people analytics product offering and fuel its international expansion. The funding was also used to enhance the people analytics platform capabilities in data-driven storytelling, skill-based workforce planning, and employee retention. Prominent players operating in the global HR analytics market include:

-

Cegid

-

Crunchr

-

GainInsights

-

IBM Corp.

-

Infor

-

MicroStrategy Inc.

-

Oracle Corp.

-

Sage Software Solutions Pvt. Ltd.

-

SAP SE.

-

Sisense Inc.

-

Tableau Software, LLC.

-

UKG Inc.

-

Visier, Inc.

-

Workday, Inc.

-

Zoho Corp. Pvt. Ltd.

Recent Developments

-

In June 2023, Cegid, a leader in cloud-based management solutions announced the availability of its Digitalrecruiters, a multi-site solution for managing recruitment in the Canada region. This will further accelerate the recruitment process for the companies .

-

In June 2023, Visier launched Smart Compensation, a product used to simplify the complex compensation planning process. This product will further redefine the pay process and provide data driven insights to the people managers.

-

In June 2023, Visier introduced Vee, a powerful AI-based digital assistant. It transforms simple query into visier’s query language and provides data-driven insights to the managers related to its workforce.

-

In June 2023, Workday Inc. announced the expansion of its strategic partnership with Samsung SDS. This partnership will provide a simple and unified Human Capital Management (HCM) experience for local HR professionals.

-

In June 2023, Oracle introduced generative AI capabilities in its Oracle Fusion Cloud Human Management (HCM). It will provide improved productivity, enhanced candidate and employee experience, and streamline all the HR processes.

-

In June 2023, UKG signed an agreement to acquire Immedis, a leading global payroll provider. This partnership will transform and simplify multi-country payroll experiences for the businesses in the U.S. and Canada by providing a unified global view of its payrolls around the world.

-

In May 2023, IBM introduced IBM Watson Orchestrate, a cloud-based solution that helps companies empower its employees to upgrade their routine tasks. It continuously monitors and guides the employees with a new set of skills keeping behind the repetitive tasks and ultimately improving productivity.

-

In May 2023,UKG, announced that Mike Morse Law Firm is transforming its employee experience with the UKG Ready HCM package. This will ensure high operational excellence and advancements in its diversity and inclusion policy.

HR Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.28 billion

Revenue forecast in 2030

USD 8.59 billion

Growth rate

CAGR of 14.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

IBM Corp.; MicroStrategy Inc.; Oracle Corp.; SAP SE; UKG Inc.; Cegid; Tableau Software, LLC; Sage Software Solutions Pvt. Ltd.; Zoho Corp. Pvt. Ltd.; Workday, Inc.; Infor; Crunchr; Visier, Inc.; GainInsights; Sisense Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HR Analytics Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the HR analytics market based on solution, service, deployment, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Employee Engagement & Development

-

Payroll & Compensation

-

Recruitment

-

Retention

-

Talent Analytics

-

Workforce Planning

-

Others (Applicant Tracking System and Succession and Leadership Planning)

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Implementation & Integration

-

Support & Maintenance

-

Training & Consulting

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise (SME)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academia

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others (Government, Transportation & Logistics, Energies & Utilities, Travel and Hospitality, and Media and Entertainment)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global HR analytics market size was estimated at USD 2.96 billion in 2022 and is expected to reach USD 3.28 billion in 2023.

b. The global HR analytics market is expected to grow at a compound annual growth rate of 14.8% from 2023 to 2030 to reach USD 8.59 billion by 2030.

b. North America held the largest share of 34.5% in 2022as the region includes developed countries, such as the Canada and U.S., and these are considered as the most developed in terms of adopting digital technologies. Furthermore, their robust financial position allows heavy investments and adoption of leading technologies and solutions for effective business operations.

b. Some key players operating in the HR analytics market include IBM Corporation, MicroStrategy Incorporated, Oracle Corporation, SAP SE., UKG Inc., Cegid, TABLEAU SOFTWARE, LLC., Sage Software Solutions Pvt Ltd., Zoho Corporation Pvt. Ltd, Workday, Inc., Infor, Crunchr, Visier, Inc., GainInsights, and Sisense Inc.

b. The growing need for efficient use of human resources and to reduce operational costs in an organization, as well as gain real insights into employee behaviors, are the key factors driving the growth of the HR analytics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.