- Home

- »

- Homecare & Decor

- »

-

UK Men’s Grooming Products Market, Industry Report, 2030GVR Report cover

![UK Men’s Grooming Products Market Size, Share & Trends Report]()

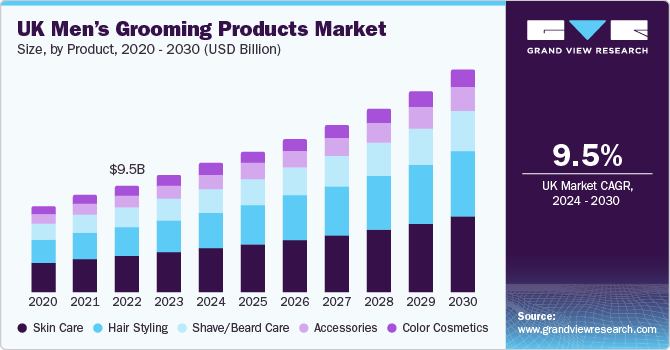

UK Men’s Grooming Products Market Size, Share & Trends Analysis Report By Product (Skin Care, Hair Styling, Shave/Beard Care), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-240-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

UK Men’s Grooming Products Market Trends

The UK men’s grooming products market size was estimated at USD 10.37 billion in 2023 and is expected to grow at a CAGR of 9.5% from 2024 to 2030. The growth of grooming products in the U.K. has been encouraged by emerging market trends. This includes creating items that appeal to the age, and ethnicity of men in addition to utilizing technology to enhance marketing strategies. The use of creative, ecologically friendly packaging and design has also contributed to the appeal of grooming goods.

The UK men’s grooming market accounted for the share of 4.75% of the global men’s grooming products market revenue in 2023. The demand for men’s grooming products is attributed to the increasing aging population in the country. According to Office for National Statistics, in the U.K., the population under the age of 16 is declining while the population over the age of 65 is increasing. A large market exists for products focused on the aging population. Thus, the demand for men grooming products for skin is expected to grow steadily in the upcoming years.

The presence of regional skincare brands and companies in the U.K. offering a wide range of skincare and skin repair products that promote healthy skin, is likely to bode well for the men’s grooming market. The increasing use of customized and personalized skincare routines among men in the U.K. is favoring the skin care products market in the country.

For instance, in February 2019, according to a YouGov survey, 1 in 20 British males applied cosmetics, 1 in 50 did so once a week, and 1 in 100 did so every day. This is anticipated to increase demand for items for men's grooming. Moreover, U.K.’s top beauty and skincare brand Boots No7 launched personalized virtual beauty services. The virtual service includes personalized sessions with No7 virtual consultants, in which, consultants share expert skincare and makeup advice, provide recommendations & application tips, and guide men and women through telephone or video services.

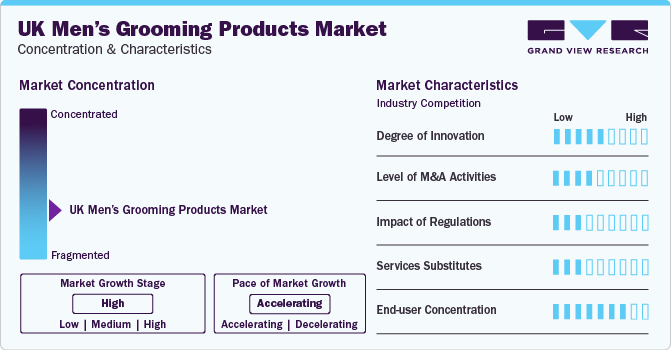

Market Concentration & Characteristics

The UK men’s grooming product market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings.Market participants are actively developing innovative electrical grooming items, such as shavers and razors, incorporating cutting-edge technology to enhance their performance. This expanding product range now includes body groomers and electric shavers, which has proven beneficial for the overall market growth.New market players are expected to differentiate their products in terms of raw materials or ingredients by using organic or natural ingredients to appeal to the generation of environment-conscious customers.

In this respect, the packaging is also expected to play a key role over the forecast period, with many grooming product manufacturers trying to achieve sustainability in packaging. For instance, Trash Plastic, a U.K.-based company, makes all its products in small batches to ensure optimum freshness using all-natural ingredients. The company adheres to sustainable packaging measures for its products by using 100% recyclable glass jars, aluminum jars, cardboard boxes, etc., as well as 100% biodegradable stickers and tissues. Such initiatives taken by players in the men’s grooming products market will help drive innovation as well as increase environmental consciousness among manufacturers and customers.

The UK men's grooming products market is witnessing a surge of new manufacturers, particularly small- and medium-sized players, entering the industry. These companies often focus on offering designer and customized grooming products, leveraging online distribution channels to optimize costs and increase product visibility.As part of their expansion strategies, manufacturers of men's grooming products are opening new retail outlets to tap into various markets and reach a broader customer base. This dynamic landscape is poised to drive considerable improvements and innovations in the men's grooming products market in the foreseeable future.

End-user concentration is a significant factor in the UK men’s grooming products market. Increasing awareness among males regarding personal hygiene and grooming has been driving the demand for men’s skincare products over the years. According to an article published by Tiege Honley, in January 2020, 83% of men aged 65 and up agreed that guys need to get serious about taking care of their skin. Furthermore, macro-level factors such as rising disposable income among consumers and mushrooming growth of distribution channels are bolstering the demand for men’s skincare brands in the region.

Product Insights

The men’s skin care market in the UK accounted for a revenue share of 33.4% in 2023.The growing importance and awareness regarding skin care has led to a changing attitude in men towards skincare products. The growing interest in maintaining an ideal skincare routine among men owing to increased awareness is projected to prompt manufacturers to focus on develop these trending products.Men's skin typically has a higher density of hair follicles compared to women's skin. Therefore, men often need skincare products with a higher concentration of active ingredients and formulations that can effectively penetrate oily or thicker skin. Since men's skincare products are specialized to address their unique needs, they tend to be of a higher cost. These factors are expected to boost segment’s growth over the forecast period.

The UK men’s hair styling products market is projected to grow at a CAGR of 10.3% from 2024 to 2030.The male grooming has evolved significantly over the years. In the past, it was mainly limited to shaving and cologne. The influence of hairstyles of male celebrities has a significant impact on grooming trends. For instance, in early 90’s, pop icons like David Bowie and Ziggy Stardust influenced younger men to explore hairstyling products like hairspray, mousse, and gel, which led to a gradual increase in awareness regarding hair styling products among men.

Type Insights

The mass men’s grooming products market in the UK accounted for a revenue share of 72.2% in 2023.Mass grooming products are priced competitively to appeal to a large customer base. These products are distributed extensively through multiple retail channels, such as supermarkets, drugstores, discount stores, and online retailers. Their widespread availability makes them easily accessible to consumers in various regions. The increasing number of innovative personal care brand launches to cater to the growing product demand from customers is expected to further support market growth. For instance, in September 2021, CavinKare entered the men’s grooming market with the launch of a new personal care brand, Biker’s. The brand’s product line includes 2-in-1 shampoo-conditioners, beard cream, shower gel, and beard oil, to meet the needs of the urban male individuals. The brand is said to be focused more on the mass market and targets new spaces emerging in hair care, face care, and body care.

The UK premium men’s grooming products market is projected to grow at a CAGR of 12.4% over the forecast period of 2024 to 2030. Premium grooming products usually imply products with organic and naturally sourced ingredients and advanced formulations to target specific concerns. These products are presented in custom-designed packages to enhance the brand’s image. Many new companies, including Maapilim, Lyonsleaf, John Masters Organics, Dr Jackson’s, Scotch Porter, and Brickell Men's Products, as well as established brands such as Burt's Bees and SheaMoisture, offer natural grooming essentials like face wash, shampoo, hand cream, face toner, and facial masks. The growing consumer preference for high-quality products has led to an increase in willingness to spend on premium products. This is projected to drive the premium men’s grooming products market.

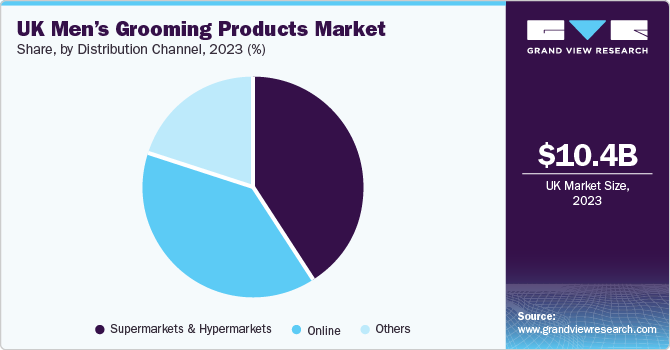

Distribution Channel

The men’s grooming product sales in the UK through supermarkets and hypermarkets accounted for a revenue share of 40.6% in 2023. Several men prefer exclusively shopping at one store for their grooming products. Brand loyalty in men's grooming may be influenced by price, but there are other factors that contribute to repeat customers at stores, such as a specific fragrance. Furthermore, mobile phones play a growing role in in-store decision-making, with a majority of men consulting their devices while shopping for grooming products. Grocery operators and supermarkets increasingly recognize the importance of having well-merchandised shelves with a wide range of men's grooming products to attract male customers. The increasing efforts of supermarkets and hypermarkets to appeal to male customers by offering a wide range of products at competitive prices will likely drive the distribution of grooming products through these stores.

The online sales of men’s grooming products in the UK is projected to grow at a CAGR of 14.3% over the forecast period. Among online channels, there is a growing preference among men to shop from company-owned websites, primarily due to their subscription-based services. According to the survey highlighted above, most men who use subscription services (11%) prefer purchasing from Gillette on Demand (39%), Dollar Shave Club (58%), Birchbox Grooming (24%), Harry's Shave Club (55%), Hims (24%), The Beard Club (24%), Bevel (21%), and Boka (20%). In addition, 70% of subscribers have made additional purchases from their service in the past. Some of the key drivers of subscription services are affordability, convenience, and the opportunity to discover new brands. Subscriptions offered by company-owned online channels are projected to be one of the key drivers of the demand for men’s grooming products through online platforms.

Key UK Men’s Grooming Products Company Insights

Some of the key players operating in the market Beiersdorf AG, L'Oréal Groupe, and Kao Corporation

-

Beiersdorf AG was founded in 1882 and is headquartered in Hamburg, Germany. The company is a manufacturer, retailer, distributor, and seller of personal care products and pressure-sensitive adhesives. The parent company of Beiersdorf AG is Maxingvest AG, which owns 50.49% shares of the company.

-

L'Oréal Groupe was founded in 1909 and is headquartered in Paris, France. The company manufactures, retails, and markets products related to hair color, skincare, sun protection, make-up, perfume, and beauty care.

Estee Lauder Companies, Inc., Coty Inc., and Baxter of California are some of the other participants in the UK men’s grooming products market,

-

Coty Inc. was founded in 1904 and is headquartered in New York, UK The company is a manufacturer, designer, distributor, and retailer of fragrances, cosmetics, skincare, nail care, and hair care products. The company sells a wide range of products under 77 brands, which are segmented into Coty Luxury, Coty Consumer Beauty, and Coty Professionals.

-

Estee Lauder Companies, Inc. is a manufacturer, marketer, and distributor of skincare, makeup, fragrance, and hair care products. Its portfolio comprises renowned brands such as Aramis, Origins, M·A·C, Estée Lauder, Smashbox, KILIAN PARIS, Dr.Jart+, La Mer, Bobbi Brown Cosmetics, Jo Malone London, Lab Series, GLAMGLOW, Too Faced, Aveda, Bumble and bumble, TOM FORD, Le Labo, Clinique, Darphin Paris, Editions de Parfums Frédéric Malle, AERIN Beauty, NIOD, and The Ordinary.

Key UK Men’s Grooming Products Companies:

- Beiersdorf AG

- L'Oréal Groupe

- Kao Corporation

- Estee Lauder Companies, Inc.

- Coty Inc.

- Baxter of California

- Koninklijke Philips

- Molton Brown

- Edgewell Personal Care

- Unilever PLC

Recent Developments

-

In May 2023, Beiersdorf AG’s Nivea launched a content series called “Skin Out Loud”. The project emphasizes the various ways that social, cultural, and personal conditions can alter one's relationship with their skin.

UK Men’s Grooming Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.32 billion

Revenue forecast in 2030

USD 19.54 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, distribution channel, type

Country scope

UK

Key companies profiled

Beiersdorf AG; L'Oréal Groupe; Kao Corporation; Estee Lauder Companies, Inc.; Coty Inc.; Baxter of California; Koninklijke Philips; Molton Brown; Edgewell Personal Care; Unilever PLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

UK Men’s Grooming Products Market Report Segmentation

This report forecasts growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UK men’s grooming products market based on product, distribution channel, type:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skin Care

-

Hair Styling

-

Shave/Beard Care

-

Accessories

-

Color Cosmetics

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mass

-

Premium

-

Frequently Asked Questions About This Report

b. The UK men's grooming products market was estimated at USD 10.37 billion in 2023 and is expected to reach USD 11.32 billion in 2024.

b. The UK men's grooming products market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 19.54 billion by 2030.

b. Skin care products dominated the UK men's grooming products market with a share of around 33.5% in 2023. The surge in popularity of skin care and the growing awareness, interest, and acceptance of skin-related cosmetic products among males is driving the demand for skin products among males.

b. Some of the key players operating in the UK men's grooming products market include Beiersdorf AG; L'Oréal Groupe; Kao Corporation; Estee Lauder Companies, Inc.; Coty Inc.; Baxter of California; Koninklijke Philips; Molton Brown; Edgewell Personal Care; Unilever PLC

b. Increasing awareness among males regarding personal hygiene and natural grooming products, coupled with the growing numbers of start-ups in the natural, organic, and herbal space, is projected to fuel market growth throughout the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."