- Home

- »

- Homecare & Decor

- »

-

UK Serviced Apartment Market Size, Industry Report, 2033GVR Report cover

![UK Serviced Apartment Market Size, Share & Trends Report]()

UK Serviced Apartment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Long-Term, Short-Term), By End Use (Corporate/Business Traveler, Leisure Traveler), By Booking Mode, And Segment Forecasts

- Report ID: GVR-4-68040-708-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

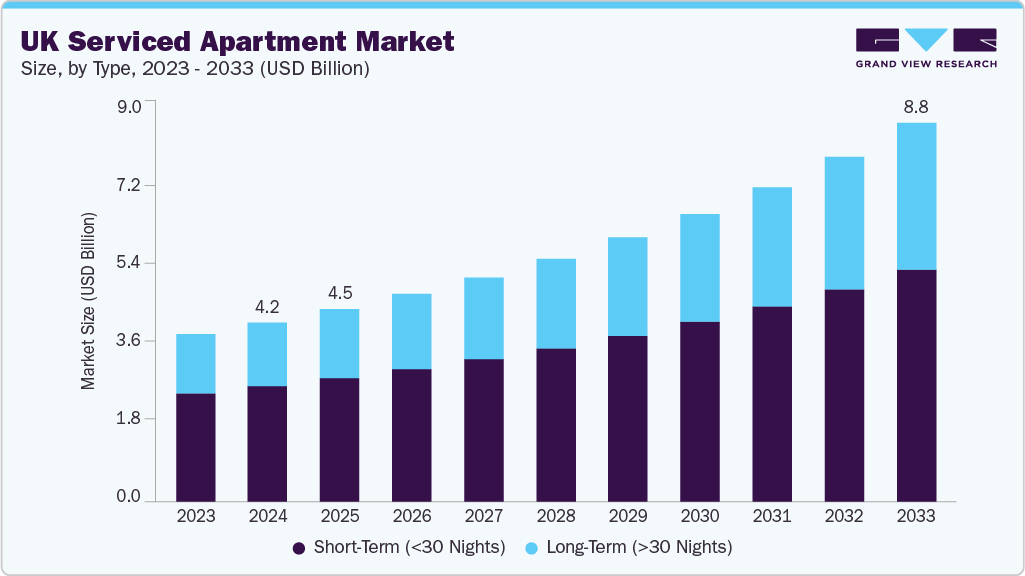

The UK serviced apartment market size was estimated at USD 4.18 billion in 2024 and is projected to reach USD 8.82 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. The market is experiencing robust growth, driven by evolving business needs, shifting travel behaviors, and a growing demand for flexible, home-like accommodations. As corporate travel rebounds and work patterns diversify, serviced apartments have become preferred for domestic and international travelers seeking longer stays without sacrificing comfort or convenience. Urban centers such as London, Manchester, Birmingham, and Edinburgh are leading this expansion, supported by infrastructure development and a surge in digital connectivity.

One of the key demand drivers is the rise in project-based corporate travel and international assignments. UK-based companies across sectors, from tech to finance and consulting, frequently relocate employees or host them for extended periods. Serviced apartments provide a practical solution, offering greater living space, fully equipped kitchens, and privacy that traditional hotels often lack. For instance, Ascott Limited expanded its Citadines brand in London with Citadines Islington, which is strategically positioned to serve corporate clients working in the city and nearby tech hubs. Similarly, STAY Camden continues attracting long-stay professionals and executives with its sleek, modern interiors and co-working amenities in a connected residential location.

Digital nomadism is also gaining momentum across the UK, particularly in cities with strong co-working ecosystems. Flexible remote work policies have allowed professionals to base themselves in cultural and business hotspots like Bristol or Edinburgh, where serviced apartments provide the infrastructure to balance work and leisure. Native Places and SACO (The Serviced Apartment Company) have adapted to this trend by offering hybrid accommodation models, blending boutique-style design with work-ready features like high-speed Wi-Fi, quiet zones, and ergonomic furniture.

Tourism has added momentum, with international and domestic travelers increasingly choosing serviced apartments over conventional hotels. Families, in particular, are drawn to the space, affordability, and cooking facilities, especially during school holidays and city breaks. The demand for more personalized, immersive stays is being met by providers like Roomzzz Aparthotels, which recently opened a new property in York. Roomzzz Aparthotels offers suites with fully fitted kitchens, smart TVs, and 24/7 concierge services tailored to tourists seeking local experiences.

The post-pandemic emphasis on health, hygiene, and autonomy has also influenced consumer preferences. Many guests prioritize self-contained units with minimal contact options. Responding to this, brands like Supercity Aparthotels have introduced enhanced digital features, including app-based check-ins and smart room controls, alongside eco-conscious touches such as energy-saving appliances and sustainable toiletries.

London-based The Gate Aparthotel, for instance, has integrated wellness-focused features such as in-room fitness equipment, organic breakfast offerings, and biophilic design elements. Other operators are experimenting with modular construction techniques to streamline new openings, reduce environmental impact, and meet the growing demand in secondary cities.

As the UK continues to embrace flexible living and working models, the serviced apartment sector is well-positioned for sustained growth. With operators investing in digital transformation, sustainable practices, and experience-driven services, the market is set to attract a diverse clientele, from business travelers and relocating professionals to leisure tourists and mobile remote workers.

Consumer Insights

Consumer behaviour in the UK serviced apartment industry is increasingly shaped by the demand for flexible, home-like environments suited to shifting work patterns and lifestyle needs. In cities like London and Manchester, operators see consistent bookings from relocating professionals, contract workers, and business consultants who require furnished living spaces with minimal commitment. Leading providers are responding by offering modular units with fully equipped kitchens, in-room laundry, and self-check-in access to appeal to those seeking privacy and autonomy during extended stays. Many guests now expect hotel-level service blended with the comfort of a residential setup, especially during work assignments or housing transitions.

A notable shift has been the rising appeal of serviced apartments among remote workers and hybrid professionals who treat accommodation not just as a place to stay but as an extension of their routine. Providers in locations like Edinburgh’s city centre and London’s Canary Wharf are integrating co-working lounges, wellness areas, and grocery partnerships to accommodate the lifestyle expectations of long-stay guests. Younger users, often in creative or tech sectors, favour apartments with aesthetic interiors, fast connectivity, and proximity to independent cafés and public parks. For these travellers, the freedom to live independently without the rigid structure of hotels has become a decisive factor, especially for stays ranging from two weeks to three months.

Leisure travellers also contribute to market evolution, particularly those seeking low-contact, high-comfort stays for city breaks, cultural events, or family visits. Operators in heritage-rich locations like Bath and York have begun restoring period buildings into serviced suites, offering character-rich interiors with modern self-serve amenities. Many guests discover these properties through curated travel content, influencers, or peer recommendations, drawn by the promise of local immersion without the unpredictability of private rentals. As preferences continue shifting toward personalised, wellness-conscious travel, serviced apartments are being seen not merely as alternative hotels but as adaptive spaces that meet the expectations of a more independent and experience-driven guest.

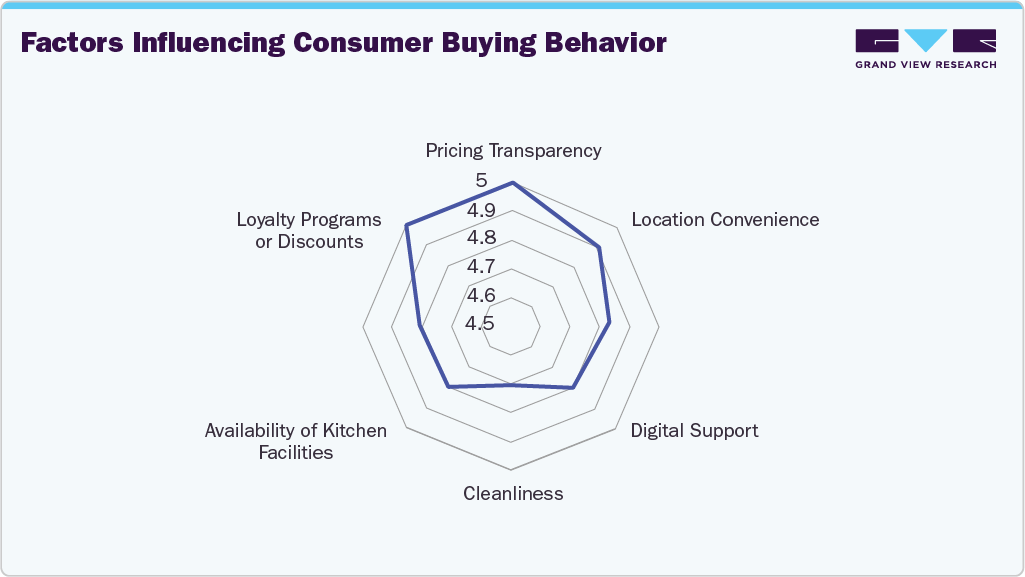

Pricing sensitivity ranks as the most influential factor shaping consumer decisions, reflecting how travellers today are highly conscious of value, especially in a market offering a wide spectrum of pricing. In the serviced apartment segment, guests often compare the cost-per-night with hotels and platforms like Airbnb or short-term rental options. Budget-conscious professionals, extended-stay visitors, and digital nomads are especially drawn to properties that offer bundled services, such as utilities, Wi-Fi, and weekly cleaning, without hidden fees. Operators in competitive cities are responding by introducing flexible pricing tiers, long-stay discounts, and loyalty incentives that enhance perceived value without compromising comfort or quality. For many consumers, the assurance of predictable costs makes serviced apartments a financially smarter choice.

Travel logistics also play a critical role in shaping preferences, particularly among travellers who prioritise accessibility, ease of check-in, and location relevance. For business travellers arriving in a new city for a short-term assignment or meeting, the proximity of the serviced apartment to transport hubs, offices, or conference venues is crucial. Providers within walking distance of rail stations or central business districts, like those in London’s Liverpool Street or Edinburgh’s Haymarket, tend to receive higher bookings due to their convenience. In addition, the rise of contactless check-in, keyless entry, and 24/7 support has become a standard expectation, especially among international guests navigating unfamiliar environments. For many, streamlined logistics equate to peace of mind, making the overall experience smoother and more efficient from arrival to departure.

Type Insights

Short-term (<30 nights) stays accounted for a revenue share of 64.64% in the UK serviced apartments industry in 2024. The segment benefited from increased demand in urban centers like London, Birmingham, and Manchester, where short-duration visits are common due to conferences, exhibitions, and cultural events. Serviced apartments catered well to these guests by offering hotel-like flexibility alongside residential amenities such as kitchens and workspaces. Furthermore, higher average daily rates (ADRs) for short stays allowed operators to generate more revenue per unit than long-term bookings, making the segment more profitable. The rise of weekend leisure travel and the convenience of online booking platforms emphasizing short-stay inventory further supported revenue concentration in this category.

The long-term (>30 nights) stays category is projected to grow at a CAGR of 9.9% over the forecast period of 2025-2033, driven by structural shifts in workforce mobility, housing affordability, and lifestyle preferences. Companies increasingly use serviced apartments as cost-effective alternatives to corporate leases for relocating employees, project-based assignments, and extended training programs. At the same time, the rise of digital nomadism and hybrid work has led professionals to seek flexible, fully furnished living arrangements for multi-month stays without the commitment of traditional rentals. With UK cities like London, Bristol, and Edinburgh experiencing sustained demand from international assignees and graduate professionals, operators are tailoring offerings with discounted monthly rates, workspace integration, and tenancy flexibility.

End Use Insights

Corporate/business travelers accounted for a revenue share of 52.34% in the UK serviced apartments industry in 2024. The growing trend of “bleisure” travel, where professionals extend business trips with personal leisure time, has strengthened the preference for spacious, home-like stays. With business activity recovering across major cities like London, Birmingham, and Edinburgh, companies increasingly opted for serviced apartments to house employees attending short-term assignments, training programs, or project deployments. These units offered lower costs per night than hotels while providing amenities such as kitchens, high-speed Wi-Fi, and dedicated workspaces, aligning well with corporate policies focused on employee comfort and budget control.

Expats and relocators are projected to grow at a CAGR of 10.2% over the forecast period of 2025-2033. The UK remains a key destination for skilled workers, corporate assignees, and academic researchers, many of whom require temporary housing while settling into new roles or securing long-term accommodation. Serviced apartments meet this demand by offering fully furnished, ready-to-move-in spaces with flexible lease terms, eliminating the complexities of traditional rentals. Post-Brexit immigration policies have also led to more structured corporate relocation programs, increasing demand for transitional housing. Moreover, rising property prices and rental constraints in cities like London and Cambridge encourage individuals and families to relocate and opt for serviced apartments during their adjustment period, supporting sustained growth in this segment.

Booking Mode Insights

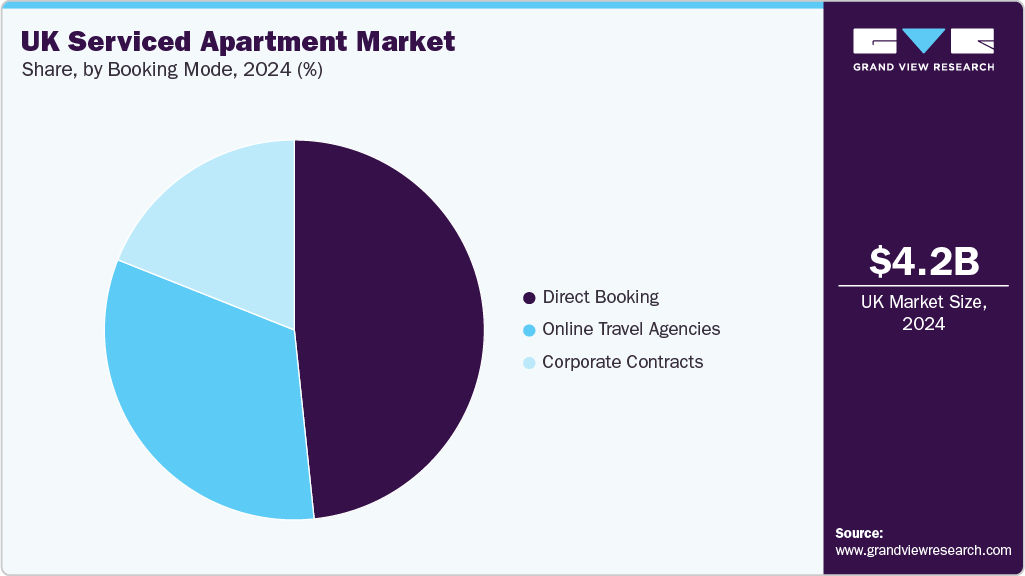

Direct bookings accounted for a revenue share of 48.34% in the year 2024 in the UK serviced apartment industry, as operators increasingly prioritized direct sales channels to reduce reliance on third-party platforms and boost profit margins. Many brands invested in improving their websites, mobile apps, and loyalty programs, offering incentives such as discounted rates, flexible cancellation policies, and added amenities to encourage guests to book directly. Corporate clients, who make up a significant portion of long-stay and repeat bookings, prefer direct agreements to streamline invoicing and secure consistent service standards. In addition, repeat leisure travelers began favoring direct channels for better customization, quicker support, and greater transparency in pricing.

Corporate contracts are projected to grow at a CAGR of 10.4% over the forecast period of 2025-2033, driven by rising demand for flexible, cost-effective housing solutions for mobile workforces. As companies increasingly deploy employees for project-based assignments, relocations, and extended business travel, serviced apartments offer a practical alternative to long hotel stays or complex private rentals. These contracts allow businesses to secure fixed rates, preferred availability, and tailored services such as housekeeping, utilities, and workspaces under a single agreement. Moreover, with corporate travel policies shifting toward accommodation models that balance comfort and cost control, serviced apartment providers are formalizing long-term partnerships with HR and procurement departments.

Key UK Serviced Apartment Company Insights

The UK serviced apartment industry has evolved into a well-established ecosystem comprising global operators, corporate housing specialists, and regional hospitality partners, all aligned with shifting travel and work patterns. Leading providers offer fully furnished units with flexible lease durations, catering to a broad range of users, from corporate assignees and remote professionals to relocating families and long-stay tourists. Operators enhance value by bundling services such as weekly housekeeping, high-speed Wi-Fi, kitchen amenities, and 24/7 support, while maintaining competitive pricing with hotels and traditional rentals. Growth is further supported by strategic partnerships with relocation firms, real estate developers, and HR outsourcing providers to service high-demand urban centres like London, Manchester, and Edinburgh.

As demand for flexible, home-like living increases, the market is shifting toward tech-enabled booking, loyalty integration, and modular units tailored for different stay durations. Younger professionals prefer digitally bookable, design-forward spaces for short stays, while corporate clients and expats drive demand for premium, extended-stay offerings. Operators are investing in smart room features, co-working add-ons, and wellness-focused amenities to cater to both. Government housing policy, global mobility trends, and urban regeneration schemes continue to shape demand in this resilient, high-yield segment.

Key UK Serviced Apartment Companies:

- SACO - The Serviced Apartment Company

- Staycity Ltd

- Marlin Apartments

- The Ascott Limited

- Supercity Aparthotels

- SilverDoor Apartments

- Fraser Suites

- Cheval Collection

- Staybridge Suites

- Clarendon Serviced Apartments

Recent Developments

-

In July 2025, Your Apartment announced the launch of a new premium aparthotel on Lovat Lane in London, marking the brand’s debut in the capital. The 13-unit property blends modern design with heritage architecture and is tailored for short- to mid-term stays by business travelers and city tourists. Each apartment features fully equipped kitchens, smart TVs, high-speed Wi-Fi, and workspace areas, catering to flexible living preferences. The launch aligns with the company’s expansion strategy into high-demand urban hubs, positioning it alongside established players in London’s growing market. This move follows Your Apartment’s earlier successes in Bristol and supports its aim to deliver high-quality, tech-enabled stays in prime UK city locations.

-

In March 2025, Your Apartment launched a new boutique collection of serviced apartments in Bristol’s Old Market area, adding 24 fully furnished units to its growing regional portfolio. Your Apartment - Old Market's development offers design-led interiors, fully equipped kitchens, high-speed Wi-Fi, and smart access technology aimed at digital nomads, business travellers, and extended-stay guests. The property blends modern amenities with the district’s historic charm and supports the brand’s vision of delivering flexible, high-spec accommodation in walkable urban locations. This launch strengthens Your Apartment’s presence in its home city and reflects continued investment in regional UK markets beyond London.

UK Serviced Apartment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.49 billion

Revenue forecast in 2033

USD 8.82 billion

Growth rate

CAGR of 8.8% from 2025 to 2033

Actuals

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, booking mode

Country scope

UK

Key companies profiled

SACO - The Serviced Apartment Company; Staycity Ltd; Marlin Apartments; The Ascott Limited; Supercity Aparthotels; SilverDoor Apartments; Fraser Suites; Cheval Collection; Staybridge Suites; Clarendon Serviced Apartments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options UK Serviced Apartment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK serviced apartment market based on type, end use, and booking mode:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Long-Term (>30 Nights)

-

Short-Term (<30 Nights)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Corporate/Business Traveler

-

Leisure Travelers

-

Expats and Relocators

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct Booking

-

Online Travel Agencies

-

Corporate Contracts

-

Frequently Asked Questions About This Report

b. The UK serviced apartment market was estimated at USD 4.18 billion in 2024 and is expected to reach USD 4.49 billion in 2025.

b. The UK serviced apartment market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2033 to reach USD 8.82 billion by 2033.

b. The short-term service apartments accounted for a revenue share of 64.64% in the UK serviced apartment market in 2024, due to their strong appeal among domestic and international travellers seeking flexible, fully furnished stays for a few days to several weeks.

b. Some of the key players in the UK serviced apartment market are SACO – The Serviced Apartment Company; Staycity Ltd; Marlin Apartments; The Ascott Limited; Supercity Aparthotels; SilverDoor Apartments; Fraser Suites; Cheval Collection; Staybridge Suites; Clarendon Serviced Apartments

b. The UK serviced apartment market is driven by strong corporate travel demand, growth in remote and hybrid work arrangements, rising expat relocations, a steady tourism influx, increasing focus on sustainability, adoption of smart home technologies, event-led stays, and the appeal of flexible, fully furnished, home-like accommodation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.