- Home

- »

- Homecare & Decor

- »

-

UK Wallpaper Market Size & Share, Industry Report, 2030GVR Report cover

![UK Wallpaper Market Size, Share & Trends Report]()

UK Wallpaper Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Product (Vinyl, Nonwoven, Paper, Fabric, Others), By End-Use (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-210-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UK Wallpaper Market Size & Trends

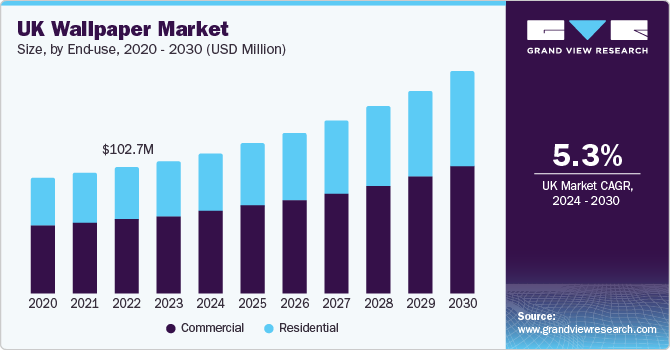

The UK wallpaper market size was estimated at USD 107.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. The growing popularity of home remodeling projects along with technical developments in wallpaper printing methods have been driving up wallpaper demand. In addition, growing disposable income, changing customer tastes, and an increase in do-it-yourself wallpaper projects are anticipated to fuel demand in the upcoming years.

The UK wallpaper market accounted for a share of 6% of the global wallpaper market revenue in 2023. Producers in the wallpaper sector divide their goods into categories according to whether they are intended for domestic or commercial use, since each requires a distinct kind of paper with a range of weight and thickness. For domestic applications, wallpaper is typically offered in pre-pasted or un-pasted forms. Conversely, commercial wallpaper comes in a variety of varieties according to usage and thickness. Since these wallpapers are utilized in high-traffic locations, they undergo a number of testing and inspections. Customers' growing need for eco-friendly and stain-resistant wallpaper is driving up demand for the material. Numerous producers are doing humidity tests in order to offer goods and remedies to address problems with bacterial development. Furthermore, businesses like York Wallcoverings and Sangetsu Corporation have introduced a number of stain- and damage-resistant products in recent years.

In an effort to reach a larger audience, manufacturers are investing more money in partnerships, marketing, and sponsorships. Brands who already have a strong brand image and a devoted client base due to their investment in promotional efforts can reap significant profits from the direct-to-customer channel. Businesses are actively concentrating on this sales technique in an effort to boost customer brand loyalty.

As there are so many businesses in the market with strong brands, a large geographic reach, and extensive distribution networks, the competition is fierce. The sector is predicted to develop in the near future as mergers and acquisitions (M&A) increase as major firms worldwide concentrate on growing their geographic presence. For example, as part of the company's global expansion and to expand the wall decorating product landscape to become a Pan-European market leader, Grandeco purchased Holden Décor Ltd in June 2020. It is anticipated that these kinds of activities will help businesses expand their consumer base, break into unexplored markets, and spur growth.

Market Concentration & Characteristics

Market players are expected to increase their focus on innovation with increasing R&D activities. The number of mergers & acquisitions in the market is expected to increase over the forecast period as companies are focusing on expanding their geographic reach.

Through tactics like partnerships, mergers and acquisitions, and joint ventures with other businesses, designers, or celebrities, players can open up new markets and acquire distribution channels and approaches that would otherwise be challenging for them to pursue alone.

Because wallpaper is so widely used and in such great demand, the market is also closely regulated. Wallpaper regulations typically outline safety requirements and restrictions on the volatile organic compound (VOC) emissions from the material. The labeling requirements must also include adherence to criteria for sustainable raw material procurement.Wallpaper has a fair variety of direct product alternatives available. Painting a wall requires a less laborious procedure, which makes the paint industry more competitive. Nonetheless, wallpapers provide a number of benefits to homes seeking reasonably priced and aesthetically beautiful wall décor.

Consumer demand for products is being driven by the growing trend of house remodeling among end users. Millennials are known for having a high rate of product acceptance, which is predicted to increase product consumption in the years to come. It is vital for manufacturers and merchants to comprehend these demographics and their driving forces in order to formulate efficacious marketing tactics and focus on particular customer segments.Product Insights

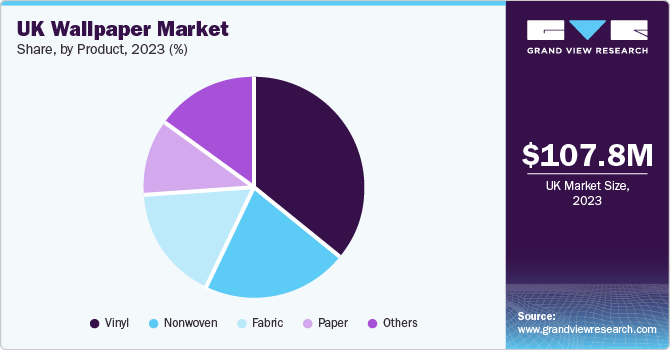

In 2023, vinyl-based wallpaper held the market share of 35.9%. Vinyl-based wallpaper is becoming more and more popular because of the benefits it provides over traditional paper wallpaper. These most popular and long-lasting wallpapers are fire-retardant, colorfast, and fully washable.

Furthermore, due in large part to its low cost, the vinyl-based wallpaper segment leads the Indian wallpaper market. Water vapor and other liquids cannot penetrate these waterproof (washable) wallpapers. Indian residential consumers are drawn to flexibility and durability because of these benefits. Demand for the solution increased significantly in the residential sector as consumers became more aware of its benefits and its cost-benefit ratio.

Because it is easy to clean and suitable for high-traffic locations, the product's growth is also growing. Moreover, it is simple to fix the vinyl wallpaper that is damaged. Vinyl-based products will become more popular in the next years because of their ease of use and capacity to repair damage. Its resilience to fire makes it an ideal choice for high-traffic areas like schools and hospitals.

Non-woven wallpaper segment is expected to register a CAGR of 6.8% from 2024 to 2030. The increasing inclination towards do-it-yourself projects is a primary driver of the market for nonwoven wallpaper. This wallpaper may be applied straight to the wall and effectively covers up wall fractures. They give the wall smoothness and a beautiful appearance because they are simple to remove. Nonwoven wallpapers are preferred by consumers in the market because they facilitate digital printing and successfully prevent the issue of mold.

End-use Insights

Commercial wallpaper held a revenue share of 53.3% in 2023. Over the course of the forecast period, it is projected that rising urbanization and the growth of supermarkets and hypermarkets to reach a wider range of consumers will propel product sales through offline end-user channels worldwide. Moreover, the main driver of demand in the commercial market is an increase in the number of busy locations like pubs, clubs, and restaurants worldwide.

Residential wallpaper market is expected to expand at a CAGR of 5.5% from 2024 to 2030. The primary driver behind the popularity of online channels in the global sector is the middle class's increasing internet penetration combined with the growing use of smartphones and other comparable devices. Furthermore, it is anticipated that major players will have the chance to diversify their product offerings due to the growing trend of adding stylish and artistic appeal to walls.

Key UK Wallpaper Company Insights

The following are the leading companies in the UK wallpaper market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy mappings, & products of these companies are analyzed to map the supply network. Such strategic expansions enable companies to position themselves in key locations, aligning with evolving customer preferences and design trends. These initiatives enhance accessibility to target markets and foster brand recognition, driving growth and competitiveness in the industry.

Key UK Wallpaper Companies:

- William Morris & Co.

- Trustworth Wallpapers

- Lewis & Wood

- Sanderson

- Little Greene

- Scion

- Zoffany

- Colefax & Fowler

- Osborn & Little

- The Victorian Museum

Recent Developments

-

In April 2023, The founder and creative director of Temperley London, Alice Temperley, and the Romo Group worked together to create a line of wallpapers, pillows, fabric, and trimmings. Twelve distinct patterns of wallpaper were introduced; these included animal prints, exotic chinoiserie, and botanicals.

-

In January 2023, Grandeco Wallfashion Group Belgium NV unveiled a digitally printed wallpaper series intended for its Mural Young Edition. These murals are printed digitally inside a printing press that is tailor-made for the company.

UK Wallpaper Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 113.2 million

Revenue forecast in 2030

USD 154.4 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

UK

Key companies profiled

William Morris & Co.; Trustworth Wallpapers; Lewis & Wood; Sanderson; Little Greene; Scion; Zoffany; Colefax & Fowler; Osborn & Little; The Victorian Museum

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Wallpaper Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the UK wallpaper market report on the basis of product and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vinyl

-

Nonwoven

-

Paper

-

Fabric

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The UK wallpaper market size was estimated at USD 107.8 million in 2023 and is expected to reach USD 113.2 million in 2024.

b. The UK wallpaper market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 154.4 billion by 2030.

b. Vinyl-based wallpaper dominated the UK wallpaper market with a share of 36% in 2023. Vinyl-based wallpaper is becoming more and more popular because of the benefits it provides over traditional paper wallpaper. These most popular and long-lasting wallpapers are fire-retardant, colorfast, and fully washable

b. Some key players operating in the UK wallpaper market include William Morris & Co.; Trustworthy Wallpapers; Lewis & Wood; Sanderson; Little Greene; Scion; Zoffany; Colefax & Fowler; Osborn & Little; The Victorian Museum

b. The growing popularity of home remodeling projects along with technical developments in wallpaper printing methods have been driving up wallpaper demand. In addition, growing disposable income, changing customer tastes, and an increase in do-it-yourself wallpaper projects are anticipated to fuel demand in the upcoming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.