- Home

- »

- Pharmaceuticals

- »

-

Ultomiris Drug Market Size And Share, Industry Report, 2030GVR Report cover

![Ultomiris Drug Market Size, Share & Trends Report]()

Ultomiris Drug Market (2025 - 2030) Size, Share & Trends Analysis Report By Indication (PNH, Myasthenia Gravis, Neuromyelitis Optica Spectrum Disorder), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-595-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultomiris Drug Market Summary

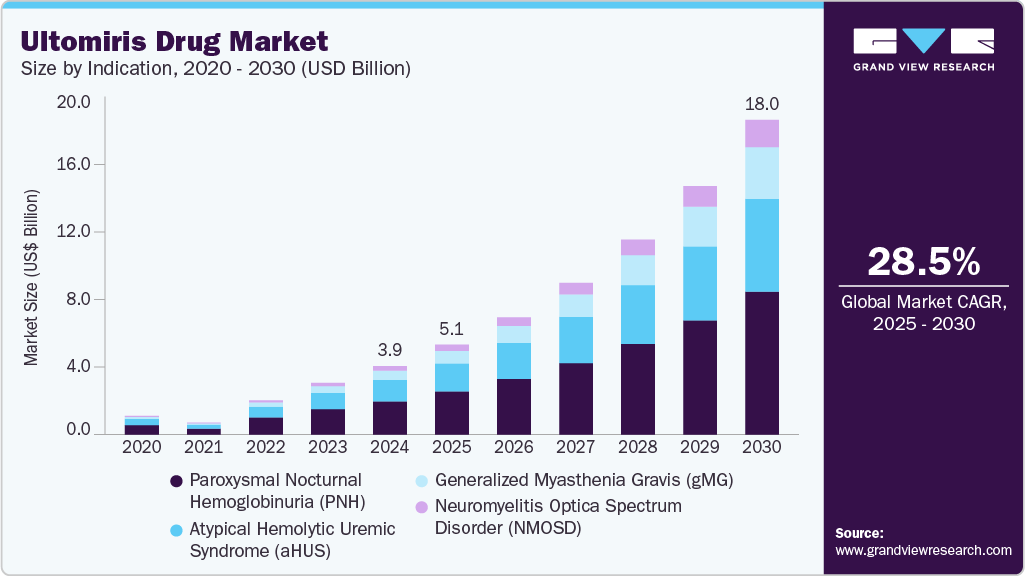

The global ultomiris drug market size was estimated at USD 3.92 billion in 2024 and is projected to reach USD 18.03 billion by 2030, growing at a CAGR of 28.47% from 2025 to 2030. The global Ultomiris (ravulizumab) drug industry is experiencing strong momentum due to the rising demand for long-acting treatments in rare disorders.

Key Market Trends & Insights

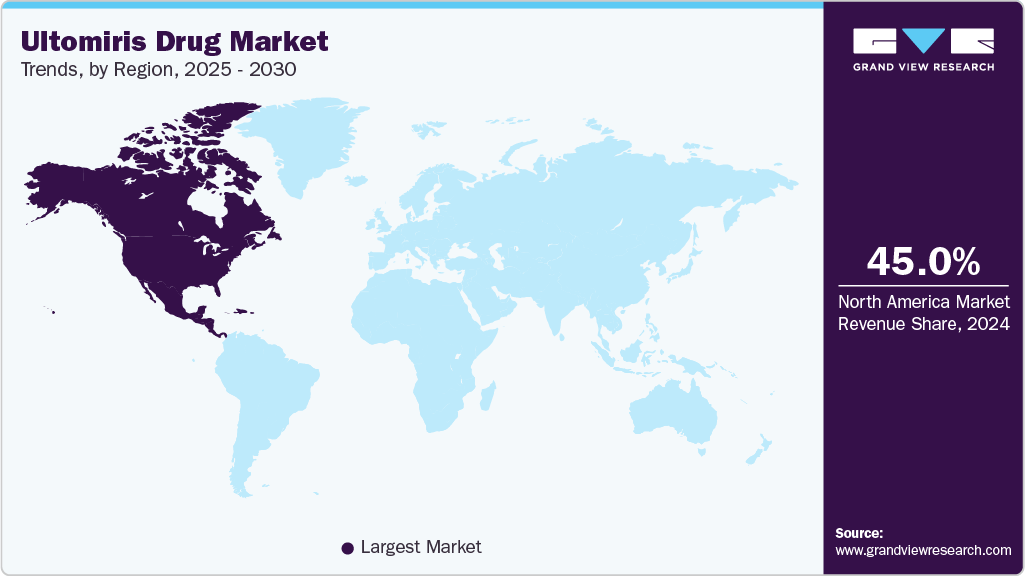

- North America ultomiris drug market dominated with a revenue share of 45.0% in 2024.

- The Latin America ultomiris drug market is characterized by advanced medical facilities and a high diagnosis rate.

- The Paroxysmal Nocturnal Hemoglobinuria (PNH) segment dominated the Ultomiris (ravulizumab) drug market with the largest revenue share of 48.80% in 2024.

- The adult segment dominated the Ultomiris (ravulizumab) drug industry with the largest revenue share in 2024, which can be attributed to this group's high disease burden and treatment eligibility.

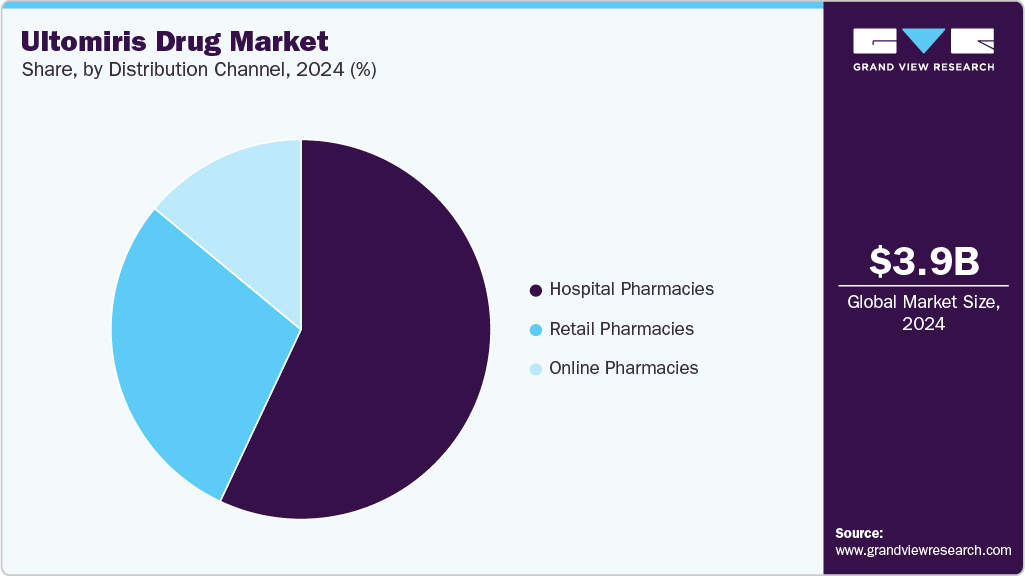

- The hospital pharmacies segment dominated the Ultomiris market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.92 Billion

- 2030 Projected Market Size: USD 18.03 Billion

- CAGR (2025-2030): 28.47%

- North America: Largest market in 2024

- Latin America: Fastest growing market

Compared to its predecessor, Soliris, the drug's extended dosing interval offers convenience and improved patient compliance. This has increased preference among healthcare providers managing conditions such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). Alexion reported that over 70% of PNH patients had transitioned to Ultomiris from Soliris in major markets, including the U.S. and EU. The transition from older complement inhibitors to ravulizumab contributes to overall market expansion.

Growth is further fueled by its expanding clinical utility across new indications such as generalized myasthenia gravis (gMG). For instance, in September 2022, Ultomiris received approval from the European Commission to treat adult patients with anti-acetylcholine receptor antibody-positive gMG, strengthening its position in the neurology segment.

The rising incidence of rare autoimmune and hematologic conditions is also a major factor driving demand for Ultomiris. Improved diagnostic tools and updated clinical guidelines have identified eligible patient populations earlier. For instance, in March 2024, the FDA granted priority review to Ultomiris for its potential use in treating neuromyelitis optica spectrum disorder (NMOSD), highlighting its pipeline strength. Strategic marketing efforts and partnerships by AstraZeneca and Alexion have helped expand awareness among clinicians and treatment centers. These combined elements shape a favorable environment for sustained revenue growth through 2030.

Pipeline Analysis for Ultomiris Market

Ultomiris is undergoing active pipeline development to expand its clinical utility beyond currently approved indications. AstraZeneca targets rare and severe conditions where complement-mediated pathways play a critical role. One of the key areas of ongoing research is hematopoietic stem cell transplant-associated thrombotic microangiopathy (HSCT-TMA), a life-threatening complication post-transplant. The drug is also being studied for cardiac surgery-associated acute kidney injury (CSA-AKI), which represents a high-burden complication with limited treatment options. In both cases, Ultomiris is being evaluated for its ability to reduce inflammation and organ damage caused by uncontrolled complement activation. These trials are part of AstraZeneca’s effort to extend Ultomiris’s role in acute care settings.

Another major investigational area is IgA nephropathy (IgAN), a chronic kidney disease that can lead to end-stage renal failure. Ultomiris’s mechanism is being tested for its potential to control immune complex deposition and complement activation in the kidneys. Positive outcomes in this indication could position the drug in a new therapeutic category outside of hematology and neurology. The broader pipeline strategy reflects AstraZeneca’s ambition to transform Ultomiris into a foundational therapy across multiple complement-driven diseases. Real-world data and ongoing clinical studies are expected to support future label expansions. These developments could significantly increase the patient population eligible for Ultomiris and enhance its long-term commercial prospects.

Ultomiris Patent & Exclusivity Summary

Region

Protection Type

Expiry Year

Notes

United States

Composition of Matter Patent

2035

Covers core molecular structure of ravulizumab

United States

Orphan Drug Exclusivity

2025

For treatment of Paroxysmal Nocturnal Hemoglobinuria (PNH)

United States

Regulatory Data Exclusivity

2030

Protects clinical trial and approval data

Europe

Composition of Matter Patent

2035

Similar scope as U.S. patent

Japan

Composition of Matter Patent

2035

Core patent protection for molecule

Japan

Orphan Drug Exclusivity

2029

Exclusivity for PNH treatment indication

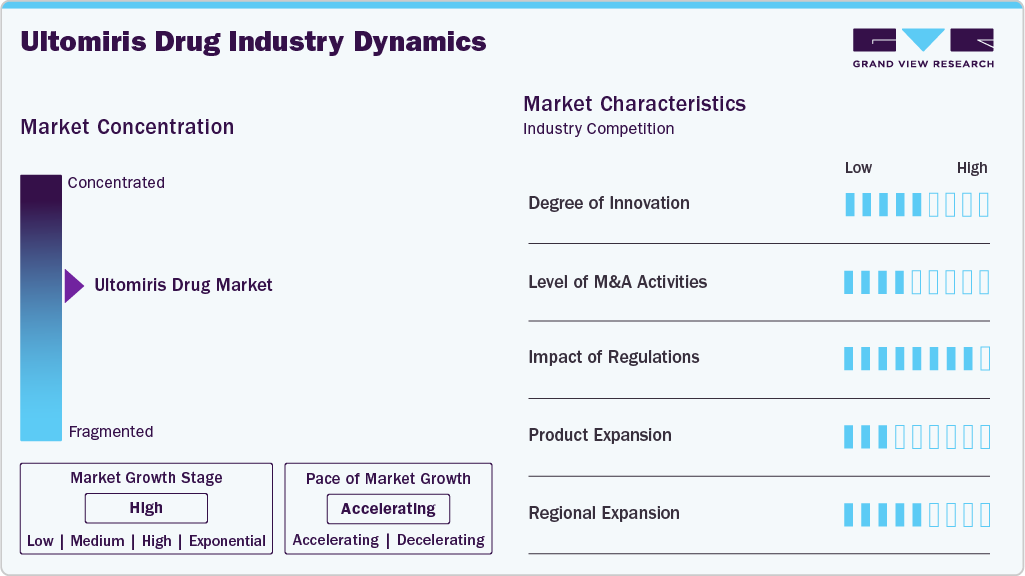

Market Concentration & Characteristics

The Ultomiris (ravulizumab) market reflects focused innovation in long-acting complement inhibitors, aiming to extend dosing intervals and improve treatment adherence in rare autoimmune conditions. Continuous efforts are directed at expanding indications, as evidenced by approvals for PNH, aHUS, gMG, and ongoing exploration in NMOSD. These advancements are driven by a better understanding of the complement cascade and the development of more precise C5-targeted therapies. Formulation innovations seek to reduce infusion times and support subcutaneous delivery for adult and pediatric populations. Pediatric formulation enhancements and trials underscore a commitment to broader accessibility and safer use across age groups. AstraZeneca also advances companion diagnostics and real-world evidence initiatives to optimize treatment protocols and personalize care.

High R&D investment, complex biologic manufacturing, and rigorous clinical validation make the Ultomiris market difficult for new entrants. Given the ultra-rare nature of PNH and aHUS, clinical trials demand global patient recruitment and long-term follow-up, significantly increasing costs. Biologic production requires specialized facilities, cold chain logistics, and quality control, creating logistical and financial barriers. AstraZeneca's strong brand equity, clinician familiarity, and reimbursement networks reinforce market dominance. Regulatory expectations for biologics in rare diseases are stringent, with limited room for abbreviated approval pathways. Additionally, orphan drug exclusivity, high treatment costs, and complex therapy administration deter biosimilar and new-brand competition.

Global regulatory bodies, including the FDA and EMA, enforce detailed clinical documentation for rare disease therapies, especially for life-threatening, chronic conditions like PNH and aHUS. Orphan drug designations offer incentives, including market exclusivity and reduced fees, yet require post-approval surveillance and risk management plans. For gMG and NMOSD, regulatory approvals emphasize demonstrating statistically significant functional outcomes and long-term safety in neurologically vulnerable populations. Reimbursement decisions are influenced by Health Technology Assessments (HTAs), particularly in Europe and Asia Pacific, where cost per QALY and patient-reported outcomes are central to pricing discussions. Pediatric usage requires additional trials and age-specific pharmacokinetic studies to meet regulatory standards. Regulatory harmonization across regions is becoming vital for AstraZeneca to streamline global market access and minimize launch delays.

Ultomiris competes primarily with other complement inhibitors like Soliris (eculizumab), but its extended dosing provides a distinct clinical advantage. In PNH and aHUS, substitutes are limited, as few therapies effectively target complement-mediated hemolysis and endothelial damage. For gMG, treatment options include corticosteroids, cholinesterase inhibitors, and monoclonal antibodies like rituximab, but these differ in mechanism and tolerability. NMOSD therapies such as eculizumab, inebilizumab, and satralizumab offer alternatives, though Ultomiris aims to differentiate with less frequent dosing and favorable safety profiles. Despite the presence of other biologics, the chronic, debilitating nature of these diseases necessitates premium therapies with strong efficacy and safety outcomes. Long-term hospital protocols and specialty care guidelines often prefer proven biologics with established real-world data, supporting Ultomiris uptake.

AstraZeneca is strategically expanding Ultomiris access across Asia Pacific, Latin America, and Central and Eastern Europe to address rising diagnoses of rare autoimmune diseases. Improved diagnostic awareness, physician education, and specialist care centers are driving demand for high-efficacy biologics in these regions. AstraZeneca enhances regional access through local licensing, expanded patient assistance programs, and collaboration with government and private healthcare stakeholders. Hospital pharmacies remain the dominant distribution channel for infusion-based therapies, while specialized online pharmacies are being explored to support home infusion services. Pediatric expansion and label extensions in emerging markets are further supported by real-world evidence collection to ensure regulatory alignment. This diversification enables AstraZeneca to reduce dependency on North American and Western European markets, while reinforcing global leadership in complement inhibition.

Indication Insights

The Paroxysmal Nocturnal Hemoglobinuria (PNH) segment dominated the Ultomiris (ravulizumab) drug market with the largest revenue share of 48.80% in 2024, driven by strong clinical adoption and sustained treatment demand. The extended dosing interval of Ultomiris significantly enhances patient compliance in PNH management. Its proven efficacy in reducing hemolysis and minimizing transfusion requirements has supported broader physician preference. Increased awareness among hematologists and streamlined diagnostic pathways have also improved early detection and treatment initiation. Alexion announced that over 60% of newly diagnosed PNH patients in Europe were initiated on Ultomiris, reflecting rapid uptake. Favorable clinical outcomes have reinforced market penetration in comparison to predecessor therapies. The strong performance of Ultomiris in long-term safety and quality-of-life measures has established it as a primary treatment choice for PNH.

The Generalized Myasthenia Gravis (gMG) segment is projected to grow at the fastest CAGR over the forecast period, fueled by expanding label approvals and rising clinical demand. Ultomiris has significantly improved muscle strength and reduced flare frequency in gMG patients. The availability of targeted complement inhibition therapy represents a significant advancement in neuromuscular disease treatment. For instance, in April 2022, the FDA and EMA approved Ultomiris for adult gMG anti-AChR antibody-positive patients, which broadened its treatment scope. Increasing neurologist familiarity with the mechanism of action and efficacy profile has led to greater prescribing confidence, the rising prevalence of autoimmune neuromuscular conditions, and the demand for durable symptom relief support market growth. The convenience of maintaining dosing every eight weeks also attracts a broader patient base.

End Use Insights

The adult segment dominated the Ultomiris (ravulizumab) drug industry with the largest revenue share in 2024, which can be attributed to this group's high disease burden and treatment eligibility. Adults represent a majority of diagnosed cases for PNH and gMG, supporting greater utilization of Ultomiris. These demographics benefit the most from the drug’s long-acting profile and reduced infusion frequency. Healthcare providers have clearly preferred Ultomiris in adults requiring chronic complement inhibition therapy. Access to specialized infusion centers and better adult treatment adherence contribute to favorable outcomes. Clinical trial participation has increased among adults, accelerating market access and physician confidence. The adult segment drives revenue growth due to consistent diagnosis and follow-up treatment patterns.

The pediatric segment is projected to grow at the fastest CAGR over the forecast period due to increasing clinical acceptance and recent regulatory clearances. Ultomiris has been gradually adopted in pediatric care for PNH, where long-term safety and efficacy data are becoming more available. Pediatric formulations and dosing protocols are now better standardized, promoting wider usage. Specialists are gaining confidence in managing rare blood disorders in children using complement inhibitors. For instance, in September 2021, the European Commission granted a pediatric extension for Ultomiris based on favorable results from the RAVULI-KIDS trial. Growing awareness among caregivers and early diagnosis of complement-mediated disorders support this trend. Hospitals with pediatric hematology and neurology units are integrating Ultomiris into long-term care strategies.

Distribution Channel Insights

The hospital pharmacies segment dominated the Ultomiris market with the largest revenue share in 2024, attributed to structured administration protocols and immediate drug availability. Ultomiris is typically infused in controlled healthcare environments, aligning well with hospital pharmacy workflows. The need for periodic infusion under supervision supports centralized drug dispensing through hospitals. Pharmacists within hospital systems are trained to handle and monitor high-cost biologics, ensuring adherence to treatment schedules. Several academic hospitals in Germany, including Charité Berlin, expanded their biologic infusion units to accommodate more Ultomiris patients. Clinical coordination between prescribing physicians and pharmacy departments enhances patient management. Hospital-based infusion centers are equipped to handle emergency support if adverse reactions occur.

The online pharmacies segment is projected to grow at the fastest CAGR over the forecast period due to evolving patient preferences and the expansion of specialty pharmacy services. Home infusion services supported by online pharmacy networks are increasingly adopted for maintenance therapy. Patients with stable disease opt for delivery options supporting convenience and privacy. Online platforms offer transparent pricing and simplified refill processes for chronic therapies. Digital health integration is enhancing prescription tracking and remote monitoring. Specialized training among online pharmacy staff enables safe handling and distribution of biological drugs. Broader insurance coverage for home delivery models contributes to market growth in this segment.

Regional Insights

The North America Ultomiris (ravulizumab) drug market accounted for over 45.0% market share in 2024, driven by a high prevalence of rare diseases and a well-established healthcare infrastructure. This region's advanced diagnostic capabilities facilitate early detection and treatment of conditions like PNH and aHUS. Strong patient demand contributes to market growth, particularly in neurology indications such as gMG and NMOSD. The transition from Soliris to Ultomiris is accelerating, supported by the latter's extended dosing intervals. Robust clinical trial activity and rapid adoption of innovative therapies further bolster the market. These factors collectively position North America as the dominant region in the Ultomiris market.

U.S. Ultomiris Drug Market Trends

The U.S. represents the largest share of the Ultomiris (ravulizumab) industry within North America. Recent FDA approvals for indications like NMOSD have expanded the drug's therapeutic reach. The country's comprehensive healthcare system enables widespread access to advanced treatments. High awareness among healthcare professionals about rare diseases ensures timely diagnosis and intervention. The preference for therapies with reduced treatment burden favors Ultomiris due to its less frequent dosing schedule. These elements contribute to the United States' significant share in the global Ultomiris market.

Europe Ultomiris Drug Market Trends

Europe holds a substantial position in the Ultomiris (ravulizumab) industry, supported by increasing awareness and diagnosis of rare diseases. The region's demand for targeted therapies aligns with Ultomiris' mechanism of action. Recent approvals for pediatric use in conditions like PNH have broadened the drug's applicability. The shift from Soliris to Ultomiris is evident, driven by the latter's improved dosing regimen. However, cost-containment measures and biosimilar competition present challenges. Despite these, Europe's commitment to innovative treatments sustains its market position.

The UK Ultomiris market is expected to grow during the forecast period. In the UK, the availability of Ultomiris through the NHS for conditions such as PNH and aHUS enhances patient access. Healthcare providers' familiarity with complement inhibitors facilitates the drug's integration into treatment protocols. The country's focus on improving the quality of life for patients with rare diseases supports the adoption of therapies with reduced treatment frequency. Clinical guidelines and recommendations endorse the use of Ultomiris in appropriate patient populations. The transition from existing therapies to Ultomiris reflects its perceived benefits. These factors collectively strengthen the drug's market presence in the UK.

The Ultomiris market in Germany is expected to witness growth over the forecast period. Germany advanced healthcare system and emphasis on innovative treatments contribute to the Ultomiris market. The country's structured approach to rare disease management ensures appropriate patient identification and therapy initiation. Healthcare professionals' expertise in managing conditions like PNH and aHUS supports the drug's utilization. The preference for therapies that reduce hospital visits aligns with Ultomiris' dosing schedule. Efforts to optimize treatment outcomes encourage the adoption of novel therapeutics. These elements reinforce Germany's role in the European Ultomiris market.

The France Ultomiris (ravulizumab) market is expected to witness growth, due to its advanced healthcare infrastructure and established rare disease frameworks. Medical specialists are increasingly transitioning patients from Soliris to Ultomiris due to its longer dosing intervals. The country's focus on improving patient quality of life supports the adoption of treatments requiring fewer hospital visits. French clinical centers actively participate in trials for complement inhibitors, boosting physician confidence in newer therapies. Awareness and early diagnosis of conditions such as PNH and aHUS ensure timely treatment decisions. These factors sustain France’s position as a key European market for Ultomiris.

Asia Pacific Ultomiris Drug Market Trends

The Asia Pacific Ultomiris (ravulizumab) industry is expected to exhibit the fastest CAGR during the forecast period, driven by a growing patient population with rare diseases. Improving healthcare infrastructure enhances access to advanced diagnostics and treatments. Increased awareness and education about rare conditions facilitate early diagnosis and intervention. The region's focus on adopting innovative therapies supports the uptake of Ultomiris. Collaborations and partnerships within the healthcare sector contribute to market expansion. These dynamics position Asia Pacific as a rapidly growing market for Ultomiris.

The Japan Ultomiris drug market is expected to grow during the forecast period. Japan approval of Ultomiris for conditions such as aHUS and gMG expands its therapeutic applications. The country's emphasis on reducing the treatment burden aligns with Ultomiris' extended dosing intervals. Healthcare providers' experience with complement inhibitors facilitates the transition from existing therapies. Japan's structured approach to rare disease management supports patient identification and treatment initiation. The integration of Ultomiris into clinical practice reflects its perceived benefits. These elements contribute to the drug's market presence in Japan.

The Ultomiris drug market in China is projected to grow during the forecast period. China expanding healthcare system and focus on rare diseases contribute to the Ultomiris market. Efforts to improve diagnostic capabilities enable earlier detection of conditions like PNH and aHUS. Healthcare professionals' increasing familiarity with complement inhibitors supports the drug's adoption. The country's commitment to integrating innovative therapies into clinical practice enhances market potential. Educational initiatives raise awareness among patients and providers about treatment options. These factors collectively drive the growth of Ultomiris in China.

Latin America Ultomiris Drug Market Trends

Latin America is witnessing rising demand for Ultomiris, driven by growing recognition of rare hematologic and neurologic conditions. Access to advanced biologics is improving through regional collaborations and public-private healthcare models. Physicians increasingly recommend longer-acting treatments to reduce clinic visits and improve patient compliance. Educational efforts are enhancing the understanding of complement-mediated diseases across key markets. Although regulatory timelines can vary, approvals are expanding across multiple countries. These developments are fostering consistent growth of the Ultomiris market in Latin America.

Brazil Ultomiris market is anticipated to grow over the forecast period. Brazil is the leading Ultomiris market in Latin America, supported by expanding access to advanced biologics and specialized care centers. Clinical professionals are prioritizing treatments with extended dosing intervals to reduce patient burden. Awareness campaigns and specialist networks are accelerating early diagnosis of conditions such as aHUS and PNH. The local adoption of international treatment guidelines promotes faster clinical integration of new therapies. Ongoing improvements in healthcare delivery are enabling wider use of high-cost targeted drugs. These trends position Brazil as the region's primary growth engine for Ultomiris.

Middle East & Africa Ultomiris Drug Market Trends

MEA region growing focus on rare diseases and improving healthcare infrastructure supports the Ultomiris (ravulizumab) industry. Enhancing diagnostic capabilities enables earlier detection of conditions like PNH and aHUS. Healthcare professionals' increasing awareness of complement inhibitors facilitates the drug's adoption. Collaborations and partnerships within the healthcare sector contribute to market development. Educational initiatives raise awareness among patients and providers about treatment options. These factors collectively drive the growth of Ultomiris in the MEA region.

Saudi Arabia Ultomiris drug market is expected to grow during the forecast period. Saudi Arabia investment in healthcare infrastructure and focus on rare diseases contribute to the Ultomiris market. Efforts to improve diagnostic capabilities enable earlier detection of conditions like PNH and aHUS. Healthcare professionals' increasing familiarity with complement inhibitors supports the drug's adoption. The country's commitment to integrating innovative therapies into clinical practice enhances market potential. Educational initiatives raise awareness among patients and providers about treatment options. These elements collectively drive the growth of Ultomiris in Saudi Arabia.

Key Ultomiris Drug Company Insights

AstraZeneca is the leading company in the global Ultomiris (ravulizumab) market. As part of its strategy to strengthen its competitive position, the company is actively working to expand its customer base. Other key players in the market are pursuing strategic initiatives such as mergers and acquisitions and partnerships to drive growth and enhance market reach.

Key Ultomiris Drug Companies:

The following are the leading companies in the ultomiris drug market. These companies collectively hold the largest market share and dictate industry trends.- AstraZeneca

Recent Developments

-

In March 2024, Ultomiris received FDA clearance in the U.S. for treating adults with AQP4 antibody-positive NMOSD. This approval was supported by positive data from the CHAMPION-NMOSD Phase III trial, where no relapses occurred in patients treated with Ultomiris.

-

In April 2022, AstraZeneca announced that the FDA approved Ultomiris (ravulizumab-cwvz) for adults with generalized myasthenia gravis (gMG) who are anti-AChR antibody-positive.

Ultomiris Drug Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.15 billion

Revenue forecast in 2030

USD 18.03 billion

Growth rate

CAGR of 28.47% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultomiris Drug Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Ultomiris (ravulizumab) drug market report based on indication, end use, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Paroxysmal Nocturnal Hemoglobinuria (PNH)

-

Atypical Hemolytic Uremic Syndrome (aHUS)

-

Generalized Myasthenia Gravis (gMG)

-

Neuromyelitis Optica Spectrum Disorder (NMOSD)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.