- Home

- »

- Medical Devices

- »

-

Ultrasound Needle Guides Market Size & Share Report, 2030GVR Report cover

![Ultrasound Needle Guides Market Size, Share & Trends Report]()

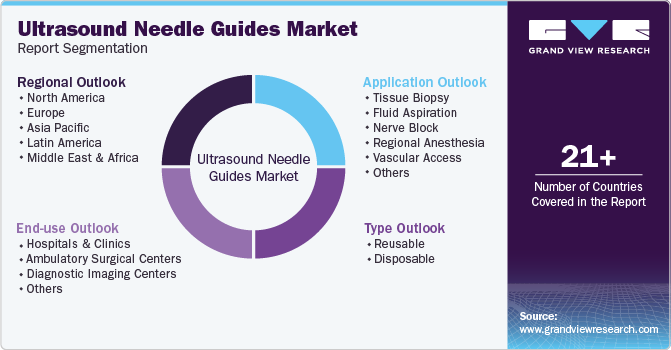

Ultrasound Needle Guides Market Size, Share & Trends Analysis Report By Type, By Application (Tissue Biopsy, Fluid Aspiration), By End-use (Hospitals & Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-120-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

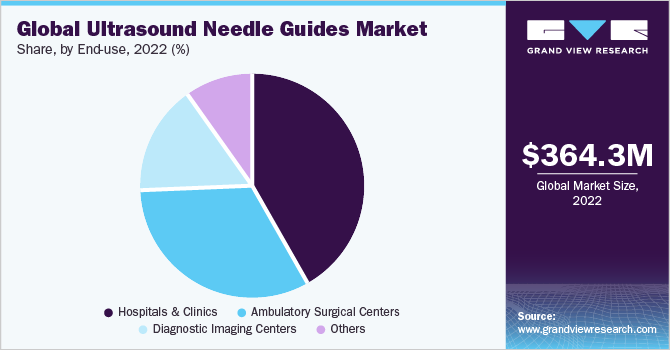

The global ultrasound needle guides market size was valued at USD 364.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.93% from 2023 to 2030. The market for ultrasound needle guides is growing due to several factors, such as increasing demand for point-of-care ultrasound systems, growing use of ultrasound-guided needle placement, rising demand for minimally invasive operations, and advancements in ultrasound imaging technology. The prevalence of chronic diseases such as cancer and diabetes, as well as the growing number of elderly patients who require minimally invasive surgeries, are both expected to fuel the demand for ultrasonic needle guides.

Additionally, due to the increased care for patient comfort and safety when using these devices, the ultrasonic needle guide market is poised to grow further. Advancements in the ultrasound imaging technology have a positive impact on the market. A variety of procedures, including biopsies and ultrasound-guided aspirations, are carried out using ultrasounds. To guarantee needle synchronization with the ultrasound transducer, ultrasound-guided needles are being used. Ultrasound needle guides are intended to keep the needle inside the sound beam for greater clarity.

In native biopsies, the use of a needle guide enhances biopsy quality and leads to lower rates of minor problems. For instance, as per an article published by Scientific Reports in March 2023, for accurate diagnosis, the EUS-guided tissue acquisition procedure for pancreatic cancer may be standardized with the use of the Franseen needle under the fanning technique with an endoscope.

Additionally, in April 2023, leading international medical technology manufacturer BD introduced a novel, elegant ultrasonic device with a unique probe intended to give professionals the best IV insertion. The BD Prevue II System utilizes actual time needle depth markers for filling a gap in IV administration. The system comprises the Needle Monitoring System ‘BD Cue’, which operates with BD Cue Needle Counting-capable catheters and provides an accurate ultrasound image of the syringe track.

As reported by the American Institute of Ultrasound in Medicine, simulation studies indicate that integrating a needle-tracking system with ultrasound assistance may help decrease the number of attempts and the duration required to successfully access a vessel. This may make vascular surgery safer and simpler for both doctors and patients.

Higher-resolution and clearer images have become possible due to advancements in ultrasonic imaging technology. Medical practitioners can recognize the body's smaller and more complex structures by using this improved imagery. In addition, ultrasound needle guides offer a visual aid for accurate needle placement, enhancing accuracy during procedures like biopsies, aspirations, and injections. For instance, in November 2022, at the Radiological Society of North America 2022, Philips unveiled a portable ultrasound equipment that will enable more patients to receive a correct first-time diagnosis.

The brand-new Ultrasound Compact System 5000 Series offers superior image quality in a portable device to support diagnosis. The system is compatible with the company’s ultrasound systems Affiniti and EPIQ transducers, as well as workflow, user interface, and automation tools, leading to a simple learning curve for users. Moreover, the addition of enhanced telemedicine capabilities for remote clinician support and training through integration with Philips Collaboration Live can also be made possible.

Biopsy is an important diagnostic technique for the detection and characterization of cancer. Medical professionals can employ ultrasound-guided biopsies to accurately target sensitive areas for tissue collection. Since cancer is more prevalent, more biopsies are performed, which raises the demand for ultrasonic needle guides to boost the precision of these treatments. According to data from the National Library of Medicine, 1.46 million incidences of cancer were estimated to occur in India in 2022. A lifelong chance of having cancer exists in one out of every nine Indians.

Lung and breast cancers were the most prevalent ones in men and women, respectively. The most prevalent type of cancer in children (0-14 years old) was lymphoma. For instance, 235 patients were randomly assigned, and 120 were examined to determine the impact of rapid on-site assessment (ROSE) on the diagnostic efficacy of EUS-FNB (endoscopic ultrasound-guided fine-needle biopsy), as per a PubMed article from June 2022. 217 patients had malignant histology in total. The diagnosis sensitivity for malignancies using EUS-FNB and EUS-FNA with ROSE, respectively, was 92.5% and 96.5%. The study led to the conclusion that EUS-FNB alone is superior to EUS-FNA with ROSE and is linked to fewer needle passes, a quicker process, and an excellent histology yield at a similar price.

Adenocarcinoma, cystic pancreatic neoplasms with solid components, neuroendocrine tumors, solid pseudopapillary tumors, pancreatoblastoma, pancreatic metastases, and pancreatic lymphoma are the most common solid pancreatic lesions. As a result, continuous research and studies that result in new discoveries and improvements in the cancer space inspire important industry players to adopt strategies that accelerate the development of the research market.

However, advanced ultrasound needle guide systems can be costly to buy and to operate, which may prevent the devices from being widely used, especially in environments with low resources. The market for medical electronic devices, such as ultrasound needle guides, is fiercely competitive with several companies providing different services. Market share and pricing may be impacted by such rivalry.

Type Insights

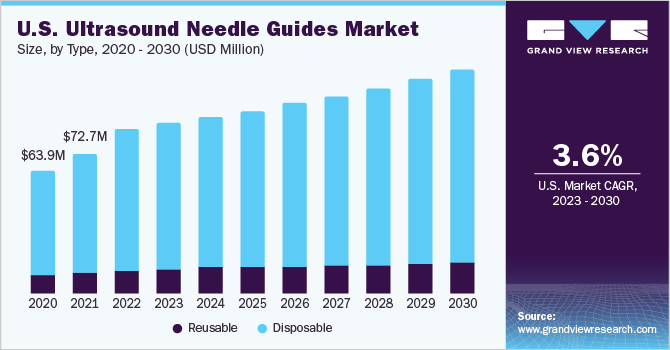

The disposable segment held the dominant revenue share of around 85.27% in the ultrasound needle guides market in 2022. By eliminating the need for workflow optimization, cleaning, and sterilization, disposable needle guides offer simplicity and efficiency as well as saving time. Their single-use design helps to improve infection control by reducing the chance of cross-contamination and diseases. Devices are also ideal for clinics and other smaller healthcare facilities due to their flexibility for point-of-care settings and ease of setup and use.

Moreover, the disposable segment is also anticipated to expand at the highest CAGR of 4.01% through 2030. When reusable devices are not properly disinfected in between usage, infections can occur. Single-use needle guides reduce this danger. Since disposable needle guides do not require extensive disinfecting procedures, healthcare facilities are able to simplify operating procedures. Due to its cost-effectiveness, ease, and advantages in terms of infection control, the demand for disposable needles has risen over the years.

Application Insights

The regional anesthesia segment held the largest market share of around 29.41 % in 2022. Since continuous monitoring of nerves and needle placement has become possible due to ultrasound technology, regional anesthesia has gone through an enormous change. This has improved operation accuracy and safety. Patients frequently heal more quickly and feel less pain after surgery with more precise injections. The probability of issues such as nerve injury, vascular puncture, and inadvertent intravascular injection is lower when the needle is placed accurately. Anesthesiologists can deliver anesthesia more securely by avoiding vital structures with the aid of ultrasound guidance.

For instance, NYSORA, a specialist in anesthesia, ultrasound, regional anesthesia, and pain medicine education, states that a variety of regional anesthetic methods, such as femoral blocks and brachial plexus, were made possible with the help of ultrasound. The use of peripheral nerve blocks (PNBs) has increased, many nerve block procedures have been improved, and surgical patients and coworkers generally accept PNBs more readily.

This is due to the adoption of ultrasound assistance in regional anesthesia. Regional anesthesia has been transformed by ultrasonography. This technology can only be used effectively with a two-dimensional understanding of anatomy, ideal imaging of the nerves and other anatomical structures, precise local anesthetic distribution, and accurate real-time needle guidance.

The tissue biopsy segment is expected to expand at the highest CAGR of 4.64% during the forecast period. Due to its crucial role in the diagnosis of numerous medical disorders, the tissue biopsy segment controls a significant share of the market for ultrasound needle guides. Ultrasound guidance is essential for tissue biopsies since proper needle placement is necessary to acquire reliable samples. The need for minimally invasive surgeries like ultrasound-guided biopsies has increased, as healthcare focuses on early and precise diagnoses. The tissue biopsy market segment has grown significantly as a result of the growing demand for precision and the rising incidences of cancer and other disorders.

End-use Insights

The hospitals & clinics segment held the largest market share of around 41.53% in 2022. These devices are used in medical institutions, including hospitals and clinics, for a variety of operations involving the insertion of needles while under ultrasound supervision. Diagnostic biopsies and therapeutic treatments are two such procedures. The demand for ultrasound needle guides is significantly influenced by hospitals, which are among the main users of ultrasound equipment for a variety of medical purposes.

The need for ultrasound needle guides among doctors is also driven by the expanding healthcare industry in emerging nations, rising global private healthcare costs, and increased demand for ultrasound operations. Furthermore, a variety of diagnostic and interventional treatments are carried out in facilities, which contributes to large procedure volumes. Ultrasound needle guides are continuously in demand due to this high volume.

The ambulatory surgical centers segment is expected to expand at the highest CAGR of 4.19% during the forecast period. A lot of procedures carried out at ambulatory surgical facilities are minimally invasive, which means they require fewer incisions and allow faster healing. Ultrasound-guided operations are a good fit for this model since they provide a precise and discreet approach. Ambulatory surgical facilities strive to offer patients convenient and effective care. The accuracy and efficiency of treatments can be improved with ultrasound needle guides, hence reducing the amount of time patients need to stay at the hospital overall.

Regional Insights

North America dominated the market for ultrasound needle guides with a share of 29.68% in 2022, aided by the presence of key manufacturers such as CIVCO Medical Solutions, BD, GEOTEK MEDICAL, and GE HealthCare in the region. Furthermore, the increasing number of cancer cases drives the regional market growth. For instance, as per the National Journal of Health Statistics, in 2023, in the United States, 1,958,310 new cases of cancer and 609,820 fatalities are anticipated. This will lead to more cancer procedures and biopsies, which will positively impact the demand for ultrasound needle guides. Also, procedures to identify and treat these disorders are needed due to the high incidence rate. As a result, the market for endoscopic ultrasound needles has expanded.

Asia Pacific is expected to expand at the highest CAGR of 5.02% during the forecast period. The adoption of cutting-edge medical technologies and better healthcare services has resulted in an increase in healthcare spending in several Asia-Pacific nations. Due to their high-quality medical facilities and affordable treatments, some Asian nations, including Singapore, Thailand, and India, have become popular medical tourism destinations. This might increase the demand for cutting-edge medical equipment, such as ultrasound needle guides, in the region.

Many regional economies have been making investments to improve their ultrasound and other medical imaging capabilities. This creates possibilities for innovations in technologies and devices that support these advancements. Furthermore, increased R&D expenditure by manufacturers and continued government efforts are significantly contributing to the regional market growth.

Key Companies & Market Share Insights

Key market players are involved in strategic mergers and acquisitions to enhance their ultrasound device portfolios with the application of artificial intelligence, which drives the ultrasound needle guide market. For instance, in February 2023, GE HealthCare announced that it had signed a contract to acquire Caption Health, Inc. Caption Health develops clinical apps to support early illness identification by utilizing AI to assist with the execution of ultrasound scans. Ultrasound investigations can be made simpler and quicker with Caption AI tools, allowing a wider range of healthcare providers to perform simple echocardiography assessments.

With the use of such equipment, patients at hospitals, homes, and other care locations can identify signs of diseases like cardiac failure in at-risk patients, potentially avoiding hospitalizations and promoting better clinical results. By incorporating AI-enabled picture guiding into ultrasound device portfolios, the acquisition boosts GE HealthCare's USD 3 billion ultrasound business. Such advancements are anticipated to boost market growth over the forecast period. Some of the key players in the global ultrasound needle guides market include:

-

CIVCO Medical Solutions

-

BD

-

GEOTEK MEDICAL

-

JingFang Precision Medical Device (Shenzhen) Co., Ltd.

-

Rocket Medical plc

-

GE HealthCare

-

Mermaid Medical

Ultrasound Needle Guides Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 377.8 million

Revenue forecast in 2030

USD 495.0 million

Growth Rate

CAGR of 3.93% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Segments Covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

CIVCO Medical Solutions; BD; GEOTEK MEDICAL; JingFang Precision Medical Device (Shenzhen) Co., Ltd.; Rocket Medical plc; GE HealthCare; Mermaid Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasound Needle Guides Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ultrasound needle guides market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Tissue Biopsy

-

Fluid Aspiration

-

Nerve Block

-

Regional Anesthesia

-

Vascular Access

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ultrasound needle guides market size was estimated at USD 364.3 Million in 2022 and is expected to reach USD 377.8 Million in 2023.

b. The global ultrasound needle guides market is expected to grow at a compound annual growth rate of 3.93% from 2023 to 2030 to reach USD 495 Million by 2030.

b. North America dominated the ultrasound needle guides market with a share of 29.68% in 2022. This is owing to the presence of key manufacturers such as CIVCO Medical Solutions, BD, GEOTEK MEDICAL, GE HealthCare in the region.

b. Some key players operating in the ultrasound needle guides market include CIVCO Medical Solutions, BD, GEOTEK MEDICAL, JingFang Precision Medical Device (Shenzhen) Co., Ltd., Rocket Medical plc, GE HealthCare, Mermaid Medical HQ

b. Key factors driving the ultrasound needle guides market growth include rising interest in minimally invasive surgeries, rising popularity for ultrasound-guided needle placement, enhancements in ultrasound imaging technology, and rising demand for Point-of-care ultrasound systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."