- Home

- »

- Sensors & Controls

- »

-

Ultrasonic Sensors Market Size, Share, Industry Report, 2030GVR Report cover

![Ultrasonic Sensors Market Size, Share & Trends Report]()

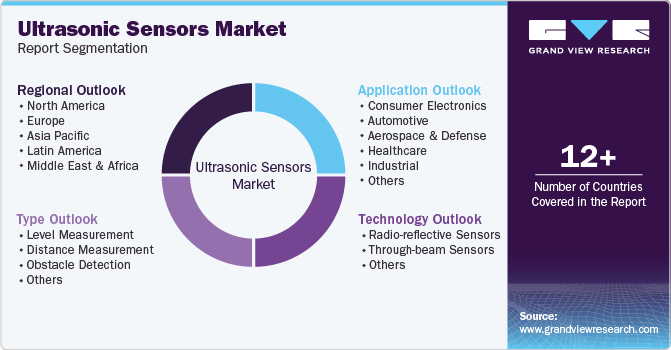

Ultrasonic Sensors Market Size, Share & Trends Analysis Report By Technology (Retro-reflective Sensor, Through-beam Sensor, Others), By Type, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-283-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Ultrasonic Sensors Market Size & Trends

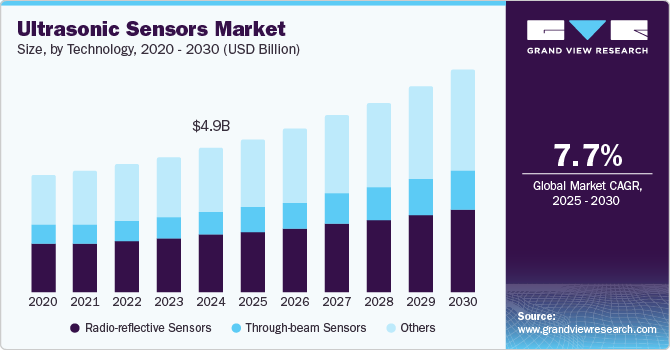

The global ultrasonic sensors market size was valued at USD 4.87 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030.The increasing adoption of ultrasonic sensors across various industries such as automotive and healthcare applications is driving significant market growth. These sensors are essential for functions such as obstacle detection in vehicles and monitoring patient health through non-invasive methods. In addition, the rise of smart manufacturing and automation technologies has led to a higher demand for precise measurement tools, further strengthening market growth.

The ongoing transition toward Industry 4.0 is a major driver as industries increasingly integrate IoT technologies and automation into their operations. This shift necessitates advanced sensor technologies for real-time data collection and monitoring. Furthermore, the rising popularity of autonomous vehicles is anticipated to significantly boost demand for ultrasonic sensors, which are critical for vehicle safety systems such as parking assistance and collision avoidance. The expansion of applications in emerging sectors such as robotics and smart home devices are contributing to the growth.

The increasing adoption of ultrasonic sensors across various industries, such as automotive and healthcare applications, enhances their capabilities. For instance, Ford's Active Park Assist system utilizes ultrasonic sensors located on the vehicle's sides, front, and rear bumpers to identify parking spaces suitable for parallel parking. These sensors continuously scan for available spots, so if a driver activates the system after passing a good parking opportunity, it will notify them of the missed space. Moreover, Innovations such as improved signal processing algorithms and integration with AI technologies lead to more efficient and accurate sensor performance. This evolution creates new applications and streamlines manufacturing processes, making these sensors more accessible to various industries.

Technology Insights

The retro-reflective sensor segment held a significant revenue share of 38.0% in 2024, primarily due to its widespread applications across various industries. These sensors are compact and efficient, making them ideal for integration into devices such as smartphones and automotive systems. Its ability to detect objects with high precision while minimizing installation complexity has made it a preferred choice in manufacturing and automation processes. In addition, the growing trend of smart devices and automation in sectors such as metalworking and life sciences has further solidified their market dominance, as these sensors are essential for tasks such as detecting small items on production lines.

The through-beam sensor segment is projected to grow at the highest CAGR during the forecast period. This anticipated surge can be attributed to their superior detection capabilities and longer range compared to other sensor types. Through-beam sensors operate by having separate emitter and receiver units, allowing for stable operation even in challenging environments. As industries increasingly seek reliable solutions for object detection and automation, the demand for through-beam sensors is expected to rise significantly. This growth is further fueled by advancements in technology that enhance their performance, making them suitable for a broader range of applications across different sectors.

Type Insights

The level measurement segment dominated the market with the highest share in 2024 due to its extensive applications across industries such as water management, food processing, and chemical production. This segment's prominence is attributed to the increasing demand for accurate and reliable liquid level monitoring in tanks and reservoirs, which is essential for operational efficiency and safety. As industries prioritize automation and strive for improved process control, the need for ultrasonic-level sensors has surged, solidifying their leading position in the industry.

The distance measurement segment is expected to grow at the highest CAGR over the forecast period, driven by advancements in technology and increasing automation across multiple industries. The ability of ultrasonic sensors to provide precise distance measurements without physical contact makes them ideal for robotics, automotive systems, and material handling applications. As industries increasingly adopt automated solutions for enhanced efficiency and safety, the demand for distance measurement capabilities will continue to rise. This trend is particularly evident in sectors such as logistics and manufacturing, where accurate distance measurement is crucial for optimizing operations and improving productivity.

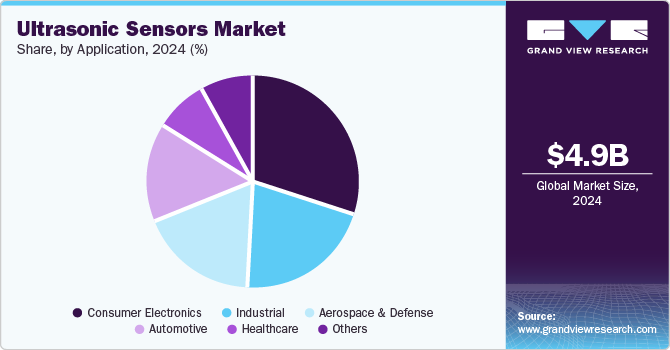

Application Insights

The consumer electronics segment dominated the market with the highest revenue share in 2024. Their applications in smartphones, smart home products, and wearables drive demand, as ultrasonic sensors provide essential functionalities such as proximity detection and gesture recognition. For instance, the Samsung Galaxy S24 Ultra features an ultrasonic fingerprint sensor from Qualcomm, specifically the QFS4008 model, which enhances the device's biometric security. This ultrasonic sensor uses sound waves to accurately recognize fingerprints, providing a reliable alternative to traditional optical sensors. The growing trend of smart technology and automation in consumer electronics has further fueled this segment's growth as manufacturers seek to enhance user experience and device performance.

The industrial segment is expected to grow at the fastest CAGR over the forecast period. This rise can be attributed to the ongoing shift toward automation and smart manufacturing practices across various industries. Ultrasonic sensors are increasingly being utilized for applications such as object detection, level measurement, and quality control, which are essential for optimizing production processes. As industries embrace Industry 4.0 principles and integrate advanced technologies into their operations, the demand for reliable and precise ultrasonic sensors in industrial settings is anticipated to surge, driving substantial market expansion.

Regional Insights

The North America ultrasonic sensors market dominated the global market with a revenue share of 30.0% in 2024, largely due to the region's advanced technological infrastructure and high demand across various industries. The integration of ultrasonic sensors in sectors such as automotive, healthcare, and manufacturing has significantly contributed to this dominance. In particular, the automotive industry utilizes these sensors for applications such as parking assistance and collision detection, driving substantial revenue growth.

U.S. Ultrasonic Sensors Market Trends

The U.S. dominated the regional ultrasonic sensors industry in 2024 and is expected to maintain its dominance over the forecast period. The U.S. market is characterized by significant investments in advanced technologies and automation processes across various sectors, including healthcare and oil and gas. The growing demand for non-contact measurement systems in healthcare, along with the need for enhanced safety features in automotive applications, is propelling market growth. As companies continue to adopt IoT solutions and smart manufacturing techniques, the U.S. is expected to maintain its leadership position in the ultrasonic sensors market throughout the forecast period.

Europe Ultrasonic Sensors Market Trends

In Europe, the ultrasonic sensors industry is witnessing significant growth driven by the increasing adoption of these sensors in various applications across multiple industries. Key sectors such as automotive, healthcare, and industrial automation are integrating ultrasonic sensors for their precise measurement capabilities, particularly in advanced driver assistance systems (ADAS) and process monitoring. In addition, European governments are investing heavily in smart city initiatives, where ultrasonic sensors play a crucial role in applications such as traffic management and waste management. For instance, the city of Barcelona, Spain, has implemented a smart waste management system that features sensors installed in waste bins. These sensors are designed to monitor fill levels and communicate with waste collection trucks, thereby optimizing collection routes based on real-time data.

Asia Pacific Ultrasonic Sensors Market Trends

The Asia Pacific region is expected to witness the highest growth during the forecast period. Countries such as India and Japan are seeing increased investments in manufacturing and robotics, which drive the demand for efficient sensing technologies. China, in particular, is a key player in this market; it boasts the largest industrial robot market globally, with substantial installations that heighten the need for ultrasonic sensors in manufacturing applications.

China stands out as a key player in the ultrasonic sensors industry within the Asia Pacific region, boasting the largest industrial robot market globally. The country's ongoing commitment to advancing its manufacturing capabilities through initiatives such as "Made in China 2025" emphasizes smart manufacturing and technological innovation. With substantial installations of industrial robots that rely heavily on ultrasonic sensors for navigation and obstacle detection, the demand for these sensors is expected to grow significantly.

Key Ultrasonic Sensors Company Insights

The ultrasonic sensors industry is characterized by the presence of several key players that significantly influence its dynamics. Major companies include Balluff Inc. known for its innovative sensor solutions that enhance automation processes. Banner Engineering Corp. specializes in advanced sensing technologies and visual indicators, catering to various industrial applications. SICK AG offers a wide range of sensors, including ultrasonic models, renowned for their reliability and precision. In addition, Pepperl+Fuchs GmbH is recognized for its robust sensor technologies that support automation in diverse sectors, including manufacturing and logistics.

-

Balluff Inc. offers a wide range of sensor solutions designed to enhance automation and operational efficiency in various industries. The company focuses on providing reliable and innovative technologies, including ultrasonic sensors that are widely used for distance measurement and object detection in manufacturing environments. Balluff's commitment to quality and customer satisfaction positions it as a trusted partner for businesses seeking advanced automation solutions.

-

Banner Engineering Corp. specializes in sensor technology and automation solutions, with a strong emphasis on user-friendly designs and advanced functionalities. Banner Engineering provides products that excel in detecting objects and measuring distances in challenging environments in the ultrasonic sensors industry. The company is dedicated to improving safety and productivity across various sectors, leveraging its expertise to deliver high-performance sensing solutions tailored to meet the specific needs of its clients.

Key Ultrasonic Sensors Companies:

The following are the leading companies in the ultrasonic sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Balluff Inc.

- Banner Engineering Corp.

- Baumer

- Hans Turck GmbH & Co. KG

- Ifm Electronic GmbH

- Murata Manufacturing Co., Ltd.

- Pepperl+Fuchs GmbH

- SICK AG

- Siemens AG

- Honeywell International Inc.

Recent Development

-

In September 2024, Baumer launched the UF200 ultrasonic sensor, which is the flattest front-mount ultrasonic sensor available, featuring a detection range of up to 2000 mm and a very short blind range of only 20.5 mm. This innovative design utilizes NexSonic technology, enhancing performance in object detection and distance measurement while providing significant engineering flexibility for various applications.

-

In August 2023, Balluff introduced the BFD ultrasonic position sensor, designed to monitor hydraulic short-stroke cylinders directly for workpiece clamping. This innovative sensor provides real-time information on clamping status and can detect issues such as oil supply problems and contour deviations, enhancing reliability and safety in metalworking applications. Its compact design and flexible integration via standardized interfaces make it a cost-effective solution for modern production demands.

Ultrasonic Sensors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.20 bllion

Revenue forecast in 2030

USD 7.53 billion

Growth Rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia.

Key companies profiled

Balluff Inc.; Banner Engineering Corp.; Baumer; Hans Turck GmbH & Co. KG; Ifm Electronic GmbH; Murata Manufacturing Co., Ltd.; Pepperl+Fuchs GmbH; SICK AG; Siemens AG; Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasonic Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrasonic sensors market report based on technology, type, application, and region.

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Radio-reflective Sensors

-

Through-beam Sensors

-

Others

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Level Measurement

-

Distance Measurement

-

Obstacle Detection

-

Others

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."