- Home

- »

- Medical Devices

- »

-

Ultrasound Transducer Market Size And Share Report, 2030GVR Report cover

![Ultrasound Transducer Market Size, Share & Trends Report]()

Ultrasound Transducer Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Linear, Convex), By Application (Cardiovascular, General Imaging), By End Use (Hospital, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-225-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultrasound Transducer Market Size & Trends

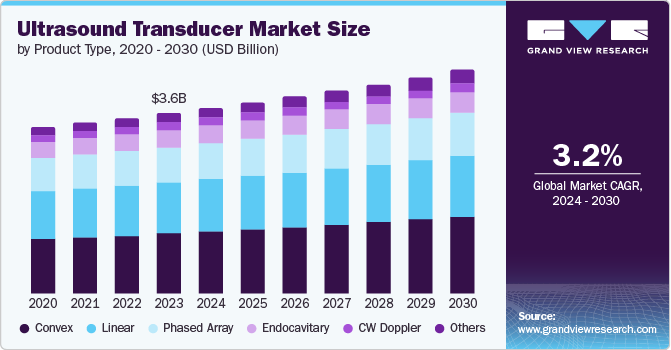

The global ultrasound transducer market size was valued at USD 3.65 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. The market growth is driven by the increasing use of ultrasound transducers in diagnostic imaging and non-invasive procedures, alongside advancements in transducer technology and frequent product launches by key players.

In addition, the rise in ultrasound-assisted surgeries and diagnostics for soft-tissue injuries contributes to this expansion. For instance, in September 2023, GE HealthCare received over USD 44 million from the Bill & Melinda Gates Foundation to develop AI-assisted ultrasound tools. These tools are designed to aid healthcare professionals in improving obstetric and lung scans for maternal, fetal, and pediatric care.

The availability of advanced ultrasound transducers is expected to drive the ultrasound transducer market during the forecast period. For instance, a comparative study published in Springer Nature Limited stated that, in comparison with the standard probes, the high-performance probes were able to generate high-resolution images with increased quality of anatomical aspects in obese patients. The study included 40 individuals (58% female) categorized according to their body mass index.

Technological advancements in ultrasound transducers have enhanced image quality and expanded clinical applications, such as detailed imaging for various medical specialties. These innovations enable more accurate diagnoses and treatments, contributing to the growth of the ultrasound transducer market. The ongoing development of portable and AI-assisted ultrasound devices further broadens their use and accessibility. For instance, in September 2023, Exo Imaging, Inc joined the handheld ultrasound market with the launch of its AI-powered Iris system, following over USD 300 million in funding. Named "echo," the company announced the Iris device, which aims to replace traditional cart-based ultrasound machines with a sleek, portable unit that connects to a smartphone for image display.

Diversified usage of ultrasonic transducers has led to rapid growth of the market. Ultrasonic transducers are also used to provide cardiac care to patients. For instance, in January 2024, Koninklijke Philips N.V. received U.S. FDA 510(k) clearance for a TEE transducer, enhancing patient care and comfort. This cardiac ultrasound tool provides cardiologists with detailed visuals of the heart, aiding in the early identification of structural heart conditions.

Product Type Insights

Convex segment dominated the market and accounted for a share of 33.4% in 2023. Convex scanning transducers, which offer a larger coverage area and clearer images, are in demand for deep tissue imaging. Their growing use in ophthalmic applications is expected to drive market growth. For instance, in early 2021, EagleView Technologies, Inc. launched a wireless portable ultrasound device, enhancing mobility and affordability in point-of-care solutions. The dual-head probe connects to tablets or phones via an iOS and Android app. It includes various transducers, functioning as a linear, convex, and phased array probe.

Others segment is expected to grow at the fastest CAGR of 5.6% over the forecast period. The growth of the segment can be attributed to advancements in imaging technology, particularly for 3D/4D transducers used in obstetrics for detailed fetal visualization. The increased use of Intracardiac Echocardiography (ICE) and Transesophageal Echocardiography (TEE) transducers is spurred by their critical role in cardiac diagnostics and procedures. In addition, Intracavitary and Intravascular Ultrasound (IVUS) transducers are gaining traction for minimally invasive procedures and vascular assessments, offering precise and real-time imaging. For instance, in May 2024, Koninklijke Philips N.V. announced Hong Kong hospitals' adoption of its VeriSight Pro. This device, a real-time 3D Intracardiac Echocardiography (ICE) catheter, aids in performing minimally invasive, image-guided procedures.

Application Insights

The general imaging segment dominated the market and accounted for a share of 33.4% in 2023 due to the increased need for radiation-free and non-invasive diagnostic techniques. Ultrasound is becoming more common in general imaging, as it aids in capturing clear images of soft tissues. The segment is expected to grow rapidly during the forecast period due to the launch of advanced ultrasound technologies for general imaging purposes. For instance, in July 2021, FUJIFILM Sonosite Inc. introduced the Sonosite Voice Assist application, enabling hands-free control of Sonosite PX and LX systems during procedures such as central venous access and nerve blocks. This innovation enhances convenience, precision, and safety by maintaining sterility with simple voice commands.

OB/GYN segment is expected to grow at the fastest CAGR of 4.0% over the forecast period due to the various applications of ultrasound transducers in diagnosing and managing gynecological disorders. The segment is growing rapidly due to the latest advances in ultrasound transducers for obstetrics and gynecology. For instance, in June 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched the Imagyn I9 Ultrasound Machine to meet the specific needs of busy OB/GYN practices. The Imagyn I9 Ultrasound System is the company’s first product designed to fulfill these requirements.

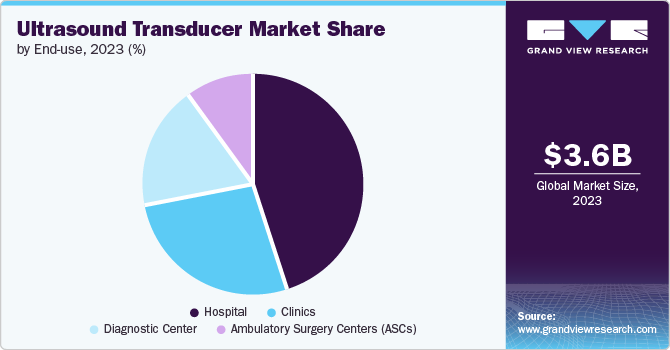

End Use Insights

The hospital segment dominated the market and accounted for a share of 44.4% in 2023. The rising demand for ultrasound transducers is fueled by the widespread adoption of portable ultrasound systems in various medical fields and healthcare expansion in developing regions, alongside a growing number of skilled practitioners and the appreciation of advanced imaging technologies.

The ambulatory surgery centers (ASCs) segment is projected to grow at the fastest CAGR over the forecast period. Ambulatory surgery centers are healthcare facilities that offer cost-effective outpatient surgical services. Their growth is driven by the demand for more convenient and less expensive alternatives to inpatient surgery. For instance, in April 2022, GE HealthCare. and Medtronic collaborated to address the specific requirements and requests for care in Ambulatory Surgery Centers (ASCs) and Office Based Labs (OBLs). The new collaboration is expected to provide clients with a wide range of products, financial services, and excellent customer support.

Regional Insights

North America market dominated the market in 2023. The introduction of innovative wearable ultrasound monitors in the region is expected to drive the market. For instance, a patch-style wearable ultrasound monitor developed by MIT researchers can evaluate internal organs without the need for an ultrasound operator or gel application, as reported in a study by Springer Nature Limited in November 2023. The wearable gadget, created to track bladder and kidney wellness, may be modified to detect cancers in the body earlier.

U.S. Ultrasound Transducer Market Trends

The ultrasound transducer market in the U.S. dominated the market with a share of 78.7% in 2023 due to the high demand for ultrasonic transducers in the country. The U.S. ultrasound transducer market is expected to witness rapid growth during the forecast period due to the recent launches made by the key market players. For instance, in February 2024, Butterfly Network, Inc., released the Butterfly iQ3, an FDA-approved handheld ultrasound system in the U.S. It features the fastest digital data transfer and double the processing power of its predecessor for higher-quality images.

Europe Ultrasound Transducer Market Trends

European ultrasound transducer market is expected to witness lucrative growth during the forecast period owing to the utilization of advanced ultrasound techniques for precision care in the region. For instance, in February 2024, at the European Congress of Radiology 2024, GE HealthCare announced its new LOGIQ Ultrasound System Portfolio, highlighting enhancements in precision care with its advanced LOGIQ Totus model.

The ultrasound transducer market in UK is expected to grow rapidly in the coming years due to a surge in the usage of point-of-care ultrasound by doctors and clinicians across the UK. Over the last decade, physicians globally, including those in the UK, increasingly used point-of-care ultrasound (PoCUS). This technique is vital to some educational programs for medical students and professionals.

Germany ultrasound transducer market held a substantial market share in 2023 owing to high utilization of the ultrasound transducers in the country. Ongoing research on 3D ultrasound in treating neurological diseases and conditions is expected to drive the market. Researchers at the Fraunhofer-Gesellschaft Institute developed a technology that uses ultrasound signals to target and stimulate specific brain regions. A cutting-edge ultrasound system with 256 adjustable transducers allows for precise focus on deep brain areas. This 3D sound technology is anticipated to treat conditions such as epilepsy, Parkinson's disease, depression, and addiction and aid in post-stroke care in the future.

Asia Pacific Ultrasound Transducer Market Trends

Asia Pacific ultrasound transducer market is anticipated to witness significant growth in the ultrasound transducer market. This growth owes to the growing utilization of ultrasound imaging in the region. For instance, research published in January 2020 in the International Journal of Maternal and Child Health and AIDS highlights the growing adoption of affordable ultrasound technology in low- and middle-income countries (LMICs), with significant usage concentrated in Southeast Asia and sub-Saharan Africa.

The ultrasound transducer market in Japan is expected to grow rapidly in the coming years due to utilization of the high-intensity focused ultrasound therapies for cancer treatment. For instance, high-intensity focused ultrasound (HIFU), combined with systemic chemotherapy, promises in treating unresectable pancreatic cancer by reducing tumor size and pain. Unlike radiation, HIFU can be used multiple times and may enhance the effectiveness of new chemotherapy treatments, potentially extending patient survival.

China ultrasound transducer market held a substantial market share in 2023 owing to a surge in the demand for ultrasonic transducers in the country. The market is expected to witness exponential growth during the forecast period due to recent launches made by the key market players. For instance, in July 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. introduced the TE Air Wireless Handheld Ultrasound. This new imaging solution enhances ultrasound availability. Healthcare professionals can effortlessly carry a wide range of scanning capabilities in their pockets with this small, wireless technology, which can be utilized in various clinical situations.

Latin America Ultrasound Transducer Market Trends

Latin America ultrasound transducer market is expected to register exponential growth in the forecast period owing to the rise in the utilization of ultrasound techniques for pregnancy surveillance in the region. For instance, a September 2023 review in the International Journal of Gynecology & Obstetrics revealed the rapid growth of ultrasound technology in obstetrics within low- and middle-income countries based on an analysis of 40 articles and 113,000 participants. This study demonstrates a significant shift towards using obstetric ultrasound as the main approach for pregnancy monitoring, replacing key elements of traditional prenatal care.

Brazil ultrasound transducer market is expected to grow rapidly in the coming years due to the initiatives undertaken by the leading companies in the country. For instance, in July 2024, the Philips Foundation and SAS Brasil partnered to launch an innovation lab to bring digital health education and enhance healthcare for 100 million people in underserved areas of Brazil by 2030. The lab is expected to focus on improving rural healthcare and advancing policy.

Middle East & Africa Ultrasound Transducer Market Insights and Trends

The Middle East and Africa ultrasound transducer market is anticipated to grow significantly over the forecast period due to increasing demand for ultrasonic transducers in the region. The availability of cost-effective ultrasonic transducers in the region is also expected to boost the market's growth during the forecast period.

South Africa ultrasound transducer market is expected to witness exponential growth during the forecast period due to various ultrasound programs launched by leading companies to provide disadvantaged individuals with access to ultrasound technology. For instance, in April 2024, Butterfly Network Inc. collaborated with notable organizations to improve maternal and fetal ultrasound tech. It launched successfully in Kenya in 2022 and plans to extend to South Africa. It provides access to 500 IQ+ systems and training.

Key Ultrasound Transducer Company Insights

Some of the key companies in the ultrasound transducer market include GE HealthCare, Siemens Healthineers AG, Koninklijke Philips N.V., CANON MEDICAL SYSTEMS CORPORATION, Hitachi, Ltd., Samsung Medison Co., Ltd., FUJIFILM Holdings Corporation, Esaote SPA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Analogic Corporation, Carestream Health, and ALPINION MEDICAL SYSTEMS Co., Ltd. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

GE HealthCare Technologies is a prominent company in supplying diagnostic agents to the worldwide radiology and nuclear medicine sector. GE HealthCare Technologies focuses on medical technology, pharmaceutical diagnostics, and digital solutions. The company manufactures, develops, and supplies diagnostic imaging, clinical systems, and products and services for different healthcare technologies, such as imaging agents and IT solutions.

-

Koninklijke Philips N.V. is a technology company that creates and produces medical equipment. The company provides a variety of products and solutions in various areas including diagnostic imaging, enterprise diagnostic informatics, image-guided therapy, ultrasound, monitoring and analytics, sleep and respiratory care, population health management, connected care informatics, and therapeutic care.

Key Ultrasound Transducer Companies:

The following are the leading companies in the ultrasound transducer market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- Hitachi, Ltd.

- Samsung Medison Co., Ltd.

- FUJIFILM Holdings Corporation

- Esaote SPA

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Analogic Corporation

- Carestream Health

- ALPINION MEDICAL SYSTEMS Co., Ltd.

Recent Developments

-

In July 2024, GE HealthCare acquired Intelligent Ultrasound's clinical AI software business for about USD 51 million to improve its ultrasound technology with AI-enhanced image analysis tools, which aims to benefit clinicians and patients.

-

In August 2023, GE HealthCare launched Vscan Air SL, a portable ultrasound device for rapid cardiac and vascular assessments. It features cutting-edge imaging technology to enhance diagnosis and treatment plans.

-

In November 2022, Koninklijke Philips N.V. announced the international release of an advanced compact portable ultrasound solution. Philip’s latest Compact 5000 Series seeks to provide the same diagnostic quality found in high-end cart-based ultrasound machines to a wider range of patients.

Ultrasound Transducer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.75 billion

Revenue forecast in 2030

USD 4.53 billion

Growth Rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product Type, Application, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Hitachi, Ltd.; Samsung Medison Co., Ltd.; FUJIFILM Holdings Corporation; Esaote SPA; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Analogic Corporation; Carestream Health; ALPINION MEDICAL SYSTEMS Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasound Transducer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ultrasound transducer market report based on product type, application, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear

-

Convex

-

Phased array

-

Endocavitary

-

CW Doppler

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

General Imaging

-

Musculoskeletal

-

OB/GYN

-

Vascular

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Clinics

-

Diagnostic Center

-

Ambulatory Surgery Centers (ASCs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.