- Home

- »

- Advanced Interior Materials

- »

-

Ultraviolet Disinfection Equipment Market Size Report, 2033GVR Report cover

![Ultraviolet Disinfection Equipment Market Size, Share & Trends Report]()

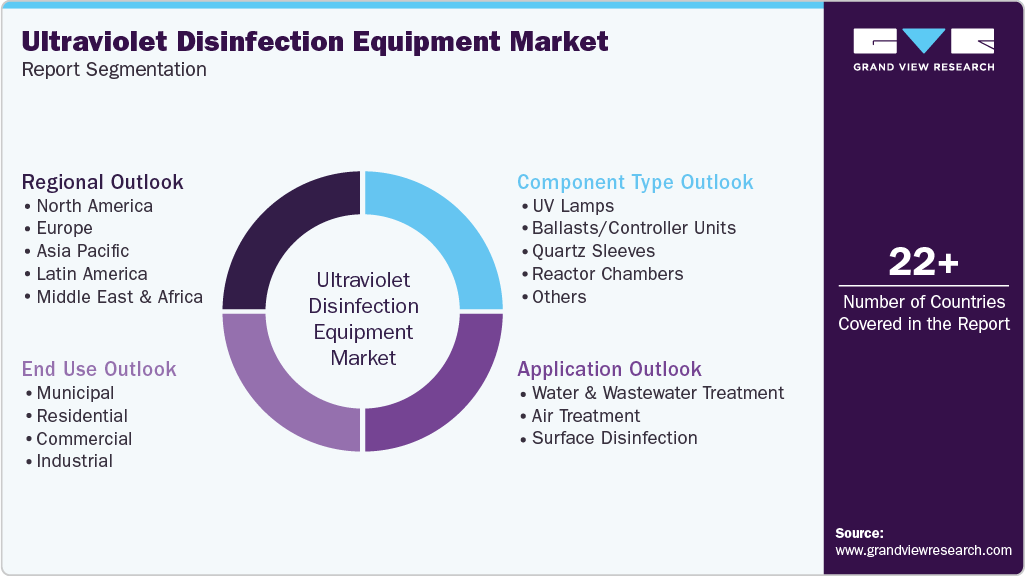

Ultraviolet Disinfection Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Component Type (UV Lamps, Quartz Sleeves), By Application (Water & Wastewater Treatment, Surface Disinfection), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-660-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultraviolet Disinfection Equipment Market Summary

The global ultraviolet disinfection equipment market size was estimated at USD 4,108.4 million in 2024 and is projected to reach USD 7,532.6 million by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The increasing demand for safe and chemical-free disinfection in municipal and industrial water treatment is a key driver of market growth.

Key Market Trends & Insights

- North America dominated the ultraviolet disinfection equipment market with the largest revenue share of 32.1% in 2024.

- The ultraviolet disinfection equipment market in China is expected to grow at a substantial CAGR of 9.4% from 2025 to 2033.

- By component type, the UV lamps segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033.

- By application, the surface disinfection segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033.

- By end use, the commercial segment is expected to grow at a considerable CAGR of 8.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 4,108.4 Million

- 2033 Projected Market Size: USD 7,532.6 Million

- CAGR (2025-2033): 7.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

Growing concerns over waterborne diseases and stringent government regulations are accelerating adoption. Rising healthcare-associated infection (HAI) concerns are boosting demand for UV-based air and surface disinfection in hospitals and labs. Technological advancements have made UV systems more compact, energy-efficient, and cost-effective. The surge in awareness post-COVID-19 has further emphasized the importance of pathogen control. Expanding applications across HVAC systems, food processing, and electronics also fuel the market.

Market Concentration & Characteristics

The global ultraviolet disinfection equipment market is moderately fragmented, with several players competing across various application segments. While a few large firms hold significant market shares, many regional and specialized companies contribute to overall competition. This fragmentation is driven by diverse end use industries such as water treatment, healthcare, and food processing. Technological innovation and customization further encourage the presence of numerous niche players.

The ultraviolet disinfection equipment market exhibits a high degree of innovation, particularly in lamp efficiency, sensor technology, and compact system design. Continuous R&D efforts are focused on enhancing performance, energy savings, and automation. Innovations like LED-based UV systems are gaining traction due to longer life and lower power use. These advancements are expanding UV adoption across non-traditional sectors.

The industry sees a moderate to high level of M&A activity as major players aim to expand portfolios and strengthen geographic presence. Strategic acquisitions help companies access advanced technologies and specialized expertise. Smaller firms with unique innovations often become targets for larger companies. This consolidation trend is shaping competitive dynamics and encouraging market synergies.

Regulations play a significant role in shaping the UV disinfection market, especially in water and air treatment sectors. Strict standards on microbial limits in treated water and indoor air quality are driving UV system adoption. Compliance with safety and performance guidelines, such as those from the EPA or WHO, is essential. Regulatory frameworks also support innovation through funding and certification incentives.

Drivers, Opportunities & Restraints

Rising concerns about waterborne diseases and the need for chemical-free disinfection are major market drivers. Governments worldwide are enforcing strict water and air quality standards. UV disinfection offers a fast, effective, and environmentally friendly solution. Increasing demand from healthcare and municipal sectors further boosts market growth.

Emerging economies offer significant growth potential due to increasing investments in water infrastructure. Advancements in UV LED technology present opportunities for energy-efficient and compact systems. Growing awareness of hygiene and infection control post-COVID-19 is expanding application scope. Integration of UV systems in HVAC and smart building technologies also opens new avenues.

High initial installation and maintenance costs may limit adoption, especially in cost-sensitive regions. Limited effectiveness against particles and turbidity in water can restrict usage. Lack of awareness in underdeveloped areas hampers market penetration. Regulatory approvals and compliance requirements can delay product launches and market entry.

Component Type Insights

The UV lamps component type segment dominated the global ultraviolet disinfection equipment market with a 37.6% revenue share in 2024. This is due to their critical role in pathogen elimination. These lamps are central to system performance, offering reliable and efficient microbial inactivation. Their wide application in water, air, and surface disinfection drives consistent demand. Long operational life and improved energy efficiency further support their dominance.

The quartz sleeve segment is experiencing significant growth due to its essential function in protecting UV lamps from direct contact with water. As system efficiency and lamp longevity depend on sleeve quality, demand is rising. Increasing adoption of advanced UV systems in harsh environments boosts quartz sleeve usage. Enhanced designs offering better thermal resistance and clarity are driving segment expansion.

Application Insights

The water & wastewater treatment application segment led the market with a revenue share of 47.7% in 2024. Water and wastewater treatment remains the dominant application due to rising global demand for clean and safe water. UV systems are widely adopted by municipalities and industries for effective microbial disinfection without harmful chemicals. Strict environmental regulations further drive integration of UV technology into treatment plants. Its proven performance and low environmental impact ensure sustained market leadership.

Surface disinfection is projected to grow at the fastest CAGR over the forecast period, driven by heightened awareness of hygiene in public and healthcare settings. The COVID-19 pandemic significantly increased demand for non-contact, chemical-free sanitization technologies. UV systems are now widely used in hospitals, offices, and public transport for rapid surface sterilization. Innovations like far-UVC and portable devices are accelerating adoption across various industries.

End use Insights

The municipal end use segment led the market with a revenue share of 40.8% in 2024,due to large-scale water and wastewater treatment needs. Governments prioritize UV systems to meet regulatory standards and ensure safe public water supplies. These systems offer reliable, chemical-free disinfection with minimal operational cost. Infrastructure upgrades and rising urbanization continue to drive demand in this segment.

The commercial sector is expected to grow at the fastest CAGR over the forecast period in ultraviolet disinfection equipment market, driven by increasing hygiene demands in offices, retail spaces, hospitality, and transportation. Businesses are investing in UV solutions to ensure safe environments for customers and staff, especially post-COVID. Applications include air and surface disinfection in HVAC systems, restrooms, and high-touch areas. Growing emphasis on health standards and sustainable cleaning methods fuels continued adoption.

Regional Insights

North America ultraviolet disinfection equipment market dominated the global market and accounted for 32.1% revenue share in 2024, due to strong regulatory enforcement and advanced infrastructure. The U.S. and Canada have widespread adoption across municipal, healthcare, and industrial sectors. High awareness of water and air quality standards supports consistent demand. Government funding and technological innovation further solidify the region’s dominant position.

The U.S. leads the North American market due to stringent water and air quality regulations. High adoption in municipal, industrial, and healthcare sectors drives consistent demand. Public health concerns and post-pandemic hygiene awareness boost use in residential and commercial spaces. Government support and innovation further strengthen market growth.

The Canada ultraviolet disinfection equipment market is witnessing steady growth owing to strong environmental policies and public investment in water infrastructure. Municipalities are increasingly adopting UV systems for drinking water and wastewater treatment. The healthcare sector also contributes to the demand for air and surface disinfection solutions. A growing focus on sustainability supports the expansion of UV technologies.

Europe Ultraviolet Disinfection Equipment Market Trends

Europe ultraviolet disinfection equipment market shows steady growth backed by strict environmental standards and a strong focus on sustainability. Adoption is high in municipal and industrial water treatment across countries like Germany, France, and the UK. The region also supports UV use in public infrastructure and healthcare settings. Growing demand for eco-friendly disinfection supports continued market development.

Germany ultraviolet disinfection equipment market leading in Europe, supported by its advanced industrial base in sectors such as pharmaceuticals, food processing, and healthcare. The country’s focus on sustainable water treatment and compliance with strict environmental standards drives UV adoption. Upgrades in municipal water and wastewater treatment systems also contribute to steady growth. Local technological capabilities and regulatory pressure further accelerate market expansion.

The UK ultraviolet disinfection equipment market is witnessing strong growth due to increasing demand in public health, education, and commercial infrastructure. Concerns about hygiene, air quality, and infection control have encouraged the use of UV systems in buildings and transit hubs. Government investments in infrastructure and water safety promote broader implementation. Supportive regulations and early adoption of innovative technologies contribute to market development.

Asia Pacific Ultraviolet Disinfection Equipment Market Trends

Asia Pacific ultraviolet disinfection equipment market is the fastest growing region, driven by rapid urbanization, population growth, and increasing water scarcity. Countries such as China, India, and Japan are heavily investing in water treatment and sanitation infrastructure. Rising industrial activities and growing awareness of health risks accelerate UV technology adoption. Government initiatives and environmental regulations are further propelling market expansion.

China ultraviolet disinfection equipment market is witnessing rapid growth due to expanding urban populations and rising industrial activities. Investments in improving water infrastructure and wastewater management are significantly boosting demand. Increased use of air purifiers and surface disinfection systems, especially after the COVID-19 outbreak, is further supporting adoption. Government initiatives promoting energy-efficient technologies, including UV-C LED systems, are accelerating market expansion.

India ultraviolet disinfection equipment market is growing steadily, supported by government programs aimed at improving water quality and sanitation infrastructure. Projects like Clean Ganga and Smart Cities are encouraging the use of advanced water treatment technologies. Rising public health awareness is driving the adoption of UV systems in both residential and commercial settings. The shift toward eco-friendly, low-maintenance disinfection solutions is also contributing to market growth.

Middle East & Africa Ultraviolet Disinfection Equipment Market Trends

The Middle East and Africa ultraviolet disinfection equipment market is witnessing gradual growth, primarily due to water scarcity and the need for reliable disinfection methods. Desalination plants and water reuse systems are driving UV adoption in countries like Saudi Arabia and the UAE. In Africa, improving healthcare and sanitation is opening up opportunities. However, infrastructural and economic challenges limit faster expansion.

The UAE ultraviolet disinfection equipment market is experiencing strong growth, largely driven by concerns over water scarcity and the need for reliable treatment technologies. Government regulations now promote the use of UV systems in the municipal and healthcare sectors. Expanding industries such as food processing and hospitality are increasing demand for effective disinfection solutions. Technological advancements and a focus on sustainable practices continue to support market expansion.

Latin America Ultraviolet Disinfection Equipment Market Trends

The Latin America ultraviolet disinfection equipment market represents an emerging market with increasing interest in water and sanitation solutions. Economic development and urban population growth are prompting investments in infrastructure. Brazil and Mexico are key contributors to regional demand. However, limited awareness and funding constraints slow broader adoption.

Brazil ultraviolet disinfection equipment market is witnessing strong growth due to rising concerns over water pollution and public health. Industrial activities such as mining, agriculture, and manufacturing generate wastewater that requires effective treatment, boosting demand for UV systems. Recent improvements in sanitation laws and government support are encouraging broader adoption of disinfection technologies. Additionally, increased awareness of hygiene and safety, especially after the pandemic, is driving the use of UV equipment in both public and private sectors.

Key Ultraviolet Disinfection Equipment Company Insights

Some key players operating in the market include Xylem, Trojan Technologies Group ULC, and Halma PLC.

-

Xylem delivers a broad range of solutions across water supply, treatment, and analytics. Its offerings span industrial and municipal pumps, filtration and clarification systems, and UV/ozone disinfection units. The company also provides smart metering, data analytics platforms, and monitoring instruments tailored for water networks. With integrated digital tools and hardware, Xylem supports sectors including utilities, industries, buildings, and agriculture.

-

Trojan Technologies specializes in ultraviolet water treatment systems designed for municipal, industrial, and residential applications. Its product range includes UV disinfection units, advanced oxidation processes, and membrane filtration solutions. The company serves critical sectors like drinking water, wastewater, and ultrapure water for industries such as semiconductors. Trojan emphasizes chemical-free, energy-efficient treatment with installations in numerous global facilities.

Key Ultraviolet Disinfection Equipment Companies:

The following are the leading companies in the ultraviolet disinfection equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Xylem Inc.

- Trojan Technologies Group ULC.

- Halma PLC

- Calgon Carbon Corporation

- Atlantic Ultraviolet Corporation

- Evoqua Water Technologies LLC

- Advanced UV, Inc.

- American Ultraviolet

- Atlantium Technologies Ltd.

- Dr. Hönle AG

- Lumalier Corporation.

- Xenex

- ENAQUA

- S.I.T.A. Srl

- Hitech Ultraviolet Pvt. Ltd

Recent Developments

-

In June 2025, Atlantic Ultraviolet Corporation launched the SaniUV‑Cube, a UV-C disinfection cabinet tailored for commercial, industrial, and institutional use. The unit features high-output UV-C lamps and adjustable quartz shelves to disinfect various items effectively. Built-in safety measures include an interlock switch, a viewing window with UV protection, and a programmable timer. It is designed to inactivate a wide range of pathogens on surfaces, including viruses and bacteria.

-

In May 2023, Xylem completed the acquisition of Evoqua Water Technologies in an all-stock deal. This merger created a global leader in water technology, with combined annual revenue of over $7 billion. The move strengthens Xylem’s ability to address water challenges like scarcity and contamination. Leadership from both companies will guide the integrated operations moving forward.

Ultraviolet Disinfection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,353.4 million

Revenue forecast in 2033

USD 7,532.6 million

Growth rate

CAGR of 7.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component type, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; China; India; Japan; Australia; Brazil; Argentina; UAE; South Africa

Key companies profiled

Xylem Inc.; Trojan Technologies Group ULC.; Halma PLC; Calgon Carbon Corporation; Atlantic Ultraviolet Corporation; Evoqua Water Technologies LLC; Advanced UV, Inc.; American Ultraviolet; Atlantium Technologies LTD.; Dr. Hönle AG; Lumalier Corporation; Xenex; ENAQUA; S.I.T.A. Srl; Hitech Ultraviolet Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultraviolet Disinfection Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ultraviolet disinfection equipment market report based on component type, application, end use, and region.

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

UV Lamps

-

Mercury

-

Low-Pressure

-

Medium-Pressure

-

Amalgam

-

-

Xenon/LED

-

-

Ballasts/Controller Units

-

Quartz Sleeves

-

Reactor Chambers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Water & Wastewater Treatment

-

Air Treatment

-

Residential

-

Healthcare Facilities

-

Retail Shops

-

Offices

-

Hospitality

-

Schools & Educational Institutions

-

Industrial

-

Others

-

-

Surface Disinfection

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Municipal

-

Residential

-

Commercial

-

Industrial

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ultraviolet disinfection equipment market size was estimated at USD 4,108.4 million in 2024 and is expected to be USD 4,353.4 million in 2025.

b. The global ultraviolet disinfection equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 7,532.6 million by 2033.

b. North America region dominated the market in 2024 by accounting for a share of 32.1%. Growing investments in the pharmaceutical, chemical, food & beverage, and automotive sectors of the U.S. and Canada are likely to play a significant role in driving demand for wastewater treatment, and hence UV disinfection equipment, over the projection period.

b. Some of the key players operating in the ultraviolet disinfection equipment market include UV Disinfection Equipment market include: Xylem Inc.; Trojan Technologies; Halma PLC; Kuraray Co., Ltd; Atlantic Ultraviolet Corp.; Evoqua Water Technologies LLC; Advanced UV, Inc.; American Ultraviolet; Atlantium Technologies LTD.; Dr. Hönle AG; Lumalier Corp.; Xenex; ENAQUA; S.I.T.A. Srl; Hitech Ultraviolet Pvt. Ltd

b. Key factors that are driving the UV Disinfection Equipment market growth include the growing healthcare industry, and changing consumer preferences coupled with technological advancement in UV disinfection equipment manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.