- Home

- »

- Next Generation Technologies

- »

-

Urban Air Mobility Market Size, Share & Trends Report, 2030GVR Report cover

![Urban Air Mobility Market Size, Share & Trends Report]()

Urban Air Mobility Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Type, By Maximum Take-off Weight, By Propulsion, By Operation, By Range, By Application, By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-377-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Urban Air Mobility Market Summary

The global urban air mobility market size was estimated at USD 3.58 billion in 2023 and is projected to reach USD 29.19 billion by 2030, growing at a CAGR of 34.2% from 2024 to 2030. The market growth is attributed to the rising need for faster and more efficient transportation amid rapid urbanization and a growing global population.

Key Market Trends & Insights

- North America accounted for largest revenue share of over 40% in 2023.

- U.S. is estimated to witness a significant growth rate of more than 29% from 2024 to 2030.

- By component, the hardware segment accounted for the largest revenue share of nearly 59% in 2023.

- By type, the personal air vehicles segment is expected to record a considerable CAGR from 2024 to 2030.

- By propulsion, the electric segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.58 Billion

- 2030 Projected Market Size: USD 29.19 Billion

- CAGR (2024-2030): 34.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Traffic congestion in urban areas has become a major concern, which makes urban air mobility (UAM) a potential solution that can improve commuting within cities, reduce travel times, and subsequently improve the quality of life for urban residents. Besides, as ride-hailing services have created a demand for flexible and convenient transportation, UAM vehicles can become the next generation of on-demand transportation. These factors are expected to open remunerative growth avenues for the UAM market over the coming years.

The continued technological advancements in mobility solutions are further fueling the growth of UAM market. For instance, the developments in electric propulsion systems and autonomous flight control are making electric vertical take-off and landing (eVTOL) vehicles a viable option for urban air mobility applications. These vehicles are more environmentally friendly, which aligns with the growing consumer preference for sustainable mobility solutions. Moreover, advancements in battery energy density and charging infrastructure are crucial for enabling longer range and shorter charging times for UAM vehicles, which will drive their adoption and commercial viability.

The growth potential of UAM market is attracting several public-private partnerships. For instance, in February 2024, Joby Aero, Inc. signed an agreement with Dubai’s Road and Transport Authority (RTA) to introduce air taxi services in the country by early 2026. The company intends to commence the initial operations as early as 2025. This deal provides exclusive rights to operate air taxis in Dubai for the next six years.

The market growth is being further driven by increasing government investments to enhance air mobility. For instance, in February 2024, Vertical Aerospace received USD 10 million in funding from the U.K. Government, as a part of the Aerospace Technology Institute (ATI) Program, to deliver next-generation propellers to be used in its VX4 aircraft. This initiative is aimed at strengthening the country’s position in the global market of urban air mobility, which aims to transform the way people travel around and between cities, providing a green and low noise means of transport.

Market Concentration & Characteristics

The urban air mobility market is characterized by a high degree of innovation, driven by the need to offer efficient and sustainable alternatives to traditional urban transportation methods. This push is fueled by increasing urban congestion and the demand for quicker, cleaner commuting options.

Regulation plays a crucial role in shaping the urban air mobility market. Stringent safety and operational standards offer regulated protocols for manufacturers around the globe. Supportive regulatory frameworks can accelerate market acceptance and expansion by ensuring safety and reliability.

The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The presence of product substitutes, such as conventional helicopters and emerging urban air mobility solutions, could either pose competitive challenges or compel eVTOL aircraft to innovate further, impacting their market share and growth trajectory.

The urban air mobility market heavily relies on a concentrated group of end users, primarily consisting of city residents and businesses seeking efficient urban transportation solutions, which can influence market dynamics and demand.

Component Insights

The hardware segment accounted for the largest revenue share of nearly 59% in 2023. This can be attributed to the increasing significance of hardware components such as airframes, avionics, engines, propulsion systems, etc., coupled with the ongoing advancements and innovation in them. Moreover, adoption of sustainable technologies such as light-weight and high strength materials, advanced battery technology, electric and hybrid propulsion is further driving the segmental growth.

The software segment is expected to record the highest CAGR of around 36% from 2024 to 2030 owing to the critical role of these solutions in facilitating efficient, safe, and autonomous operation of UAM vehicles. The software solutions form an integral part of the flight control systems, air-traffic management, vehicle health monitoring, fleet management systems, and advanced piloting features, which is instigating their demand and creating lucrative opportunities for the segment.

Type Insights

The air taxis segment accounted for the largest revenue share in 2023. Air taxis offer the potential for significantly faster journeys, especially for short-distance travel within cities, by bypassing the traffic altogether. Unlike the conventional modes of transport that follow fixed routes, these taxis provide point-to-point travel, eliminating detours and potentially reducing the overall travel time. The advantages offered by these vehicles are contributing to segmental growth. Moreover, developments in electric vertical takeoff and landing aircraft are making UAM a realistic and potentially affordable means of transport, which is expected to enhance the segment outlook over the coming years.

The personal air vehicles segment is expected to record a considerable CAGR from 2024 to 2030. The segment growth is ascribed to the increasing potential for the adoption of personal air vehicles in the foreseeable future, driven by the ongoing technological advancements in aviation and shifting public perception. Moreover, the supportive government initiatives and favorable regulatory scenarios across various countries, coupled with increasing consumer demand, are expected to make UAM vehicles a mainstream mode of transportation, thereby driving segmental growth.

Maximum Take-off Weight Insights

The >300 Kg segment accounted for the largest revenue share in 2023. These UAM vehicles offer potential benefits in terms of increased capacity, versatility, and range required for applications beyond the urban air taxis. For instance, these vehicles could transport more passengers per trip (4-6 or even more) as compared to smaller air taxis, thereby improving the overall efficiency and potentially reducing the costs per passenger. Besides, these vehicles can transport larger and heavier cargo within cities, which could be beneficial for logistics and e-commerce companies. Such advantages associated with these vehicles underline the large revenue share of the segment.

The <100 Kg segment is expected to record the fastest CAGR from 2024 to 2030 as their compact size, potentially lower costs, better efficiency, and lower noise pollution is expected to stimulate their adoption in urban environments. These UAM vehicles are well suited for the urban air taxi concept, designed to transport 1-2 passengers per trip. Their compact size makes them suitable for short-distance commutes within cities and they also require less space for landing pads and vertiports. This can facilitate faster and wider deployment compared to larger UAM vehicles, thereby propelling the segmental growth over the coming years.

Propulsion Insights

The electric segment accounted for the largest revenue share in 2023 with the growing preference for sustainable solutions. In this regard, electric UAMs powered by batteries produce zero operational emissions unlike conventional gasoline or jet-fueled aircraft. This can significantly contribute to the reduction in air pollution within cities. Moreover, electric motors are generally less noisy, which mitigates noise pollution associated with transportation, enhancing the quality of life in urban environments. For instance, the eVTOL technology is specifically designed for electric UAM vehicles.

The hybrid segment is expected to record a notable CAGR from 2024 to 2030. Hybrid UAM vehicles combine an electric motor with an internal combustion engine or another fuel source. This can extend their operational range as compared to the purely electric vehicles, which are limited by battery capacity. This could be beneficial for applications requiring longer commutes or operations in areas with limited charging infrastructure. Besides, these vehicles might offer faster refueling times compared to electric vehicles that rely solely on battery charging. The advantages offered by these vehicles are expected to drive the segmental growth over the coming years.

Operation Insights

The remotely piloted segment accounted for a significant revenue share in 2023 owing to increasing urbanization and the subsequent rise in the demand for efficient and reliable intra-city transportation solutions. Technological advancements in control systems and avionics are increasing safety and reliability, which make remotely piloted UAM vehicles more viable. Moreover, the increasing focus of regulatory authorities on establishing frameworks to integrate remotely piloted UAM vehicles into the existing airspaces and substantial investments by the governments in this segment are accelerating its expansion.

The fully autonomous segment is expected to record the fastest CAGR across the urban mobility market from 2024 to 2030. The growth is credited to the technological advancements involving artificial intelligence and machine learning, which further improves the precision and safety of autonomous systems. In addition, increasing investments from public and private sectors in smart city initiatives and urban air mobility are favoring this growth. Moreover, regulatory support and pilot programs for autonomous flights are also driving the segment growth.

Range Insights

The intracity segment accounted for largest market share in 2023 on account of the increasing need for faster and efficient transportation solutions driven by growing congestion in urban areas. Besides, advancements in battery technology and autonomous flight systems are enhancing the feasibility and safety of urban air mobility operations. These factors are contributing to the rapid expansion of the intracity urban air mobility segment, promising a transformative impact on segmental growth

The Intercity segment is expected to witness the highest CAGR from 2024 to 2030 The intercity segment of the UAM market is experiencing significant growth on account of the advancements in battery technology and autonomous flight systems to increase the range and safety. Increased urbanization and congestion in metropolitan areas are creating demand for faster, more efficient travel solutions over longer distances. In addition, growing investments from both private and public sectors in infrastructure and regulatory frameworks are expediting the segmental growth.

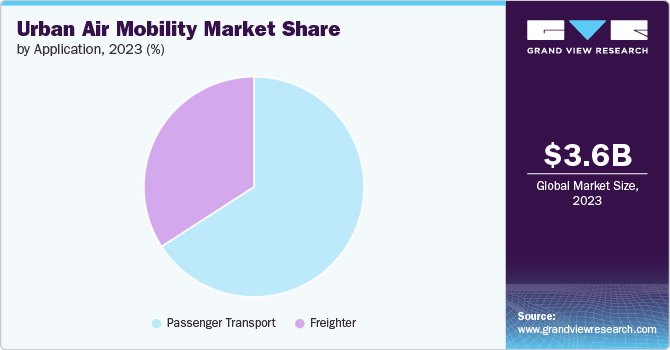

Application Insights

The passenger transport segment accounted for a significant revenue share in 2023. As traffic congestion in major cities increases, UAM vehicles can potentially offer a faster and more efficient way to travel. In this regard, passenger UAMs offer newer alternatives for transportation, especially in densely populated or geographically challenged areas. In addition, technological advancements such as features for autonomous flight operations will create significant market demand in the future. Moreover, the establishment of stringent safety standards and regulations, coupled with the development of required infrastructure for these vehicles can drive the segmental growth further.

The freighter segment is anticipated to record the highest CAGR from 2024 to 2030 owing to the potential advantages of UAM vehicles for bypassing traffic congestion and delivering goods directly between points, reducing delivery times compared to ground transportation, especially in urban areas. Moreover, they can reach remote or hard-to-access areas, which can be beneficial for delivering medical supplies, disaster relief aid, or critical equipment to remote locations. In addition, the use of these vehicles for just-in-time deliveries can reduce the need for businesses to maintain large warehouses or inventories, which offers significant growth potential for the segment.

Product Insights

The rotary blade segment accounted for the largest revenue share in 2023. Rotary blades, such as those on helicopters, offer vertical take-off and landing capabilities, a critical feature for urban air mobility vehicles that are required to land and take off in urban environments without the need for long runways. Besides, rotary blade designs can provide relatively better maneuverability to the UAM vehicles as compared to the fixed-wing counterparts. This could be valuable for navigating dense urban environments with obstacles. Such advantages associated with this product are expected to create ample growth opportunities for the segment in the coming years.

The hybrid segment is expected to record the highest CAGR from 2024 to 2030. The sizeable revenue share of the segment is credited to the increasing preference for the product driven by numerous advantages. Hybrid UAM vehicles can carry a variety of payloads, which stimulates their demand for heavy-lift and long-endurance applications such as cargo delivery, passenger commute, business travels, etc. UAMs with a high payload capacity can carry more goods within a city, ideal for businesses such as logistics companies or medical supply delivery services.

End Use Insights

The private operators segment accounted for significant revenue share in 2023 owing to high usability of UAM vehicles for businesses as they significantly reduce travel times for employees, especially for those traveling between worksites, offices, or meetings across a city. Besides, these vehicles could be used for efficient and rapid delivery of goods within cities, ideal for urgent deliveries. This offers remunerative opportunities for the segment by improving logistics efficiency and potentially reducing the dependency on conventional ground transportation. For businesses with geographically dispersed operations, UAMs could facilitate faster and more frequent on-site visits for maintenance, inspections, or client meetings.

The commercial ridesharing operators is expected to record the highest CAGR from 2024 to 2030 owing to the advantages associated with UAM vehicles in this segment. One of the biggest advantages is the ability to bypass traffic congestion, which is a significant pain point for several major cities. In this regard, urban air mobility ridesharing can reduce travel times significantly, especially for intra-city commutes. Moreover, these vehicles offer the potential to reach areas not easily accessible by car, which can be beneficial for geographically challenged areas or those with limited sources of public transportation.

Regional Insights

The urban air mobility market in North America accounted for largest revenue share of over 40% in 2023 on account of increasing inclination toward technological innovation and a significant push towards managing the rising urban congestion through sustainable solutions. Moreover, increasing investments in public as well as private sectors aimed at the development of the required infrastructure for urban air mobility is positively influencing the regional market.

U.S. Urban Air Mobility Market Trends

The U.S. urban air mobility market is estimated to witness a significant growth rate of more than 29% from 2024 to 2030 on account of the thriving aviation industry and rigorous development of air mobility solutions backed by major companies such as Boeing, Delta Air Lines, Inc., StellSTELLANTIS N.V., Toyota Motor Corporation, and United Airlines, Inc.

Asia Pacific Urban Air Mobility Market Trends

The urban air mobility market in Asia Pacific is expected to record its highest growth rate of 36% from 2024 to 2030 owing to increasing government initiatives, such as investments, collaborations, and partnerships, to develop the required infrastructure for the development as well as operation of UAM solutions. Moreover, the expansion of various renowned urban air mobility solutions providers in the region that bring their technological expertise and state-of-the-art facilities is further enhancing the overall market outlook.

India Urban Air Mobility Market

The urban air mobility market in India is estimated to record a notable growth rate from 2024 to 2030 as the country offers significant potential for the adoption of air transport solutions as it faces significant challenges pertaining to traffic congestion and crowded cities.

China Urban Air Mobility Market

The urban air mobility market in China accounted for a significant revenue share in 2023 owing to favorable aviation policies by the government supporting the development of urban air transport infrastructure.

Japan Urban Air Mobility Market

Urban air mobility market in Japan is expected to witness a notable CAGR from 2024 to 2030 owing to the expansion of several major market players in the country and establishment of state-of-the-art facilities by them in the country.

Europe Urban Air Mobility Market Trends

The urban air mobility market in Europe accounted for a notable revenue share of in 2023 and is expected to witness a notable growth over the coming years. This growth is attributed to the presence of several urban air mobility solutions providers, such Lilium GmbH and Volocopter GmbH. Moreover, the ongoing progress in electric vertical takeoff and landing (eVTOL) aircraft technology in the region is making UAM a more realistic transportation mode, which is expected to drive the market growth over the coming years.

U.K. Urban Air Mobility Market

The urban air mobility market in U.K. is expected to witness a significant growth over the coming years with supportive government initiatives, such as allocation of funds for research & development and infrastructure development, which is attracting UAM industry players in the country.

Germany Urban Air Mobility Market

Urban air mobility market in Germany is estimated to record a notable CAGR from 2024 to 2030. The growth is attributed to increasing investment in air mobility solutions systems and rising demand for faster intracity transportation modes in the country.

Middle East and Africa (MEA) Urban Air Mobility Market Trends

The urban air mobility market in the Middle East and Africa (MEA) region is estimated to record a considerable CAGR from 2024 to 2030.Governments in the region, particularly Saudi Arabia and the United Arab Emirates (UAE), are actively supporting the development of UAM infrastructure, which is significantly contributing to the regional market growth. Besides, the growing significance of rapid and efficient delivery of goods within cities, particularly for time-sensitive items, coupled with the ongoing expansion of e-commerce in the region is expected to drive the market growth over the coming years.

Saudi Arabia Urban Air Mobility Market

Urban air mobility market in Saudi Arabia accounted for a considerable revenue share in 2023 owing to increasing government investment into the development of infrastructure of air taxis that can serve as a regional mode of transportation.

Key Urban Air Mobility Company Insights

Some of the key players operating in the market include Guangzhou EHang Intelligent Technology Co. Ltd., Airbus, Lilium GmbH, Joby Aero, Inc., and Embraer Group among others.

-

Lilium GmbH is engaged in the development of accessible and sustainable modes of high-speed regional transportation. The company works with technology, aerospace, and infrastructure companies across U.S., Brazil, China, UAE, Saudi Arabia, U.K., and other European countries, to deliver high-end aircrafts.

-

Guangzhou EHang Intelligent Technology Co. Ltd. is engaged in the development of safe, autonomous, and environmentally friendly air mobility solutions. The company delivers unmanned aerial vehicle systems, air mobility (passenger transportation and logistics), aerial media solutions, and smart city management solutions.

-

Joby Aero, Inc. is a U.S. based transportation firm that develops all-electric, vertical take-off and landing air taxis, which the company aims to operate as a fast, convenient, and quiet service in cities across the globe. It has formed strategic partnerships with Toyota Motor Corporation, Uber Technologies, Inc., etc., to strengthen its position in aerial ridesharing domain.

The AIRO Group, Inc., Wingcopter GmbH, and BETA Technologies, Inc. are some of the emerging market participants in the urban air mobility market.

-

The AIRO Group, Inc., is an air mobility, autonomy, and aerospace platform provider with differentiated capabilities and technologies addressing market trends across the drone ecosystem. It offers a wide range of drone technologies and services, and defense training.

-

Wingcopter GmbH manufactures unmanned, all-electric delivery drones and provides drone delivery services with expertise in medical supply chains and logistics of urgent goods. The company has several investors including REWE Group, Salvia, XAI technologies, Xplorer Capital, and Futury Capital among others.

-

Beta Technologies, Inc. produces electric vertical takeoff and landing (eVTOL) aircraft and recharging pad systems. The company aims to expand beyond the military to deliver its eVTOL to be used by passenger-carrying operators and cargo carriers. It has electrification collaborations with U.S. FBOs Atlantic Aviation and Shoreline Aviation that offer charging stations for eVTOL and eCTOL service.

Key Urban Air Mobility Companies:

The following are the leading companies in the urban air mobility market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus

- Lilium GmbH

- Guangzhou EHang Intelligent Technology Co. Ltd

- Eve Holding, Inc.

- Vertical Aerospace

- Textron Inc.

- Joby Aero, Inc.

- Embraer Group

- Hyundai Motor Company

- Archer Aviation Inc.

- The AIRO Group, Inc.

- Wingcopter GmbH

- BETA Technologies, Inc.

- Volocopter GmbH

- Uber Technologies, Inc.

- Safran Group

Recent Developments

-

In June 2024, Lilium GmbH collaborated with Bao’an District in China with an aim to establish itself as an active and contributing industry player with the support of local infrastructure partners, customers, and regulatory authorities. The district offers extensive regional knowledge required to build the foundation for high-end eVTOL operations in the Greater Bay Area. The company intends to expand across the country and the Asia-Pacific region in the future.

-

In June 2024, Guangzhou EHang Intelligent Technology Co. Ltd. announced the first autonomous air taxi flight of EH216-S, its pilotless electric vertical takeoff and landing (eVTOL) aircraft in Mecca, Saudi Arabia. The company has partnered with Front End Limited Company, a domestic advanced solutions provider for various industries, implying transformative potential of pilotless eVTOL aircraft for the regional transportation system.

-

In April 2024, Joby Aero, Inc. signed a Memorandum of Understanding (MoU) with the Abu Dhabi Department of Economic Development (DED), the Department of Municipalities and Transport - Abu Dhabi (DMT), and the Department of Culture and Tourism - Abu Dhabi (DCT Abu Dhabi) with an aim to establish air taxi services in Abu Dhabi.

Urban Air Mobility Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.99 Billion

Revenue forecast in 2030

USD 29.19 Billion

Growth rate

CAGR of 34.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, maximum take-off weight, propulsion, operation, range, application, product, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Airbus; Lilium GmbH; Guangzhou EHang Intelligent; Technology Co. Ltd.; Eve Holding, Inc.; Vertical Aerospace; Textron Inc.; Joby Aero, Inc.; Embraer Group; Hyundai Motor Company; Archer Aviation Inc.; The AIRO Group, Inc.; Wingcopter GmbH; BETA Technologies, Inc.; Volocopter GmbH; Uber Technologies, Inc.; and Safran Group Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Urban Air Mobility Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global urban air mobility market report based on component, type, maximum take-off weight, propulsion, operation, range, application, product, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Aerostructure

-

Avionics

-

Flight Control System

-

Propulsion System

-

Others

-

Software

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Taxis

-

Air Metros & Air Shuttles

-

Personal Air Vehicles

-

Cargo Air Vehicles

-

Air Ambulances & Medical Emergency Vehicles

-

Last-Mile Delivery Vehicles

-

-

Maximum Take-off Weight Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 Kg

-

100 – 300 Kg

-

>300 Kg

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Electric

-

Hybrid

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Fully Autonomous

-

Hybrid

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Intracity (Below 100 km)

-

Intercity (Above 100 km)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Transport

-

Freighter

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Wing

-

Rotary Blade

-

Hybrid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

E-Commerce

-

Commercial Ridesharing Operators

-

Private Operators

-

Medical Emergency Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global urban air mobility market size was estimated at USD 3.58 billion in 2023 and is expected to reach USD 4.99 billion in 2024.

b. The global urban air mobility market is expected to grow at a compound annual growth rate of 34.2% from 2024 to 2030 to reach USD 29.19 billion by 2030.

b. The North America region dominated the industry with a revenue share of 40.5% in 2023. This can be attributed to increasing inclination toward technological innovation and managing the rising urban congestion through sustainable solutions.

b. Some key players operating in urban air mobility market include Airbus, Lilium GmbH, Guangzhou EHang Intelligent Technology Co. Ltd, Eve Holding, Inc., Vertical Aerospace, Textron Inc., Joby Aero, Inc., Embraer Group, Hyundai Motor Company, Archer Aviation Inc., The AIRO Group, Inc., Wingcopter GmbH, BETA Technologies, Inc., Volocopter GmbH, Uber Technologies, Inc., and Safran Group

b. Key factors that are driving urban air mobility (UAM) market growth include rising demand for faster and efficient modes of transportation, increasing need to address traffic congestions amid growing urbanization, favorable government initiatives, and continued technological advancements in mobility solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.