- Home

- »

- Next Generation Technologies

- »

-

Urban Planning Software And Services Market Report, 2030GVR Report cover

![Urban Planning Software And Services Market Size, Share & Trends Report]()

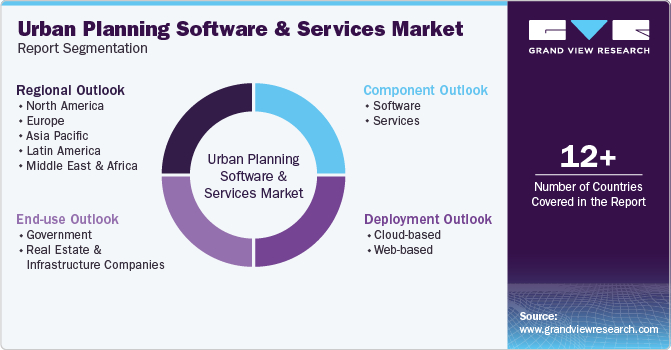

Urban Planning Software And Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By End Use (Government, Real Estate And Infrastructure Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-559-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Urban Planning Software And Services Market Summary

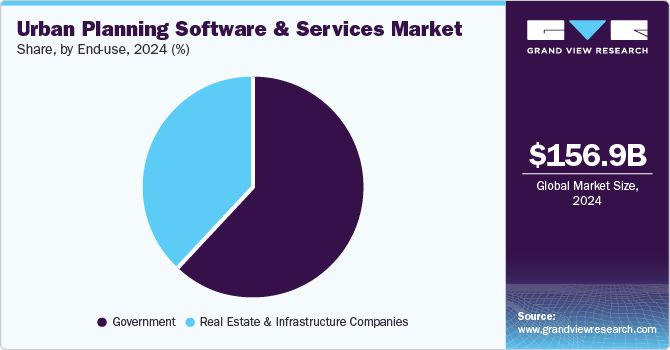

The global urban planning software and services market size was estimated at USD 156.89 billion in 2024 and is projected to reach USD 226.25 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. Rising urbanization is a primary driver, as more people migrate to cities, necessitating efficient planning and management of urban spaces.

Key Market Trends & Insights

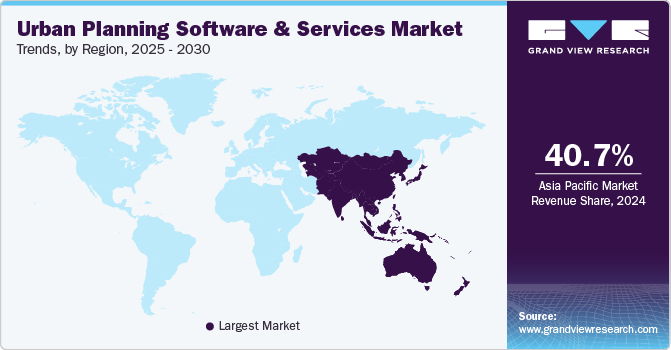

- Asia Pacific urban planning software and services market dominated the global market with a revenue share of 40.7% in 2024

- The U.S. urban planning software and services market dominated the regional market in 2024

- By component, the software segment dominated the market with a share of 73.2% in 2024.

- By deployment, the cloud-based segment dominated the market with the largest revenue share in 2024,

Market Size & Forecast

- 2024 Market Size: USD 156.89 Billion

- 2028 Projected Market Size: USD 226.25 Billion

- CAGR (2025-2030):6.8%

- Asia Pacific: Largest market in 2024

In addition, advancements in technology, particularly in Geographic Information Systems (GIS) and simulation software, have enhanced the ability of urban planners to analyze complex data sets and make informed decisions. The increasing emphasis on sustainable development has led to a greater demand for innovative solutions to address environmental challenges while promoting livable communities.As cities strive to integrate technology into their infrastructure, the demand for advanced software solutions that facilitate real-time data analysis and decision-making is increasing. For instance, San Francisco planners leverage ArcGIS Urban to enhance their urban planning processes. This GIS tool integrates the full planning workflow, allowing for comprehensive analysis and visualization of urban environments. Recently, planners utilized ArcGIS to visualize existing land supply in 3D, enabling them to perform preliminary estimates of capacity for new housing units and jobs. Moreover, the growing focus on data-driven strategies in both the public and private sectors creates opportunities for urban planners to leverage sophisticated tools that enhance project outcomes and community engagement.

The rising demand for collaborative planning tools enhances stakeholder engagement and streamlines communication among various entities involved in urban development. In addition, the increasing importance of regulatory compliance related to urban development and environmental sustainability necessitates robust software solutions that help organizations meet legal requirements efficiently.

Component Insights

The software segment dominated the market with a share of 73.2% in 2024. Urban planners increasingly rely on sophisticated tools for data analysis, scenario modeling, and visualization to navigate the complexities of modern urban environments. According to the United Nations (UN), nearly 68% of the global population is projected to reside in urban areas by 2050, emphasizing the need for robust software solutions. These tools enhance operational efficiency and support sustainable development initiatives by enabling planners to simulate various scenarios and assess their potential impacts on communities and the environment.

The services segment is projected to grow at the highest CAGR during the forecast period, driven by an increasing demand for specialized consulting and implementation services. As urban challenges become more complex, municipalities and developers seek expert guidance to navigate regulatory frameworks and community engagement processes effectively. For instance, in 2024, AECOM announced that it had been awarded a contract to support the Los Angeles County Metropolitan Transportation Authority (Metro) transition to Zero Emission Buses (ZEB). This initiative aims to significantly reduce greenhouse gas emissions and improve air quality in Los Angeles County. This trend is particularly evident in smart city projects requiring tailored strategies to integrate technology into urban infrastructure. The growing emphasis on sustainability also necessitates advisory services that help organizations align their projects with environmental goals.

Deployment Insights

The cloud-based segment dominated the market with the largest revenue share in 2024, reflecting a significant shift toward flexible and scalable solutions within the urban planning software and services industry. Cloud computing offers numerous advantages, such as improved accessibility, cost-effectiveness, and enhanced stakeholder collaboration. As organizations increasingly adopt cloud-based platforms, they benefit from real-time data access and integration capabilities that facilitate more efficient urban management practices. For instance, CITYPLAIN is a cloud-based urban planning AI tool developed to tackle the challenge of affordable housing amid urban expansion. This platform streamlines the urban planning process by enabling users to compare various design scenarios and facilitate stakeholder collaborative decision-making.

The web-based segment is projected to grow at a significant CAGR during the forecast period, fueled by a rising preference for online tools that promote collaboration and data sharing among stakeholders. Web-based solutions allow urban planners to engage with diverse stakeholders in real-time, fostering greater community involvement in the planning process. This capability is crucial as cities strive to incorporate public input into their development strategies. Furthermore, as technology evolves, web-based platforms become increasingly sophisticated, offering features such as interactive mapping and visualization tools that enhance user experience and facilitate informed decision-making.

End Use Insights

The government segment dominated the market with the largest revenue share in 2024, owing to public sector entities' pivotal role in shaping urban planning initiatives. Government agencies are responsible for establishing regulations, zoning laws, and development guidelines that dictate land use and infrastructure development. Their investment in urban planning software and services reflects a commitment to enhancing public infrastructure while addressing pressing challenges such as climate change and population growth. In addition, as governments increasingly adopt innovative technologies such as GIS and predictive analytics, they are better equipped to make data-driven decisions that promote sustainable urban development.

The real estate and infrastructure companies segment is expected to grow at the highest CAGR over the forecast period due to a surge in construction projects and urban redevelopment initiatives. These companies rely heavily on advanced planning tools to streamline workflows, assess project feasibility, and ensure compliance with regulatory requirements. The increasing demand for housing and commercial spaces in rapidly growing urban areas necessitates efficient project execution supported by sophisticated software solutions. Furthermore, as these companies seek to enhance their competitive edge in a crowded market, investing in cutting-edge technology becomes essential for optimizing operations and meeting evolving consumer expectations within the urban planning software and services industry.

Regional Insights

North America urban planning software and services market is expected to grow at a significant CAGR from 2025 to 2030, driven by increasing urbanization and the need for smart city solutions. As cities face challenges related to population growth and infrastructure demands, there is a rising demand for innovative software solutions to streamline planning processes and enhance decision-making. The integration of advanced technologies such as artificial intelligence and data analytics into urban planning tools further supports this growth, enabling planners to develop more sustainable and efficient urban environments.

U.S. Urban Planning Software And Services Market Trends

The U.S. urban planning software and services market dominated the regional market in 2024, reflecting its advanced technological infrastructure and significant investment in urban development initiatives. The country's focus on modernizing its infrastructure and implementing smart city projects has created a robust demand for urban planning software solutions. With major cities, including New York and Los Angeles, leading the way in adopting cutting-edge technologies, the U.S. remains at the forefront of the urban planning software and services industry, setting benchmarks for other regions to follow.

Europe Urban Planning Software And Services Market Trends

Europe urban planning software and services market is expected to grow at a significant CAGR from 2025 to 2030, driven by increasing regulatory requirements for sustainable development and environmental protection. European countries are prioritizing green initiatives and smart city frameworks that require advanced planning tools to ensure compliance with stringent regulations. The emphasis on collaborative decision-making among stakeholders further enhances the demand for integrated software solutions within the urban planning software and services industry, fostering innovation in urban design and management practices.

Asia Pacific Urban Planning Software And Services Market Trends

Asia Pacific urban planning software and services market dominated the global market with a revenue share of 40.7% in 2024, owing to the region's rapid urbanization and economic growth. Countries such as India and China are experiencing unprecedented population growth in urban areas, necessitating effective planning tools to manage resources efficiently. The increasing focus on sustainable development and smart city initiatives in this region drives demand for advanced software solutions that can address complex urban challenges while improving the quality of life for residents.

China urban planning software and services market dominated the Asia Pacific region in 2024, reflecting its robust infrastructure development initiatives and commitment to sustainable urbanization. The Chinese government has made substantial investments in smart city projects that utilize advanced planning tools to enhance land use efficiency, optimize transportation systems, and improve environmental management. This emphasis on technology-driven solutions positions China as a significant player in the urban planning software and services industry, shaping trends and practices throughout the Asia Pacific region.

Key Urban Planning Software And Services Company Insights

The urban planning software and services market features several key players who shape its landscape. AECOM offers urban analytics and sustainable infrastructure solutions, while Autodesk Inc. provides design software with generative design tools for efficient planning. Bentley Systems, Incorporated specializes in infrastructure engineering software for managing complex urban projects, and Esri is known for its GIS technology that enables planners to visualize spatial data for informed decision-making. These companies significantly influence the evolution of urban planning through their technological advancements.

-

AECOM is an infrastructure consulting firm that provides a wide range of services, including engineering, architecture, and project management. The company delivers innovative solutions across various sectors, such as transportation, water, and environmental management. AECOM partners with public and private clients to tackle complex challenges and improve community infrastructure, emphasizing sustainability and resilience in its projects.

-

Esri provides Geographic Information System (GIS) software and technology, specializing in spatial data analysis and mapping solutions. The company’s flagship product, ArcGIS, enables users to visualize and analyze geographic data to inform decision-making across various industries, including urban planning, environmental management, and transportation. Esri's tools facilitate stakeholder collaboration by providing intuitive mapping capabilities that enhance the understanding of spatial relationships.

Key Urban Planning Software And Services Companies:

The following are the leading companies in the urban planning software and services market. These companies collectively hold the largest market share and dictate industry trends.

- AECOM

- Autodesk Inc.

- Bentley systems, incorporated

- Boston Consulting Group

- Esri.

- CityCAD Technologies Limited

- Trimble Inc.

- Savannah Simulations

- Stantec

- UrbanFootprint, Inc.

Recent Development

-

In November 2024, IBM and Sustainable Energy for All (SEforALL) launched AI-powered tools to foster sustainable urban development globally. These tools are part of the IBM Sustainability Accelerator program, which assists policymakers in mapping urban growth and identifying energy and infrastructure requirements in developing regions. The Open Building Insights (OBI) platform consolidates detailed building data to support energy planners, while the Modeling Urban Growth (MUG) tool forecasts future urban expansion by analyzing historical satellite data.

-

In October 2024, Bentley Systems, Incorporated announced a partnership with Google to incorporate Google's high-quality geospatial content into Bentley's digital twin platform and infrastructure engineering software. This collaboration seeks to enhance infrastructure design, construction, and operation by combining engineering data from Bentley with Google's geospatial data, artificial intelligence, and cloud technologies. Bentley software users can utilize Google Maps Platform's geospatial resources, including Photorealistic 3D Tiles, to gain real-world context and immersive experiences in their digital workflows.

Urban Planning Software And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 162.97 billion

Revenue forecast in 2030

USD 226.25 billion

Growth Rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

AECOM; Autodesk Inc.; Bentley Systems, incorporated; Boston Consulting Group; Esri.; CityCAD Technologies Limited; Trimble Inc.; Savannah Simulations; Stantec; UrbanFootprint, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urban Planning Software And Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global urban planning software and services market report based on component, deployment, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud-based

-

Web-based

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government

-

Real Estate and Infrastructure Companies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.