- Home

- »

- Medical Devices

- »

-

Urolithiasis Management Devices Market Size Report, 2030GVR Report cover

![Urolithiasis Management Devices Market Size, Share & Trends Report]()

Urolithiasis Management Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment Type (Intracorporeal Lithotripsy, Percutaneous Nephrolithotomy), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-152-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

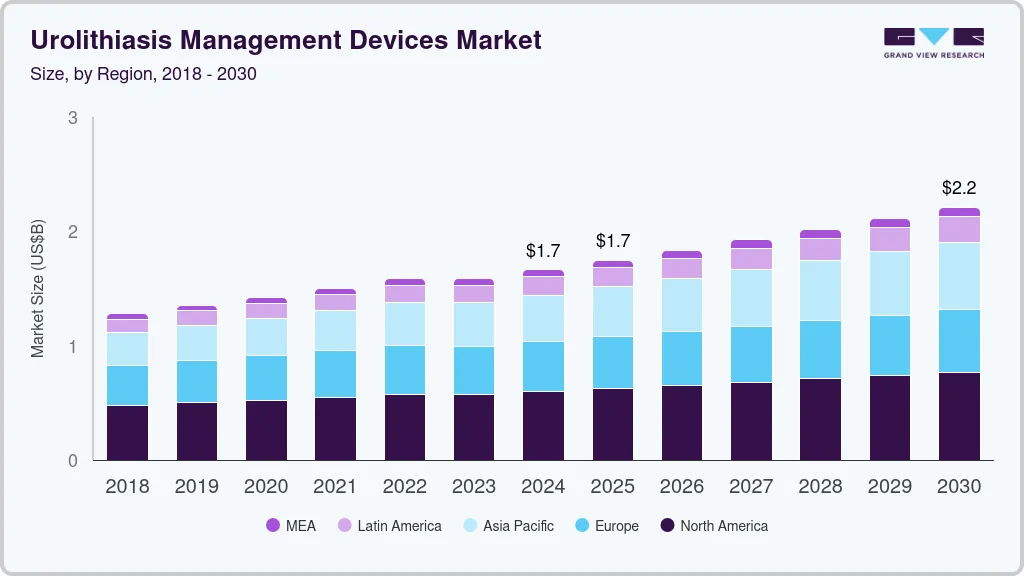

The global urolithiasis management devices market size was valued at USD 1.66 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2025 to 2030. Due to several factors, the market for urolithiasis management devices is experiencing increased product demand. The increasing prevalence of urolithiasis worldwide is a significant contributing factor. According to the European Association of Urology, the prevalence of urinary stones ranges from 1% up to 20%. Renal stones are substantially more common (>10%) in developed nations like Canada, Sweden, and the U.S. Kidney stones are common, according to the British Association of Urological Surgeons’ 2021 report. Kidney stones have an 8% probability of developing in patients getting a CT scan, and their occurrence has been continuously rising since the early 20th century. In addition, 9% of persons will experience stone symptoms at some point in their lifespan.

According to the NHS inform, the most common age range for those who acquire kidney stones is between 30 and 60. Around three in 20 males and up to two in 20 women will experience them at some point, making them highly prevalent. Nephrolithiasis is the medical word for kidney stones, and renal colic is used when they produce excruciating agony. As per a a May 2023 report by St. Pete Urology, around 500,000 people in the U.S. go for emergency treatment of kidney stones each year.

In addition, increased sedentary behaviors such as binge drinking alcohol and drinking less water may contribute to kidney stone development. Also, the rising prevalence of obesity in the population-a high-risk factor for developing renal calculi-caused by sedentary lifestyles, including unhealthy eating patterns and a lack of physical activity-could also support the expansion of the market for urolithiasis management devices.

According to the European Association of Urology, around 10% of the global population suffers from kidney stones. In addition, the recurrence rate of this disorder is approximately 50% in a patient's lifetime. The rising prevalence and incidence rates of urinary stones, coupled with the increasing preference for minimally invasive surgeries across the globe, are crucial factors contributing to an increased demand for urolithiasis management procedures.

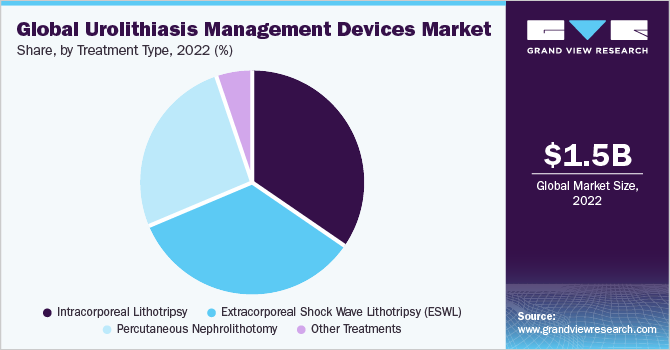

Urinary stones can be classified based on their size, location inside the body, and anatomical characteristics of the urogenital tract. Based on these features, and primarily the stone size, various approaches can be applied for their removal. Stone sizes are stratified into those measuring up to 5 mm, 5-10 mm, 10-20 mm, and >20 mm and larger. Treatment approaches are customized according to patient needs to achieve optimum results. Based on available treatment types, the global urolithiasis management devices market is categorized into Extracorporeal Shock Wave Lithotripsy (ESWL), Intracorporeal Lithotripsy, Percutaneous Nephrolithotomy, and other treatments.

The most typical methods for treating kidney stones include medication, dietary modifications, and in more serious circumstances, surgical intervention. The kidney stone's size, makeup, and underlying cause affect each treatment method's efficacy. Simple medicine and hydration can help tiny stones travel through the system with the least discomfort. However, surgical intervention such as ureteroscopy or extracorporeal shock wave lithotripsy (ESWL) may be required for bigger stones.

End-use Insights

The hospitals & clinics segment held a significant revenue share in 2022 due to hospital investments in surgical infrastructure growth, an increase in kidney stone treatments conducted in hospitals, and the opening of new hospitals in various regions. In addition, satisfactory reimbursement provided by hospitals is also one of the major factors responsible for the segment’s growth.

The ASCs segment is expected to witness the fastest CAGR over the forecast period. Surgical removal of stones is an inevitable option in cases where stones block the flow of urine due to their large size. Ambulatory surgical centers are slowly gaining popularity as they offer time-saving and cost-effective treatment options and reduce prolonged hospital stays. The technological advancements in the field of surgery, such as the availability of minimally invasive endoscopes, scalpels, baskets, etc., enable urologists to perform painless stone removal. The preference for ambulatory surgical centers for the treatment of urinary stones would be greater in developed countries, such as the U.S., Canada, the UK, and Germany, due largely to their easy accessibility.

Treatment Type Insights

The intracorporeal lithotripsy segment dominated the market and held the largest revenue share of 34.6% in 2022 and is expected to grow at the fastest CAGR of 6.8% over the forecast period. Intracorporeal lithotripsy involves the visualization of stones using an endoscope and their simultaneous disintegration into manageable fragments using lasers. Large stone patients who are not suitable candidates for ESWL typically have intracorporeal lithotripsy. Treatments using intracorporeal lithotripsy have a nearly 95% stone-free rate and require little implantation. The treatment, which is carried out under anesthesia, is easily accessible in hospitals and clinics around the world. Although an invasive technique, intracorporeal lithotripsy results in a remarkable stone-free outcome and takes less time than ESWL while having no obvious side effects. Therefore, it is probably going to be the more popular stone removal method over the forecast period.

The ESWL segment held a significant revenue share in 2022. ESWL is a minimally invasive treatment that is still widely used owing to easy access to this treatment and it is cost-efficient. In this technique, shock waves are primarily employed to disintegrate stones of diameter range 4 mm-2 cm into smaller pieces allowing their easy passage out of the body. It is usually an outpatient treatment as there is no need for a hospital stay and works well in case of relatively smaller urinary stones which are common in patients with stones. The types of shock wave generators used are electrohydraulic, piezoelectric, and electromagnetic.

The percutaneous nephrolithotomy segment is anticipated to grow at a significant CAGR over the forecast period. Large stones in the kidney or upper ureter are removed by a keyhole procedure called percutaneous nephrolithotomy. If other methods fail to break or remove the stone, it can also be employed as a "salvage" treatment. However, it does allow the treatment of stones in unusual places that would be difficult to reach or target with ESWL as well as clear bigger quantities of stones in a single treatment. The biggest drawback is a higher chance of injury, especially bleeding, which may necessitate a blood transfusion or further care to stop the bleeding.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 36.4% in 2022. Factors such as the rising prevalence of stone formations that cause urolithiasis, the increased risk of end-stage renal disease among the population, and rising product approvals are expected to drive the market. According to the Canadian Urological Association's guidelines for 2021, nephrolithiasis affects up to 10-12% of men and 7-8% of women globally, and the prevalence of urolithiasis is gradually rising despite some geographical variation. In addition, according to the Centers for Disease Control and Prevention (CDC), kidney disorders are a prominent cause of death in the U.S. Most adults in the U.S. are undiagnosed out of the 37 million adults who have chronic kidney disease (CKD). In addition, the rising awareness among the patient population about new treatment alternatives available for stone diseases as well as the availability of medical devices in the region is expected to expand the market in the region.

Asia Pacific is expected to grow at the fastest CAGR of 6.4% during the forecast period. The prevalence of kidney stones is increasing in the Asia Pacific region, due to a number of factors, including changes in diet, lifestyle, and climate. According to the National Center for Biotechnology Information (NCBI), the prevalence of kidney stones is expected to reach 14.3% in China and 12.7% in India by 2030. The healthcare spending in the region is growing rapidly, as governments and individuals are becoming more aware of the importance of good health. This is providing a boost to the market, as patients are more likely to seek treatment for kidney stones.

Key Companies & Market Share Insights

The market is moderately competitive and consists of several market players. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. Investment in research and development of non-invasive solutions to treat kidney stones by some players is also expected to drive the market. For instance, in July 2022, Calyxo, a company developing technology for kidney stone removal, declared that its USD 32.7 million Series C investment round was closed. California-based Calyxo, with the intention of removing kidney stones without surgery, created the CVAC Aspiration system. It uses irrigation and aspiration to do it.

In January 2022, the FDA designated Applaud Medical's Acoustic Enhancer technology as a breakthrough product, according to an announcement. Applaud Medical, a San Francisco-based company, created an Acoustic Enhancer technology for use with ureteroscopy with laser lithotripsy (URS-LL) to divide calcium-based urinary stones that are obstructing or that a urologist or other qualified medical professional determines to pose a significant risk of future hindrance and are at least 6mm in diameter but not larger than 20mm.

In addition, in March 2021, Boston Scientific and a Baring Private Equity Asia (BPEA) unit inked a legally binding agreement for Boston Scientific to pay USD 1.07 billion in cash upfront to purchase Lumenis' global surgical business. This acquisition allowed Boston Scientific to expand its kidney stone management products globally. Similarly, in June 2020, Olympus Corporation introduced the Soltive Laser System, a new thulium fiber laser application created for soft tissue applications and stone lithotripsy. The following are some of the major participants in the global urolithiasis management devices market:

-

Allengers

-

Boston Scientific

-

BD

-

Cook Medical

-

ConMed

-

DirexGroup

-

Dornier MedTech

-

KARL STORZ

-

Potent Optotronic

-

HealthTronics

-

Lumenis

-

Olympus

-

Richard Wolf

-

Siemens Healthcare

Urolithiasis Management Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2030

USD 2.21 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Allengers; Boston Scientific; BD; Cook Medical; ConMed; DirexGroup; Dornier MedTech ;KARL STORZ; Potent Optotronic; HealthTronics; Lumenis; Olympus; Richard Wolf; Siemens Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urolithiasis Management Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global urolithiasis management devices market based on treatment type, end-use, and region:

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Extracorporeal Shock Wave Lithotripsy (ESWL)

-

Intracorporeal Lithotripsy

-

Percutaneous Nephrolithotomy

-

Other Treatments

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers (ASCs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global urolithiasis management devices market size was estimated at USD 1.58 billion in 2022 and is expected to reach USD 1.58 billion in 2023.

b. The global urolithiasis management devices market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 2.21 billion by 2030.

b. North America dominated the urolithiasis management devices market with a share of 36.40% in 2022. This is attributable to rising prevalence and incidence rates of urolithiasis in the North American countries that stands at approximately 12% of the population as per American Urological Association.

b. Some key players operating in the urolithiasis management devices market include Boston Scientific Corporation,ConMed Corporation, Cook Medical, Dornier MedTech GmbH, Karl Storz GmbH & Co. KG, Guangzhou Potent Optotronic Technology Co., Ltd., Olympus Corporation, Lumenis, Siemens Healthcare, and C.R. Bard, Inc.

b. Key factors that are driving the market growth include rising prevalence and incidence rates of urinary stones coupled with the increasing preference for minimally invasive surgeries across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.