- Home

- »

- Medical Devices

- »

-

Urology Surgical Instruments Market Size, Share Report, 2030GVR Report cover

![Urology Surgical Instruments Market Size, Share & Trends Report]()

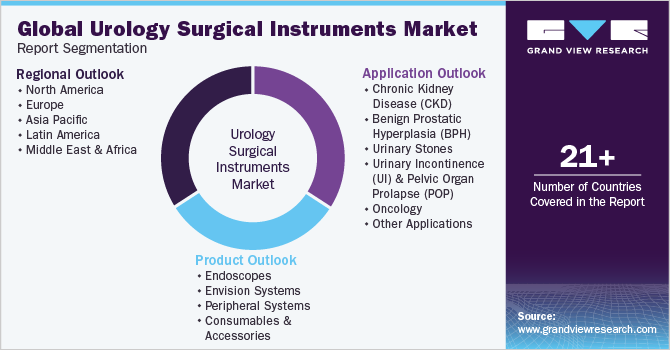

Urology Surgical Instruments Market Size, Share & Trends Analysis Report By Product (Endoscopes, Envision Systems, Peripheral Systems), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-323-2

- Number of Report Pages: 165

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

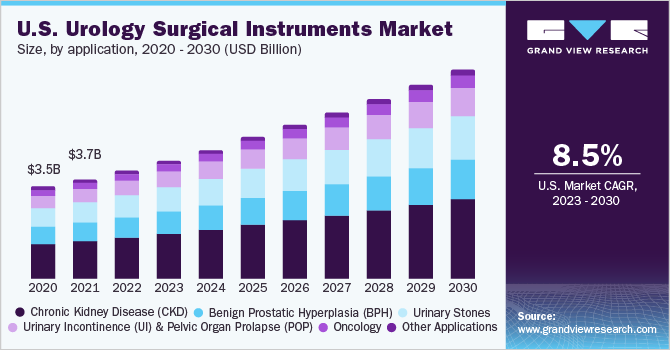

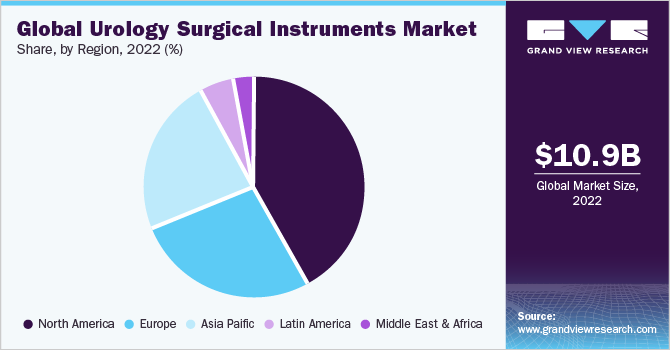

The global urology surgical instruments market size was estimated at USD 10.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030. The market is witnessing rapid growth due to numerous factors including the rising geriatric population, increasing prevalence of urological problems, and diseases like kidney stones, urinary incontinence, and prostate cancer. These disorders necessitate surgical intervention, which increases the demand for urology surgical instruments. Technological development has been an important part of market expansion. Less invasive surgical methods such as laparoscopy and robot-assisted surgery are common in urological therapy. These procedures provide advantages such as smaller incisions, less discomfort, shorter hospital stays, and faster recovery, increasing the use of urological surgical devices.

The geriatric population is more susceptible to digestive disorders, incontinence, and chronic conditions, which require long-term care. Hence, a rise in the global geriatric population is expected to serve as a high-impact rendering driver. The rise in the geriatric population will also increase the number of surgeries performed. Advancing technologies, improving healthcare delivery services, and an overall improvement in the quality of life is contributing to the increasing life expectancy of people around the world.

According to the Centers for Disease Control and Prevention, in the U.S., kidney illnesses are one of the main causes of mortality. In 2021, around 15% of U.S. adults, or around 37 million people that is more than one in seven were estimated to have Chronic Kidney Disease (CKD). Around 40% of individuals with significant renal impairment (not receiving dialysis) are unaware that they have CKD.

The COVID-19pandemic had a substantial influence on the market for urological surgical tools. Non-urgent operations, including urological treatments, were either postponed or canceled, resulting in a fall in surgical volumes and a decrease in demand for urology surgical instruments. Disruptions in the global supply chain and industrial activity impeded market expansion even further. However, as healthcare systems improved and implemented safety measures, surgery numbers eventually rebounded, resulting in a market recovery. The long-term consequences will be determined by the virus's continuous control, immunization efforts, and the restoration of the surgical capacity to address the backlog of postponed surgeries.

The high cost of sophisticated urology surgical instruments is one of the key constraints. These devices use advanced technology and demand substantial investment, which may limit their use, particularly in poor countries with limited healthcare resources.

Product Insights

Based on the product, the market is segmented into endoscopes, envision systems, peripheral systems, and accessories and consumables. The endoscope segment is further divided into laparoscopes, ureteroscopes, nephroscopes, resectoscopes, and cystoscopes. Laparoscopic surgery is surgical operations carried out through one or more tiny incisions rather than a larger, often single, abdominal wall incision.

The accessories and consumables segment is further divided into guidewires, stone basket/extraction and retrieval devices, catheters, stents, biopsy devices, fluid flushing devices, connecting tubes, clamps, over tubes, and distal attachments, drainage bags, surgical dissectors, needle forceps, and needle holders.

The accessories and consumables segment held the largest market share of 50.7% in 2022. This segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. Frequent use and the throwaway nature of these instruments are the main drivers of this market. In addition, a projected increase in urological treatments around the world is anticipated to increase demand for these instruments in the upcoming years.

The endoscopes segment held a significant market share in 2022 and is expected to grow at a CAGR of 7.9% over the forecast period. One of the main factors propelling the urology endoscopes market is the rising need for less invasive approaches in diagnostic and therapeutic procedures. In addition, factors such as an increase in private player investments, an increase in public sector grants or funds, and a rise in the number of hospitals and clinics globally are expected to drive segment market growth.

Application Insights

Based on application, the urology surgical instruments industry is segmented into chronic kidney diseases (CKD), Benign Prostatic Hyperplasia (BPH), urinary stones, Urinary Incontinence (UI), Pelvic Organ Prolapse (POP), oncology, and others. The CKD segment dominated the market in 2022 due to the increasing prevalence of CKD, the expansion of clinical trials for novel, non-invasive therapies for these conditions, and global government initiatives.

According to Global Burden of Disease (GBD), CKD has continued to rise among the leading causes of death, ranking 13th in 2016 and 12th in 2017, and is projected to be the fifth leading cause of premature death worldwide by 2040. GBD studies have also shown the uneven distribution of CKD mortality worldwide, especially in Latin America, the Caribbean, Southeast and East Asia, Oceania, North Africa, and the Middle East. In Singapore, Greece, and Israel CKD was among the top 10 causes of death.

The UI and POP segment is projected to grow at a significant CAGR over the forecast period. This can be attributed to the rise in the number of surgeries performed to treat urine incontinence, rising incontinence awareness, developing technology, and rising use of these products to treat incontinence. The demand for urology surgical instruments is also anticipated to increase in the upcoming years due to an increase in POP surgical operations. According to the National Library of Medicine (NLM), pelvic organ prolapse is a prevalent ailment, and 12% to 19% of women will require a surgical intervention over their lifetime to address the condition.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.80% in 2022. Growing geriatric populations in the U.S. and Canada, rising urology cancer and disorder incidences, rising hospital urology equipment purchases, an increase in urologists, a favorable reimbursement environment, and rising healthcare spending on urology disorders are some of the major factors anticipated to drive the regional market for urology surgical instruments throughout the forecast period.

The U.S. is the largest market in the region for urinary surgical instruments, and its expansion can be attributed to the prevalence of large patient populations with urinary disorders, increasing urology procedures, rising hospital spending on urology surgical instrument purchases, and the ongoing technological cutting-edge products. In the coming years, it is anticipated that the availability of reimbursement for urology operations would increase the volume of urological procedures performed and, consequently, the need for related instruments.

Asia Pacific is projected to grow at the fastest CAGR of 8.6% over the forecast period 2023 - 2030. The market growth is anticipated to be supported by an increase in free trade agreements between Asian and Western nations, government spending on urology healthcare, strict regulations governing the use of invasive devices, improved healthcare infrastructure in China and India, and a sharp rise in medical tourism. To address the growing demand for urological procedures, numerous private and governmental institutions in China; India; Japan; New Zealand; Australia; Singapore; and Indonesia are also investing in modern urology technology.

Key Companies & Market Share Insights

The market is highly competitive, with several major players competing for market dominance. Players operating in the market are adopting strategies such as new product launches, technological innovation, partnerships, and distribution network expansion to gain a competitive advantage. To introduce novel equipment and stay on the cutting edge of technical breakthroughs, companies frequently spend on research and development.

Technological innovation has resulted in the creation of increasingly sophisticated and effective urological surgical devices. For instance, urological operations have been transformed by the incorporation of robotics and minimally invasive surgical techniques, which enable more precision, less invasiveness, and quicker patient recovery. Companies that invest in these technologies often get a competitive advantage. Some prominent players in the global urology surgical instruments market include:

-

Medtronic

-

Boston Scientific Corporation

-

Olympus Corporation

-

Karl Storz GmbH & Co. KG

-

Cook Medical LLC

-

Richard Wolf GmbH

-

Stryker

-

Teleflex Incorporated

-

Coloplast Group

Urology Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.78 billion

Revenue forecast in 2030

USD 20.36 billion

Growth rate

CAGR of 8.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Olympus Corporation; Coloplast Group; Richard Wolf GmbH; Karl Storz; Cook; Boston Scientific Corporation; Medtronic; Teleflex Incorporated; Stryker; Cook Medical LLC

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urology Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global urology surgical instruments market report based on the product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopes

-

Laparoscopes

-

Ureteroscopes

-

Nephroscopes

-

Resectoscopes

-

Cystoscopes

-

-

Envision Systems

-

Light Sources

-

Cameras

-

Camera Heads

-

Monitors & Displays

-

-

Peripheral Systems

-

Insufflators

-

Endoscopy Fluid Flushing Devices

-

-

Consumables & Accessories

-

Guidewires

-

Stone Baskets/Retrieval Devices and Extractors

-

Catheters

-

Stents

-

Biopsy Devices

-

Fluid Flushing Devices, Connecting Tubes, Clamps, Overtubes, and Distal Attachments

-

Dilator Sets and Ureteral Access Sheaths

-

Drainage Bags

-

Surgical Dissectors

-

Needle Forceps and Needle Holders

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Diseases (CKD)

-

Benign Prostatic Hyperplasia (BPH)

-

Urinary Stones

-

Urinary Incontinence (UI) and Pelvic Organ Prolapse (POP)

-

Oncology

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

Kuwait

- Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global urology surgical instruments market size was estimated at USD 10.9 billion in 2022 and is expected to reach USD 11.78 billion in 2023.

b. The global urology surgical instruments market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 20.36 billion by 2030.

b. North America dominated the urology surgical instruments market with a share of 41.8% in 2022. This is attributable to rising incidences of urology cancers and disorders, increasing urology equipment purchases by hospitals, a rise in the number of urologists, positive reimbursement scenarios, and increasing healthcare spending on urology disorders.

b. Some of the key players operating in the urology surgical instruments market include Olympus Corporation, Coloplast Group, Richard Wolf GmbH, KARL STORZ, Cook, Boston Scientific Corporation, Medtronic, Teleflex Incorporated, and Stryker.

b. Key factors that are driving the market growth include increasing R&D expenditures & incessant product launches, growing preference for minimally invasive surgeries, and increasing prevalence of urinary disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."