Market Size & Trends

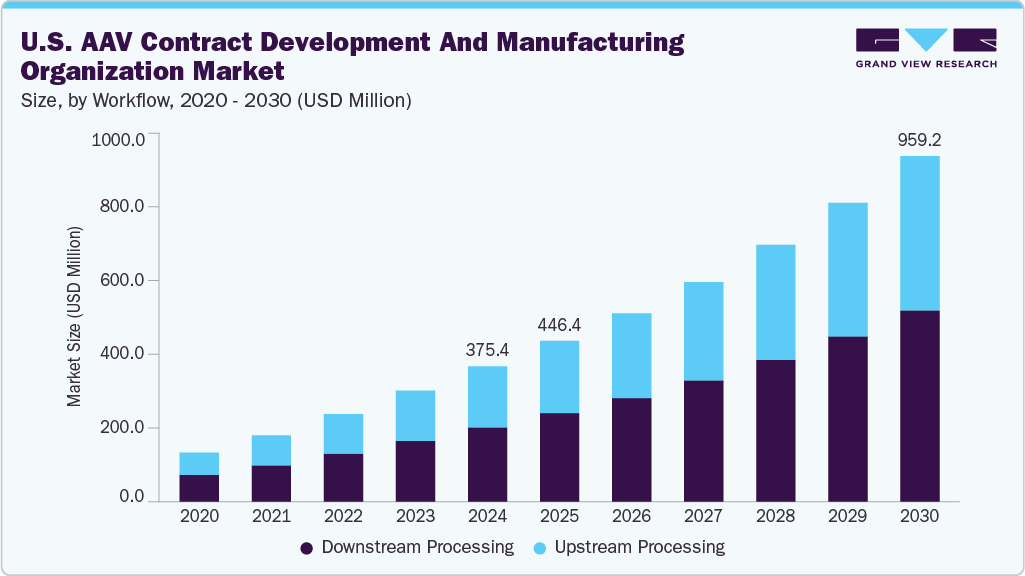

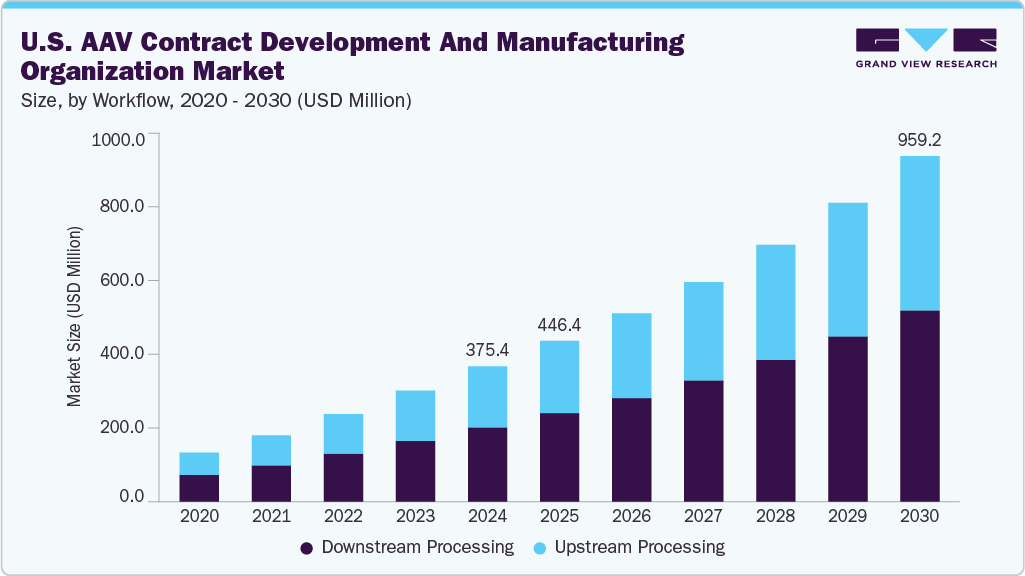

The U.S. AAV contract development and manufacturing organization market size was valued at USD 375.4 million in 2024 and is expected to grow at a CAGR of 16.5% from 2025 to 2030. This growth is fueled by the rapidly increasing approval and adoption of gene therapies utilizing AAV vectors, driven primarily by the urgent need to treat rare genetic and complex diseases such as spinal muscular atrophy and inherited retinal disorders. According to the FDA, over 40 gene therapy products have been approved globally as of 2024, with many more in clinical development, reflecting robust growth in this field. This surge in gene therapies significantly fuels demand for specialized Adeno-associated virus (AAV) manufacturing services, which require advanced expertise to ensure product safety and efficacy.

The rising demand for AAV-based gene therapies in the U.S. is driving a significant increase in clinical trial activity. This surge highlights the urgent need for scalable, compliant manufacturing infrastructure to support early- to late-stage development. As a result, pharmaceutical and biotech companies are increasingly turning to specialized CDMOs for efficient vector production and quality control. In addition, growing government and private sector investments in gene therapy research are expediting trial initiation, further strengthening the demand for robust contract manufacturing support.

The complexity of manufacturing AAV vectors, which involves precise viral vector design, purification, and regulatory compliance, presents a significant challenge for many companies. As a result, biotech firms increasingly outsource production to CDMOs with the advanced technical capabilities needed for GMP-grade manufacturing. This outsourcing trend is vital for accelerating timelines and managing costs, which are critical in bringing gene therapies to market swiftly and safely.

The U.S. Adeno-Associated Virus (AAV) Contract Development and Manufacturing Organization (CDMO) market has experienced notable mergers and acquisitions (M&A) and strategic collaborations, underscoring its dynamic growth and innovation. In November 2023, Forge Biologics, a prominent AAV-focused CDMO, was acquired by Ajinomoto Co., Inc., for USD 620 million. In October 2023, Andelyn Biosciences partnered with Purespring Therapeutics to accelerate the clinical development of gene therapies targeting chronic kidney diseases.

Workflow Insights

The downstream processing segment dominated the industry, with a 55.0% revenue share in 2024. This process includes culture agitation, biomass separation, condensing collected materials, and other isolation and concentration procedures. This step involves purification, concentration, and formulation, which are essential for removing impurities and achieving clinical-grade quality.

Upstream processing is anticipated to witness growth over the forecast period. This phase focuses on producing AAV vectors through cell expansion and transfection, laying the foundation for high-quality yields. With rising demand for gene therapies, companies invest heavily in optimizing upstream workflows to improve volumetric productivity and reduce production time.

Culture Type Insights

The adherent culture segment dominated the market, with the highest revenue share in 2024. Most viral vector products are manufactured using adherent cells. HEK293 cells are often transfected with a vector construct (including GOI) and helper/packaging plasmids.

The small suspension culture segment is anticipated to grow at the highest CAGR over the forecast period. This growth is due to the demand for scalable, high-yield AAV manufacturing processes.

Application Insights

The cell and gene therapy development segment dominated the market with the highest revenue share in 2024. This is due to AAV vectors' increasing clinical and commercial use in treating rare genetic disorders. AAVs are preferred due to their low immunogenicity and ability to deliver genetic material effectively to target cells.

The biopharmaceutical and pharmaceutical discovery segment is expected to grow significantly in the coming years as AAV vectors are increasingly used in preclinical research and novel drug development.

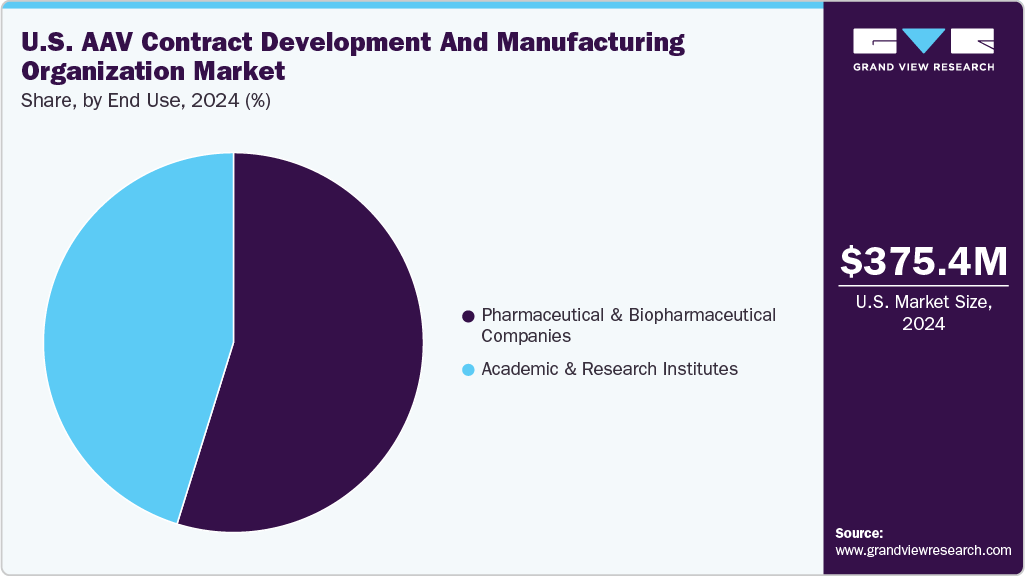

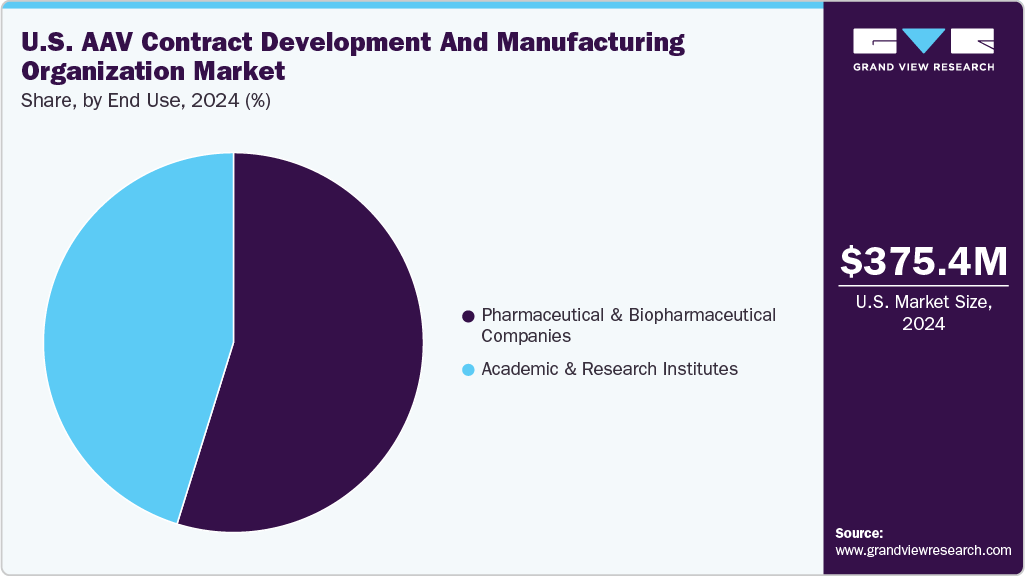

End Use Insights

The pharmaceutical and biopharmaceutical companies segment dominated the market with the highest revenue share in 2024, due to their extensive pipelines and commercial focus on gene therapies. These firms rely heavily on CDMOs for scalable vector production, regulatory compliance, and speed-to-market advantages.

Academic and research institutes are anticipated to witness significant growth in the coming years. Backed by public funding from agencies like the NIH, these institutions increasingly partner with CDMOs to translate bench research into clinical-grade material.

Key U.S. AAV Contract Development And Manufacturing Organization Market Company Insights:

Some key companies operating in the U.S. AAV contract development and manufacturing organization include Thermo Fisher Scientific Inc., Andelyn Biosciences, and National Resilience, Inc..

-

Thermo Fisher Scientific Inc. offers end-to-end gene therapy manufacturing solutions, including AAV vector development and GMP production. Its large-scale infrastructure and continuous expansion make it a critical partner for clinical and commercial gene therapy programs.

-

Andelyn Biosciences is a U.S.-based CDMO specializing in AAV vector development and GMP manufacturing, backed by over 20 years of industry expertise.

Key U.S. AAV Contract Development And Manufacturing Organization Companies:

- Thermo Fisher Scientific Inc.

- Forge Biologics

- Andelyn Biosciences

- National Resilience, Inc.

- Akron Biotech

- ViroCell Biologics, Ltd.

- ElevateBio.

- VintaBio LLC.

- Clover Biopharmaceuticals

- iVexSol

U.S. AAV Contract Development And Manufacturing Organization Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 446.4 million

|

|

Revenue forecast in 2030

|

USD 959.2 million

|

|

Growth Rate

|

CAGR of 16.5% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Workflow, culture type, application, and end use

|

|

Key companies profiled

|

Thermo Fisher Scientific Inc.; Forge Biologics ; Andelyn Biosciences; National Resilience, Inc.; Akron Biotech; ViroCell Biologics, Ltd.; ElevateBio.; VintaBio LLC.; Clover Biopharmaceuticals; iVexSol

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to the country, and segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. AAV Contract Development And Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. AAV contract development and manufacturing organization market report based on workflow, culture type, application, and end use.

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Processing

-

Downstream Processing

-

Culture Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adherent Culture

-

Suspension Culture

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)