- Home

- »

- Pharmaceuticals

- »

-

U.S. Actinic Keratosis Treatment Market Size Report, 2030GVR Report cover

![U.S. Actinic Keratosis Treatment Market Size, Share & Trends Report]()

U.S. Actinic Keratosis Treatment Market Size, Share & Trends Analysis Report By Therapy (Topical/Drugs, Surgery, Photodynamic Therapy), By Drug Class, By Product, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-027-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

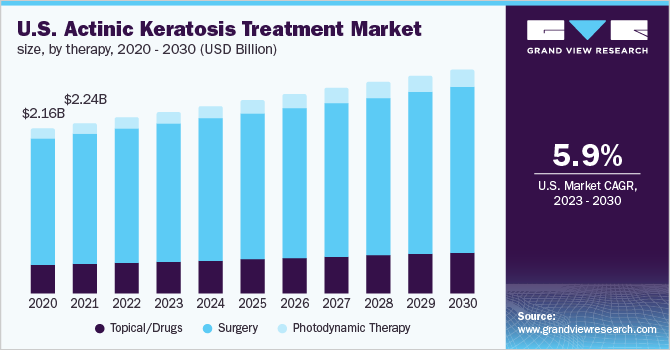

The U.S. actinic keratosis treatment market size was valued at USD 2.32 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.03% from 2023 to 2030. The increasing prevalence of actinic keratosis, the increased risk of developing skin cancer, and the surge in the geriatric population of the country are the major driving growth factors. For instance, according to a report published in JAMA Dermatology, actinic keratosis affects around three of every 10 older Medicare recipients. Moreover, the presence of potential investigational candidates in the pipeline and the rising R&D efforts from pharmaceutical companies to develop novel treatment approaches for actinic keratosis are likely to contribute to market expansion over the forecast period.

According to the American Academy of Dermatology Association, more than 40 million Americans develop AK each year and the overall prevalence rate of AK in the U.S. is estimated to be about 26.5% in males and 10.2% in females. Factors such as severe baldness, the high tendency of sunburn, and skin wrinkling may increase the predisposition to AK in the male population. In addition, it is the most common pre-cancerous dermatological condition, around 5-10% of actinic keratosis can develop into Squamous cell carcinoma. Thus, the increasing prevalence of AK is anticipated to increase the treatment rate in the country.

Currently, treatment approaches such as home-based treatments with topical preparations, cryotherapy, and PDT are commonly employed to treat actinic keratosis. Moreover, several novel agents are under development phases to reduce adverse events, which is expected to increase the adoption rate of treatment of actinic keratosis. For instance, according to the NIH, some of the novel drugs being investigated for AK are resiquimod, betulinic acid, paclitaxel, potassium dobesilate, potassium hydroxide, and celecoxib. These therapeutic drugs are directed toward personalized treatment for patients having AK lesions as well as symptoms of cutaneous SCC.

In addition, the ongoing efforts to develop next-generation therapeutics for various dermatological disorders including AK, basal cell carcinoma, and atypical moles are expected to offer lucrative growth opportunities for the market. For instance, in October 2022, the Skin Cancer Foundation granted USD 125,000 to researchers to manage dermatological applications. This funding is mainly intended to promote innovation for the early detection and treatment of skin diseases such as AK.

Furthermore, higher rates of actinic keratosis treatment and increasing novel medicines usage in the country along with favorable initiatives from non-profit organizations to prevent actinic keratosis is a growth rendering factor for the market. For instance, in June 2021, the American Academy of Dermatology published new recommendations for the treatment of AK with its new GRADE approach. Moreover, according to Almirall’s presentation, the prescription of Klisyri in the U.S. AK topical market has increased by over 41,000 prescriptions since its launch.

However, most treatment options such as imiquimod, Solaraze, and Efudex have lost their patent exclusivities in the U.S., leading to the penetration of generics in the market. Genericization is expected to lower the revenue generation capacity of the market, thereby impeding market growth. Moreover, a stringent regulatory framework related to the safety and efficacy of drugs is further anticipated to reduce market growth over the forecast period. For instance, in October 2020, Leo Pharma’s Picato, a topical gel used to treat AK, was discontinued due to safety, efficacy, and quality reasons.

Therapy Insights

The surgery segment held the largest share of 76.55% in 2022 and is anticipated to continue leading during the projected period. The higher demand for complete disease eradication and high penetration of cryotherapy procedures are fueling segment uptake. However, the topical/drugs segment held the second largest share owing to the increasing trend for home-based treatment, lesser possibility of adverse effects, higher preference by medical professionals for topical treatments, and ongoing regulatory approvals. For instance, in December 2020, the U.S. FDA approved Klisyri (tirbanibulin) for the topical treatment of actinic keratosis. Some of the common topical brands available for AK treatment are Carac, Efudex, Tolak, and Aldara among others.

However, the photodynamic therapy segment is projected to register the fastest growth rate over the forecast period. Factors such as the high site specificity of PDT, less incidence of adverse effects, the high adoption rate for long-term treatments, and great efficiency in patients with multiple skin lesions are responsible for the lucrative growth rate of the segment. In addition, significant clinical studies to enhance outcomes from PDT are other factors contributing to segment growth. For instance, in November 2022, Biofrontera Inc. announced the initiation of a phase-3 clinical study to evaluate the safety of BF-RhodoLED-XL and Ameluz in the management of AK.

Drug Class Insights

Based on topical/drugs segment, the nucleoside metabolic inhibitors dominated the market and is projected to hold a significant market share during the forecast period. The high growth rate of the segment is owing to the strong commercial performance of Fluroplex, Carac, and Efudex along with a higher demand for topical formulations to treat the initial stages of the condition. Moreover, the rising awareness regarding the diagnosis and treatment of disease has further fueled the segment’s growth.

The photoenhancers segment is anticipated to grow at the fastest rate throughout the forecast period. Factors including high efficacy, convenient handling, better skin rejuvenation, high healing rates, and lower recurrence rates of lesions are increasing the adoption of photoenhancers. In addition, the surge in demand for actinic keratosis treatment has also fueled segment uptake at a substantial rate. For instance, in 2021 an estimated 13.2 million actinic keratosis treatments were performed in the U.S.

Furthermore, several strategic initiatives undertaken by leading participants are another potential factor fueling segment growth. For instance, in March 2022, Biofrontera announced that the U.S. FDA added a patent for a novel RhodoLED XL lamp for performing PDT with its candidate Ameluz.

Product Insights

5-fluorouracil was the leading segment in 2022 having a 31.28% share of AK drugs in the country. Higher instances of reliable treatment and relatively lower chances of non-response to 5-FU are increasing the adoption of the drug for the treatment of actinic keratosis. In addition, the highest proven efficacy of up to 74% and significant therapeutic results are also expected to cater to the product demand. Moreover, owing to the high clearance rates it reduced the chance of developing squamous cell carcinoma.

The recent product approvals, strong commercial performance, satisfactory results in clinical trials, and fewer chances of remission are fueling the high growth rate of the tirbanibulin segment. Moreover, increasing awareness regarding the use of the product among the target population is further propelling the segment’s growth. For instance, in May 2022, Almirall partnered with Euromelanoma for raising awareness about skin conditions.

End-use Insights

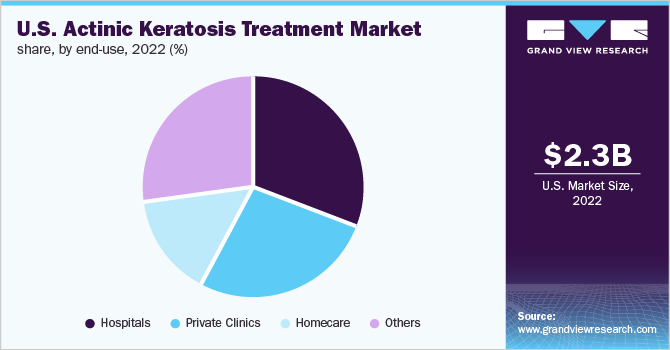

The hospitals segment captured the largest revenue share of 30.4% in 2022. Factors such as treatment accessibility, high penetration of surgery, and increasing photodynamic therapy procedures performed in hospitals are supporting the segment share. Moreover, the increase in the number of physician-assisted therapies like cryotherapy, PDT, and laser therapy in moderate to severe cases of actinic keratosis is expected to fuel the segment growth over the forecast period.

Whereas, the homecare segment is likely to be the fastest-growing segment during the coming years. The growth of the segment is attributed to the rising adoption of topical products, patient convenience factors, availability of OTC products, and the increasing launch of products for topical use. The homecare segment has witnessed an increased demand owing to the rising availability of topical products including imiquimod, 5-FU, diclofenac, and tirbanibulin among others.

Key Companies & Market Share Insights

Key players are adopting new product development, merger & acquisition, and partnership strategies to increase their market share. Market players such as Bausch Health Companies, Inc., LEO Pharma A/S, Almirall, S.A., Biofrontera AG, and others are actively involved in the development of therapeutics for actinic keratosis. For instance, in June 2020, Sun Pharmaceutical Industries Ltd. presented the results of its two specialty medicines ODOMZO and LEVULAN KERASTICK + BLU-U from its skincare portfolio. The data analysis provides insights for using BLU-U+ LEVULAN KERASTICK to treat moderate actinic keratosis. Some prominent players in the U.S. actinic keratosis treatment market include:

-

Bausch Health Companies, Inc.

-

LEO Pharma A/S

-

Almirall, S.A

-

Biofrontera AG

-

GALDERMA

-

Sun Pharmaceutical Industries Ltd

-

Novartis AG

-

Hill Dermaceuticals, Inc.

-

3M

-

Viatris, Inc.

U.S. Actinic Keratosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.39 billion

Revenue forecast in 2030

USD 2.94 billion

Growth rate

CAGR of 3.03% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, drug class, product, end-use

Country scope

U.S.

Key companies profiled

Bausch Health Companies, Inc.; LEO Pharma A/S; Almirall, S.A; Biofrontera AG; GALDERMA; Sun Pharmaceutical Industries Ltd.; Novartis AG; Hill Dermaceuticals, Inc.; 3M; Viatris, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Actinic Keratosis Treatment Market Segmentation

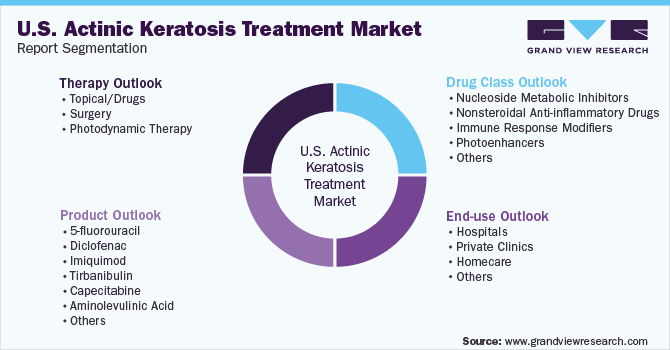

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. actinic keratosis treatment market report based on therapy, drug class, product, and end-use:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical/Drugs

-

Surgery

-

Cryotherapy

-

Others

-

-

Photodynamic Therapy

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleoside metabolic inhibitors

-

Nonsteroidal anti-inflammatory drugs

-

Immune response modifiers

-

Photoenhancers

-

Others

-

-

Product Outlook (Volume, Number of Units Sold; Revenue, USD Million, 2018 - 2030)

-

5-fluorouracil

-

Carac

-

Fluoroplex

-

Actikerall

-

Tolak

-

Others

-

-

Diclofenac

-

Solaraze

-

Voltaren

-

Pennsaid

-

Others

-

-

Imiquimod

-

Aldara

-

Zyclara

-

Others

-

-

Tirbanibulin

-

Capecitabine

-

Xeloda

-

Others

-

-

Aminolevulinic acid

-

Ameluz

-

Levulan

-

-

Porfimer sodium

-

Others

-

Gemzar

-

Clolar

-

Vidaza

-

Metvix

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Private clinics

-

Homecare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. actinic keratosis treatment market size was estimated at USD 2.32 billion in 2022 and is expected to reach USD 2.39 billion in 2023.

b. The U.S. actinic keratosis treatment market is expected to grow at a compound annual growth rate of 3.03% from 2023 to 2030 and is expected to reach USD 2.94 billion by 2030.

b. The surgery segment is expected to dominate the U.S. actinic keratosis treatment market with a share of 76.55% in 2022 due to the high adoption rate of cryotherapy and other surgery procedure to treat actinic keratosis.

b. Some key players operating in the U.S. actinic keratosis treatment market include Bausch Health Companies, Inc., LEO Pharma A/S, Almirall, S.A, Biofrontera AG, GALDERMA, and Sun Pharmaceutical Industries Ltd among others.

b. Increasing prevalence of actinic keratosis, surge in geriatric population, and high risk of developing skin cancer from actinic keratosis are the major factors driving the U.S. actinic keratosis treatment market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."