- Home

- »

- Pharmaceuticals

- »

-

Actinic Keratosis Treatment Market, Industry Report, 2030GVR Report cover

![Actinic Keratosis Treatment Market Size, Share & Trends Report]()

Actinic Keratosis Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapy (Topical, Surgery, Photodynamic Therapy), By Drug Class (NSAIDs), By End use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-940-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Actinic Keratosis Treatment Market Trends

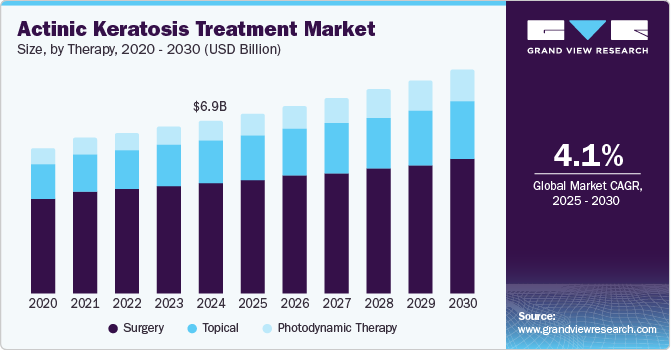

The global actinic keratosis treatment market size was estimated at USD 6.90 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. The increasing incidence of actinic keratosis, especially among aging populations and those living in regions with high sun exposure, is a major factor driving the demand for actinic keratosis treatment options. As people age, their skin becomes more vulnerable to UV radiation, a key risk factor for developing actinic keratosis. In addition, climate change has led to increased UV radiation, raising the risk of actinic keratosis, particularly in hot and sunny areas. As a result, there is a growing demand for solutions that can address and manage this condition. These trends are significantly shaping the actinic keratosis treatment industry.

Technological advancements have led to developing new and more effective treatments for actinic keratosis, including topical creams, Photodynamic Therapy (PDT), cryotherapy, and laser treatments. These emerging therapies provide patients with a wider range of options to manage and treat the condition. Minimally invasive procedures, such as cryosurgery, laser therapy, and PDT, are gaining popularity due to their convenience, lower levels of discomfort, and faster recovery times compared to traditional methods. These innovative treatments are more patient-friendly and contribute to better overall outcomes. Hence, these technologies continue to evolve, driving significant growth in the actinic keratosis treatment industry.

In addition, growing awareness about skin cancer, particularly actinic keratosis as a precursor to more serious conditions, has led to increased efforts in early diagnosis. Public awareness campaigns have significantly encouraged individuals to seek regular screenings, resulting in more cases being detected early. Alongside this, advancements in early detection technologies, such as dermoscopy and skin imaging devices, allow for more accurate identification of actinic keratosis, leading to timely treatment and improved outcomes. The availability of effective topical treatments, such as 5-fluorouracil, imiquimod, and diclofenac, has further contributed to the market's expansion. These factors are fueling significant progress in the actinic keratosis treatment industry.

Therapy Insights

The surgery segment dominated the market with a revenue share of 63.8% in 2024, which can be attributed to the increasing incidence of actinic keratosis, particularly among the aging population. Surgical interventions, such as cryotherapy and excisional surgery, are preferred for their immediate results and effectiveness in removing precancerous lesions. In addition, advancements in surgical techniques and technologies have enhanced patient outcomes and reduced recovery times, further driving demand in this segment.

The photodynamic therapy segment is projected to grow at the highest CAGR of 7.3% over the forecast period, fueled by the rising awareness of PDT's benefits, including its minimally invasive nature and effectiveness against actinic keratosis. The increasing prevalence of skin conditions and the demand for innovative treatment options also contribute to the segment's expansion. Furthermore, ongoing research and development in photosensitizing agents are expected to enhance treatment efficacy, attracting more patients to this therapeutic approach.

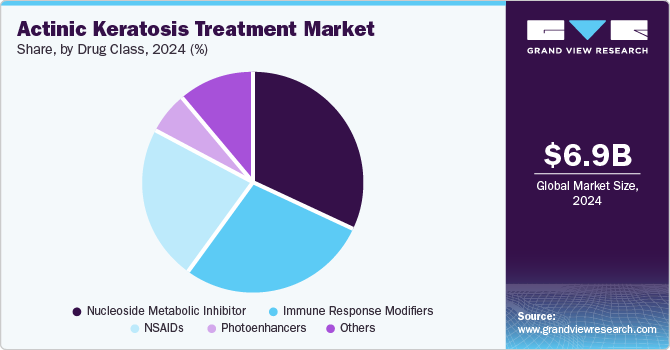

Drug Class Insights

The nucleoside metabolic inhibitor segment dominated the market with the largest revenue share in 2024, driven by the effectiveness of these drugs in targeting the cellular mechanisms linked to actinic keratosis. These drugs are known for inhibiting tumor growth and promoting cell turnover, making them popular among dermatologists for treating actinic keratosis. As they address the condition's underlying causes, their use continues to rise in clinical settings. Moreover, the growing focus on personalized medicine and targeted therapies is increasing the adoption of these drugs. This trend is contributing significantly to the growth and development of the actinic keratosis treatment industry.

The photoenhancers segment is predicted to grow at the highest CAGR over the forecast period due to advancements in drug formulations that improve the effectiveness of photodynamic therapy. These photoenhancers help enhance light absorption, improving treatment outcomes with fewer side effects. As patients increasingly seek less invasive treatments, photoenhancers provide a promising solution. Furthermore, the growing number of clinical trials demonstrating their effectiveness is driving greater interest in this class of drugs. This trend is expected to significantly impact the actinic keratosis treatment industry growth.

End-use Insights

The hospitals segment dominated the market with the largest revenue share in 2024, fueled by the advanced medical infrastructure and access to specialized dermatological care. Hospitals are equipped to provide comprehensive treatment options, including surgical procedures and advanced therapies such as PDT. The rising patient volume seeking effective treatments for actinic keratosis further solidifies hospitals' position as key players in this market.

The homecare segment is projected to grow at the highest CAGR over the forecast period, which can be attributed to patients growing preference for at-home treatments that offer convenience and flexibility. The rise of telemedicine and digital health solutions has made it easier for patients to manage their conditions from home while receiving guidance from healthcare professionals. Moreover, advancements in home-use medical devices are enhancing treatment accessibility and effectiveness.

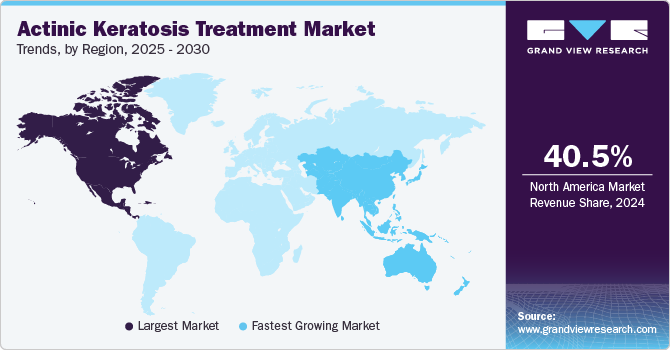

Regional Insights

North America actinic keratosis treatment market held the highest revenue share of 40.5% in 2024, driven by a high prevalence of skin cancer cases and a well-established healthcare infrastructure that supports advanced dermatological treatments. The region's strong research and development focus has led to readily available innovative therapies, further boosting market growth.

U.S. Actinic Keratosis Treatment Market Trends

The U.S. actinic keratosis treatment market dominated North America with a significant revenue share in 2024, fueled by its robust healthcare system and high patient awareness regarding skin health issues. The aging population increasingly seeks effective treatment for actinic keratosis, leading to higher demand for various therapeutic options. Furthermore, ongoing innovations in treatment modalities are enhancing patient outcomes and satisfaction.

Europe Actinic Keratosis Treatment Market Trends

Europe actinic keratosis treatment market held a substantial market share in 2024, driven by rising awareness about skin cancer risks and preventive care measures among the population. The region's strong regulatory framework ensures that innovative treatments are available while maintaining high safety standards. In addition, increasing investment in dermatological research is expected to introduce more effective therapies into the Europe actinic keratosis treatment market.

Asia Pacific Actinic Keratosis Treatment Market Trends

Asia Pacific actinic keratosis treatment market is expected to register the highest CAGR of 5.4% over the forecast period, which can be attributed to a growing aging population and increased exposure to UV radiation leading to higher incidences of actinic keratosis. Rising disposable incomes enables more individuals to seek dermatological care, contributing to market growth. Moreover, expanding healthcare infrastructure facilitates access to advanced treatment options across this diverse region.

Australia actinic keratosis treatment market dominated the Asia Pacific with a significant revenue share in 2024 due to its high UV exposure rates and public health initiatives focusing on skin cancer awareness and prevention. The country's proactive approach toward early diagnosis and treatment has increased patient engagement with dermatological services. Hence, advancements in treatment technologies are making effective therapies more accessible to patients across Australia.

Key Actinic Keratosis Treatment Company Insights

Some key companies operating in the market are Almirall, S.A; LEO Pharma A/S; Sun Pharmaceutical Industries Ltd.; Novartis AG, and Galderma. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in actinic keratosis treatment market.

-

Almirall, S.A. offers Klisyri (tirbanibulin), a topical treatment for actinic keratosis on the face and scalp, recently approved by the FDA. Available in two package sizes, it requires only a 5-day application. This provides a short treatment protocol with strong efficacy and a good safety profile while minimizing severe skin reactions and improving patient comfort.

-

LEO Pharma A/S offers Ingenol Mebutate (Picato), a topical gel for treating actinic keratosis on the face and scalp, with a short application period of 2 to 3 days. The company is also developing Ingenol Disoxate, a new formulation for treating larger areas such as the full face or chest, which has shown promising results in clinical trials. Both products effectively clear actinic keratosis lesions while minimizing local skin reactions, providing convenient treatment options for patients.

Key Actinic Keratosis Treatment Companies:

The following are the leading companies in the actinic keratosis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Almirall, S.A

- LEO Pharma A/S

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Galderma

- Ortho Dermatologics (Bausch Health Companies Inc.)

- BIOFRONTERA Inc

- Hill Dermaceuticals, Inc

- 3M

- Alma Lasers

Recent Developments

-

In August 2024, Biofrontera AG announced the partnership with LEO Pharma GmbH to promote two established dermatological products, Advantan and Skinoren, in Germany. The collaboration aims to use Biofrontera's specialized sales team to increase the reach of these treatments for conditions such as atopic dermatitis and acne vulgaris. Advantan, containing methylprednisolone aceponat, is used for various eczema types, while Skinoren, with azelaic acid, treats acne.

-

In June 2024, Almirall, S.A. launched Klisyri in Europe to treat actinic keratosis in larger field areas. The topical ointment, containing tirbanibulin, is designed to treat multiple lesions on the face and scalp effectively. Klisyri offers a convenient five-day treatment duration while maintaining a strong safety profile.

Actinic Keratosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.17 billion

Revenue forecast in 2030

USD 8.93 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Therapy,drug class, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Japan, China, India, South Korea, Australia, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE.

Key companies profiled

Almirall, S.A; LEO Pharma A/S; Sun Pharmaceutical Industries Ltd.; Novartis AG; Galderma; Ortho Dermatologics (Bausch Health Companies Inc.); BIOFRONTERA Inc; Hill Dermaceuticals, Inc; 3M; Alma Lasers.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Actinic Keratosis Treatment Market Report Segmentation

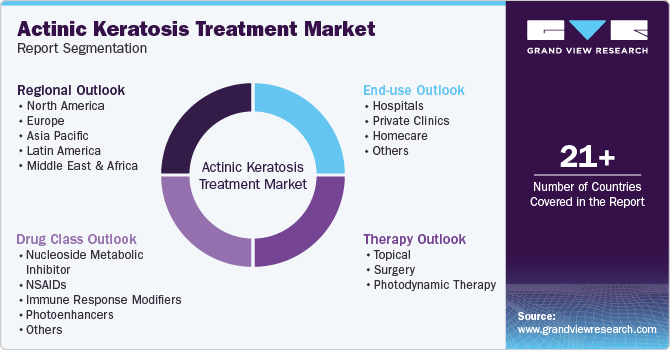

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global actinic keratosis treatment market report based on therapy, drug class, end use, and region:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Surgery

-

Photodynamic Therapy

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleoside Metabolic Inhibitor

-

NSAIDs

-

Immune Response Modifiers

-

Photoenhancers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Private Clinics

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.