Market Size & Trends

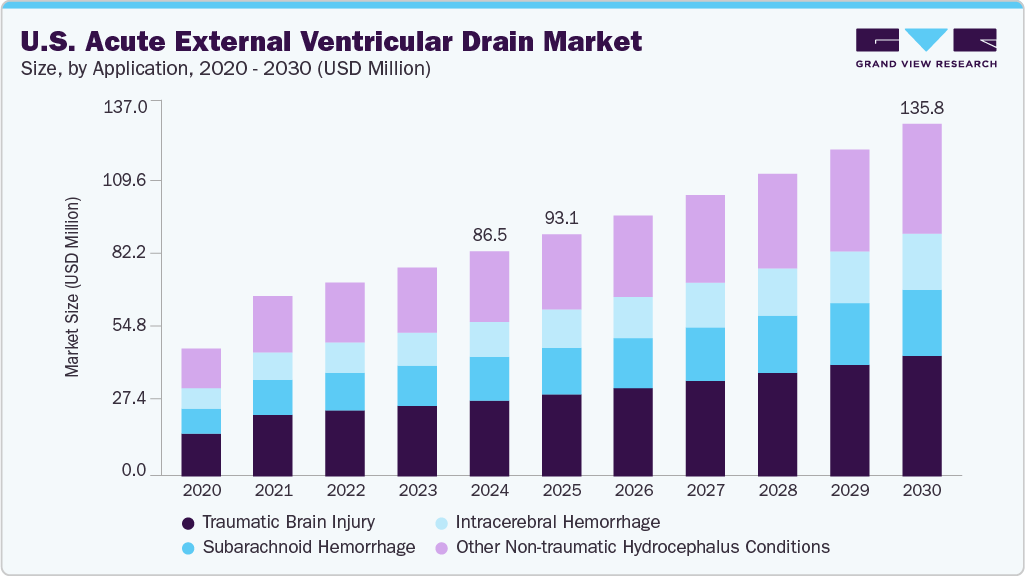

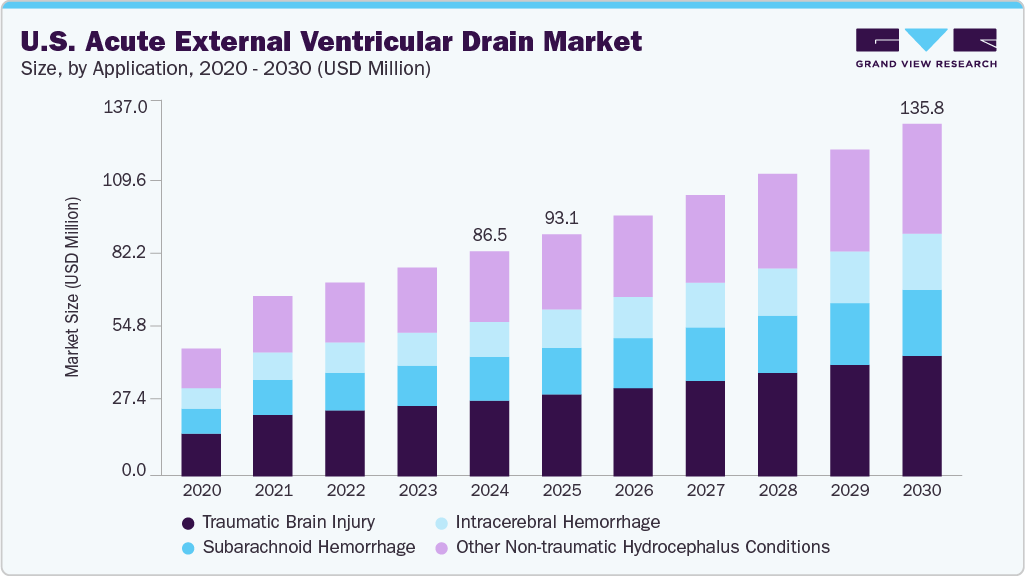

The U.S. acute external ventricular drain market size was valued at USD 86.5 million in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2030. The growth is expected to be driven by the rising prevalence of non-traumatic hydrocephalus, increased demand for minimal or noninvasive neurosurgeries, and the rising adoption of technologically improved devices. With the growing incidence of accidents, sports injuries, and strokes, the demand for external ventricular drain (EVD) procedures is rising steadily.

As the aging population expands, the prevalence of conditions like strokes and aneurysms rises, further boosting the need for EVD procedures. For instance, according to the World Bank Group, the total population aged 65 and above in the U.S. was 49.98 million in 2018, increasing to 58.38 million in 2023. In addition, advancements in healthcare infrastructure and the rising number of emergency and trauma centers equipped to handle acute neurological cases contribute to market growth.

Technological innovations in EVD systems, such as improved catheter designs, antimicrobial coatings, and integrated monitoring capabilities, enhance patient outcomes and reduce infection risks, making these devices more appealing to healthcare providers. Hospitals and clinics increasingly adopt these advanced EVD systems to improve treatment efficiency and minimize complications. Moreover, the growing emphasis on minimally invasive neurosurgical techniques supports the demand for EVDs, as they offer a less invasive solution for managing CSF drainage than traditional surgical methods.

Another factor fueling market expansion is the rising healthcare expenditure in the U.S., coupled with favorable reimbursement policies for neurological procedures. According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending increased by 7.5% in 2023, reaching USD 4.9 trillion, which amounts to USD 14,570 per person. Insurance coverage for EVD placements and related treatments ensures broader patient access, encouraging hospitals to invest in these devices. Furthermore, increased physician awareness about the benefits of early and effective CSF management in critical care settings drives higher adoption rates.

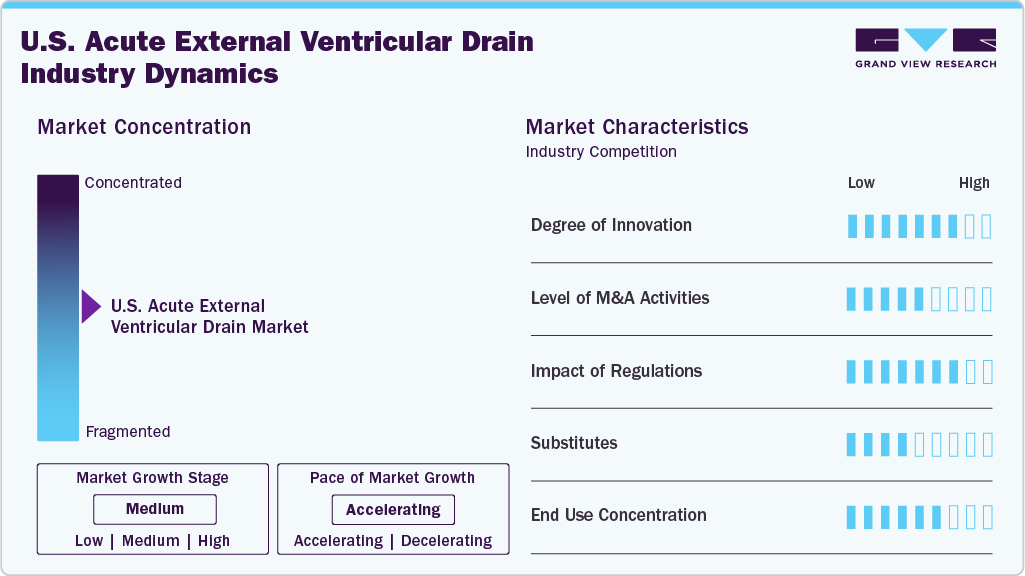

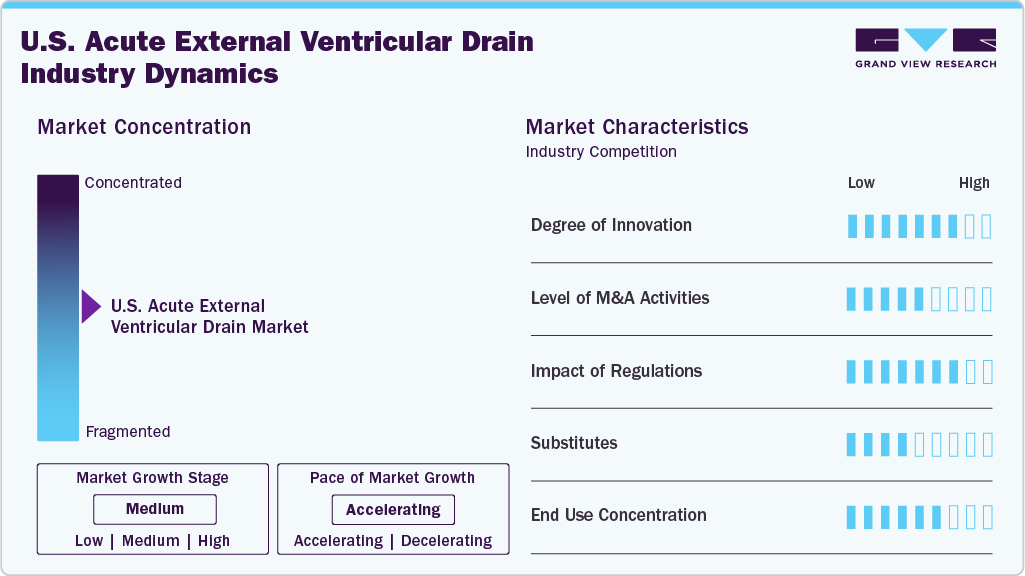

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The acute external ventricular drain market exhibits moderate to high innovation, driven by advancements in catheter materials, antimicrobial coatings, and integrated monitoring systems.

In March 2025, Anuncia Medical received FDA Breakthrough Device Designation for its ReFlow EVD system. The device enhances acute CSF management and expands the company’s neurocritical care portfolio alongside its existing ReFlow solutions.

Leading companies benefit from extensive research and development capabilities, allowing them to offer advanced, FDA-approved products that meet stringent clinical standards. In addition, long-standing relationships with healthcare providers and hospitals create loyalty and trust, making it difficult for new entrants to compete.

Application Insights

Traumatic brain injury dominated the market with a 33.9% share in 2024 and is expected to grow significantly over the forecast period. The rising incidence of TBIs due to accidents, falls, sports injuries, and military-related trauma increases the demand for emergency neurosurgical interventions, where EVDs are critical for managing ICP and draining CSF. The aging population is particularly vulnerable to falls, further contributing to TBI cases. In February 2025, according to an article in the National Library of Medicine, TBI affected approximately 1.7 million individuals annually in the U.S., with higher prevalence observed among older adolescents (ages 15 to 19) and adults over 65.

Intracerebral hemorrhage is anticipated to grow at a significant CAGR of 7.9% during the forecast period. This growth is attributed to several key factors, including the rising prevalence of hypertension, a leading cause of spontaneous ICH, which is increasing the incidence of hemorrhagic strokes, particularly among the aging population. As more patients require emergency intervention to manage brain swelling and CSF drainage, EVDs become essential in critical care. In October 2024, as per a CDC report, between August 2021 and August 2023, 47.7% of U.S. adults had hypertension.

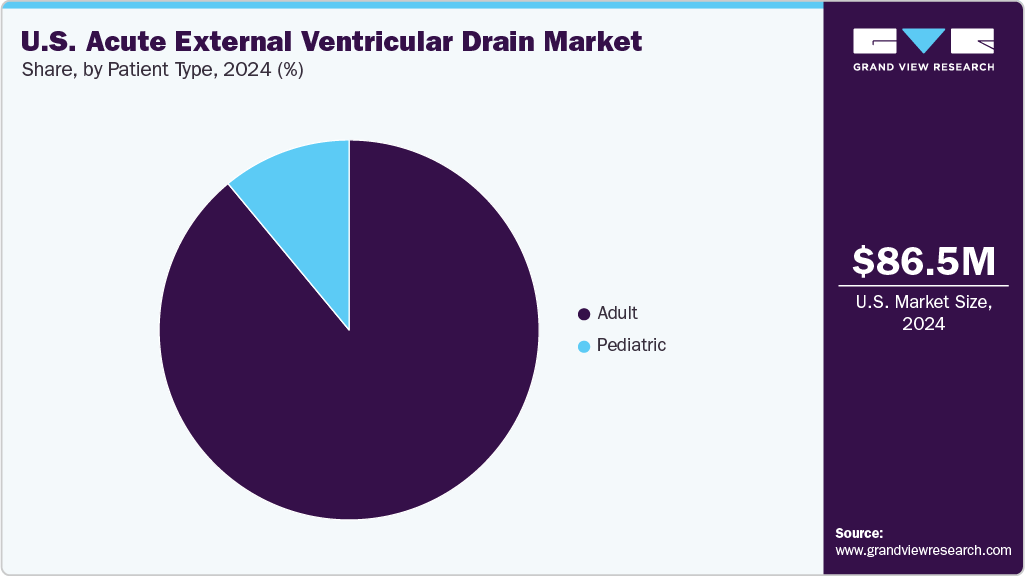

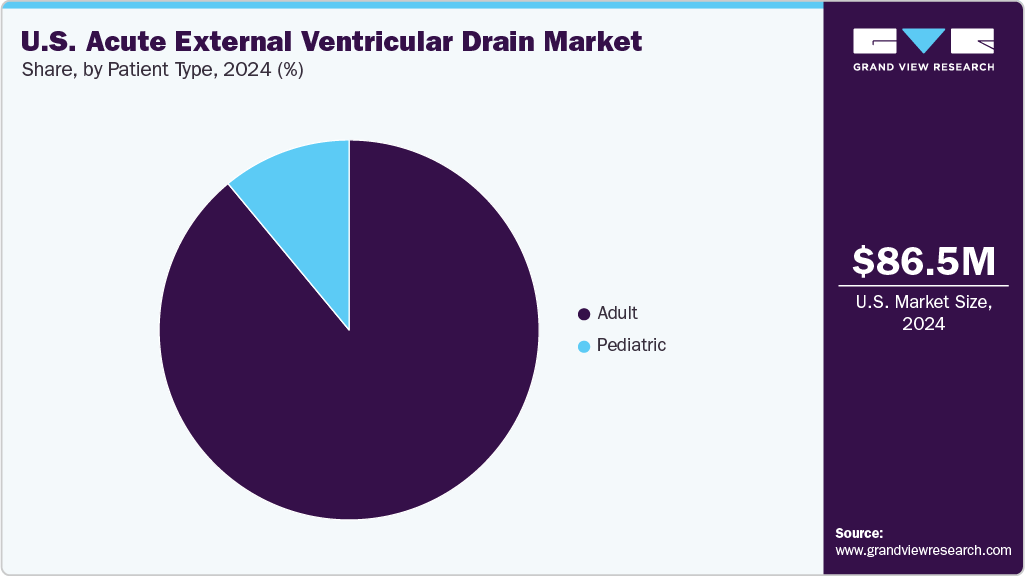

Patient Type Insights

The adult segment held a dominant market share in 2024, primarily due to the high incidence of TBIs and other neurological conditions in this population group. According to the University of Florida Health, in 2021, approximately 1.4 million people in the U.S. sustained a TBI. Around 214,000 cases required hospitalization, over 69,000 resulted in death, and about 1.1 million were treated and released the same day. This substantial patient pool, combined with an aging population more susceptible to strokes and hemorrhages, creates sustained demand for EVD procedures.

The pediatric segment is expected to grow at the fastest CAGR over the forecast period. The rising incidence of neurological conditions such as hydrocephalus and traumatic brain injuries among children drives this accelerated growth. Increased awareness, early diagnosis, and improvements in pediatric neurosurgical care have also contributed to higher demand for EVD systems in this age group.

Key U.S. Acute External Ventricular Drain Company Insights

Organizations focus on increasing their customer base to gain a competitive edge in the market. Therefore, key players are undertaking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Integra LifeSciences Corporation is a global medical technology company offering a broad portfolio of innovative products to manage conditions such as brain tumors, TBI, hydrocephalus, hemorrhagic stroke, and various neurological disorders. In the field of external ventricular drains (EVDs), Integra provides products such as the Codman Bactiseal EVD catheter and AccuDrain system.

Key U.S. Acute External Ventricular Drain Companies:

- Medtronic

- Integra LifeSciences Corporation

- Anuncia Medical, Inc.

- Natus

- Fuji Systems

- B Braun/Aesculap

- Boston Scientific

- Abbott

U.S. Acute External Ventricular Drain Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 93.08 million

|

|

Revenue forecast in 2030

|

USD 135.80 million

|

|

Growth rate

|

CAGR of 7.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, patient type

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Medtronic, Integra LifeSciences Corporation , Anuncia Medical, Inc., Natus, Fuji Systems, B Braun/Aesculap, Boston Scientific, Abbott

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Acute External Ventricular Drain Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. acute external ventricular drain market report based on application, and patient type.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)