Market Size & Trends

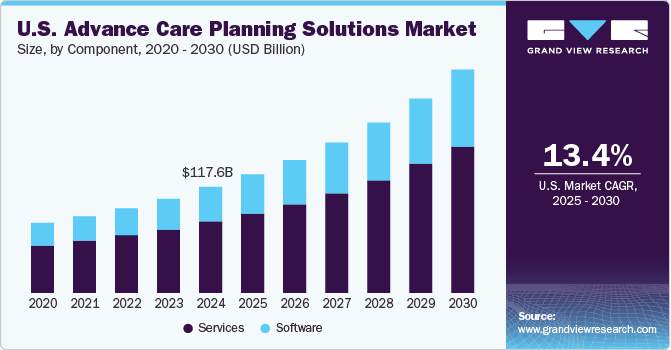

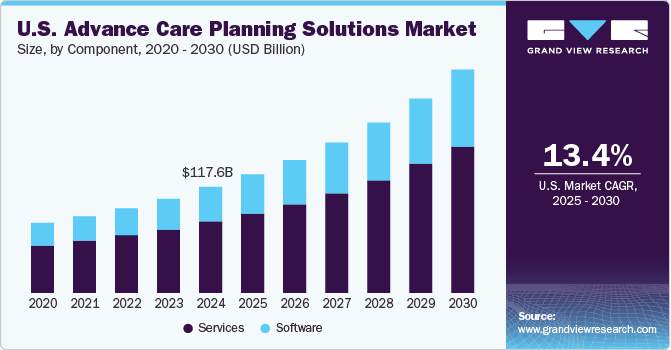

The U.S. advance care planning solutions market size was estimated at USD 117.6 billion in 2024 and is forecasted to grow at a CAGR of 13.4% from 2025 to 2030, driven by the growing elderly population. As the number of older adults increases, the need for individuals to articulate their healthcare preferences becomes more critical. This demographic shift leads to an increased demand for advanced care planning solutions, allowing individuals to document their wishes regarding medical treatment and end-of-life care. Therefore, healthcare providers are increasingly focused on facilitating these discussions to ensure patients preferences are respected.

Another important factor influencing the U.S. advance care planning solutions industry is the increased focus on patient-centered care. Healthcare systems recognize the importance of involving patients in their treatment options and end-of-life care decisions. This shift toward personalized care enhances patient satisfaction and improves health outcomes by aligning medical interventions with patients values and preferences. As healthcare providers adopt this approach, there is a growing need for advance care planning solutions that support meaningful conversations between patients, families, and providers, driving further market growth.

In addition, the rising prevalence of chronic diseases significantly impacts the demand for advanced care planning solutions. Chronic conditions often require ongoing management and support for healthcare decisions, making it essential for individuals to have a plan. Advance care planning enables patients to make informed choices about their treatment options, reducing unnecessary interventions and hospitalizations at the end of life. This proactive approach improves patients' quality of life and alleviates pressure on healthcare systems by promoting efficient resource use. As a result, the increasing incidence of chronic diseases contributes to expanding the U.S. advance care planning solutions industry as more individuals seek to prepare for their future healthcare needs.

Component Insights

The services segment dominated the market with the largest revenue share of 67.3% in 2024, driven by the increasing demand for personalized guidance in healthcare decision-making. As more individuals recognize the importance of planning for their future medical care, they seek professional services to help them navigate complex healthcare choices and complete necessary documentation. This trend highlights the critical role that service providers play in facilitating meaningful discussions about end-of-life care, ensuring that patients preferences are clearly articulated and respected. The growing awareness of advance care planning benefits further supports the expansion of this segment within the U.S. advance care planning solutions industry.

The software segment is projected to grow at a highest CAGR of 14.2% over the forecast period, fueled by advancements in technology that enhance user engagement and accessibility to advance care planning tools. Digital platforms allow individuals to create, manage, and share their advance care planning documents more efficiently than traditional methods. As technology continues to evolve, these solutions become increasingly user-friendly and integrated with other healthcare systems, encouraging more people to participate in their own healthcare decision-making. This shift toward digital solutions is a significant driver of growth within the U.S. advance care planning solutions market.

Types of ACP Documents Insights

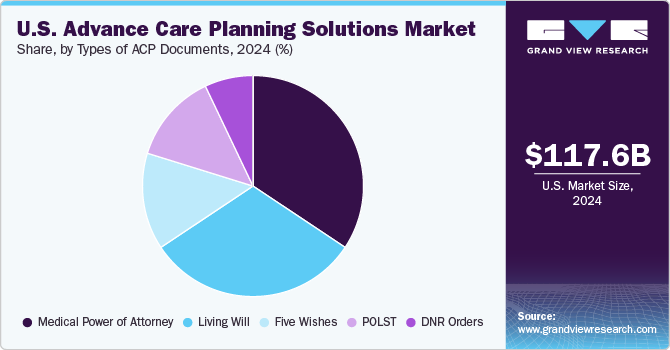

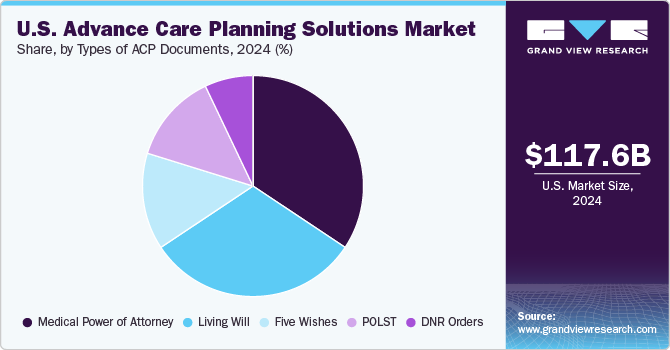

The medical power of attorney segment dominated the market with the largest revenue share in 2024, attributed to its essential role in designating a trusted individual to make healthcare decisions on behalf of someone incapacitated. This legal document provides individuals with peace of mind, knowing that their healthcare choices will be honored even when they cannot communicate with them. The importance of having a medical power of attorney reflects its critical function in ensuring effective decision-making during health crises, contributing to its dominance in the U.S. advance care planning solutions industry.

The five wishes segment is projected to grow at the highest CAGR over the forecast period due to its comprehensive approach that addresses medical preferences and emotional and personal needs at the end of life. This document resonates with individuals seeking a holistic way to express their desires regarding healthcare and personal values, making it an appealing choice for many. As awareness of this option increases, more people are likely to adopt it as part of their advance care planning efforts, driving growth in this area within the U.S. advance care planning solutions market.

End Use Insights

The healthcare payers segment dominated the market with the largest revenue share in 2024 driven by their crucial role in managing costs associated with end-of-life care while ensuring that patients receive appropriate services based on their documented preferences. Payers are increasingly recognizing that effective advance care planning can lead to better health outcomes and reduced overall costs by preventing unnecessary treatments and hospitalizations. This understanding encourages healthcare payers to support initiatives that promote advance care planning solutions within their networks, thereby enhancing their market presence in the U.S. advance care planning solutions industry.

The healthcare providers segment is projected to grow at the highest CAGR over the forecast period due to an increasing focus on patient-centered care within healthcare settings. Providers prioritize improved communication with patients regarding their treatment preferences and end-of-life decisions, enhancing patient satisfaction and outcomes. As healthcare organizations integrate advance care planning practices into their standard operations, this segment anticipated expansion within the U.S. advance care planning solutions market, reflecting a commitment to honoring patients' wishes and improving overall quality of care.

Key U.S. Advance Care Planning Solutions Company Insights

Some key companies operating in the market include MyDirectives, Inc.; Iris (Aledade); Bronson Healthcare; ACP Decisions; and Sharp HealthCare. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands through U.S. advance care planning solutions.

-

MyDirectives, Inc. offers a comprehensive product and service suite to facilitate advance care planning. Their flagship product is the MyDirectives platform, allowing users to create and manage digital advance care plans easily. Users can document their healthcare preferences, upload existing documents, and designate individuals to decide.

-

Bronson Healthcare offers a comprehensive advance care planning program that provides one-on-one support to help individuals understand their healthcare wishes and complete advance directive documents. This program includes educational resources, such as guides and worksheets, to facilitate discussions with family members about personal values and preferences.

Key U.S. Advance Care Planning Solutions Companies:

- MyDirectives, Inc.

- Iris (Aledade)

- Bronson Healthcare

- ACP Decisions

- Sharp HealthCare.

- WiserCare

- VyncaCare.

- ThoroughCare, Inc.

- Honor My Decisions LLC

- Thanacare

Recent Developments

-

In October 2024, MyDirectives, Inc. announced a strategic agreement with the National POLST collaborative to enhance advance care planning solutions. This partnership aims to integrate the MyDirectives digital platform with the POLST (Physician Orders for Life-Sustaining Treatment) framework, improving the communication of patients healthcare preferences. By combining their resources, both organizations seek to empower individuals and healthcare providers to make informed decisions about end-of-life care.

-

In October 2020, WiserCare announced a partnership with UnityPoint Health to enhance Digital Advance Care Planning (ACP) services for patients across Iowa, Illinois, and Wisconsin. This collaboration aims to empower patients and their families to make informed healthcare decisions aligned with their preferences, initially focusing on medicare patients before expanding to all adult patients.

U.S. Advance Care Planning Solutions Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 131.7 billion

|

|

Revenue forecast in 2030

|

USD 246.9 billion

|

|

Growth rate

|

CAGR of 13.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Component, types of ACP documents, end use.

|

|

Key companies profiled

|

MyDirectives, Inc..; Iris (Aledade); Bronson Healthcare; ACP Decisions; Sharp HealthCare.; WiserCare; VyncaCare.; ThoroughCare, Inc.; Honor My Decisions LLC; Thanacare.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Advance Care Planning Solutions Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. advance care planning solutions market report based on component, types of ACP documents, end use:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Types of ACP Documents Outlook (Revenue, USD Billion, 2018 - 2030)

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers