- Home

- »

- Medical Devices

- »

-

U.S. Advanced Wound Care Market Size & Share ReportGVR Report cover

![U.S. Advanced Wound Care Market Size, Share & Trends Report]()

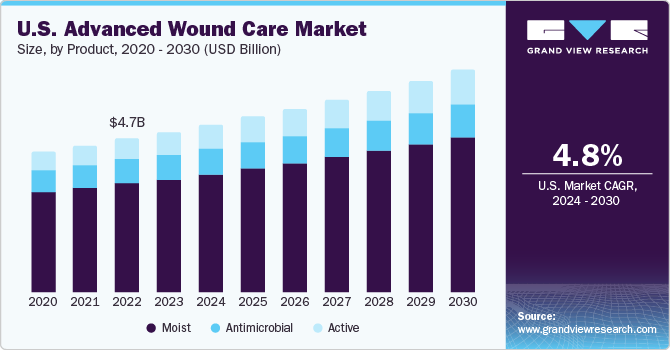

U.S. Advanced Wound Care Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial, Active), By Application (Chronic, Acute), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-424-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The U.S. advanced wound care market size was valued at USD 2.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.43% over the forecast period from 2023 to 2030. Major factors contributing to the market growth are rising incidence of chronic wounds, increasing demand for reducing hospital stay, and rising number of surgeries in the U.S. Increasing incidence of chronic diseases such as diabetes, cancer, and other autoimmune diseases are anticipated to increase the incidence rate of chronic wounds in the U.S. For instance, according to the international diabetes federation, there were about 32.2 million adults with diabetes in the U.S., the number is expected to reach 36.2 million by 2045.

Increasing incidence of accidents such as road accidents, and trauma events across the globe is anticipated to drive the market growth. For instance, as per the Association for Safe International Road Travel, approximately 1.35 million people die every year in a road crash, whereas on an average 3,700 people lose their life every day in RTA (road traffic accidents). Thus, rising number of accidents is expected to boost the demand for advanced wound care products, which is expected to boost market growth over the forecast period.

The rising number of surgeries is also one of the major factors driving the market growth. The number of surgeries is increasing owing to the rising prevalence of chronic conditions. Wound care products, thus, are increasingly being used to prevent surgical site infections. Most surgical wounds, post cancer surgery, are relatively large in size and deep, releasing exudates that require regular management. Advanced wound care products such as hydrogel, alginate, and foam help manage large wounds, thereby significantly reducing the risk of infection. Thus, rising incidence of chronic diseases is another factor which is expected to boost the demand for wound care products.

The prevalence of chronic disorders that affect skin integrity, such as diabetes and peripheral vascular disease (venous hypertension, arterial insufficiency), is growing with rising geriatric population. These disorders frequently result in skin disintegration, ulceration, and development of persistent wounds. Moreover, wound treatment becomes more difficult in the elderly due to increased risk of infection, weak immune system, especially in case of severe wounds, thereby boosting the need for advanced wound care products. For instance, elderly people (aged ≥65) are currently the fastest-growing group of the general population in the U.S. The National Population Projections by the US Census Bureau, states that, nearly one in four U.S. citizens are likely to be an older adult by 2060.

Technological advancements are also projected to have a significant impact on advanced wound care industry in the coming years. The quality of life of patients suffering from chronic wounds improves as technology advances and becomes more affordable. Traditional wound care and closure products are gradually being replaced by advanced wound care & closure products due to their efficacy and effectiveness in wound management by allowing quicker healing.

Some of the major technological innovations in this field that are expected to be commercialized soon include:

-

Nanoparticle-based wound healing and skin regeneration - bioactive molecules to applied area, maintain the drug release and specifically improve the therapeutic effectiveness of drugs

-

Smart wound dressings - track wound healing progress or to confirm the presence of infectious microbes in wounds

-

Gene therapy - induce wound healing by introducing normal healthy genes into cells,

-

Stem cell technology - hasten wound healing and skin remodeling

-

Biochips - promoting the natural wound healing procedure and in the development of tailored wound management methods

-

The micro anchor technology - efficient, noninvasive wound closure

Product Insights

Moist dressings dominated the product segment in U.S. advanced wound care market by capturing a share of 59.83%. This segment is further subdivided into foam, hydrocolloid, film, alginate, hydrogel, collagen, and other. Foam dressings segment held the largest market share of 23.8% in terms of revenue in 2022.Foams dressings are made up of hydrophilic polyurethane material which is a highly absorbent material. Foams help in absorbing moisture that aids in maintaining the integrity of tissue.

The increasing cases of burns and trauma across the globe are expected to propel the segment growth. For instance, as per the American Burn Association (ABA) every year, 450,000 people are given medical treatment due to burn injuries in the U.S. It also reported that complications of infection have accounted to be highest in burn patients. Foams are majorly used to prevent and heal the exudation of burn injuries and hence the increasing cases of such incidents is expected to surge the segment growth over the forecast period.

Hydrocolloid dressings is anticipated to witness the fastest growth over the forecast period. These are made up of gel forming agents such as Carboxy Methylcellulose (CMC) and gelatin. These materials are occlusive in nature that helps in moisture retention. Furthermore, they help in rapid healing and are impermeable to any type of bacterial infection.

Application Insights

The chronic wounds segment held the largest market share of about 60% in 2022. Increase in number of chronic wounds such as diabetic foot ulcers, venous leg ulcers, pressure ulcers is expected to increase the demand for wound care products. Moreover, a rise in number of people suffering from diabetes is expected to further increase the number of diabetic foot ulcer patients, thereby propelling the segment growth. For instance, as per National Institute of Diabetes and Digestive Kidney Diseases, an estimated of 34.2 Million people have diabetes, which comprises of 10.5% of the U.S.

The acute wounds segment is anticipated to witness fastest growth of 5.54% over the forecast period.Rising incidence of burn and trauma injuries in the U.S. majorly contributes to the segment growth. For instance, according to Joye Law Firm, the following are the statistics about burn injuries in the US:

-

On average, there are 450,000 burn injuries in the U.S.

-

Each year, about 3,500 people are fatally injured in a fire or burn accident

-

Approximately 45,000 people are hospitalized each year for burn injuries. Of those who are hospitalized, 25,000 are admitted to specialized burn centers.

Similarly, the CDC also states that in the U.S. approximately 136 million patients visit emergency rooms per year, with around 30% visits associated with injuries. As a result, a dramatic increase in the number of hospitals and hospital admissions raises demand for wound care products, propelling market growth.

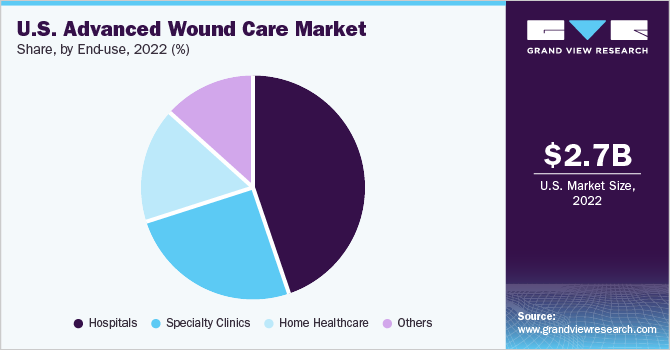

End-use Insights

Based on end-use, the U.S. advanced wound care market has been segmented into hospitals, specialty clinics, home healthcare, and others. The hospitals segment held the largest market share of around 44.9% in 2022. The increasing cases of diabetic foot ulcers and venous leg ulcers are the major factors driving the segment growth. In addition, increasing cases of surgical wounds due to rising number of surgeries is also expected to boost the segment growth.

The home healthcare segment is expected to witness fastest growth with a CAGR of 6.14% over the forecast period.The introduction of single-use NPWT systems revolutionized wound care in homecare settings. These devices are lightweight, portable, canister-free, and are easy to use. In addition, cost-effectiveness of such therapy of treating wounds also encourages patients to adopt homecare settings over hospital stays. Furthermore, rising research & development related to such therapies by major market players to promote home healthcare is also anticipated to contribute to the segment growth over the forecast period. For instance, PICO and RENASYS GO are easy to use portable NPWT devices, manufactured by Smith & Nephew and are widely used at home.

Key Companies & Market Share Insights

The market is highly fragmented in nature with the presence of several small and large manufacturers. Competitive rivalry and degree of competition in the wound market is expected to intensify over the forecast period due to the presence of many players in the market.

Furthermore, leading players are involved in collaborations, product launches, mergers and acquisitions to strengthen their product portfolios. For instance, in January 2022, Convatec Group entered into the attractive wound biologics segment through the acquisition of Triad Life Sciences Inc. This is expected to strengthen Convatec’s Advanced Wound Care business in the US – highly complementary product portfolios and commercial expertise. Some of the prominent players in the U.S. advanced wound care market include:

-

Smith+Nephew

-

Mölnlycke Health Care AB

-

ConvaTec Group PLC

-

Ethicon (Johnson & Johnson)

-

URGO

-

Coloplast Corp.

-

3M

-

Integra LifeSciences

-

PAUL HARTMANN AG

-

McKesson

-

Hydrofera

-

Medline Industries, Inc.

-

Organogenesis

-

Kerecis

U.S. Advanced Wound Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.1 billion

Growth rate

CAGR of 5.43% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Smith+Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Ethicon (Johnson & Johnson); URGO; Coloplast Corp.; 3M; Integra LifeSciences; PAUL HARTMANN AG; McKesson; Hydrofera; Medline Industries, Inc.; Organogenesis; Kerecis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Advanced Wound Care Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. advanced wound care market based on product, application, and end-use:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Moist

-

Foam

-

Hydrocolloid

-

Film

-

Alginate

-

Hydrogel

-

Collagen

-

Other Advanced Dressings

-

-

Antimicrobial

-

Silver

-

Non-silver

-

-

Active

-

Biomaterials

-

Skin-substitute

-

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Chronic wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Others

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The US advanced wound care market size was estimated at USD 2.7 billion in 2022 and is expected to reach USD 2.8 billion in 2023.

b. The US advanced wound care market is expected to grow at a compound annual growth rate of 5.43% from 2023 to 2030 to reach USD 4.1 billion by 2030.

b. Some key players operating in the US advanced wound care market include Smith & Nephew PLC, Mölnlycke Health Care AB, Acelity, ConvaTec Group PLC, Johnson & Johnson, Baxter, Coloplast Corp., Medtronic, 3M, Medline Industries, Inc., and Integra LifeSciences.

b. The foam dressings segment dominated the US advanced wound care market with a share of 23.8% in 2022. This is attributable to the usage of this product in most wound care treatments, the increase in technological advancement, and the increase in the number of sports-related injuries.

b. Key factors that are driving the US advanced wound care market growth include the rising number of sports injuries, increasing prevalence of chronic and acute wounds, a growing number of road accident cases, and changing lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.