- Home

- »

- Advanced Interior Materials

- »

-

U.S. Aerospace Fasteners Market Size, Industry Report 2033GVR Report cover

![U.S. Aerospace Fasteners Market Size, Share & Trends Report]()

U.S. Aerospace Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Aircraft Type (Commercial, Business & General Aviation, Military), By Product (Bolts, Nuts, Screws, Rivets), And Segment Forecasts

- Report ID: GVR-4-68040-656-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aerospace Fasteners Market Summary

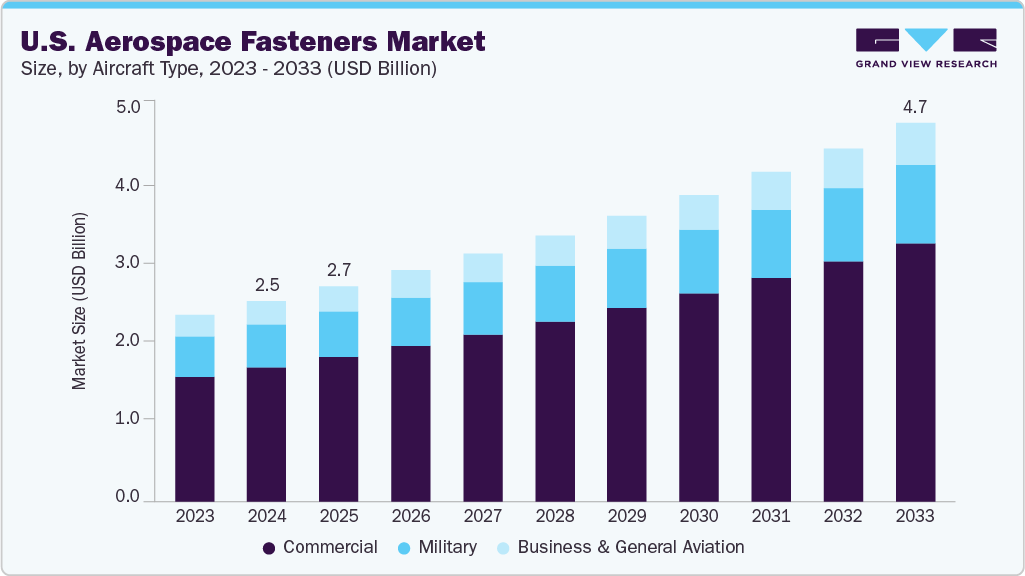

The U.S. aerospace fasteners market size was estimated at USD 2.49 billion in 2024 and is projected to reach USD 4.70 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. The market is witnessing a steady rise in demand due to the resurgence of the aviation industry and increased aircraft production.

Key Market Trends & Insights

- By aircraft type, the commercial segment is expected to grow at fastest CAGR of 7.5% over the forecast period.

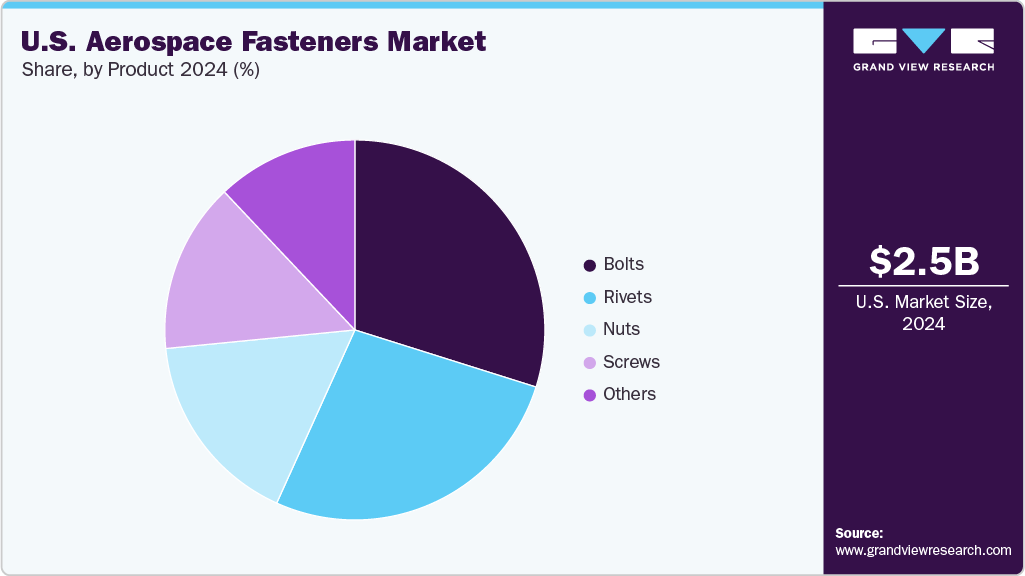

- By product, the rivets segment is expected to grow at fastest CAGR of 7.8% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.49 Billion

- 2033 Projected Market Size: USD 4.70 Billion

- CAGR (2025-2033): 7.3%

As commercial airlines work to modernize and expand their fleets, the need for high-performance, lightweight, and durable fastening components has grown significantly. In addition, the defense sector continues to be a major contributor, with ongoing procurement and maintenance of military aircraft driving consistent demand for aerospace-grade fasteners. The expanding space industry and the rise of new aerial platforms, including unmanned aerial vehicles and eVTOLs, further amplify the requirement for highly specialized fastener solutions.

Several factors are driving this demand surge. One key driver is the aviation industry’s focus on fuel efficiency and weight reduction, prompting a shift toward advanced materials such as titanium and high-strength aluminum alloys. In addition, the emphasis on safety, performance, and regulatory compliance necessitates precision-engineered fastening systems. The integration of advanced electronics and sensors into aircraft also requires miniaturized and custom fasteners that can withstand extreme conditions. Moreover, increased government investment in defense and aerospace programs supports a strong pipeline of new aircraft, which in turn sustains fastener demand across both original equipment manufacturers and the maintenance, repair, and overhaul (MRO) segment.

Innovations in the U.S. aerospace fasteners market are centered around material science, digital manufacturing, and sustainability. Manufacturers are increasingly adopting additive manufacturing and automation to produce fasteners with complex designs while improving efficiency and reducing waste. Enhanced coatings and finishes are being developed to improve corrosion resistance and eliminate the use of hazardous substances. Digital technologies such as AI, IoT, and blockchain are being utilized for quality control, supply chain transparency, and lifecycle management of components. These innovations not only improve the performance and reliability of fasteners but also align with the aerospace industry’s broader goals of safety, sustainability, and operational excellence.

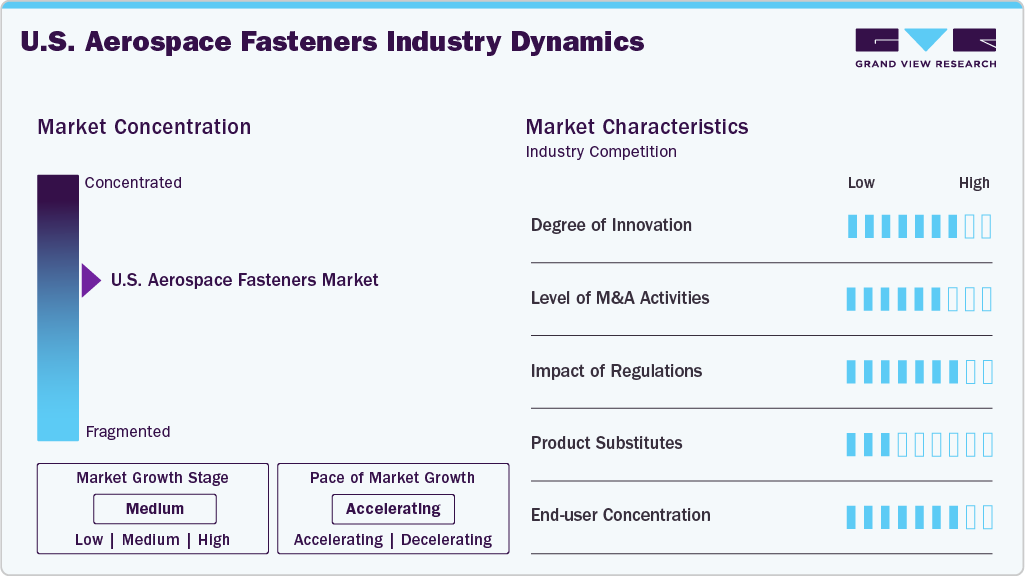

Market Concentration & Characteristics

The U.S. aerospace fasteners market is moderately to highly concentrated, dominated by a few major players with strong technological capabilities, long-term contracts, and established relationships with aircraft manufacturers and defense agencies. Companies such as Howmet Aerospace, LISI Aerospace, Precision Castparts, and TriMas Corporation hold significant market share, leveraging their scale and advanced production capabilities to meet stringent aerospace standards. The high entry barriers-such as regulatory certifications, capital intensity, and the need for precision engineering-limit new competition. This consolidation allows leading firms to influence pricing and innovation while maintaining tight control over supply chain integration, especially in military and commercial aircraft segments.

Product substitutes for aerospace fasteners are limited, given the specific strength, weight, and durability requirements in aerospace applications. However, innovations in adhesive bonding and composite joining techniques are emerging as partial alternatives, particularly in lightweight aircraft structures. Despite this, traditional mechanical fasteners continue to dominate due to their proven reliability, inspectability, and ease of disassembly for maintenance. While adhesives and hybrid joining systems may supplement fasteners in specific use cases, they are unlikely to replace them at scale in critical aerospace assemblies. As a result, the demand for advanced, high-performance fasteners remains resilient, especially as aircraft designs grow more complex.

Aircraft Type Insights

The commercial segment held the highest revenue market share of 67.0% in 2024, primarily due to the surge in aircraft production and fleet modernization efforts. As airlines continue to ramp up orders to meet travel demand, commercial OEMs rely heavily on high-quality aluminum and titanium fasteners to ensure structural integrity and fuel efficiency. Aluminum fasteners, favored for their corrosion resistance and light weight, currently hold a significant share of the market, especially within commercial airframes. With North America and specifically the U.S. holding a substantial portion of the global aerospace fasteners market, Boeing's output and the aggressive production schedules of other major aircraft manufacturers continue to reinforce this segment’s dominance.

The military segment is expected to grow at a significant CAGR of 7.0% over the forecast period in the U.S., driven by expanding defense budgets, modernization programs, and the deployment of advanced military platforms. Escalating geopolitical tensions, such as those involving NATO commitments and technological competition in unmanned systems, have led to increased Pentagon spending on aircraft and drone programs, a trend that directly boosts demand for high-performance military-grade fasteners. Military aviation requires fasteners made from sophisticated materials such as high-strength alloys and titanium, capable of withstanding extreme loading conditions and harsh environments. As defense appropriations continue to rise and programs prioritize readiness and fleet upgrades, the military aerospace fasteners market is expected to maintain its rapid growth trajectory.

Product Insights

Bolts segment held the highest revenue of 29.9% in 2024 in the U.S. market, due to their critical role in providing strong, secure, and removable joints in aircraft assembly. These fasteners are essential in areas requiring periodic inspection, maintenance, or part replacement, such as engines, landing gear, and structural components. Their superior tensile strength and reliability make them the preferred choice in high-stress and load-bearing applications. Aircraft manufacturers also favor bolts for their compatibility with a wide range of materials, including titanium and high-strength steel, which are commonly used in both commercial and military aircraft.

The rivets segment is expected to grow at the fastest CAGR of 7.8% over the forecast period. Their lightweight nature and ability to form permanent, vibration-resistant joints make them ideal for use in the skin panels and airframe structures of modern aircraft. Rivets are increasingly being adopted in new aircraft designs due to advancements in automation and riveting technology, which enhance production efficiency and consistency. The rising demand for fuel-efficient, lightweight aircraft further accelerates the use of rivets, especially in composite and aluminum-based structures. This trend reflects the industry’s shift toward optimizing both performance and manufacturing speed.

Key U.S. Aerospace Fasteners Company Insights

Some of the key players operating in the U.S. market include Howmet Aerospace, Precision Castparts Corp.

-

Howmet Aerospace is a leading manufacturer of high-performance aerospace fasteners and engineered metal products, specializing in titanium, aluminum, and superalloy components for commercial and military aircraft. The company produces a wide range of aerospace fasteners including bolts, screws, and specialty components used in critical structural and engine applications.

-

PCC is a major supplier of complex metal components and fasteners for the aerospace industry, known for its expertise in forging, casting, and machining high-strength materials used in engines and structural applications. It manufactures aerospace-grade fasteners through its SPS Technologies division, supplying high-strength bolts, nuts, and rivets for airframe and engine assembly.

Boeing Distribution Services, M.S. Aerospace are some of the emerging market participants in aerospace fasteners market.

-

Formerly Aviall, this Boeing subsidiary supplies a broad range of aerospace parts and fasteners, serving as a key logistics and supply chain partner for OEMs and MRO operations across the aerospace sector. It distributes thousands of aerospace fastener types, including threaded, non-threaded, and specialty fasteners, supporting Boeing’s internal needs and third-party clients.

-

M.S. Aerospace specializes in manufacturing high-strength, close-tolerance aerospace fasteners, focusing on critical applications in jet engines, airframes, and defense systems with full AS9100 certification. The company is dedicated solely to aerospace fasteners, producing bolts and screws engineered for extreme environments and demanding performance standards.

Key U.S. Aerospace Fasteners Companies:

- Howmet Aerospace

- Precision Castparts Corp.

- 3V Fasteners

- LISI Aerospace

- Boeing Distribution Services

- TriMas Aerospace

- M.S. Aerospace

- Fastenal Aerospace

- National Aerospace Fasteners Corp.

- B&B Specialties

Recent Developments

-

In January 2025, Howmet Aerospace introduced the FC43 structural panel fastener with an innovative solid-stud, self-retaining design, which means it remains securely attached to the panel even when disengaged helping prevent foreign object damage (FOD), a critical concern in aircraft manufacturing and maintenance.

-

In March 2025, TriMas Aerospace secured a multi-year global fastener manufacturing contract with Airbus, expanding output across its California facilities.

U.S. Aerospace Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.67 billion

Revenue forecast in 2033

USD 4.70 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aircraft type, product

Country scope

U.S

Key companies profiled

Howmet Aerospace; Precision Castparts Corp.; 3V Fasteners; LISI Aerospace; Boeing Distribution Services; TriMas Aerospace; M.S. Aerospace; Fastenal Aerospace; National Aerospace Fasteners Corp.; B&B Specialties

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aerospace Fasteners Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. aerospace fasteners market report based on aircraft type, and product:

-

Aircraft Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Business & General Aviation

-

Military

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Bolts

-

Nuts

-

Screws

-

Rivets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. aerospace fasteners market size was estimated at USD 2.49 billion in 2024 and is expected to reach USD 2.67 billion in 2025.

b. The U.S. aerospace fasteners market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033 to reach USD 4.70 billion by 2033.

b. The commercial segment in the U.S. market accounted for the largest revenue share of 67.0% in 2024, due to the surge in aircraft production and fleet modernization efforts.

b. Some of the prominent companies in the U.S. aerospace fasteners market include Howmet Aerospace, Precision Castparts Corp., 3V Fasteners , LISI Aerospace, Boeing Distribution Services, TriMas Aerospace, M.S. Aerospace, Fastenal Aerospace, National Aerospace Fasteners Corp., and B&B Specialties.

b. Key factors driving the U.S. aerospace fasteners market include rising aircraft production, defense modernization, lightweight material adoption, and advancements in fastening technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.