- Home

- »

- Advanced Interior Materials

- »

-

U.S. Aluminum Composite Material Market Size Report, 2033GVR Report cover

![U.S. Aluminum Composite Material Market Size, Share & Trends Report]()

U.S. Aluminum Composite Material Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Construction, Signage Industry, RV/Trailer Construction Skins, Others), And Segment Forecasts

- Report ID: GVR-4-68040-696-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aluminum Composite Material Market Summary

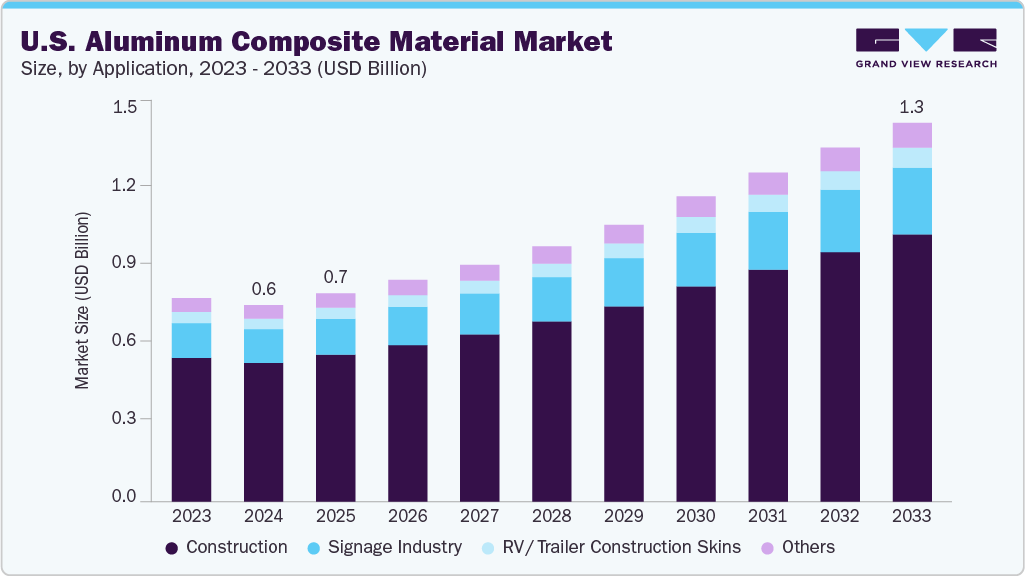

The U.S. aluminum composite material market size was estimated at USD 0.67 billion in 2024 and is projected to reach USD 1.29 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033, driven by the robust demand in the commercial construction sector. As the country continues to invest in modernizing office buildings, retail centers, airports, and educational institutions, ACMs are increasingly used for exterior cladding, curtain walls, and architectural facades.

Key Market Trends & Insights

- By application, the construction segment led the market and accounted for the largest revenue share of 70.6% in 2024

- By application, the signage industry segment is expected to grow at the fastest CAGR of 8.1% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 0.67 Billion

- 2033 Projected Market Size: USD 1.29 Billion

- CAGR (2025-2033): 7.8%

Their lightweight structure, ease of installation, and superior weather resistance make them a preferred application for high-performance building envelopes. Furthermore, the aesthetic versatility of ACMs aligns well with contemporary architectural designs, thereby boosting their adoption across both new developments and renovation projects. Stringent building codes and fire safety regulations across the United States have propelled the demand for fire-rated ACM panels. Regulatory authorities such as the International Building Code (IBC) and local jurisdictions enforce strict standards for applications used in high-rise and public buildings. In response, manufacturers have developed ACM products with non-combustible cores that meet these safety requirements. The growing awareness of fire risks in urban environments, combined with compliance-driven procurement in public and institutional construction, continues to drive the demand for high-quality, safety-certified aluminum composite applications in the U.S. market.

Technological innovations in ACM manufacturing are enhancing product performance, including improved thermal insulation, acoustic properties, and recyclability. These advancements align with the growing trend toward sustainable and energy-efficient construction in the U.S. market. ACMs contribute to LEED certifications and green building initiatives by offering longevity, reduced maintenance needs, and the potential for end-of-life recycling. Moreover, increased investment in research and development by domestic manufacturers is yielding advanced panel solutions that cater to evolving environmental regulations and performance standards, reinforcing their value in sustainable architecture.

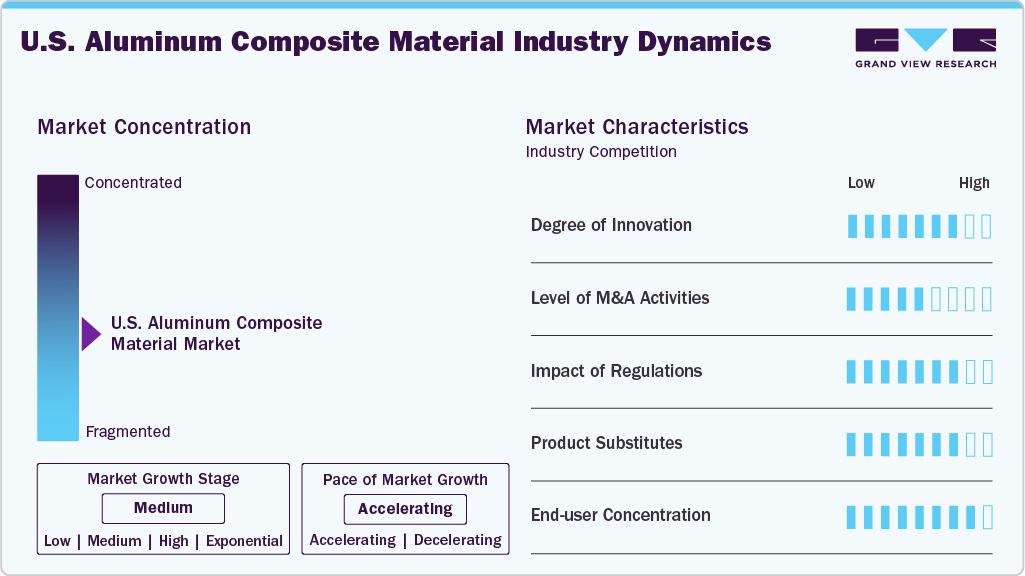

Market Concentration & Characteristics

The U.S. aluminum composite application (ACM) industry exhibits moderate market concentration, with a mix of global players and regional manufacturers competing based on technological capabilities, product customization, and pricing strategies. The degree of innovation in the market is relatively high, as companies invest in developing advanced fire-resistant cores, eco-friendly applications, and high-performance coatings that meet both regulatory and aesthetic requirements. Mergers and acquisitions, though not overly frequent, play a strategic role in expanding product portfolios, enhancing geographic reach, and strengthening production capacities. Leading players often engage in collaborative ventures or technological partnerships to remain competitive in a market shaped by design innovation and sustainability demands.

Regulations have a profound impact on the U.S. ACM market, particularly those concerning fire safety, environmental performance, and building codes. Compliance with standards set by organizations such as ASTM International and the International Building Code (IBC) is critical for market participation, prompting manufacturers to consistently improve product quality and testing procedures. While substitutes such as fiber cement panels, high-pressure laminates (HPL), and traditional metal cladding exist, ACMs are preferred for their superior strength-to-weight ratio, aesthetic flexibility, and durability. The market shows a high end-user concentration in the construction sector-especially in commercial, institutional, and infrastructure projects-though demand is also rising in signage, transportation, and industrial applications, adding to the application’s versatility and long-term growth prospects.

Application Insights

The construction segment led the market and accounted for the largest revenue share of 70.6% in 2024, driven by increasing demand for modern, lightweight, and energy-efficient building materials. ACM panels are widely used for exterior cladding, curtain walls, and architectural facades due to their durability, design flexibility, and weather resistance. The push toward sustainable construction practices and LEED-certified buildings further boosts adoption. Strict building codes and fire safety regulations are encouraging the use of fire-rated ACM products. In addition, urban redevelopment projects and commercial real estate investments are supporting sustained growth. The material’s ease of installation and low maintenance needs make it ideal for large-scale

The signage industry segment is expected to grow significantly at a CAGR of 8.1% over the forecast period, driven by strong demand for visually engaging and durable display materials across retail, transportation, and corporate environments. ACM panels are valued in signage and branding due to their smooth, printable surfaces and wide array of finishes, enabling high-resolution graphics and custom branding solutions. Their lightweight and corrosion-resistant nature makes ACM ideal for both indoor and outdoor applications, including storefront displays, billboards, and wayfinding systems. As retailers and businesses increasingly prioritize brand visibility and consumer experience, the need for long-lasting and visually dynamic signage is rising. Advancements in digital printing and fabrication technologies are enhancing the efficiency of ACM-based sign production. Additionally, the material’s ease of cutting, bending, and mounting supports rapid deployment, further encouraging its adoption in the signage industry segment.

Key U.S. Aluminum Composite Material Company Insights

Some of the key players operating in the market include Arconic Corporation and 3A Composites USA Inc.

-

Arconic Corporation is a key player in the U.S. aluminum composite application market, specializing in engineered aluminum products. Through its Reynobond® brand, Arconic offers aluminum composite panels for exterior and interior architectural applications. These panels are known for their durability, fire resistance, and a wide range of finishes, catering to high-rise buildings, corporate identity projects, and signage systems.

-

3A Composites USA Inc., a subsidiary of Schweiter Technologies, produces high-quality ACM panels under the brand ALUCOBOND. The company’s product portfolio serves the architecture, transportation, and display industries. ALUCOBOND panels are praised for their rigidity, weather resistance, and design flexibility, making them a preferred choice in both commercial and institutional projects across the U.S.

Mitsubishi Chemical America and Alpolic Applications are some of the emerging market participants in the aluminum composite material industry.

-

Mitsubishi Chemical America, through its ALPOLIC division, manufactures advanced aluminum composite applications in the U.S. for a variety of architectural applications. ALPOLIC panels are engineered for high strength, excellent flatness, and superior coating performance. The company also offers fire-retardant core panels that comply with U.S. building codes, targeting exterior cladding and interior wall systems.

-

Alpolic Applications, part of Mitsubishi Chemical, operates a major production facility in Chesapeake, Virginia, serving North American markets. The company specializes in fire-resistant ACMs that meet stringent safety standards. Their offerings come in a broad range of colors, textures, and finishes, supporting the aesthetic needs of modern architectural design while maintaining durability and compliance.

Key U.S. Aluminum Composite Material Companies:

- Arconic Corporation

- 3A Composites USA Inc.

- Mitsubishi Chemical America

- Alpolic Applications

- Alucoil North America

- Reynobond (Arconic brand)

- Stacbond America

- Alfrex, LLC

- East Coast Metal Systems, Inc.

U.S. Aluminum Composite Material Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.71 billion

Revenue forecast in 2033

USD 1.29 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in KiloTons, Revenue in USD Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S

Key companies profiled

Arconic Corporation; 3A Composites USA Inc.; Mitsubishi Chemical America; Alpolic Applications; Alucoil North America; Reynobond; Stacbond America; Alfrex, LLC; East Coast Metal Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aluminum Composite Material Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. aluminum composite material market report based on application.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Signage Industry

-

RV / Trailer construction skins

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. aluminum composite application market size was estimated at USD 0.67 billion in 2024 and is expected to reach USD 0.71 billion in 2025.

b. The U.S. aluminum composite application market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 1.29 billion by 2033.

b. The construction segment led the market and accounted for the largest revenue share of 70.6% in 2024, driven by increasing demand for modern, lightweight, and energy-efficient building materials.

b. Some of the prominent companies in the aluminum composite application market include Arconic Corporation, 3A Composites USA Inc., Mitsubishi Chemical America, Alpolic Applications, Alucoil North America, Reynobond, Stacbond America, Alfrex, LLC, East Coast Metal Systems, Inc.

b. Key factors driving the U.S. aluminum composite application market include robust construction activity requiring lightweight, weather‑resistant, and fire‑rated cladding solutions, combined with growing demand from the signage and architectural display sectors for customizable, durable, and aesthetically versatile panel materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.