- Home

- »

- Advanced Interior Materials

- »

-

U.S. Ammunition Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Ammunition Market Size, Share & Trends Report]()

U.S. Ammunition Market (2024 - 2030) Size, Share & Trends Analysis Report By Caliber (Small, Medium, Large, Rockets & Missiles), By Product (Rimfire, Centerfire), By Application (Civil & Commercial, Defense), And Segment Forecasts

- Report ID: GVR-4-68040-218-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ammunition Market Size & Trends

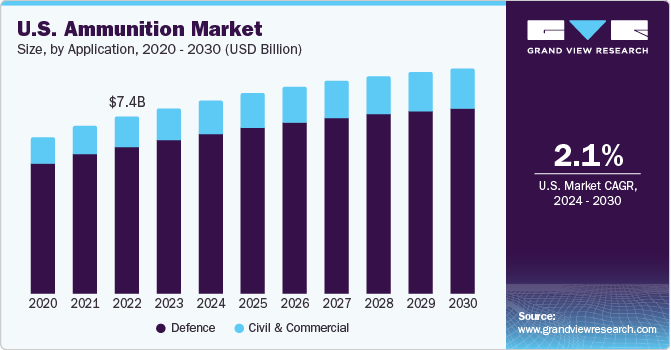

The U.S. ammunition market size was estimated at USD 7.70 billion in 2023 and is anticipated to grow at a CAGR of 2.1% from 2024 to 2030. This growth is attributed to the increased product demand from hunters and gun enthusiasts as well as weapon upgrades by law enforcement agencies. Flexible legislation related to the use of guns and increased defense spending is expected to fuel the growth of the market. Furthermore, the rise in terrorist activities grouped with political instabilities is further projected to boost product demand.

The U.S. Army has given the contract to companies including Textron Systems, General Dynamics, and Sig Sauer to manufacture 6.8mm bullets. This increased strain of producing bullets in the U.S. is due to the Russia-Ukraine war. Due to this war situation, Ukraine is sourcing ammunition from the U.S. and its partners. According to the general secretary of NATO, Ukraine's spending on ammunition is currently higher than its production rate. The market growth is also anticipated to increase due to the potential changes in laws and rising crime rates leading to more sales of guns for self-defense. The largest consumers of bullets and ammunition are the federal and state governments due to their increased involvement in military engagements. In addition, the country's rising crime rate has led to a surge in product demand among law enforcement agencies and police.

The United States dominates the global arms trade, accounting for over 40% of all weapons exports, driving the market growth. Beyond financial gains, selling arms internationally serves as a strategic foreign policy lever, enabling the U.S. to shape conflicts and security dynamics worldwide without direct military intervention. Furthermore, technological advancements in the ammunition market have led to the innovation of designs including reduced recoil, specialized rounds, and enhanced performance, attracting professionals and enthusiasts. In addition, the easy accessibility of ammunition purchases through online platforms has attracted a wider customer base, significantly contributing to the growth of the market.

Market Concentration And Characteristics

The U.S. Ammunition market is market is moderately concentrated owing to several key players dominating the market. However, there may be rivalry among a few manufacturers and companies, few players hold a significant share in the market.

The market is marked by a high level of innovation owing to technological advancements. Various companies invest significantly in research and development to come up with new and upgraded ammunition products. For instance,Hornady has unveiled its latest range of cutting-edge products for 2024. These include new ammunition, bullets, reloading tools, and security items, all accessible through stocking dealers, major retail sporting goods stores, and online platforms.

Merger and Acquisition activities in the U.S. ammunition market are usually moderate. To expand their market share, broaden product offerings, and enhance rivalry, different companies merge. In some instances, larger manufacturers acquire smaller manufacturers to gain access to customer base and distribution channels. In addition, the market can be highly impacted by regulatory norms and guidelines. The regulations can influence the production standards, licensing requirements, and sales restrictions. Manufacturers and companies in the market must adhere to the regulatory requirements as noncompliance can affect the market demand and sales volume.

Furthermore, new product launches and product expansion are common among ammunition companies to meet the emerging needs of consumers. These expansions include new calibers, bullet designs, and manufacturing different ammunition following specific needs such as long-range shooting, law enforcement, or self-defense.

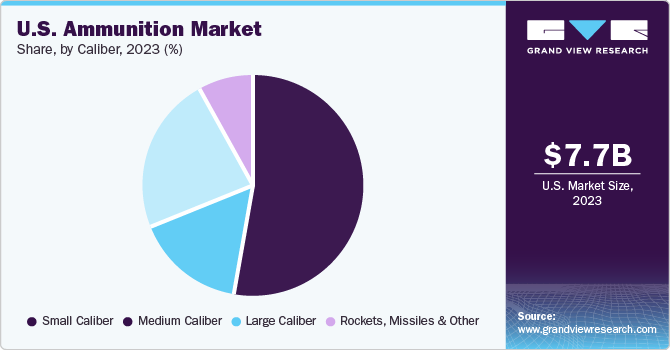

Caliber Insights

The small caliber segment accounted for the highest revenue share of 53.32% in 2023. The increasing demand for small-caliber ammunition is due to concerns about personal safety and military modernization efforts worldwide. Technologically advanced small-caliber ammunition is in high demand due to these factors. The popularity of sport shooting and competitive shooting events is also contributing to the market growth. The most commonly used ammunition is the 5.56mm caliber bullet, which is used in rifles, pistols, submachine guns, and shotguns. With a bullet weight of around 2 to 2.5 grams, it is suitable for mild shooting. Additionally, assault rifles use 5.56mm caliber bullets due to their shorter effective range.

The U.S. Army and its allies are expected to boost overall ammunition demand by procuring medium-caliber ammunition. These high-performance cartridges find applications across land, sea, and air, capable of penetrating light armor, materials, and personnel targets. The increasing use of guns and rifles by prominent global militaries will further drive the demand for medium-caliber ammunition.

Large-caliber ammunition held a significant revenue share in 2023. Large-caliber ammunition is used for long-range tank engagement and anti-armor weapons. These cartridges can be divided into three categories: spin-stabilized, fin-stabilized, and rocket-assisted, with the last one being a combination of the first two. Most guns use spin-stabilized large caliber cartridges for flight stability through spinning. In contrast, fin-stabilized projectiles achieve stability through the fins located at the end of the projectile. These cartridges are also employed for gunnery training in tank-mounted gun cannons.

Product Insights

The Centerfire dominated the market with a revenue share of 71.12% in 2023. This growth is attributed to its capability of high-pressure and reusable casing making it a global standard in the Army, security agencies, and police. Rifles, shotguns, and pistols are some of the firearms that frequently utilize centerfire ammunition. The center of the casing base houses the primer in centerfire ammunition, which enables it to be reloaded and commonly reused. The thicker metal casing of these cartridges makes them a top choice for military operations as they can endure rough handling with minimal damage. Moreover, they are relatively safer to handle. Thanks to its robust base, a centerfire cartridge can withstand high pressure, resulting in a higher velocity and energy for the bullet.

Rimfire accounted for a significant revenue share in 2023. Rimfire ammunition is a preferred choice for those who are new to firearms due to its limited recoil. It is also relatively cheaper than other types of ammunition. The reason for this is the simple manufacturing process involved, which includes a thin casting with a flattened primer. However, Rimfire ammunition is only suitable for low-pressure loads and cannot be reloaded. Because of the low-pressure requirements, Rimfire ammunition firearms tend to be lighter and less expensive.

Application Insights

The defense segment accounted for the largest share of 82.84% in 2023. The growth is attributed to the increasing number of cross-border conflicts. The segment is further expected to grow at a compound annual growth rate of 2.0% over the forecast period. The ammunition designed for military and law enforcement groups is continuously updated. The defense segment is the largest consumer of ammunition, utilizing it for various applications such as training, combat, and security. Ammunition plays a critical role in modern military operations, and its development and improvement have resulted in better performance and increased lethality in combat situations.

The Civil & Commercial segment held a significant share of the market in 2023. The growth in this segment is driven by various factors, including the rising number of civilian gun owners, increasing interest in shooting sports, and the growing demand for personal security. Different types of firearms, such as pistols, shotguns, and rifles, are used for civil & commercial applications like sporting, hunting, and self-defense. The selection of the appropriate ammunition type is essential for maintaining optimal performance and firearm safety, and it varies depending on the bullet's application.

Key U.S. Ammunition Company Insights

The U.S. Ammunition Market is highly competitive due to the presence of both international and local manufacturers. Furthermore, supportive government initiatives are fueling product innovation as well as M&A activities. For instance, in 2024 the Joint Program Executive Office Armaments and Ammunitions (JPEO A&A) is working in alignment with the DoD’s National Defense Industrial Strategy to significantly increase the production capacity of 155mm artillery munitions and aims to manufacture 100,000 artillery projectiles every month till 2025, as part of the U.S. Army's effort to strengthen its arsenal.

Key players operating in the market include Hornady, Olin Corporation, and General Dynamics Corporation.

-

Hornady is an American producer of ammunition cartridges, components, and hand-loading equipment. The company became a top innovator of bullet, manufacturing, ammunition, accessory design, and reloading tools.

-

General Dynamics Corporation is a global aerospace and defense company. The company offers a wide range of innovative products in combat vehicles, munitions, C4ISR solutions, weapons systems, and business aviation.

Sierra Bullets and Sig Sauer are some other participants in the U.S. ammunition market.

-

Sierra Bullets, a US-based bullet manufacturer for firearms since 1990, has been operating from Sedalia, Missouri. Their range of products such as bullets is extensive and includes rifles as well as pistols. These bullets are highly regarded for their precision and are used for a variety of purposes including, defense, hunting, and target shooting.

Key U.S Ammunition Companies:

- Hornady

- Olin Corporation

- Nosler

- CCI ammunition

- Federal Premium

- Remington

- General Dynamics Corporation

- ICC Ammo

- Magtech Ammunition Inc. (A subsidiary of CBC Global Ammunition)

- Sierra Bullets

- Textron systems

- Sig Sauer

Recent Developments

-

In February 2024, Remington Ammunition declared the availability of its newly introduced 22 Golden Hunter rimfire ammunition. This product sets a fresh benchmark for rimfire hunting, providing hunters with an upgraded level of accuracy and performance. The 22 Golden Hunter delivers unmatched field performance. By merging the reliable legacy of the 22 Golden Bullet with Remington's advanced rimfire technology, this ammunition is perfect for hunting creatures like squirrels, rabbits, varmints, coyotes, and more.

-

In January 2024, Federal Ammunition introduced new centerfire rifle ammunition choices for 2024. The brand-new Fusion Tipped range, along with several line extensions, will be featured and exhibited at the 2024 SHOT Show. The innovative Federal Fusion Tipped design delivers the same excellent terminal performance as the original bonded soft points but with an added polymer tip. This enhancement improves the ballistic coefficient, levels the trajectories, and amplifies energy, resulting in improved accuracy and a longer effective range.

U.S. Ammunition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.99 billion

Revenue forecast in 2030

USD 9.04 billion

Growth rate

CAGR of 2.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Caliber, product, application

Key companies profiled

Hornady; Olin Corporation; Nosler; CCI ammunition; Federal Premium; Remington; General Dynamics Corporation; ICC Ammo; Magtech Ammunition Inc. (A subsidiary of CBC Global Ammunition); Sierra Bullets; Textron systems; Sig Sauer.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ammunition Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ammunition market report based on caliber, product, and application:

-

Caliber Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Caliber

-

5.56 mm

-

7.62 mm

-

7.62 x 51 mm

-

7.62 x 39 mm

-

-

Others

-

9 mm

-

9 x 18 mm

-

9 x 19 mm

-

-

Others

-

-

Medium Caliber

-

23 mm

-

30 mm

-

Others

-

-

Large Caliber

-

VSHORAD

-

122 mm

-

Others

-

-

Rockets, Missiles & Other

-

Tank Ammunition

-

Artillery Ammunition

-

-

-

Small Caliber Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rimfire

-

Centerfire

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil & Commercial

-

Sports

-

Hunting

-

Self Defense

-

-

Defense

-

Military

-

Law Enforcement

-

-

Frequently Asked Questions About This Report

b. The U.S. ammunition market size was estimated at USD 7.71 billion in 2023 and is expected to reach USD 7.99 billion in 2024

b. The U.S. ammunition market is expected to grow at a compound annual growth rate of 2.1% from 2024 to 2030 to reach USD 9.04 billion by 2030.

b. The small caliber ammunition segment dominated the market with a revenue share of 53.3% owing to wide array of small caliber ammunition applications including shotgun pistols, assault rifles, rifles, and revolvers.

b. Some of the key players operating in the U.S. ammunition market include Northrop Grumman Corporation, FN Herstal, Olin Corporation, General Dynamics Corporation, and BAE Systems, Inc. among others.

b. The key factors driving the U.S. ammunition market include rising military expenditure. Rising terrorist activities and political violence are anticipated to increase the demand for ammunition over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.