- Home

- »

- Medical Devices

- »

-

U.S. Annual Wellness Visits Market Size & Share Report, 2030GVR Report cover

![U.S. Annual Wellness Visits Market Size, Share & Trend Report]()

U.S. Annual Wellness Visits Market (2023 - 2030) Size, Share & Trend Analysis Report By Services (Health Risk Assessment, Physical Exam, Laboratory Tests, Immunizations), By Provider Type, By Type, By Specialty, And Segment Forecasts

- Report ID: GVR-4-68040-050-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

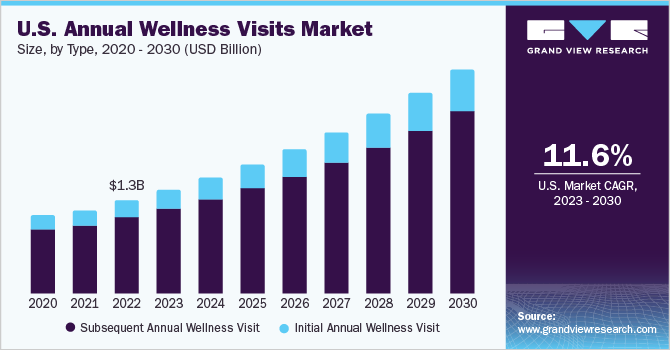

The U.S. annual wellness visits market size was estimated at USD 1.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.63% from 2023 to 2030. The growth is attributed to the factors such as rising awareness about the benefits of preventive healthcare, increasing healthcare expenditure, the aging population, and rising government initiatives.Medicare, the federal health insurance program for the older population, covers annual wellness visits(AWV)s as a preventive care service for eligible beneficiaries. The Centers for Medicare and Medicaid introduced the annual wellness visit for elderly people who are enrolled under Medicare. AWV is an opportunity for older people and their providers to focus on disease prevention and the early recognition of disease. In the AWV, primary-care practitioners identify health risks and encourage and promote healthy behaviors, enable proper disease screening, and prevent and manage syndromes of aging.

AWV specifically includes assessments of psychosocial risks, cognition, depression, physical function, and behavioral risks, such as drinking, nutritional status, smoking, sedentary behavior, and obesity. Moreover, screening for pertinent diseases, such as diabetes, cardiovascular disease, and cancer is also included in the AWV.

The increasing demand for early detection of diseases has boosted the demand for annual wellness visits. For instance, in September 2022 , Alzheimer’s Association published an article that stated that early detection of Alzheimer's disease and associated dementias allows patients and clinicians to identify treatment options and prepare for future needs.Furthermore, significant cost-saving and a decrease in the number of emergency hospitalization are driving the market growth.

The COVID-19 pandemic had a significant impact on the U.S. AWV market. During the pandemic, many healthcare providers suspended routine in-person visits, including wellness visits, to reduce the risk of COVID-19 transmission. Owing to this there was a significant decline in the number of wellness visits in 2020 compared to previous years.

However, the pandemic has highlighted the importance of preventive healthcare and the need for regular checkups and screenings to maintain overall health and detect potential health conditions at an early stage. This has increased awareness of the benefits of wellness visits and may lead to increased demand for these services in the coming years.

Services Insights

Health risk assessment (HRA) dominated the market in 2022. It is an important component of annual wellness visits . It identifies potential health risks and provides personalized guidance to the patients. Primary care providers can help their patients maintain good health and prevent disease. HRA can also serve as a starting point for ongoing healthcare management and disease prevention.

The cancer screening segment is projected to witness considerable growth in the coming years. Annual wellness visits could help to detect cancer at an early stage when it is more treatable. During the visit, the healthcare provider recommends various cancer screening tests such as pap smears, ultrasounds, and others depending on age, gender, and other risk factors. The identification of risk factors and undiagnosed conditions provides adults with evidence-based preventive care. Owing to these factors the visit has progressively increased.

Type Insights

Subsequent annual wellness visits captured the highest revenue share in 2022. The segment is estimated to dominate the market throughout the forecast period. It helps in healthcare management and assists clinicians evaluate a patient's health status from time to time. Moreover, it identifies any changes or new health risks that may have developed since the previous AWV. Subsequent AWVs also serve as an opportunity to monitor chronic conditions and adjust treatment plans as needed.

The initial AWV segment is projected to witness lucrative growth in the coming years. It is provided to patients who are newly enrolled in Medicare. The exam includes a review of the patient's medical history, current medications, and any existing health conditions. Primary care providers may also conduct screenings for various health issues, such as blood pressure and cholesterol levels among others.

Provider Type Insights

In terms of provider type, the hospitals segment accounted for a major portion of the market. Hospitals conduct annual wellness visits as part of their preventive care services. These visits assist patients to stay healthy and determine any potential health problems at an early stage.Additionally, healthcare providers offer health screenings and tests, such as blood pressure and cholesterol checks, to detect any potential health issues. By conducting annual wellness visits, hospitals can help patients better manage their health and prevent serious illnesses from developing or progressing.

Clinics are projected to witness the fastest growth during the forecast period. The high growth of the segment can be attributed to the favoring reimbursement policies and increasing adoption of AWV. Outpatient clinics are more convenient owing to less waiting time. Moreover, with the deployment of telemedicine in many clinics, access to primary care has increased. This is propelling the segment’s growth.

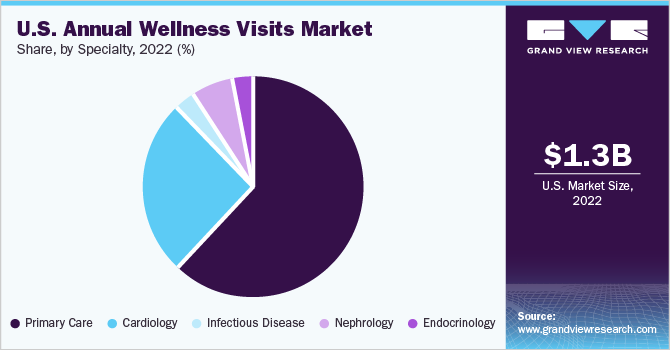

Specialty Insights

The primary care segment dominated the market in 2022 with a revenue share of 61.7%. The provider recommends lifestyle modifications such as diet and exercise, as well as medications or other treatments to help manage existing health conditions. They can also coordinate follow-up care and referrals to specialists as needed.

The cardiology segment is projected to witness considerable growth during the forecast period. Cardiovascular disease is the leading cause of death in the U.S. and the government is taking several initiatives to prevent disease onset and cardiac events. For instance, cardiovascular risk assessments and screenings are covered by Medicare at no out-of-pocket expense to the patient. These factors are likely to boost the growth of the cardiology segment during the forecast period.

Key Companies & Market Share Insights

Market players are offering various services to their customers which is making the market highly competitive. The providers are incorporating telehealth to enhance their services. Furthermore, partnerships and collaborations are major strategies undertaken by key players to gain a competitive edge. Some prominent players in the U.S. annual wellness visits market include:

-

Morris Hospital & Healthcare Centers

-

Sparta Community Hospital District

-

Medical Center Clinic

-

St. Luke Community Healthcare.

-

Mason Health.

-

UC San Diego

-

HealthCare Partners, MSO.

-

Mercy

-

RUSH Copley Medical Center

-

Carson Tahoe Health

-

Overlake Hospital Medical Center

-

Northwestern Medicine

-

The General Hospital Corporation

-

Hamilton Health Care System

-

UCLA Health

U.S. Annual Wellness Visits Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.4 billion

Revenue forecast in 2030

USD 3.1 billion

Growth rate

CAGR of 11.63% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Services, type, specialty, provider type

Country Scope

U.S.

Key companies profiled

Morris Hospital & Healthcare Centers; Sparta Community Hospital District; Medical Center Clinic; St. Luke Community Healthcare; Mason Health; UC San Diego; HealthCare Partners, MSO.; Mercy; RUSH Copley Medical Center; Carson Tahoe Health; Overlake Hospital Medical Center; Northwestern Medicine; The General Hospital Corporation; Hamilton Health Care System; UCLA Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Annual Wellness Visits Market Report Segmentation

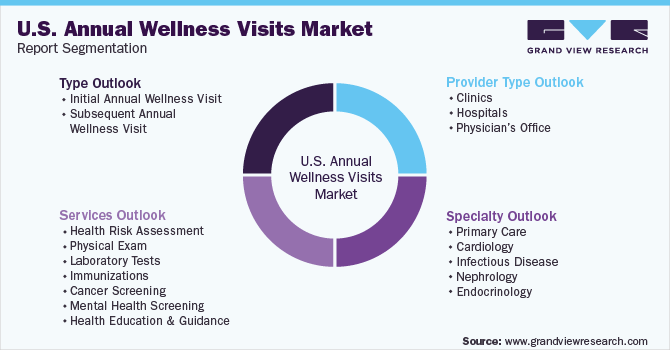

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. annual wellness visits market report based on type, service, specialty, and provider type:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Initial Annual Wellness Visit

-

Subsequent Annual Wellness Visit

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Health Risk Assessment

-

Physical Exam

-

Laboratory Tests

-

Immunizations

-

Cancer Screening

-

Mental Health Screening

-

Health Education And Guidance

-

-

Provider Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Physician’s Office

-

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Care

-

Cardiology

-

Infectious Disease

-

Nephrology

-

Endocrinology

-

Frequently Asked Questions About This Report

b. The U.S. annual wellness visits market size was estimated at USD 1.3 billion in 2022 and is expected to reach USD 1.4 billion in 2023.

b. The U.S. annual wellness visits market is expected to grow at a compound annual growth rate of 11.63% from 2023 to 2030 to reach USD 3.1 billion by 2030.

b. The primary care segment dominated the U.S. annual wellness visits market with a share of 61.7% in 2022. The provider recommends lifestyle modifications such as diet and exercise, as well as medications or other treatments to help manage existing health conditions.

b. Some key players operating in the U.S. annual wellness visits market include Morris Hospital & Healthcare Centers; Sparta Community Hospital District; Medical Center Clinic; St. Luke Community Healthcare; Mason Health; UC San Diego; HealthCare Partners, MSO.; Mercy; RUSH Copley Medical Center; Carson Tahoe Health; Overlake Hospital Medical Center; Northwestern Medicine; The General Hospital Corporation; Hamilton Health Care System; UCLA Health

b. Key factors that are driving the market growth include rising awareness about the benefits of preventive healthcare, increasing healthcare expenditure, growing aging population, and growing government initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.