U.S. Anti-Venom Market Summary

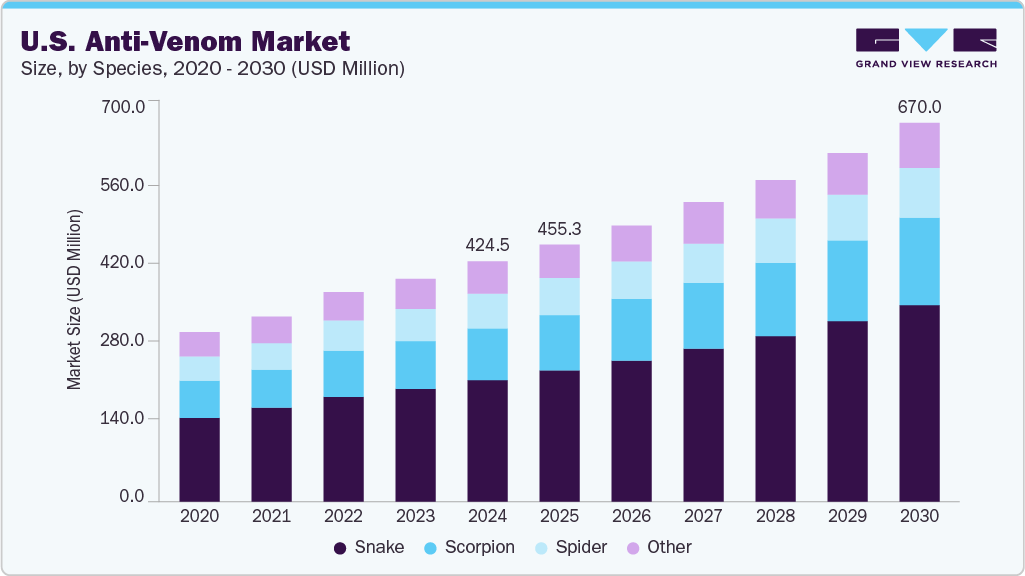

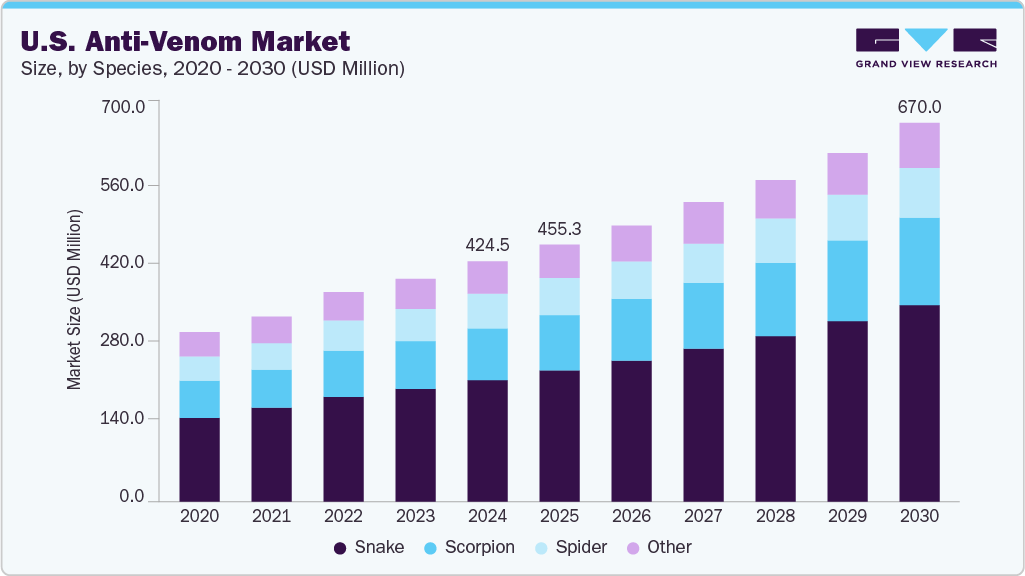

The U.S. anti-venom market size was estimated at USD 424.5 million in 2024 and is projected to reach USD 670.0 million by 2030, growing at a CAGR of 8.0% from 2025 to 2030. The market is expanding due to the rising incidence of venomous bites and stings, especially from snakes and insects.

Key Market Trends & Insights

- By species, snakes dominated the industry and accounted for the largest revenue share of 51.0% in 2024.

- By type, polyvalent dominated the industry and accounted for the largest revenue share of 67.5% in 2024.

- By mode of action, the neurotoxic segment dominated the U.S. anti-venom industry in 2024.

- By end use, the hospitals segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 424.5 Million

- 2030 Projected Market Size: USD 670.0 Million

- CAGR (2025-2030): 8.0%

Increased human interaction with venomous species is fueled by urbanization, deforestation, and climate change, which have impacted the habitats of these animals and brought them closer to populated areas. This trend has heightened the need for effective anti-venom treatments to reduce fatalities and long-term health complications associated with envenomation, driving the U.S. anti-venom industry.

Advancements in biotechnology significantly contribute to market growth. Innovations such as monoclonal antibody-based anti-venoms and recombinant DNA technologies have resulted in the development of more potent, safer, and targeted therapies. These improvements enhance treatment outcomes and help reduce production costs, making anti-venoms more accessible. The continuous research and development efforts by pharmaceutical companies and research institutions, particularly in the U.S., foster innovation and the introduction of advanced anti-venom products tailored to specific venom types.

The U.S. market benefits from a robust healthcare system that facilitates rapid access to anti-venom treatments in emergency settings. The prevalence of outdoor recreational activities and expanding urban development into wildlife habitats increases the likelihood of encounters with venomous species, thereby driving market demand. Moreover, the presence of key industry players and ongoing government support for pharmaceutical innovation strengthen the market’s growth prospects.

Species Insights

The snake segment accounted for the largest revenue share of 51.0% in 2024, primarily due to the high incidence of snakebites and the increasing demand for effective treatments. The growing prevalence of venomous snakes, particularly in warmer regions and outdoor recreational activities, has led to more snakebite cases. According to the CDC report in August 2024, each year, 7,000 to 8,000 people are bitten by venomous snakes in the U.S., resulting in 5 deaths.

The Russell’s viper segment dominated the snake category in 2024 due to several key factors. First, the Russell viper's venom is highly potent and requires specialized anti-venom, driving demand for effective treatments. The common cobra segment is expected to experience significant growth in the U.S. anti-venom industry. The growing awareness among healthcare providers about the need for specialized anti-venom for cobra bites has boosted demand. Advances in anti-venom development, such as more effective and safer formulations, have also encouraged adoption.

The scorpion segment is projected to grow at the fastest CAGR of 9.3% over the forecast period, driven by increasing scorpion stings, particularly in southwestern states such as Arizona, where over 1,000 scorpion sting cases occur each year, according to the Arizona Poison and Drug Information Center (APDIC). Many of these stings are caused by Centruroides sculpturatus (Arizona bark scorpion), identified based on the signs and symptoms linked to severe toxic reactions.

Type Insights

The polyvalent segment dominated the market in 2024. Polyvalent anti-venoms provide valuable treatment options by neutralizing venom from a variety of related poisonous species. This makes them effective in cases where the exact biting animal is unknown, which is a common scenario in snakebite emergencies.

The monovalent segment is projected to grow significantly over the forecast period. This is largely due to the growing need for species-specific anti-venoms, as certain species pose a greater threat. Monovalent anti-venoms offer more targeted protection against the specific toxins of a single species, which is expected to drive a substantial increase in their demand.

Mode of Action Insights

The neurotoxic segment dominated the U.S. anti-venom industry in 2024. This can be attributed to the high threat posed by neurotoxic venom and the increasing efforts to counter the high prevalence of these poisons. Moreover, neurotoxic venom has the potential to kill the victim within 30 minutes, depending on the injected amount.

The cytotoxic segment is expected to grow significantly over the forecast period. This growth is driven by the rising incidence of venomous snakebites and the severity of tissue damage caused by cytotoxic venoms. Cytotoxic venoms, found in species such as rattlesnakes and copperheads, commonly lead to local tissue destruction, swelling, necrosis, and long-term complications, increasing the demand for specialized anti-venom treatments targeting cytotoxic effects.

End Use Insights

The hospitals segment dominated the market in 2024 as they are the primary centers equipped to handle severe envenomation cases that require immediate and specialized medical intervention. Hospitals possess advanced emergency response infrastructure, experienced personnel, and the capacity to monitor and manage complications from bites.

The clinics segment is expected to grow significantly over the forecast period. This growth is driven by increasing accessibility, cost efficiency, and faster treatment for mild to moderate envenomation cases. Clinics, including urgent care centers and specialized toxin treatment facilities, provide quicker and more affordable alternatives to hospitals for non-life-threatening bites, reducing emergency room burdens.

Key U.S. Anti-venom Company Insights

Some key companies in the U.S. anti-venom industry include Boehringer Ingelheim; CSL Limited, Merck & Co., Inc.; Pfizer, Inc.;, and others

- Merck & Co., Inc. is a global pharmaceutical company, specializing in the development, manufacture, and commercialization of innovative medicines, vaccines, biologic therapies, and animal health products. In the anti-venom domain, Merck markets Antivenin (Latrodectus mactans), an equine-derived antivenom indicated for treatment of black widow spider bites.

Key U.S. Anti-venom Companies:

- Boehringer Ingelheim

- CSL

- Merck & Co., Inc.

- Pfizer, Inc.

Recent Developments

- In March 2022, Ophirex, Inc. received FDA Fast Track designation for its investigational drug, oral varespladib, aimed at treating snakebite.

U.S. Anti-Venom Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 455.3 million

|

|

Revenue forecast in 2030

|

USD 670.0 million

|

|

Growth Rate

|

CAGR of 8.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Species, snake, type, mode of action, end use.

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Boehringer Ingelheim; CSL Limited; Merck & Co., Inc.; Pfizer, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Anti-Venom Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. anti-venom market report based on species, type, mode of action, and end use.

-

Species Outlook (Revenue, USD Million, 2018 - 2030)

-

Snake

-

Common Cobra

-

Common Krait

-

Russell Viper

-

Others

-

Scorpion

-

Spider

-

Other

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mode of Action Outlook (Revenue, USD Million, 2018 - 2030)

-

Cytotoxic

-

Neurotoxic

-

Hemotoxic

-

Cardiotoxic

-

Myotoxic

-

Others

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)