- Home

- »

- Advanced Interior Materials

- »

-

U.S. Arc Welding Equipment Market, Industry Report, 2033GVR Report cover

![U.S. Arc Welding Equipment Market Size, Share & Trends Report]()

U.S. Arc Welding Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Shielded Metal/Stick Arc Welding, Tungsten Inert Gas welding), By Product (Automatic, Semi-automatic), By End Use (Aerospace, Automotive), And Segment Forecasts

- Report ID: GVR-4-68040-671-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Arc Welding Equipment Market Summary

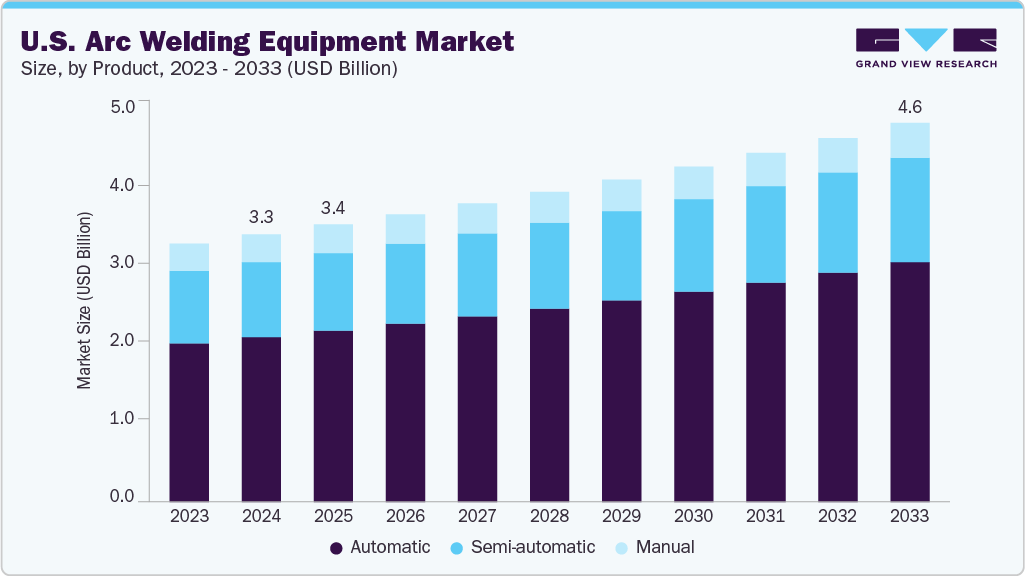

The U.S. arc welding equipment market size was estimated at USD 3,255.8 million in 2024 and is projected to reach USD 4,610.8 million by 2033, growing at a CAGR of 4.0% from 2025 to 2033. The rising adoption of automation in manufacturing has significantly boosted the demand for advanced arc welding equipment in the U.S. Industries such as automotive and construction are increasingly implementing robotic and automated welding systems to enhance productivity and reduce labor costs.

Key Market Trends & Insights

- The arc welding equipment market in the U.S. is expected to grow at a substantial CAGR of 4.0% from 2025 to 2033.

- By product, the automatic segment is expected to grow at a considerable CAGR of 4.3% from 2025 to 2033 in terms of revenue.

- By type, the tungsten inert gas welding (TIG) segment is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue.

- By end use, the aerospace segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,255.8 Million

- 2033 Projected Market Size: USD 4,610.8 Million

- CAGR (2025-2033): 4.0%

Additionally, the revival of infrastructure and energy projects across the U.S. is creating strong demand for arc welding equipment. The government’s increased investments in bridges, pipelines, and renewable energy infrastructure are supporting equipment sales. Heavy-duty welding tools capable of operating under extreme conditions are essential for these sectors. This surge in infrastructure activities is expected to sustain long-term growth in the arc welding equipment market.

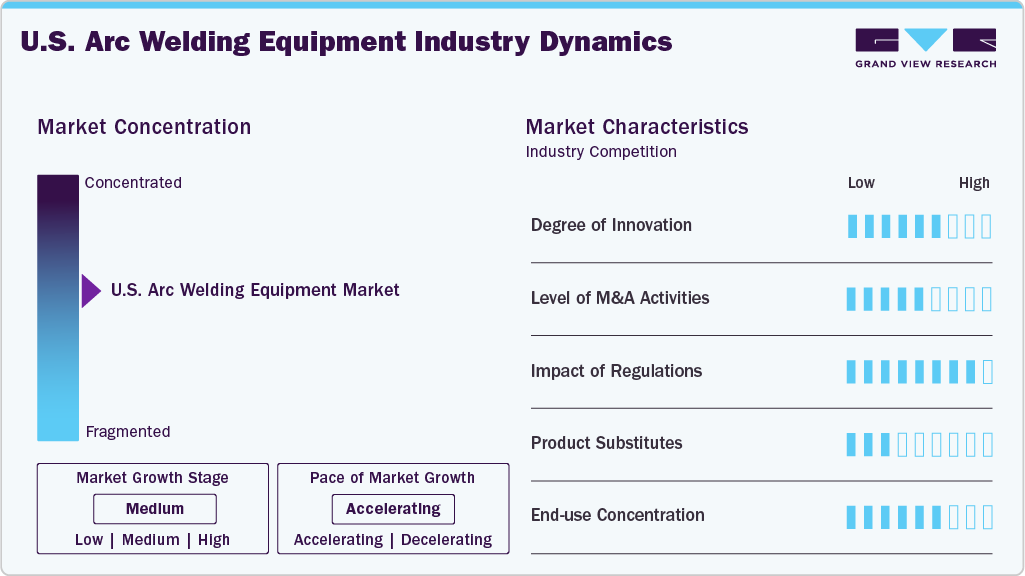

Market Concentration & Characteristics

The U.S. arc welding equipment market is moderately concentrated, with a few major players holding significant market share. Companies like Lincoln Electric, Miller Electric, and ESAB dominate due to their strong distribution networks and advanced product offerings. However, smaller regional manufacturers also compete by offering specialized or cost-effective solutions. This blend of large and niche players creates a competitive yet somewhat consolidated market landscape.

The U.S. arc welding equipment industry experiences steady innovation, driven by automation, IoT integration, and energy-efficient technologies. Manufacturers are investing in advanced control systems and smart welding solutions to improve precision and performance. Innovation is also focused on enhancing operator safety and reducing welding defects. Continuous R&D helps companies maintain a competitive edge in this evolving industry.

Mergers and acquisitions play a strategic role in the U.S. arc welding sector, enabling companies to expand their capabilities and market reach. Larger firms often acquire smaller players to access new technologies or enter niche markets. These deals help consolidate market presence and improve supply chain efficiency. The trend supports industry growth and fosters competition among top manufacturers.

Regulations related to workplace safety, environmental emissions, and energy efficiency significantly influence the arc welding market. Compliance with OSHA standards and EPA regulations drives demand for safer and low-emission equipment. Manufacturers must ensure products meet these guidelines, which can impact design and production costs. Such regulations promote innovation while also shaping market dynamics.

Drivers, Opportunities & Restraints

The U.S. arc welding equipment market growth is driven by strong demand from the automotive, construction, and energy sectors. Growth in infrastructure development and manufacturing reshoring initiatives is boosting equipment sales. The rise of automation and robotics further enhances welding efficiency and precision. Additionally, government investments in renewable energy projects are fueling market expansion.

Advancements in smart welding technologies offer significant opportunities for manufacturers in the U.S. There is growing potential in sectors like aerospace, defense, and offshore wind energy, where high-precision welding is critical. Increasing adoption of additive manufacturing and customized welding solutions also opens new avenues. Furthermore, workforce training programs are supporting the adoption of advanced welding systems.

The U.S. market faces restraints due to the high initial costs of advanced arc welding systems. Small and medium enterprises may struggle to afford or integrate automated solutions. A shortage of skilled welders also limits the full utilization of equipment in some regions. Additionally, compliance with evolving environmental and safety regulations can increase production and operational costs.

Type Insights

The shielded metal/stick arc welding segment led the U.S. arc welding market with a share of 29.0% in 2024, due to its versatility and low equipment cost. It is widely used in construction, maintenance, and pipeline welding, especially in outdoor and remote locations. Its ability to perform well on dirty or rusty surfaces makes it ideal for fieldwork. The simplicity and reliability of this method continue to drive its widespread adoption.

TIG welding is the fastest-growing segment in the U.S. due to rising demand for high-precision and clean welds. It is especially favored in industries like aerospace, automotive, and medical device manufacturing. The method's ability to work with thin materials and non-ferrous metals enhances its appeal. As quality standards tighten, TIG welding adoption is increasing across advanced applications.

Product Insights

The automatic arc welding equipment segment held a 61.6% share in 2024, due to its integration in large-scale manufacturing and automotive assembly lines. It ensures consistent weld quality, reduces labor costs, and increases operational efficiency. Industries are increasingly turning to automation to address the skilled labor shortage. These benefits make automatic systems essential in high-volume U.S. industrial operations.

Semi-automatic welding equipment is growing rapidly in the U.S. as mid-sized manufacturers seek cost-effective automation solutions. It offers better control than manual welding while improving productivity and weld consistency. The flexibility to adapt to different tasks without full automation investments appeals to many U.S. firms. Its growth is supported by increasing adoption in the fabrication and construction sectors.

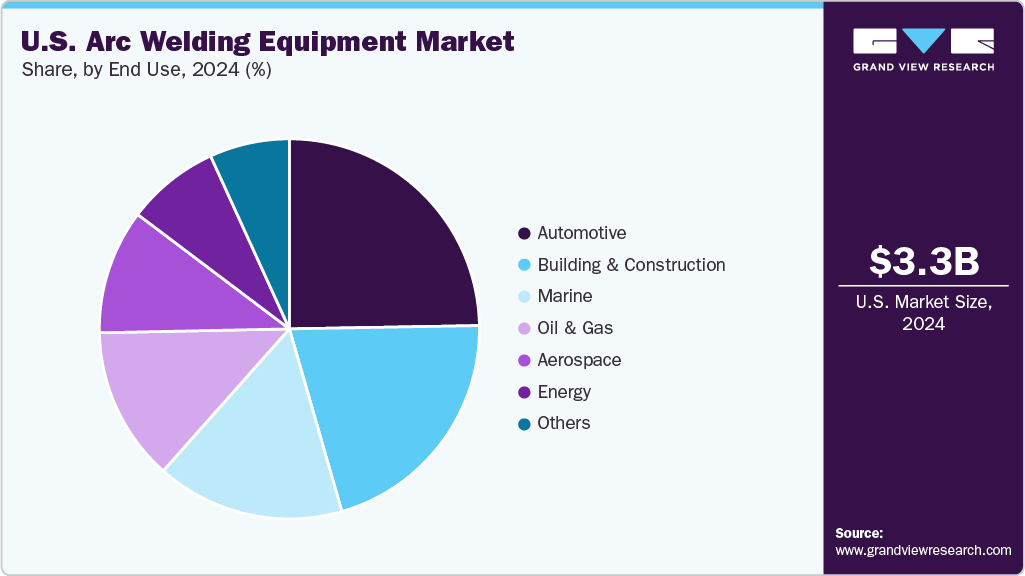

End Use Insights

The automotive sector dominated the U.S. arc welding equipment industry, with a share of 24.8% in 2024, due to the high demand for precision welding in vehicle assembly and part manufacturing. Major automakers rely on automated welding systems for chassis, exhaust, and body structures. The push for EV production further drives investment in advanced welding technologies. Consistent quality and production speed are key factors supporting this dominance.

The aerospace sector is the fastest-growing end use segment in the U.S. arc welding equipment industry, driven by the need for high-strength, lightweight welds. TIG and advanced welding methods are essential for joining complex alloys and thin materials. Increased defense spending and growth in commercial aviation are fueling equipment demand. Strict quality standards also push the adoption of precision welding technologies.

Key U.S. Arc Welding Equipment Company Insights

Some of the key players operating in the market include The Lincoln Electric Company; ACRO Automation Systems, Inc.; and Illinois Tool Works Inc.

-

The Lincoln Electric Company specializes in advanced welding and cutting technologies with a strong focus on automation and system integration. It offers industry-specific solutions, including robotic welding cells, CNC plasma systems, and welding consumables tailored for high-performance applications. The company is known for integrating IoT and real-time monitoring features into its equipment for enhanced productivity. Lincoln also provides custom-engineered systems for complex manufacturing environments. Its solutions are widely used in automotive, shipbuilding, and structural steel sectors.

-

ACRO Automation Systems, Inc. is a provider of custom robotic welding and assembly systems, focusing on turnkey automation for industrial manufacturers. The company designs and builds automated production lines that include precision welding, vision inspection, and material handling systems. ACRO specializes in handling complex, high-precision components in the automotive and heavy equipment industries. Their expertise lies in seamlessly integrating robotics with advanced motion control and part tracking. They also offer post-installation support, including system upgrades and process optimization.

Key U.S. Arc Welding Equipment Companies:

- The Lincoln Electric Company

- ACRO Automation Systems, Inc

- Illinois Tool Works Inc.

- voestalpine Böhler Welding Group GmbH

- OTC DAIHEN Inc.

- Coherent, Inc.

- ESAB

- Hobart Welding Products

- Kemppi Oy.

- Fronius International GmbH

Recent Developments

-

June 2025, ESAB Corporation is set to acquire German welding equipment manufacturer EWM GmbH. The deal is aimed at expanding ESAB’s capabilities in heavy industrial welding and automation.

-

July 2024, Lincoln Electric has acquired Vanair Manufacturing, a U.S.-based company known for its vehicle-mounted power solutions, including compressors, generators, and welders. This acquisition enhances Lincoln’s capabilities in the mobile power sector, especially for service trucks. Vanair’s offerings align well with Lincoln’s maintenance and repair product lines, expanding its reach in key markets. The move is expected to support long-term growth and innovation in portable industrial solutions.

U.S. Arc Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,373.7 million

Revenue forecast in 2033

USD 4,610.8 million

Growth rate

CAGR of 4.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use

Country Scope

U.S.

Key companies profiled

The Lincoln Electric Company; ACRO Automation Systems, Inc.; Illinois Tool Works Inc.; voestalpine Böhler Welding Group GmbH; OTC DAIHEN Inc.; Coherent, Inc.; ESAB; Hobart Welding Products; Kemppi Oy.; Fronius International GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Arc Welding Equipment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the industry trends in each of the sub-segments from 2025 to 2033. For this study, Grand View Research has segmented the U.S. arc welding equipment market report based on product, type, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic

-

Semi-automatic

-

Manual

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Shielded Metal/Stick Arc Welding

-

Metal Inert Gas welding (MIG)

-

Tungsten Inert Gas welding (TIG)

-

Plasma Arc Welding

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. arc welding equipment market size was estimated at USD 3,255.8 million in 2024 and is expected to reach USD 3,373.7 million in 2025

b. The U.S. arc welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2033 to reach USD 4,610.8 million by 2033

b. Automatic arc welding equipment segment holds a 61.6% share due to its integration in large-scale manufacturing and automotive assembly lines. It ensures consistent weld quality, reduces labor costs, and increases operational efficiency. Industries are increasingly turning to automation to address the skilled labor shortage.

b. Some of the key players operating in the arc welding equipment market include The Lincoln Electric Company, ACRO Automation Systems, Inc, Illinois Tool Works Inc., Ador Welding Limited, Mitco Weld Products Pvt. Ltd., voestalpine Böhler Welding Group GmbH, Carl Cloos Schweisstechnik GmbH, and among others.

b. Key factors driving the arc welding equipment market include the rise in industrial automation and the growing demand from automotive, construction, and energy sectors. Advancements in welding technologies and increased infrastructure investments further support market growth. Additionally, the need for high-precision and efficient welding processes boosts equipment adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.