- Home

- »

- Healthcare IT

- »

-

U.S. AI In Physical Therapy Market, Industry Report, 2033GVR Report cover

![U.S. AI In Physical Therapy Market Size, Share & Trends Report]()

U.S. AI In Physical Therapy Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-based, Server-based), By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-846-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. AI In Physical Therapy Market Summary

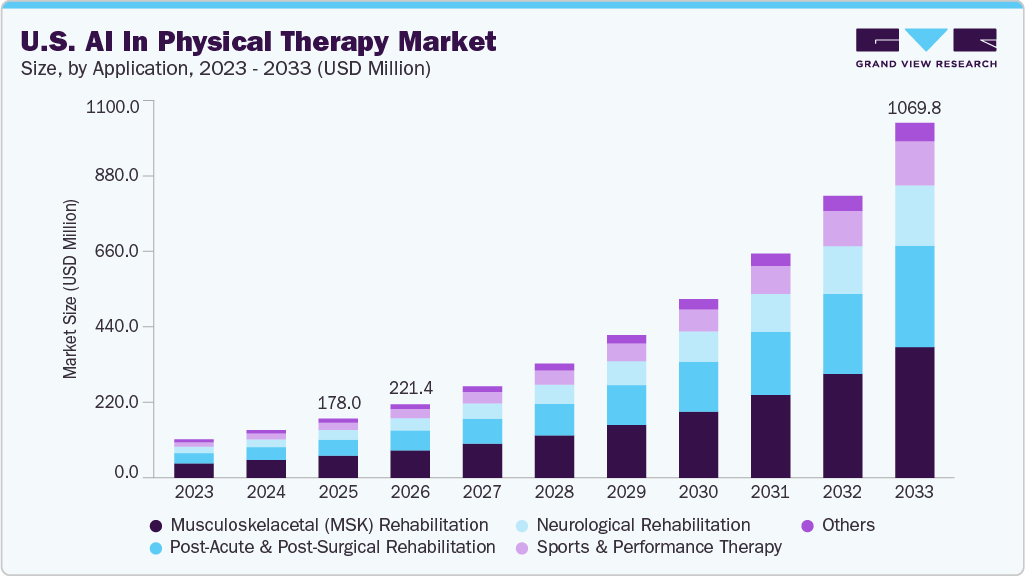

The U.S. AI in physical therapy market was estimated at USD 178.00 million in 2025 and is projected to reach USD 1,069.81 million by 2033, growing at a CAGR of 25.24% from 2026 to 2033. The rising prevalence of musculoskeletal (MSK) conditions, growing adoption of telehealth and telemedicine are significant factors contributing to market growth.

Key Market Trends & Insights

- Based on deployment mode, cloud-based held the largest market share of 78.64% in 2025.

- Based on component, software held the highest market share 68.17% in 2025.

- Based on application, the musculoskeletal (MSK) rehabilitation segment held the highest market share of over 37.33% in 2025.

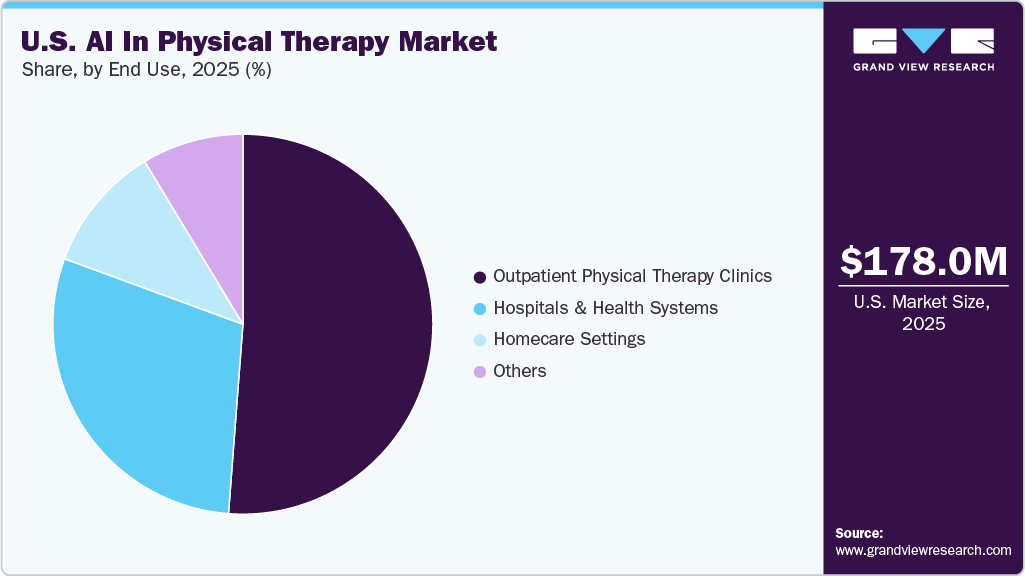

- Based on end use, the outpatient physical therapy clinics segment held the largest market share of over 51.21% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 178.00 Million

- 2033 Projected Market Size: USD 1,069.81 Million

- CAGR (2026-2033): 25.24%

The country faces a growing burden of musculoskeletal conditions, driven by a larger geriatric population, sedentary lifestyles, and sports-related injuries. As the population ages, demand for physical therapy services rises, with conditions such as osteoarthritis, osteoporosis, and falls becoming more prevalent. For example, the Health Policy Institute reports that low back pain—affecting nearly 65 million Americans each year—remains the most common MSK complaint.Moreover, therapist shortages and burnout in outpatient and hospital-based PT settings drive interest in AI tools that automate repetitive tasks and documentation. AI-driven physical therapy software is able to automatically generate visit notes, track home-exercise adherence, and adjust plans based on real-time performance metrics, thereby reducing administrative burden.

Computer-vision systems provide form feedback and rep counting. Therapists can supervise more patients asynchronously and allocate in-person time to address complex needs. Abto Software data shows digital rehabilitation improves recovery by 27%. These efficiency gains support higher throughput and revenue per clinician. This is critical for large MSK networks, hospital systems, and digital PT companies seeking to scale without increasing staff linearly.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The market is slightly fragmented. However, several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation is high, the level of partnerships & collaborations, the impact of regulations, and the regional expansion of industry is high.

U.S. AI in physical therapy industry is characterized by constant innovation, with a strong focus on launching new platforms and programs. For instance, in May 2024, Kaia Health launched its evidence-based Balance Program, targeting seniors (aged 65 and above), to improve balance, strength, and mobility through app-based exercises and education, in accordance with CDC guidelines.

“Falls are now the number one cause of injury among adults ages 65 and older, significantly impacting their mobility, confidence, and sometimes independence. With our digital-first approach to balance support, we provide our users with education and exercises to build into their routines that decrease fall risk and improve quality of life.”

-Nicole Fellows, Physical Therapist at Kaia Health

The industry is experiencing a high level of partnerships & collaborations undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in July 2025, WebMD Health Services partners with Kaia Health to integrate AI-driven digital MSK and chronic pain programs into WebMD ONE. Features include motion tracking, certified pain coaching, and telephonic check-ins for 68,000 users. Aims to reduce pain, improve mobility, and cut costs.

“More than 52 million Americans live with chronic pain—but only 10 percent are able to access treatment due to long wait times, high costs, and the challenges of missing work.1 Our partnership with Kaia Health addresses this gap by delivering accessible, personalized digital therapy integrated into WebMD ONE and supported by our health coaches. This collaboration underscores our commitment to delivering innovative, effective solutions that help employees and health plan members reduce pain and enhance overall well-being that fit into their daily lives.”

-Bruce Foyt, Vice President, Partnerships, WebMD Health Services

Regulations, such as HIPAA in the U.S., establish standards for safeguarding patient data privacy and security. Compliance with these regulations is crucial for AI applications in healthcare to ensure the safe and secure handling of patient information, reducing the risk of data breaches and unauthorized access.

The industry is witnessing high geographical expansion. Companies within the AI in physical therapy industry seek geographic expansion strategies to maintain their foothold in the market. For instance, in November 2025, Ascension, one of the largest U.S. health systems, selected Raintree as its enterprise EMR platform for post-acute outpatient rehabilitation and physical therapy. The partnership aims to power next-generation rehab operations by standardizing workflows and documentation on a unified Raintree platform across Ascension’s outpatient rehab network.

Case Study Insights: Cost Reduction with Kaia Health’s Digital MSK Solution

Kaia Health’s Rise-uP RCT evaluated the economic impact of its digital MSK program for non-specific low back pain, comparing the costs of a smartphone-based therapeutic with standard-of-care.

Challenge

Low back pain generates substantial direct medical costs and productivity losses, while only a fraction of patients receive evidence-based MSK care. Health plans and employers face growing MSK expenditures and limited access to high-quality, consistent therapy pathways.

Solution

Kaia Health deployed a digital MSK solution delivered through a smartphone camera, using motion-analysis technology to guide and correct exercises remotely. The program aimed to democratize access to guideline-concordant MSK care, providing scalable, at-home therapy integrated into existing treatment pathways.

Results and Impact

In a multicenter RCT with 1,237 low back pain patients over 12 months, claims data showed that Kaia users had 80% lower medical costs than those receiving standard care. These results demonstrate that Kaia’s solution is a cost-effective, clinically supported option for reducing MSK expenses while maintaining care quality.

Component Insights

Based on component, software held the largest market share of 68.17% in 2025. This segment encompasses AI-driven platforms for assessment, treatment planning, progress tracking, and patient engagement. These solutions use computer vision, motion analytics, and machine learning to evaluate movement quality and functional performance. Moreover, interoperability with electronic medical records (EMR) and electronic health records (EHR) enhances clinical workflow integration. For instance, in April 2024, EXI, a clinically validated “exercise intelligence” platform, integrated Kemtai’s computer-vision AI into its mobile app to deliver real-time, guided physical activity at home. The partnership supports safe technique, adherence, and personalized programs for users with up to 20+ comorbid conditions, aiming to improve outcomes at scale.

The services segment is expected to grow at the fastest CAGR during the forecast period. This segment encompasses implementation, training, customization, system integration, and ongoing support related to AI platforms. Integration services ensure interoperability with electronic health records and billing systems. Ongoing technical support maintains system performance and compliance.

Deployment Mode Insights

Based on deployment mode, cloud-based segment held the largest revenue share of 78.64% in 2025. Cloud deployment supports real-time motion analysis, remote patient monitoring, and data-driven treatment adjustments. In addition, centralized data storage enables continuous performance tracking and outcome measurement. Clinics benefit by avoiding large upfront investments in hardware and maintenance, resulting in more manageable operational costs and rapid setup.

Moreover, this segment is expected to grow at the fastest CAGR from 2026 to 2033. The expansion of home-based and hybrid physical therapy delivery drives growth in cloud-based adoption. Cloud infrastructure supports multi-site clinic networks and remote oversight of therapists. Subscription-based models improve affordability and predictability of costs. Compliance with U.S. data security standards strengthens provider confidence.

Application Insights

Based on application, musculoskeletal (MSK) rehabilitation accounted for the largest revenue share of 37.33% in 2025. MSK conditions, including back pain, osteoarthritis, joint injuries, and repetitive strain disorders, account for the highest physical therapy demand. AI-driven motion analysis and computer vision provide an objective assessment of movement quality and functional limitations. For instance, in January 2024, Kaia Health launched the first comprehensive Spanish-language digital MSK pain management platform for the 40 million U.S. Spanish-speaking population. Features personalized therapy, exercises with voice-overs, education, and Spanish-speaking health coaches. Enhances health equity and access, developed with PTs.

“Being the first company to provide an AI-powered MSK solution in Spanish goes beyond addressing a market gap; it guarantees access to a substantial segment of the U.S. MSK population. This underscores Kaia Health’s commitment to health equity and ensures everyone can seamlessly access our innovative musculoskeletal platform anytime, anywhere,”

-Konstantin Mehl, Founder and CEO, Kaia Health.

Moreover, growth in MSK rehabilitation is supported by the shift toward outpatient and home-based care. AI platforms enable remote monitoring of exercise adherence and technique.

The post-acute & post-surgical rehabilitation segment is anticipated to grow at the fastest CAGR from 2026 to 2033. Patients recovering from orthopedic surgeries such as joint replacements, spinal procedures, and ligament repairs require structured rehabilitation programs. AI-driven tools support protocol-driven therapy and early detection of complications. Remote monitoring allows clinicians to track recovery progress without the need for frequent in-person visits. Moreover, integration with surgical care pathways improves outcomes and patient adherence.

End Use Insights

Based on end use, the outpatient physical therapy clinics segment held the largest market share of 51.21% in 2025. These clinics manage high patient volumes across musculoskeletal, post-surgical, and chronic rehabilitation programs. AI solutions enhance therapist efficiency through automated movement analysis and digital assessments.

The homecare settings segment is anticipated to grow at the fastest CAGR from 2026 to 2033. AI-enabled platforms support remote assessment, exercise guidance, and progress tracking in patient homes. Computer vision and wearable-integrated systems provide real-time feedback on movement quality. These tools improve adherence and reduce the need for frequent in-person visits. Home-based AI therapy increases access for elderly and mobility-limited patients.

Key U.S. AI In Physical Therapy Company Insights

Key players operating in the U.S. market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key U.S. AI In Physical Therapy Companies:

- Sword Health, Inc.

- kemtai.com

- Raintree Systems.

- Prompt Therapy Solutions

- Empower EMR (by MerlinWave, Inc.)

- Kaia Health

- NXGN Management, LLC.

- Axxess

- Zanda Health Pty Ltd (formerly Power Diary)

- Meditab

- HENO

Recent Developments

-

In March 2025, Kaia Health partnered with Ramp Health, integrating AI-powered digital MSK therapy, personalized exercises, and motion coaching into Ramp's workplace health solutions. Targets employers, health plans for injury prevention, cost reduction, and scalable care access.

“We’re thrilled to join forces with Ramp Health to expand the reach of our digital MSK care programs. By integrating our digital-first solutions into Ramp’s established health and safety ecosystem, we’re prioritizing a user-centric approach for delivering accessible, impactful care to clients and individuals alike.”

- In February 2025, Raintree launched ScribeIQ, the first AI-centric EMR scribe for rehab therapy, following the acquisition of Yoomi Health. It self-onboards therapists in under 15 minutes, using ambient transcription with noise filtering and specialized terminology for precise EHR documentation.

"ScribeIQ is a game changer for rehab therapists. Its depth of integration, enabled by Raintree's recent acquisition of Yoomi Health, means more impactful innovation, including AI automated workflows that would be impossible to build if the AI technology is not owned by the EHR company."

- Tara Clem, Raintree Chief Product Officer

-

In January 2025, Raintree Systems acquired Yoomi Health, a rehab therapy AI company, to accelerate its roadmap toward becoming the leading AI‑centric EMR in rehab therapy. The deal expands Raintree’s AI Center of Excellence, enabling deeply embedded AI workflows that reduce manual tasks, address declining reimbursements and staff attrition, and enhance outcomes for both practices and patients.

-

In March 2024, Kaia Health launched clinically validated pelvic floor support within its MSK app, addressing pelvic pain, bowel/bladder dysfunction, and postpartum recovery for 25% of U.S. women. It features AI-powered evidence-based exercises, education, health coaching, and PT support to enhance access and quality of life nationwide.

-

In January 2024, Clever Health, an AI-driven virtual care platform, partnered with Kemtai to embed AI-guided, computer-vision exercise into its care management solution.

-

In June 2023, Kaia Health launched Angela, a HIPAA-compliant AI-powered voice-based digital care assistant. It supports MSK patients with real-time guidance, exercise feedback, and care team summaries for 650,000+ users.

“Angela provides a first glimpse into the future of care — leveraging AI and natural language processing to transform the patient experience and support the care team. I believe providing personalized help, motivation, and guidance has the potential to reshape care and help more patients achieve their desired clinical outcomes."

- In January 2023, Kaia Health partnered with Mutual of Omaha to pilot its clinically validated digital MSK therapy for Medicare Supplement policyholders in Indiana and Colorado.

U.S. AI In Physical Therapy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 221.35 million

Revenue forecast in 2033

USD 1,069.81 million

Growth rate

CAGR of 25.24% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, application, end use

Country scope

U.S.

Key companies profiled

Sword Health, Inc.; kemtai.com; Raintree Systems; Prompt Therapy Solutions; Empower EMR (by MerlinWave, Inc.); Kaia Health; NXGN Management, LLC.; Axxess; Zanda Health Pty Ltd (formerly Power Diary); Meditab; HENO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI In Physical Therapy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. AI in physical therapy market report based on component, deployment mode, modality, application, and end use:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-Based

-

Server-based

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Musculoskeletal (MSK) Rehabilitation

-

Post-Acute & Post-Surgical Rehabilitation

-

Neurological Rehabilitation

-

Sports & Performance Therapy

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Outpatient Physical Therapy Clinics

-

Hospitals & Health Systems

-

Homecare Settings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. AI in physical therapy market size was estimated at USD 178.00 million in 2025 and is expected to reach USD 221.35 million in 2026.

b. The U.S. AI in physical therapy market is expected to grow at a compound annual growth rate of 25.24% from 2026 to 2033 to reach USD 1,069.81 million by 2033.

b. The outpatient physical therapy clinics segment held the largest market share of 51.21% in 2025.

b. Some key players operating in the U.S. AI in physical therapy market include kemtai.com; Raintree Systems; Prompt Therapy Solutions; Empower EMR (by MerlinWave, Inc.); Kaia Health; NXGN Management, LLC.; Axxess; Zanda Health Pty Ltd (formerly Power Diary); Meditab; and HENO.

b. Key factors that are driving the U.S. AI in physical therapy market are rising prevalence of musculoskeletal (MSK) conditions, growing adoption telehealth and telemedicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.