- Home

- »

- Medical Devices

- »

-

U.S. Artificial Ventilation And Anesthesia Masks Market, 2030GVR Report cover

![U.S. Artificial Ventilation And Anesthesia Masks Market Size, Share & Trends Report]()

U.S. Artificial Ventilation And Anesthesia Masks Market (2025 - 2030) Size, Share & Trends Analysis Report By Mask Type (Disposable Masks, Reusable Masks), By Application (Operating Rooms, ICU, Emergency Rooms, Homecare, ASCs), And Segment Forecasts

- Report ID: GVR-4-68040-637-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

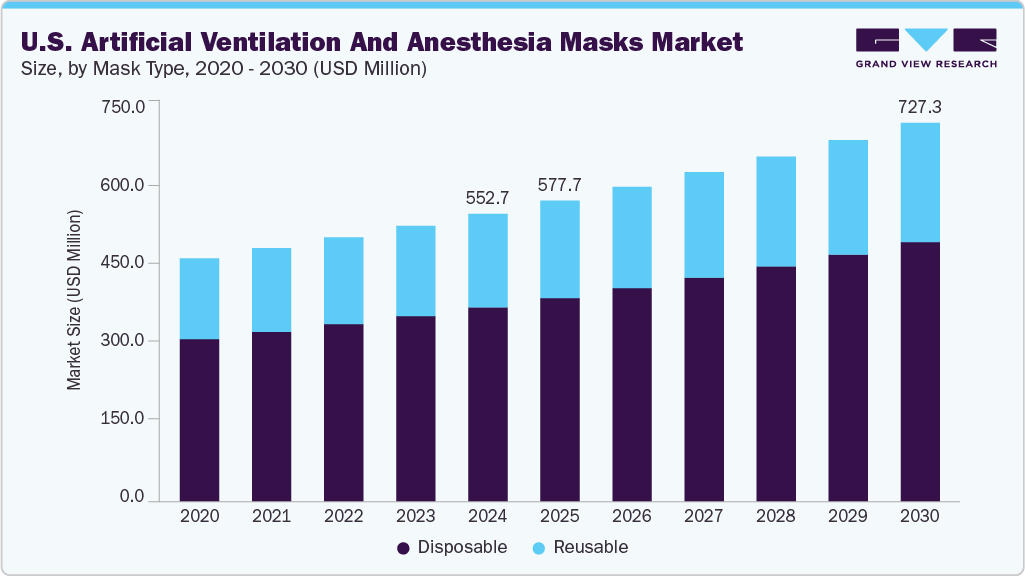

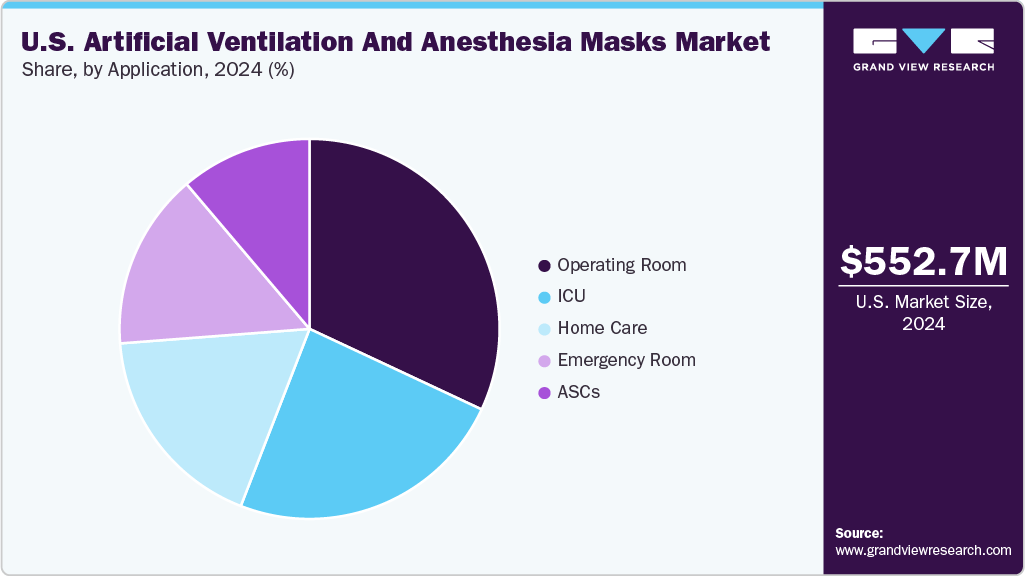

The U.S. artificial ventilation and anesthesia masks market size was estimated at USD 552.7 million in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030. The growth can be attributed to the rising incidences of respiratory diseases, development in technology, rising number of surgeries, population growth, especially of the geriatric people, effects of the covid-19 pandemic, increased healthcare spending, and support in the policies.

The rising prevalence of chronic respiratory diseases such as COPD, asthma, and pneumonia will drive market growth. According to the CDC report of June 2024, around 6 million adults in the U.S. have COPD, and it is one of the top 10 causes of death in the U.S., presenting a significant opportunity for healthcare providers and manufacturers to invest in respiratory care solutions. The increasing demand for long-term home care and emergency treatment for lung diseases in adults and children will also contribute to market demand.

Advancements in technology have led to the development of more user-friendly and efficient artificial ventilation and anesthesia masks. Features such as integrated monitoring systems for disposables, improved mask designs for enhanced patient comfort, and enhanced safety features are attracting healthcare providers to these products. Moreover, as the demand for high-quality respiratory care solutions increases, manufacturers are investing in research and development to create innovative products that meet the evolving needs of healthcare professionals. With a focus on patient comfort, safety, and efficacy, the artificial ventilation and anesthesia masks market is poised for significant growth in the coming years.

The COVID-19 pandemic greatly impacted the U.S. artificial ventilation and anesthesia masks market, driving a surge in demand for respiratory support equipment due to the high incidence of severe respiratory complications. Hospitals and emergency departments faced acute shortages of ventilators and associated consumables, including masks, prompting rapid production scale-ups and emergency use authorizations by the FDA. The crisis accelerated the adoption of single-use and disposable masks to reduce cross-contamination risks and spurred innovations in non-invasive ventilation technologies. Additionally, supply chain disruptions and raw material shortages exposed vulnerabilities, leading to increased domestic manufacturing initiatives and stockpiling strategies post-pandemic.

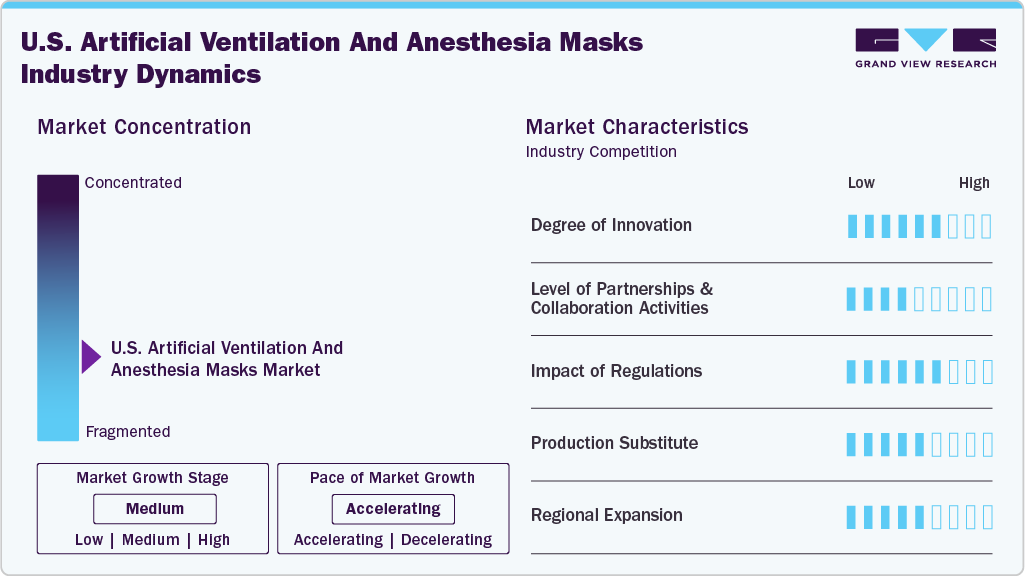

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. artificial ventilation and anesthesia masks market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is moderate. The market is experiencing significant innovation as numerous players introduce new products with advancements in smart technologies, patient safety, and sustainability. Modern devices now incorporate digital interfaces, real-time monitoring sensors, and automated pressure controls that enhance precision and safety during procedures.

The level of partnerships and collaboration activities in the U.S. ventilation and anesthesia masks market remains relatively low. Most companies focus on in-house R&D, proprietary product development, and direct sales rather than strategic alliances.

The impact of regulations on the market is high. The U.S. artificial ventilation and anesthesia market is significantly influenced by various laws & regulations, which play a critical role in shaping product design, approval timelines, and market entry. The FDA classifies these masks as Class II medical devices, requiring 510(k) premarket notification and compliance with stringent safety, biocompatibility, and performance standards. Evolving standards from agencies like OSHA and the CDC regarding infection control and respiratory protection have led to the need for continuous product updates.

A potential substitute for artificial ventilation and anesthesia masks is the growing adoption of non-invasive ventilation interfaces such as high-flow nasal cannulas (HFNC) and helmet-based ventilation systems. These alternatives offer greater patient comfort, reduced risk of skin breakdown, and improved communication during use. In addition, advancements in automated closed-loop ventilation systems and conscious sedation techniques may reduce the dependence on traditional anesthesia masks in certain procedures. As healthcare providers seek more efficient, patient-friendly solutions, the increasing acceptance of these substitutes poses a moderate threat to the conventional artificial ventilation and anesthesia masks market.

The level of regional expansion in industry is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

Mask Type Insights

Disposable masks segment accounted for the largest revenue share of 67.49% in 2024. The dominance of disposable masks in the medical industry is largely driven by their cost-effectiveness, user convenience, reduced infection risk, and adherence to legal requirements. Healthcare professionals opt for disposables to minimize the risk of healthcare-acquired infections through cross-contamination barriers. Systematic production ensures consistent design, material quality, and predictable performance.

Reusable masks segment is expected to grow significantly over the forecast period. Reusable masks offer a cost-effective solution for hospitals, as they can be cleaned and reused, reducing waste and minimizing costs. In addition, healthcare facilities are adopting sustainable products in response to plastic pollution concerns. Opting for reusable masks promotes a healthier environment and reduces medical waste, making it a more responsible choice for healthcare organizations.

Application Insights

The operating rooms application segment dominated the market in 2024. Operating rooms have modern working ventilation systems and devices for anesthesia where one is able to control in detail the amount of air circulation and the concentration of the anesthetic mixture. In addition, healthcare professionals and other employees who are in direct contact with operating rooms are well-trained and familiar with utilizing appropriate forms of artificial ventilation, including the anesthesia masks.

Ambulatory surgical centers (ASCs) are expected to register the fastest CAGR in the forecast period. ASCs are renowned for offering cost-effective surgical options compared to traditional hospital settings. As day surgery facilities, they benefit from reduced operational costs and patient charges. With a focus on efficient procedures that require minimal hospital stays, ASCs excel in delivering high-tech treatments, driving operational efficiency, and enhanced patient care.

Key U.S. Artificial Ventilation And Anesthesia Masks Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key U.S. Artificial Ventilation And Anesthesia Masks Companies:

- Medtronic

- BD (Becton, Dickinson and Company)

- ResMed

- Vyaire Medical, Inc.

- Thermo Fisher Scientific Inc.

- Drägerwerk AG & Co. KGaA

- Koninklijke Philips N.V.

- Nihon Kohden Corporation

- Hamilton Medical

- Ambu A/S

- Cardinal Health

Recent Developments

-

In March 2025, An InventHelp inventor from Diamond Bar, California, developed the M J Surgical Induction Mask a pediatric anesthesia mask integrated with a pacifier to comfort children during surgical induction. This patented design aims to reduce stress and fear in young patients by allowing them to suckle and feel nurtured when separated from their parents

U.S. Artificial Ventilation And Anesthesia Masks Market Report Scope

Report Attribute

Details

Market Size for 2025

USD 577.6 million

Revenue forecast in 2030

USD 727.3 million

Growth rate

CAGR of 4.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mask type, application

Key companies profiled

Medtronic; BD (Becton, Dickinson and Company); ResMed; Vyaire Medical, Inc.; Thermo Fisher Scientific Inc.; Drägerwerk AG & Co. KGaA; Koninklijke Philips N.V.; Nihon Kohden Corporation; Hamilton Medical; Ambu A/S; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Artificial Ventilation And Anesthesia Masks Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. artificial ventilation and anesthesia masks market report based on mask type and application:

-

Mask Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Masks

-

Reusable Masks

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Operating Rooms

-

ICU

-

Emergency Rooms

-

Home Care

-

ASCs

-

Frequently Asked Questions About This Report

b. The U.S. artificial ventilation and anesthesia masks market size was estimated at USD 552.70 million in 2024 and is expected to reach USD 577.67 million in 2025.

b. The U.S. artificial ventilation and anesthesia masks market is expected to grow at a compound annual growth rate of 4.71% from 2025 to 2030 to reach USD 727.3 million by 2030.

b. Disposable masks segment accounted for the largest revenue share of 67.49% in 2024. The dominance of disposable masks in the medical industry is driven by their cost-effectiveness, user convenience, reduced infection risk, and adherence to legal requirements.

b. Some key players operating in the U.S. artificial ventilation and anesthesia mask market include Medtronic, BD (Becton, Dickinson and Company), ResMed, Vyaire Medical, Inc., Thermo Fisher Scientific Inc., Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Nihon Kohden Corporation, Hamilton Medical, Ambu A/S, Cardinal Health

b. Key factors that are driving the market growth include the rising incidences of respiratory diseases, development in technology, rising number of surgeries, population growth especially of the geriatric people, effects of the covid-19 pandemic, increased healthcare spending, and support in the policies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.