- Home

- »

- Medical Devices

- »

-

U.S. Assisted Living Facility Market, Industry Report, 2033GVR Report cover

![U.S. Assisted Living Facility Market Size, Share & Trends Report]()

U.S. Assisted Living Facility Market (2025 - 2033) Size, Share & Trends Analysis Report By Age (More Than 85, 75-84, 65-74, Less Than 65), By Region (West, Southeast, Southwest, Midwest, Northeast), And Segment Forecasts

- Report ID: GVR-4-68038-060-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Assisted Living Facility Market Summary

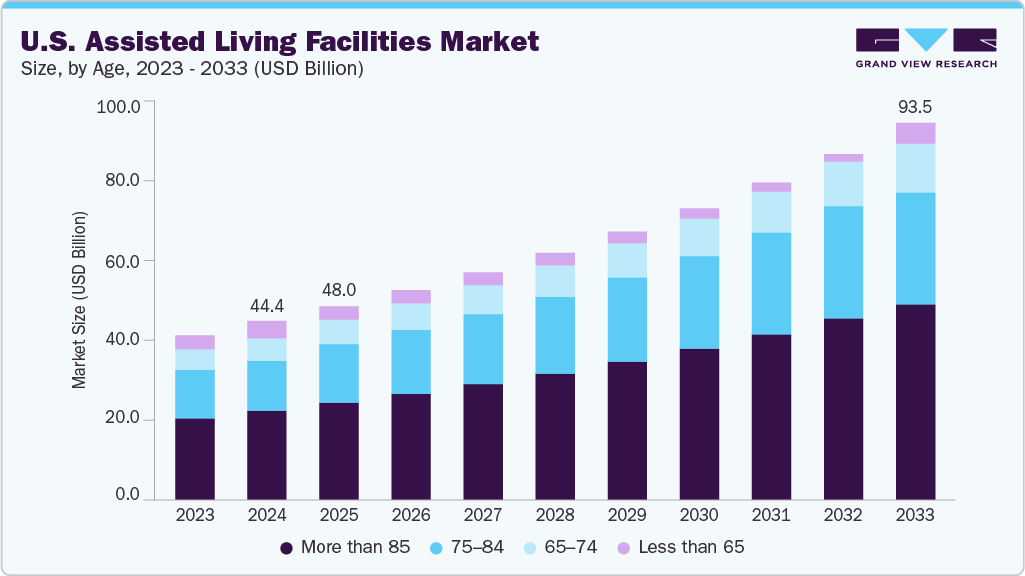

The U.S. assisted living facility market size was estimated at USD 44.38 billion in 2024 and is expected to reach USD 93.54 billion by 2033, growing at a CAGR of 8.69% from 2025 to 2033. This growth is driven by the increasing life expectancy and the baby boomer generation contributing to the demand for assisted living facilities (ALFs). Moreover, the growing geriatric population seeking companionship, security, & assistance with daily activities and patients suffering from neurological & other chronic disorders are expected to drive the market growth. As per the data published by the Population Reference Bureau in January 2024, the number of Americans aged 65 and above is projected to reach 95 million by 2060, increasing from 52 million in 2018. By percentage, the age group of 65 years and above is expected to increase from 16% in 2018 to 23% by 2060.

Rise in Demand for Assisted Living Facilities (ALF):

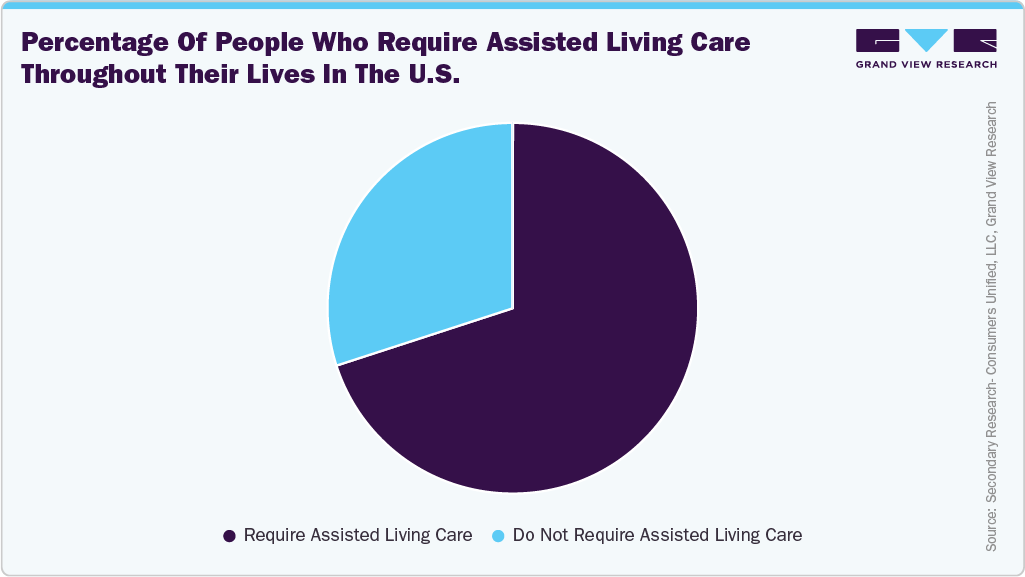

As the U.S. population of seniors continues to grow, the demand for ALFs is becoming increasingly pressing. According to the RubyHome article published in September 2023, approximately 1.2 million Americans reside in nursing homes, with over 15,000 nursing facilities nationwide. In addition, more than 30,000 communities cater primarily to older adults, as half of all facility residents are 85 or older. The financial implications of these arrangements are significant, with the median monthly cost for assisted living averaging USD 4,500. In contrast, a private room in a nursing home can cost around USD 9,034/month, nearly double the assisted living rate. Notably, California, Florida, and Washington lead the nation in assisted living communities, with 5,900, 2,400, and 2,000, respectively. Moreover, according to Consumers Unified, LLC, seven out of ten individuals in the U.S. require assisted living care in their lifetime.

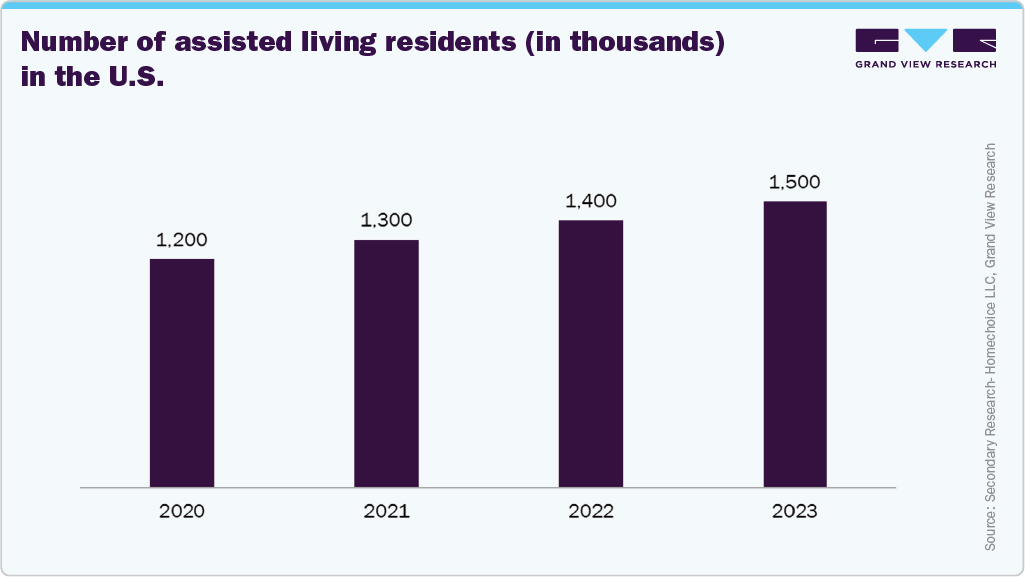

The Growing Number of Residents in ALF:

The growing number of residents in ALFs indicates an increasing demand for these services. This trend highlights the need for high-quality assisted living facilities across the country. As this demand continues to rise, providers must evolve to address the changing needs of the aging population. The urban areas have a greater concentration of assisted living facilities for several reasons. The higher population density in cities results in a larger pool of potential residents. Moreover, the proximity to healthcare services, social amenities, and transportation makes urban settings appealing for these facilities. The market in urban areas benefits from various amenities and services, allowing facilities to offer multiple activities, dining choices, and recreational opportunities that cater to diverse residents.

Assisted Living Resident By Age in the U.S.

Half of all residents are 85 years of age or older. Below is the breakdown of residents in assisted living facilities by age group.

Growing need for assistance with daily activities and the high prevalence of chronic health conditions:

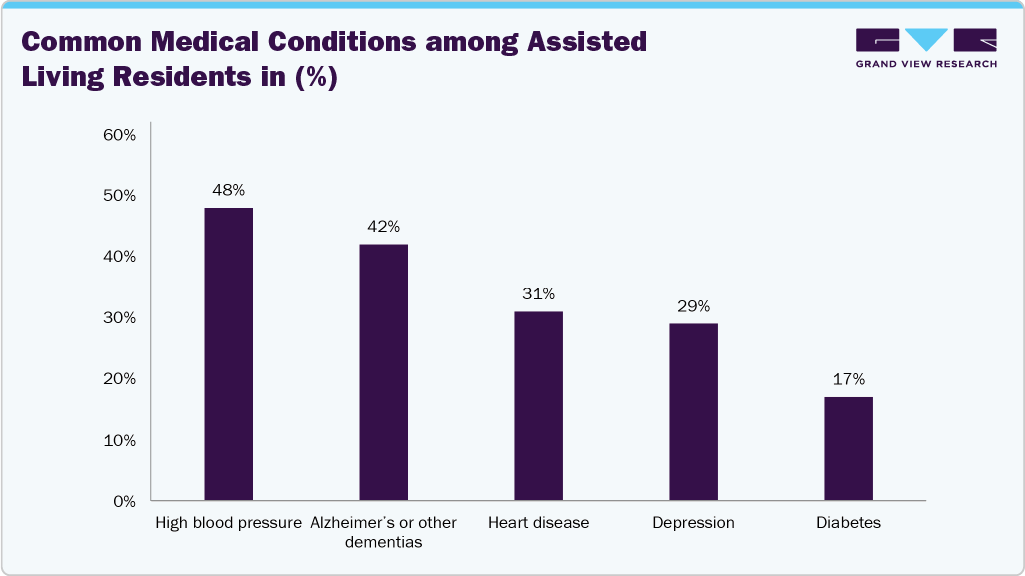

The growing need for assistance with daily activities and the high prevalence of chronic health conditions among older adults are key factors driving the growth of the ALF market in the U.S. While most residents in these facilities require only limited help with tasks such as bathing, dressing, or medication management, the consistent availability of professional support enhances their quality of life and safety. The presence of chronic conditions such as high blood pressure, Alzheimer’s and other dementias, heart disease, depression, and diabetes underscores the demand for specialized care services within these settings. These health needs necessitate a structured environment that can offer both medical oversight and personal care, making ALF an increasingly attractive option for aging adults and their families.

Common Daily Activities Requiring Help

Typically, residents require help with only a few activities and do not need round-the-clock assistance, though staff members are always present. Below are the common daily activities residents may need:

Growing Investments and Franchises:

There is a surge in investments and franchising of ALFs, propelled by a growing demand for quality senior care. Real estate investment trusts (REITs), private equity firms, and institutional investors are investing capital into the sector, recognizing the long-term growth potential of senior housing. As the industry evolves, established operators expand their footprint through partnerships, acquisitions, and franchise models. The rise of franchised ALF and adult care facilities has provided investors with scalable business opportunities, allowing for brand consistency, standardized care protocols, and operational efficiencies.

Franchising is a popular option for entrepreneurs entering the assisted living and adult care market, providing advantages such as marketing support, a proven business model, and regulatory guidance. Major brands, such as Brookdale Senior Living, Ventas, and Welltower, dominate the market, with 56% of assisted living facilities being chain-owned and typically serving over 100 patients each. In addition, there are numerous local providers of varying sizes across the country.

In October 2024, National Health Investors, Inc. acquired 10 memory care and ALFs, which included 522 units, for about USD 120 million in North Carolina. The communities acquired by NIH are as follows:

-

Spring Arbor of Apex, 41 units

-

Spring Arbor of Albemarle, with 45 units

-

Spring Arbor of Greensboro, 74 units

-

Spring Arbor of Cary, 68 units

-

Spring Arbor of Kinston, 44 units

-

Spring Arbor of Greenville, 42 units

-

Spring Arbor of Rocky Mount, 52 units

-

Spring Arbor of Outer Banks, 69 units

-

Spring Arbor of Wilson, 45 units

-

Spring Arbor of Wilmington, 42 units

Growing Technological Investments:

Assisted living incorporates innovative features and amenities to meet residents' evolving needs and preferences. These enhancements aim to provide older adults with a comfortable and engaging environment. Thus, such technological advancements in the facilities boost the number of residents in those facilities. The innovative features and amenities are listed in the table below:

Trend/Technology

Description

Smart Home Technology

Integration of smart thermostats, automated lighting, and voice-activated assistants to improve resident safety and convenience.

Wellness Programs

Comprehensive programs include mental health support, nutritional counseling, and fitness classes to promote holistic well-being.

Personalized Care

Tailored care plans with customized meals, personalized assistance, and medication management for each resident.

Social and Recreational Spaces

Creation of spaces like game rooms, libraries, gardens, and communal dining to encourage socialization and engagement.

Cybersecurity and Data Integration

Focus on breaking down siloed systems, ensuring data interoperability, and improving digital security in senior living facilities.

Remote Monitoring

Use of digital platforms, mobile apps, and remote health monitoring tools as standard in senior living communities.

AI and Predictive Analytics

Use of AI for staffing optimization, scheduling, and predictive care planning to enhance operational efficiency.

Automating Business

Adoption of tech to streamline financial workflows, compliance, and administrative operations, allowing staff to focus more on resident care.

Source: Grand View Research

Market Concentration & Characteristics

The U.S. assisted living facility market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, and the level of partnerships & collaborationsactivities is medium. The impact of regulations on the market is high, and the service expansion of players is medium.

Innovations include enhancing resident care, improving operational efficiency, and differentiating their services. For instance, facilities are adopting smart home technologies, such as voice-activated assistants, automated lighting, and smart thermostats, allowing residents greater autonomy in managing their environments. Another major innovation is the development of community-centered living spaces that promote engagement, mental wellness, and socialization, moving away from the institutional model. On the administrative side, automation of business operations, such as compliance tracking and billing, helps streamline workflows.

The U.S. assisted living facility industry saw notable consolidations as larger companies aim to expand their reach and capabilities. For instance, in March 2025, Ballad Health and Ahava Healthcare officially announced the partnership and joint venture to operate four Ballad Health long‑term care and ALF. The facilities included in the collaboration are:

-

Francis Marion Manor, Marion, Virginia

-

Wexford House, Kingsport, Tennessee

-

Laughlin Healthcare Center, Greeneville, Tennessee

-

Madison House (assistive‑living), Kingsport, Tennessee

Heather Lansaw, chief operating officer of Ahava Healthcare, said:

“We are honored to continue the legacy of excellence in long-term care that Ballad Health has built. Our goal is to ensure our partnership expands resources and support for residents, families and team members. Ahava Healthcare and Ballad Health are committed to fostering a loving, welcoming and encouraging environment where residents can reach their highest potential in physical, emotional and social well-being.”

Regulations play a crucial role in the U.S. assisted living facility market, dictating operational standards and care delivery. Unlike nursing homes, these facilities are primarily governed by state laws, leading to differences in licensing, staffing, and quality standards. For instance, California has strict guidelines for resident agreements and staff training, while Florida requires regular inspections for memory care units. These variations impact market entry, operational costs, and scalability for providers across states.

The market is expanding due to an aging population, evolving care preferences, and demand for personalized services. As baby boomers seek supportive environments that allow for independence, operators are modernizing and expanding facilities. For instance, companies such as Brookdale and Atria are investing in upgrades and new developments, including smart-enabled units. There is also a rise in regional players in underserved suburban and rural areas. Mixed-use senior living developments are becoming popular, combining healthcare with hospitality and retail. Partnerships with healthcare providers are enhancing on-site services, reflecting a shift toward integrated and lifestyle-oriented care models.

Age Insights

More than 85 years segment dominated the U.S. assisted living facility industry with a revenue share of 49.87% in 2024. The segment is expected to grow at the fastest CAGR during the forecast period. Increasing life expectancy is a major factor contributing to the segment’s growth. According to the National Association of Real Estate Investment Trusts (NAREIT), the average age of assisted living residents is 87 years old. Moreover, more than half (52%) of the residents in these communities are 85 years old or older. These statistics demonstrate the need for specialized care for seniors who require assistance in daily activities. In addition, as per the ACL Administration for Community Living. The number of people aged 85 and above is expected to grow from 6.6 million in 2019 to 14.4 million in 2040. More ALFs are needed in the region as the rapidly aging population grows. This is likely to raise the demand for professional caregivers as well as new assisted living facilities that provide daily living activities.

The less than 65 years segment is anticipated to grow at the significant CAGR during the forecast period, owing to the rising prevalence of early-onset chronic diseases, such as multiple sclerosis, Parkinson’s disease, traumatic brain injuries, and diabetes-related complications, which limit individuals’ ability to live independently and require supportive care. In addition, the increase in disabilities due to accidents, congenital conditions, and mental health disorders has prompted a need for residential care settings that provide medical supervision, personal assistance, and rehabilitative support. Many in this age group seek environments that offer both autonomy and tailored care, which ALFs are increasingly able to provide through personalized care plans, remote health monitoring, and supportive infrastructure.

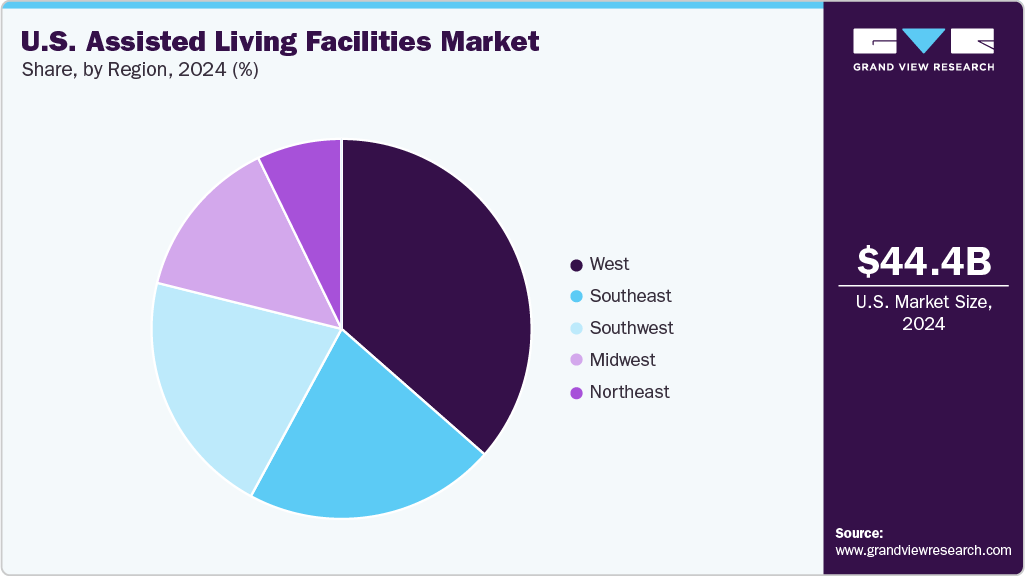

Regional Insights

The West region dominated the U.S. assisted living facility market with the largest revenue share of 36.46% in 2024. The West U.S., including states such as Oregon, California, Arizona, and Washington, has a significant older population. This has resulted in a highly competitive market for ALF operators. The U.S. Census Bureau's 2020 population estimates show that Oregon’s 18.6% of the population is 65 or above, Arizona’s 18.5% is 65 or above, and Washington’s 16.2% of the population is 65 or above. SeniorHomes.com reports that there are 1,057assisted living facilities in Arizona, 584 in Colorado, and over 3,588 in California. This is expected to contribute to the growth of the West region. Factors such as the rapidly aging population, increasing demand for senior care services, and changes in healthcare policy are driving the market growth.

The Southeast region is expected to witness the fastest CAGR over the forecast period, owing to the growing aging population in states such as Florida, Texas, and Georgia boosts demand for senior care services, especially assisted living, due to their warm climates and tax-friendly policies. The South's lower cost of living makes it appealing for retirees seeking affordable care. In addition, increased investment in healthcare infrastructure and state-level incentives, including Medicaid waiver programs, are supporting the expansion of assisted living services in the region.

Key U.S. Assisted Living Facility Company Insights

The U.S. market for the assisted living facility is consolidated, with a presence of a few large and various medium & small service providers. Sunrise Senior Living, Brookdale Senior Living, and Kindred Healthcare, LLC are some of the established ALF providers in the U.S. Service providers are taking initiatives such as the construction of new facilities to strengthen their market presence.

Key U.S. Assisted Living Facility Companies:

- Kindred Healthcare

- Brookdale Senior Living Solutions

- Sunrise Senior Living

- Sonida Senior Living

- Atria Senior Living, Inc

- Five Star Senior Living (AlerisLife)

- Merrill Gardens

- Centers for Dialysis Care

- Integral Senior Living (ISL)

- Belmont Village, L.P.

Recent Developments

-

In December 2024, Morgan Stanley Investment Management, via its private real estate arm Morgan Stanley Real Estate Investing (MSREI), completed the acquisition of a portfolio of eight premium senior housing communities originally developed by Brightview Senior Living and previously held by Harrison Street. This portfolio comprises approximately 1,186 units spread across major metropolitan markets in Baltimore, Philadelphia, Providence (RI), and Boston, and is predominantly independent living residences.

-

In February 2024, Ally Senior Living merged with Onelife Senior Living, a family‑owned developer/operator with historic roots in Oregon. The deal created a newly unified company, continuing under the Onelife Senior Living name and branding. The merger aims to accelerate growth, targeting roughly three to five value‑add acquisitions or third‑party management contracts over the next 12–18monthswhile preserving high standards of resident care through careful integration and operational alignment.

U.S. Assisted Living Facilities Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 93.54 billion

Growth rate

CAGR of 8.69% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age, region

Country scope

U.S.

Key companies profiled

Kindred Healthcare; Brookdale Senior Living Solutions; Sunrise Senior Living; Sonida Senior Living; Atria Senior Living, Inc.; Five Star Senior Living (AlerisLife); Merrill Gardens; Centers for Dialysis Care; Integral Senior Living (ISL); Belmont Village, L.P.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Assisted Living Facility Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 For this study, Grand View Research has segmented the U.S. assisted living facility market report based on age, and region:

-

Age Outlook (Revenue, USD Billion, 2021 - 2033)

-

More than 85

-

75-84

-

65-74

-

Less than 65

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. assisted living facility market size was estimated at USD 44.38 billion in 2024.

b. The U.S. assisted living facility market is expected to grow at a compound annual growth rate of 8.69% from 2025 to 2033 to reach USD 93.54 billion by 2033.

b. The west region dominated the regional segment of the U.S. assisted living facility market with a share of 36.46% in 2024. This is attributable to the presence of the highest number of ALFs in the region.

b. Some key players operating in the U.S. assisted living facility market include Kindred Healthcare, Inc.; Atria Senior Living, Inc.; Integral Senior Living; Brookdale Senior Living Solutions; Five Star Senior Living; Sunrise Senior Living, Inc.; Capital Senior Living; Merrill Gardens; and Belmont Village Senior Houston.

b. Key factors that are driving the U.S. assisted living facility market growth include increasing awareness and desire of consumers to age in home-based services and lower cost of assisted living facilities (ALFs) as compared to nursing homes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.