- Home

- »

- Medical Devices

- »

-

U.S. Assisted Living Facility Market Size & Share Report, 2030GVR Report cover

![U.S. Assisted Living Facility Market Size, Share & Trends Report]()

U.S. Assisted Living Facility Market Size, Share & Trends Analysis Report By Age (More Than 85, 75-84, 65-74, Less Than 65), Region (West, South, Midwest), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-060-6

- Number of Pages: 66

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

The U.S. assisted living facility market size was valued at USD 91.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.53% from 2023 to 2030. Major factor driving the market growth is the growing geriatric population seeking companionship, security, and assistance with daily activities, are residing in ALFs. The rise in the geriatric population due to increased life expectancy is expected to grow rapidly in the future. According to National Institute on Aging (NIA), globally, around 8.5% of the population is aged 65 and above. As per data published by Population Reference Bureau, the number of Americans aged 65 years & above is projected to reach 95 million by 2060, from 52 million in 2018.

The rise in the geriatric population due to increased life expectancy is expected to grow rapidly in the future. According to National Institute on Aging (NIA), globally, around 8.5% of the population is aged 65 and above. As per data published by Population Reference Bureau, the number of Americans aged 65 years & above is projected to reach 95 million by 2060, from 52 million in 2018.

Technological developments for ALFs are expected to propel its U.S. market. The development of sophisticated & easy-to-use devices and services, such as Internet-enabled home monitors, telemedicine, and apps for mobile health, is likely to boost the market over the forecast period.

The COVID-19 U.S. assisted living facility market impact: 5.0% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The cost of maintaining a high quality of care at senior care facilities has increased, especially for those with COVID-19 patients

Vaccination drive and implementation of other safety measures are expected to help facilities increase their occupancy and in turn revenue from operations

A major decline in the ALF occupancy was observed due to the high risk of infection

Adults suffering from mental illness require assisted living to sustain in mainstream society. In the U.S., mental illness is considered to be the most expensive disorder, costing about USD 201 billion annually to the nation. This is expected to translate into exponential growth in the assisted living industry.

Over the past few years, the healthcare sector has witnessed various technological advancements, such as wireless data communication, electronic health records, telemedicine/telehealth, activity monitoring systems, fall prevention or detection systems, tracking or wandering management systems, and medication adherence systems. For instance, an electronic medication adherence system enables tracking a patient’s medication schedule and whether they are following it.

Based on the nature of the population served and service provision, residents at assisted living facilities may be at a high risk of contracting COVID-19. According to the CDC, in the early months of the pandemic, around 2.1 million people lived in residential care or ALFs and nursing homes, which represents 0.6% of the U.S. population. A number of these facilities became hotspots for the transmission of the novel coronavirus and 42% of the total COVID-19 deaths in the U.S. were ALF residents.

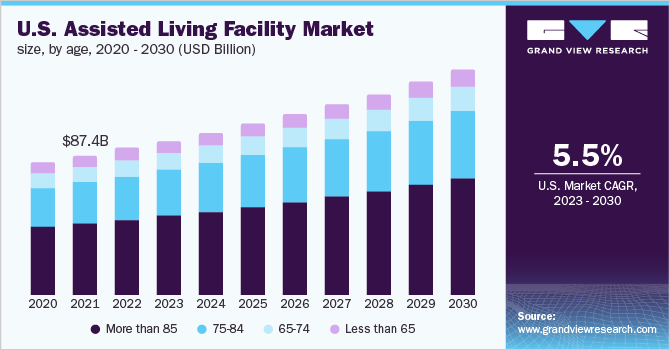

Age Insights

An increase in the baby boomer population, rising incidence of brain injury, growing prevalence of target diseases, and technological advancements are major factors contributing to the growth of the market. More than 85 years segment accounted for the largest market share of 52.35% in 2022 and is expected to register the fastest CAGR of 5.65% during the forecast period, while the 75 to 84 age group was the second largest segment in 2022.

In the U.S., the growing geriatric population is seeking ALF services to improve their quality of life. According to the United States Census Bureau, the 75 to 84 age group made up roughly 14.3 million or 29% of the senior population in 2016, which is more than double the number and proportion (6.3 million or 13 percent) of those 85 & older. Around 27% of the population is between the ages of 75 and 84.

According to data published by Aging.com, two million housing facilities will be needed for senior residents for adequate living space by 2040. The concept of continual care retirement communities is gaining traction among seniors with high disposable income. Such retirement communities are known to cater to people aged 50 years and above. The idea behind these communities is to prevent seniors from relocating when additional care is needed. As a result, the less than 65 years segment is likely to receive a moderate boost over the forecast period.

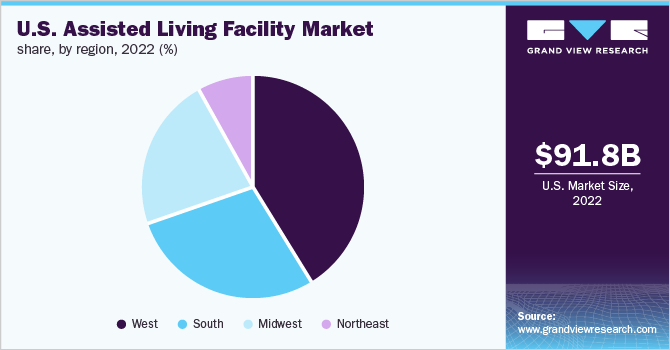

Regional Insights

On the basis of region, the market is categorized into West, South, Midwest, and Northeast. The west region dominated the segment with the largest market share of 41.38% in 2022, which can be attributed to the presence of the highest number of ALFs in the region. The South is expected to witness the fastest growth owing to the increasing geriatric population and rising demand for senior care facilities.

ALFs in the South are evenly distributed among small, medium, and large facilities. Some of the largest senior care organizations, such as Brookdale Senior Living, Inc. and Sunrise Senior Living, Inc. are located in the South. The south region is estimated to register the fastest CAGR of 6.20% from 2023 to 2030. Texas is one of the fastest-growing states in terms of improved living conditions and a number of facilities for senior residents. However, ALFs in certain states of the Southern region are facing a shortage of healthcare workers.

Key Companies & Market Share Insights

The U.S. market for the assisted living facility is consolidated with a presence of a few large and various medium & small service providers. Sunrise Senior Living, Brookdale Senior Living, and Kindred Healthcare, LLC are some of the established ALF providers in the U.S. Service providers are taking initiatives such as the construction of new facilities to strengthen their market presence. For instance, in January 2021, Kindred Healthcare, LLC and Tampa General Hospital initiated the construction of a joint rehabilitation facility as per their joint venture in May 2020.

Some of the key players in the U.S. assisted living facility market include:

-

Kindred Healthcare, LLC

-

Brookdale Senior Living Inc.

-

Sunrise Senior Living, LLC

-

Atria Senior Living, Inc.

-

Five Star Senior Living

-

Capital Senior Living

-

Merrill Gardens

-

Integral Senior Living (ISL)

-

Belmont Village, L.P.

-

Gardant Management Solutions

U.S. Assisted Living Facility Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 96.6 billion

The revenue forecast in 2030

USD 140.8 billion

Growth rate

CAGR of 5.53% from 2023 to 2030

The base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Segments covered

Age, region

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

West; South; Midwest; Northeast

Key companies profiled

Kindred Healthcare, LLC; Brookdale Senior Living Inc.; Sunrise Senior Living, LLC; Atria Senior Living, Inc.; Five Star Senior Living; Capital Senior Living; Merrill Gardens; Integral Senior Living (ISL); Belmont Village, L.P.; Gardant Management Solutions

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Assisted Living Facility Market Segmentationt

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. assisted living facility market report based on age and region:

-

Age Outlook (Revenue, USD Billion, 2017 - 2030)

-

More than 85

-

75-84

-

65-74

-

Less than 65

-

- Region Outlook (Revenue, USD Billion, 2017 - 2030)

-

West

-

South

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. assisted living facility market size was estimated at USD 91.8 billion in 2022 and is expected to reach USD 96.6 billion in 2023.

b. The U.S. assisted living facility market is expected to grow at a compound annual growth rate of 5.53% from 2023 to 2030 to reach USD 140.8 billion by 2030.

b. The west region dominated the regional segment of the U.S. assisted living facility market with a share of 41.4% in 2022. This is attributable to the presence of the highest number of ALFs in the region.

b. Some key players operating in the U.S. assisted living facility market include Kindred Healthcare, Inc.; Atria Senior Living, Inc.; Integral Senior Living; Brookdale Senior Living Solutions; Five Star Senior Living; Sunrise Senior Living, Inc.; Capital Senior Living; Merrill Gardens; Gardant Management Bradley; and Belmont Village Senior Houston.

b. Key factors that are driving the U.S. assisted living facility market growth include increasing awareness and desire of consumers to age in home-based services and lower cost of assisted living facilities (ALFs) as compared to nursing homes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."