- Home

- »

- Medical Devices

- »

-

U.S. Assisted Living Facility & Neurorehabilitation Market Report, 2030GVR Report cover

![U.S. Assisted Living Facility & Neurorehabilitation Market Size, Share & Trends Report]()

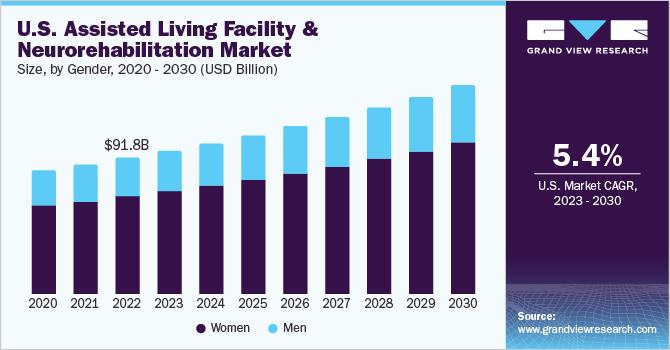

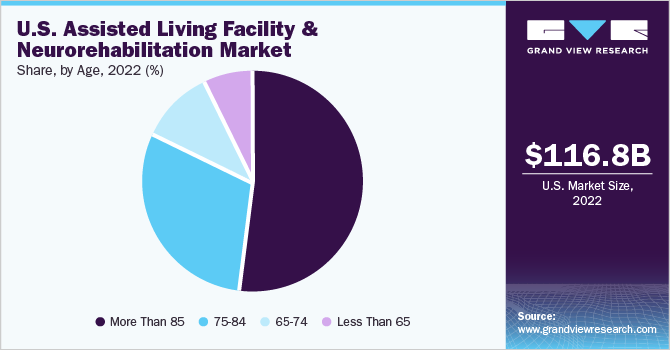

U.S. Assisted Living Facility & Neurorehabilitation Market Size, Share & Trends Analysis Report By Gender (Women, Men), By Age (More Than 85 Years, 75-84 Years, 65-74 Years, Less Than 65 Years), By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-920-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The U.S. assisted living facility & neurorehabilitation market size was valued at USD 116.8 billion in 2022 and is anticipated to grow at a CAGR of 5.4% from 2023 to 2030. Individuals residing in Assisted Living Facilities (ALFs), largely senior citizens, seek companionship, security, and assistance with daily activities. An increasing number of Traumatic Brain Injury (TBI) survivors seeking neurorehabilitation and residential care and a growing geriatric population are the key factors driving the market for assisted living facilities and neurorehabilitation. According to the UN estimates, one out of five people in the U.S. are estimated to be aged 65 years and above by 2050. The U.S. has a significantly high geriatric population, as advancements in medicine and technology have increased life expectancy.

About 7 out of every ten people in assisted living facilities depend on their personal wealth or their families to pay for their services. To make these facilities more affordable for low-income individuals, several states are changing the Medicaid regulations applicable to any assisted living facility. An assisted living facility does not abide by federal regulations, therefore, cannot claim Medicare reimbursement. This is the major restraining factor as the cost is one of the primary factors potential tenants consider while making decisions. However, this scenario is anticipated to improve as almost 40 states provide or plan to reimburse these services through Medicaid partially. According to Genworth Financial, in 2021, the national median cost of assisted living facilities was approximately USD 4,500 a month, or USD 54,000 per year in the U.S.

Increased life expectancy, growing income from the senior population, and the desire to live in senior housing communities for better healthcare and quality of life are expected to fuel the market for assisted living facilities and neurorehabilitation over the forecast period. Adults suffering from various mental illnesses require prolonged assistance in mainstream society. In the U.S., mental illness is considered the most expensive disorder. This is expected to grow exponentially in the assisted living facility and neurorehabilitation industry. Many assisted living facilities offer special treatment for Traumatic Brain Injury (TBI) survivors.

According to an article published by the World Health Organization in October 2022, the proportion of the geriatric population is expected to almost double to 22% in 2050 from 12% in 2015. Due to reducing immunity levels, the geriatric population is more prone to age-related neurological conditions, such as Parkinson’s disease. Therefore, over the forecast period, the increasing global base of the aging population will drive the growth of the neurorehabilitation devices market. In Asian countries such as Japan, China, and India, an increasing aging population coupled with large untapped opportunities is anticipated to increase the need for neurorehabilitation devices.

Neurorehabilitation has changed tremendously in recent years due to the adoption of computer-aided and electronic robotic devices. These devices help in improving patient response to rehabilitation treatments. The market has immense growth potential due to the rising incidence and prevalence of neurological disorders. In May 2023, the University of Calgary and Alberta Health Services partnered to support individuals suffering from strokes, spinal cord injuries, and movement issues. The Researching Strategies for Rehabilitation, or the RESTORE Network, collaborates with academics and experts to conduct clinical trials and test new therapies to improve the quality of life for patients with neurological disorders.

Immobility is the most common effect of neurological conditions. According to American Stroke Association, stroke is 5th cause of death in the U.S. and the leading cause of disability. Around 2.5 million people have multiple sclerosis, whereas 10 million have Parkinson’s disease worldwide. Spinal cord injuries can also affect the nervous system, leading to disability, which depends on the injury. According to WHO, 250,000 and 500,000 people suffer spinal cord injuries yearly.

The current treatment cost of neurorehabilitation is high. Developed countries such as the US, Canada, and the UK are adopting newer treatments at a fast rate due to technological advancements and higher disposable income. On the other hand, developing countries such as China, India, and Brazil lack technology. A deficit in the capital is required to employ high-end rehabilitation treatments due to lower disposable income.

Gender Insights

Based on gender, the market for assisted living facilities and neurorehabilitation is segmented into women and men. The women segment held the largest market share in 2022 and is expected to grow at the fastest CAGR during the forecast period. An assisted living facility is a long-term senior care facility that provides personal care support services, such as social and recreational activities, housekeeping, meals, exercise, and wellness services. The greater life expectancy of women, higher rates of disability and chronic health problems, and lower income compared to men are some of the major factors behind the dominance of this gender group in an assisted living facility.

Age Insights

The U.S. assisted living facility & neurorehabilitation market is segmented based on age into more than 85, 75-84, 65-74, and less than 65. The more than 85-year-old segment accounted for the largest share in 2022 in the market for assisted living facilities and neurorehabilitation and is also expected to register the fastest CAGR of 5.7% during the forecast period. According to the U.S. Department of Health and Human Services, a person turning 65 today has a nearly 70% probability of needing long-term care services and support in their remaining years.

According to Administration for Community Living (ACL), the population aged 85 years and above is projected to increase from 6.4 million in 2016 to 14.6 million by 2040. The growing geriatric population demands more assisted living facilities and neurorehabilitation centers in the region. This is likely to increase the demand for professional caregivers and new assisted living facilities offering neurorehabilitation. According to Aging.com, seniors in the U.S. will need about two million housing facilities by 2040 to provide adequate living space for those in need of care.

Continuing-care retirement communities have been gaining traction among seniors with stable financial means. Such a facility is known to cater to tenants as young as 50 years of age. The idea behind these communities is that “seniors” do not have to relocate when additional care is needed as time passes. As a result, the less than 65 years segment in the market for assisted living facilities and neurorehabilitation is likely to receive a moderate boost over the forecast period. According to the report published by SeniorLiving.org in June 2023, more than 800,000 Americans currently live in assisted living facilities in the U.S.; only half are 85 or older.

Competitive Insights

In June 2023, an immersive therapy startup, Neuro Rehab VR, launched a teaching course and a VR therapy certification program expected to help advance rehabilitation services. The Neuro Rehab VR's XR Therapy System is an FDA-registered medical device that allows U.S. patients to access services under healthcare insurance plans. The course offers approved treatments for strokes, spinal cord, sports injuries, Alzheimer's, and Parkinson's diseases.

Acquisition and partnerships are key strategies followed by the major players in the assisted living facility and neurorehabilitation market. For instance, in January 2020, NeuroRestorative partnered with Main Line Rehabilitation Associates, Inc. in Pennsylvania, to expand its post-acute TBI service portfolio. Main Line Rehabilitation Associates provides community-based support services to patients who suffered a brain injury. The following are some of the major participants in the U.S. assisted living facility & neurorehabilitation market:

-

Centre For Neuro Skills

-

Mary Lee Foundation

-

NeuroRestorative

-

The MENTOR Network

-

Pate Rehabilitation

-

ResCare, Inc.

-

Texas NeuroRehab Center

-

Texas Rehabilitation and Habilitation Specialists, LLC

-

Moody Neurorehabilitation Institute

U.S. Assisted Living Facility & Neurorehabilitation Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 177.3 billion

Growth Rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender, age, country

Country scope

U.S.

Key companies profiled

Centre For Neuro Skills; Mary Lee Foundation; NeuroRestorative; The MENTOR Network; Pate Rehabilitation; ResCare, Inc.; Texas NeuroRehab Center; Texas Rehabilitation and Habilitation Specialists, LLC; Moody Neurorehabilitation Institute

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Assisted Living Facility & Neurorehabilitation Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. assisted living facility & neurorehabilitation market report based on gender, age, and country:

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Women

-

Men

-

-

Age Outlook (Revenue, USD Billion, 2018 - 2030)

-

More than 85 years

-

75-84 years

-

65-74 years

-

Less than 65 years

-

Frequently Asked Questions About This Report

b. The U.S. assisted living facility & neurorehabilitation market size was estimated at USD 116.8 billion in 2022 and is expected to reach USD 122.7 billion in 2023.

b. The U.S. assisted living facility & neurorehabilitation market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 177.3 billion by 2030.

b. The age group of more than 85 years dominated the telemedicine market with a share of around 52% in 2019. This is attributable to an increase in this age group from 6.4 million in 2016 to 14.6 million by 2040. The growing geriatric population base demands for more assisted living facilities in the region.

b. Some key players operating in the U.S. assisted living facility & neurorehabilitation market include Kindred Healthcare, LLC, Encompass Health Corporation, Tenet Healthcare Corporation, MEDNAX Services, Inc., TeamHealth, UnitedHealth Group, Quorum Health Corporation, Surgery Partners, Surgical Care Affiliates (SCA), Community Health Systems, Inc., HCA Healthcare, Inc., and Surgical Center Development, Inc.

b. Key factors that are driving the market growth include the increasing number of Traumatic Brain Injury (TBI) survivors seeking neurorehabilitation and residential care and the growing geriatric population is the key factor driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."