U.S. Attention Deficit Hyperactivity Disorder Market Summary

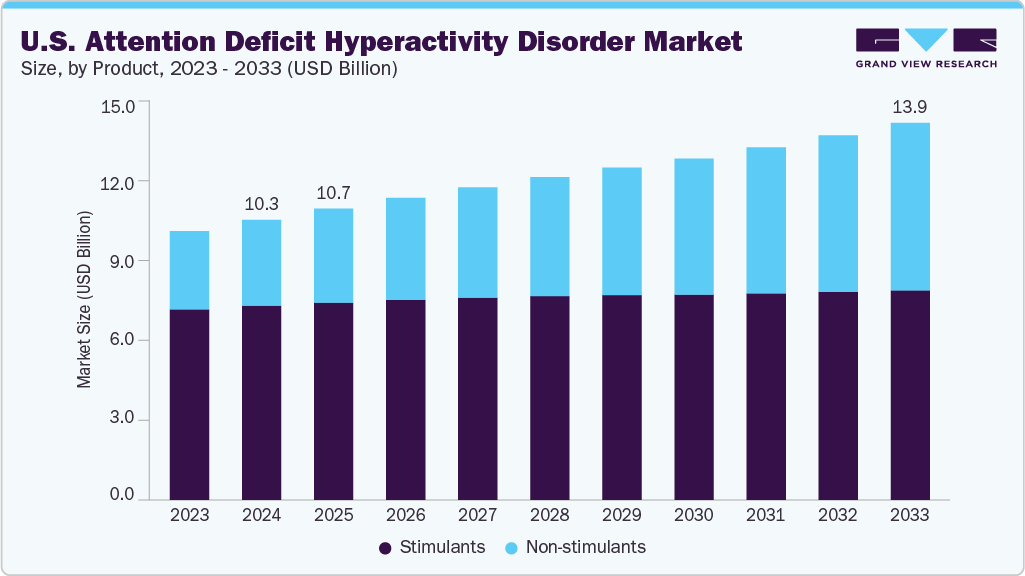

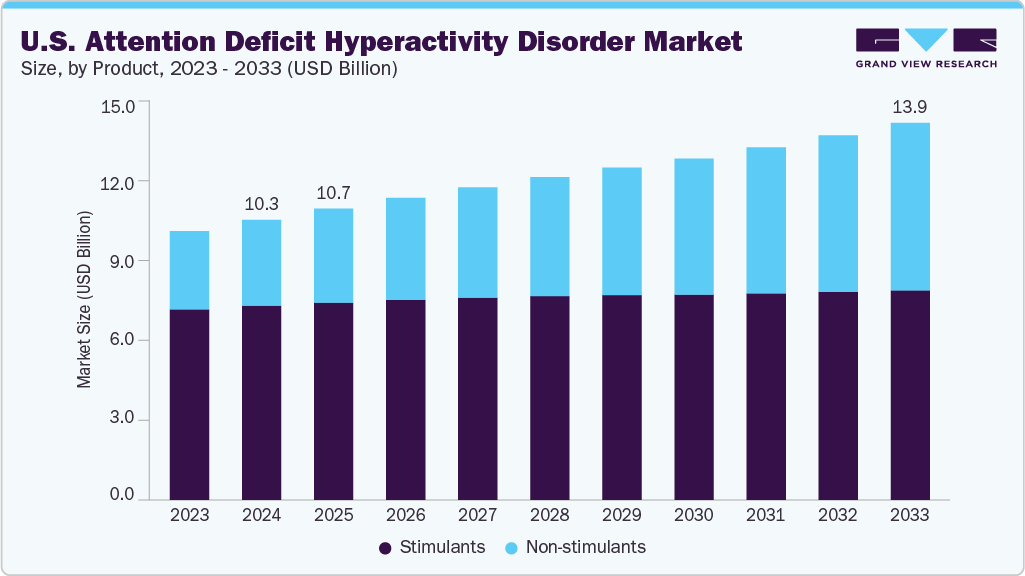

The U.S. attention deficit hyperactivity disorder market size was estimated at USD 10.31 billion in 2024 and is projected to reach USD 13.88 billion by 2033, growing at a CAGR of 3.3% from 2025 to 2033. The market is primarily driven by a continuous increase in diagnosed cases, supported by expanded diagnostic criteria, greater public awareness, and more consistent screening in primary care settings.

Key Market Trends & Insights

- By drug type, the stimulants segment held the highest market share of 69.3% in 2024.

- Based on demographics, the adults segment held the highest market share in 2024.

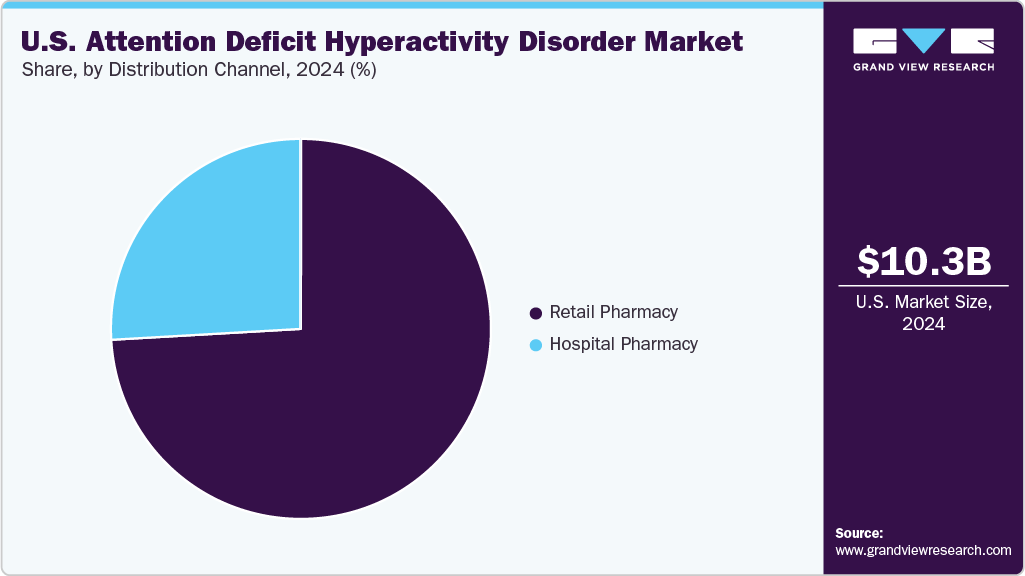

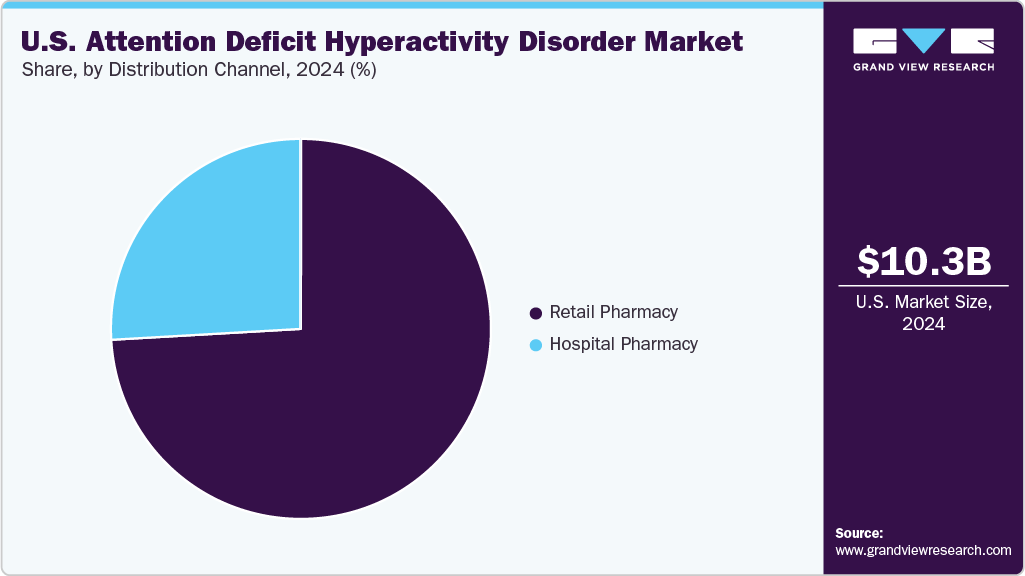

- By distribution channel, the retail pharmacy segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.31 Billion

- 2033 Projected Market Size: USD 13.88 Billion

- CAGR (2025-2033): 3.3%

Attention Deficit Hyperactivity Disorder (ADHD) remains one of the most commonly diagnosed neurodevelopmental disorders in the U.S., shaping clinical practice and public health initiatives. A 2020-2022 National Health Interview Survey reported that 11.3% of U.S. children aged 5 to 17 have been diagnosed with ADHD at some point. Boys (14.5%) are nearly twice as likely as girls (8.0%) to receive a diagnosis. Similar trends are seen in adults, with lifetime ADHD prevalence estimated at around 8.1% among those aged 18 to 44.

Growing awareness among caregivers and educators, driven by school screening programs and destigmatization efforts, is further expanding the pool of patients being identified. Innovation in treatment options is another major driver of growth of the U.S. attention deficit hyperactivity disorder industry. Although stimulant medications such as methylphenidate and amphetamines continue to dominate prescriptions, recent advances highlight the market’s shift toward non-stimulant and digital therapies. In December 2023, the FDA expanded the indication for EndeavorRx, the first game-based digital therapeutic, to include adolescents aged 13 to 17, following pivotal STARS-ADHD trial data showing significant attention improvements on TOVA assessments (p < 0.0001).

Changes in care delivery and payer policies continue to influence market dynamics. The widespread adoption of telehealth, accelerated by the COVID-19 pandemic, has reduced barriers to ongoing treatment by facilitating more frequent follow-ups and dose adjustments. In addition, updated insurance coverage guidelines now commonly reimburse digital and behavioral therapies alongside medication. Integrated care models that combine behavioral therapy with medication management within pediatric and adolescent health networks are becoming increasingly prominent, especially as comorbid conditions such as anxiety and learning disorders receive greater attention. In January 2025, Supernus Pharmaceuticals obtained an FDA label update for Qelbree, adding new pharmacodynamic data and information on breastfeeding women.

M&A activity in the ADHD segment is relatively selective, primarily involving specialty pharmaceutical companies aiming to broaden their therapeutic or digital health portfolios. In September 2024, Collegium Pharmaceutical acquired Ironshore Therapeutics. The deal expanded Collegium's reach in the neurology sector, specifically in the ADHD market, and added Jornay PM, a stimulant to treat ADHD, to its portfolio.

Drug Type Insights

The stimulants segment dominated the U.S. attention deficit hyperactivity disorder industry and accounted for a revenue share of 69.3% in 2024. This is due to their proven effectiveness, fast action, and strong support from guidelines by the American Academy of Pediatrics and the American Psychiatric Association. Extended-release and once-daily dosing options have also improved treatment adherence and quality of life, particularly for school-age children and working adults. The development of age-specific formulations is a significant factor in the segment’s continued leadership.

The non-stimulants segment is expected to grow at the fastest CAGR of 7.5% over the forecast period. These are increasingly seen as safer for long-term use, especially for patients with a substance use history, anxiety, or cardiovascular concerns. Their non-controlled status also makes them easier to prescribe via telehealth and by primary care providers. Viloxazine ER (Qelbree) from Supernus Pharmaceuticals is another key factor driving this growth. Originally approved for pediatric ADHD, Qelbree’s label was expanded to include adults. In May 2024, Tris Pharma received the U.S. FDA approval for Onyda XR, a liquid non-stimulant formulation to treat ADHD in pediatric patients of 6 years and above age.

Demographics Insights

The adult segment accounted for the highest revenue share in 2024. This is attributed to better recognition of inattentive and executive function symptoms beyond childhood. Many adults are either newly diagnosed or returning to treatment after stopping care in childhood. As ADHD impacts work performance, emotional regulation, and social relationships, effective long-term symptom management has become a priority. The focus on functional, long-acting stimulant formulations drives growth in this segment. In November 2024, Lupin Limited received the U.S. FDA approval for its Abbreviated New Drug Application (ANDA) for mixed salts of a single entity amphetamine product, to market a generic version of Adderall XR Extended-Release Capsules of Takeda Pharmaceuticals U.S.A., Inc. The product is used to treat ADHD in adults and pediatric patients of 6 and above age.

The children’s segment (ages 2-17) is expected to grow at a significant CAGR in the U.S. attention deficit hyperactivity disorder industry during the forecast period, driven by early detection efforts and an increased focus on youth mental health. Programs like the CDC’s Healthy Schools initiative and expanded behavioral screenings in pediatric clinics have increased ADHD referrals. As a result, children are being diagnosed and treated at younger ages, fueling demand for flexible dosing, non-tablet formulations, and treatments that address comorbidities.

Distribution Channel Insights

The retail pharmacy segment accounted for the largest revenue share in 2024. This is because pharmacies are the preferred source for refilling stimulant and non-stimulant prescriptions due to their accessibility, extended hours, and integration with electronic prescribing systems. Major retail chains also provide medication synchronization, adherence support, and pharmacist-led counseling, essential services for patients managing lifelong neurodevelopmental disorders.

The hospital pharmacy segment is projected to experience a significant CAGR from 2025 to 2033. The segment growth is driven by factors such as availability of multiple treatment options, the increasing prevalence of ADHD, and the launch of new therapeutics for better & more effective treatment with minimal adverse effects.

Key U.S. Attention Deficit Hyperactivity Disorder Company Insights

Some leading companies in the U.S. attention deficit hyperactivity disorder industry are Pfizer Inc.; Johnson & Johnson Services, Inc.

- Johnson & Johnson Services, Inc., headquartered in New Brunswick, New Jersey, is a global healthcare company with a diverse portfolio that includes immunology, oncology, neuroscience, infectious diseases, cardiovascular health, and medical devices. Through its Janssen Pharmaceuticals division, Johnson & Johnson offers Concerta.

Key U.S. Attention Deficit Hyperactivity Disorder Companies:

- Eli Lilly and Company

- Pfizer Inc.

- Johnson & Johnson

- Lupin Pharmaceuticals, Inc.

- Novartis Pharmaceuticals Corporation

- Takeda Pharmaceutical Company Limited.

- Mallinckrodt.

- PURDUE PHARMA L.P.

- NEOS THERAPEUTICS, INC. (Aytu BioPharma)

- Supernus Pharmaceuticals, Inc.

Recent Developments

-

In September 2024, the U.S. DEA increased production quotas for lisdexamfetamine (Vyvanse), including generic versions, by 24%. This increase aims to resolve a multi-year shortage and ensure continuous treatment for patients on Vyvanse.

U.S. Attention Deficit Hyperactivity Disorder Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 10.71 billion

|

|

Revenue forecast in 2033

|

USD 13.88 billion

|

|

Growth rate

|

CAGR of 3.3% from 2025 to 2033

|

|

Historical Period

|

2021 - 2023

|

|

Actual data

|

2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Drug type, demographics, and distribution channel

|

|

Key companies profiled

|

Lilly.; Pfizer Inc.; Johnson & Johnson; Lupin Pharmaceuticals, Inc.; Novartis Pharmaceuticals Corporation; Takeda Pharmaceutical Company Limited.; Mallinckrodt.; PURDUE PHARMA L.P.; NEOS THERAPEUTICS, INC.; Supernus Pharmaceuticals, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Attention Deficit Hyperactivity Disorder Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. attention deficit hyperactivity disorder market report based on drug type, demographics, and distribution channel:

-

Drug Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Stimulants

-

Amphetamine

-

Methylphenidate

-

Lisdexamfetamine

-

Dexmethylphenidate

-

Non-stimulants

-

Atomoxetine

-

Guanfacine

-

Clonidine

-

Others

-

Demographics Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Pharmacy

-

Hospital Pharmacy