- Home

- »

- Automotive & Transportation

- »

-

U.S. Automotive Collision Repair Market Size, Report, 2030GVR Report cover

![U.S. Automotive Collision Repair Market Size, Share & Trends Report]()

U.S. Automotive Collision Repair Market Size, Share & Trends Analysis Report By Vehicle (Light-duty Vehicle, Heavy-duty Vehicle), By Product, By Service Channels (DIY, DIFM, OE), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-976-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

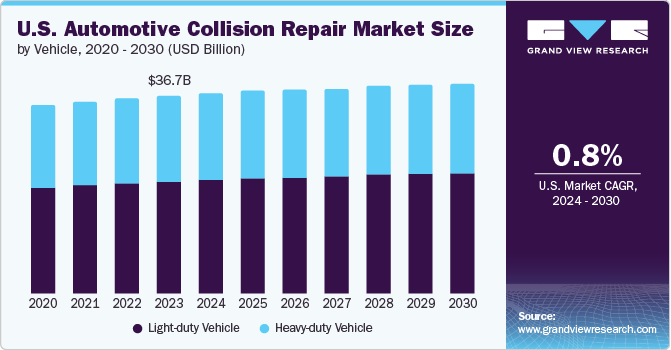

The U.S. automotive collision repair market size was valued at USD 36.66 billion in 2023 and is projected to grow at a CAGR of 0.8% from 2024 to 2030. In the U.S., transportation authorities and local governments require car owners to have active car insurance. This ensures that car owners can cover any expenses they are legally responsible for in the event of bodily injuries or vehicle damages during accidents. This requirement is a key factor contributing to the growth of the automotive collision repair market in the U.S.

High employment rates in the U.S. have contributed to continued economic growth and, in turn, high automobile sales. Subsequently, the average miles driven per vehicle has also increased, thereby driving the need for repairs and part replacement. Stringent mileage regulations set up by the U.S. government have compelled vehicle manufacturers to shift to carbon-based and aluminum-based products. These products offer an environmentally friendly and cost-effective way to increase vehicle performance and reduce emissions.

The U.S. economic conditions play a significant role in shaping market dynamics. Consumer spending power, insurance reimbursement rates, and the availability of financing options impact the utilization and revenue of repair shops. The country's robust economy is linked to increased car sales, accidents, and maintenance costs. Additionally, economic downturns may lead to repair delays or the selection of more affordable repair techniques.

Vehicle Insights

The light-duty vehicle segment dominated the market and accounted for a revenue share of 56.5% in 2023. Consumers prioritize light-duty vehicles such as cars, SUVs, and small trucks for personal and professional use. Customers in the country are increasingly seeking affordable and fuel-efficient vehicles. Moreover, the increasing popularity of electric SUVs among environmentally conscious consumers is expected to drive the segment’s growth.

The heavy-duty vehicle segment is expected to register a significant CAGR during the forecast period. This segment includes commercial and multi-axle vehicles such as trucks and buses. Heavy-duty vehicle collision repair depends on truck repair maintenance, troubleshooting, and comprehensive repairs. Automotive collision repairs performed on rolled trucks include sandblasting and painting, heavy collision, animal hits, light collision, and collision-related mechanical maintenance. These processes are mainly performed at workshops. Collision repair centers in the U.S. comply with the newly established Clean Air Act (CAA) regulations that focus on reducing air pollution around workshops.

Product Insights

The spare parts segment dominated the market in 2023. The spare parts used in the automobile industry include repair materials, supplementary mechanical parts, spare parts restoration materials, and tools. The increasing rate of road accidents destroying vital components such as grilles, bumpers, fenders, dents, and scratches drives the need for spare parts replacement. Additionally, better maintenance practices lead to longer vehicle lifespans. The constant need for change in spare parts to ensure the smooth operation of older vehicles drives the segment's growth.

The paints & coatings is projected to grow at the fastest CAGR over the forecast period. The growing emphasis on aesthetics, customization, and personalized options is expected to boost market growth. Moreover, the increasing use of advanced paint technologies such as anti-scratch and self-healing paints requires more frequent repainting. Furthermore, the expansion of this category is expected to be driven by more stringent environmental policies requiring low-VOC paints, which need to be reapplied more often because they fade quicker than conventional paints and synthetic coatings.

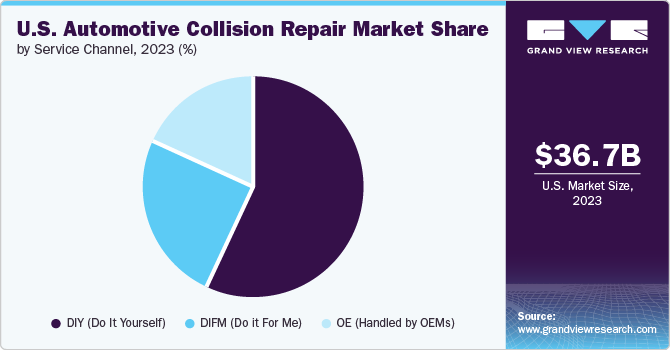

Service Channel Insights

The OE (handled by OEMs) segment dominated the market in 2023. Consumers prioritize original equipment parts for repairs to maintain their vehicle's integrity, safety features, and guarantee coverage. The emphasis on quality, high standards, and the manufacturer's expertise strengthen the OE sector's dominance in the U.S. collision repair industry.

The DIFM (Do it For Me) segment is projected to grow at the fastest CAGR over the forecast period. The increasing busy lifestyle of consumers and have less availability for car maintenance and repairs, along with the advance features of modern vehicles, makes it harder for the average person to repair, this leads to a preference for professional repair services. Additionally, the increasing preference for leasing and subscription car models often requires reliance on authorized repair shops that follow precise maintenance rules established by the manufacturers. The rely on professional services drives the growth of the DIFM segment. Moreover, technology enhancements like online booking and repair updates are increasing convenience and transparency for customers, thus driving growth within the DIFM sector.

Key U.S. Automotive Collusion Repair Company Insights

Some of the key companies in the U.S. automotive collision repair market include ZF Friedrichshafen AG, VALEO, Federal-Mogul LLC, and others. The major players are taking strategic initiatives, such as acquisitions and partnerships with other major players to gain a competitive edge in the industry.

-

ZF is a global tech firm providing advanced mobility products and systems for passenger cars, commercial vehicles, and industrial technology. Its product range is aimed at automobile manufacturers, companies providing transportation services, and startups in the transportation and mobility sectors. The company focuses on reducing emissions, protecting the climate, and enhancing safe mobility.

-

3M offers a perfect blend of art and science in the automotive collision repair market. It plays a vital role in enduring relationships with customers. The company constructed adhesives, abrasives, and coatings to solve the latest auto body repair demands. Their various products deliver new levels of efficiency in auto body paint and coating applications.

Key U.S. Automotive Collision Repair Companies:

- ZF Friedrichshafen AG

- VALEO

- Federal-Mogul LLC

- Faurecia

- Continental AG

- 3M

Recent Development

-

In May 2024, Foxconn acquired 50% of ZF Chassis Modules GmbH. The strategic partnership is expected to enhance cooperation, promote business growth, and expand the customer base. Foxconn's acquisition stake in ZF Chassis Modules GmbH achieves a 50-50 partnership, which was approved on July 24, 2023.

-

In April 2022, 3M acquired technology assets of LeanTec, which offer digital inventory management solutions for the automotive aftermarket industry in the US and Canada. The acquisition adds new levels of data insights and integration, enabling body shops to have increased operational efficiency, visibility into their business operations, and customer experience.

U.S. Automotive Collision Repair Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 38.95 billion

Growth rate

CAGR of 0.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, product, service channels

Key companies profiled

ZF Friedrichshafen AG; VALEO; Federal-Mogul LLC; Faurecia; Continental AG; 3M

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Collision Repair Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automotive collision repair market report based on vehicle, product, and service channels:

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Light-duty Vehicle

-

Heavy-duty Vehicle

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Paints & Coatings

-

Consumables

-

Spare Parts

-

-

Service Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

DIY (Do It Yourself)

-

DIFM (Do it For Me)

-

OE (handled by OEMs)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."