- Home

- »

- Automotive & Transportation

- »

-

Light Duty Vehicles Market Size, Share, Industry Report 2030GVR Report cover

![Light Duty Vehicles Market Size, Share & Trends Report]()

Light Duty Vehicles Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type, By Fuel Type (Diesel, Gasoline), By Transmission (Manual, Automatic), By Drivetrain, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-610-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Light Duty Vehicles Market Summary

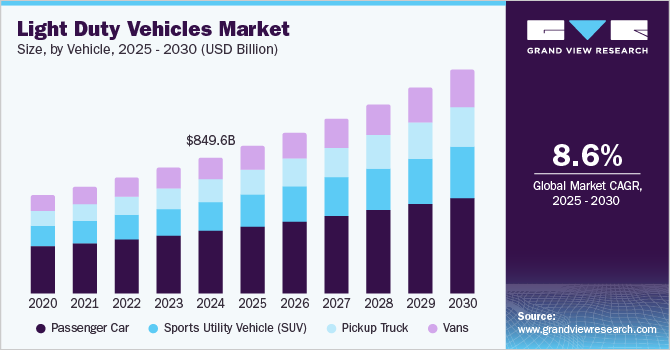

The global light duty vehicles market size was valued at USD 849.57 billion in 2024 and is projected to reach USD 1,394.24 billion by 2030, growing at a 8.6% from 2025 to 2030. These vehicles are highly regarded for their versatility, comfort, and perceived safety, making them ideal for families and individuals. As consumers prioritize vehicles that can accommodate both personal and family needs, the demand for light-duty vehicles continues to rise, reflecting a broader trend toward spacious and functional transportation options.

Key Market Trends & Insights

- The North America light duty vehicles market dominated the global revenue with a share of 37.0% in 2024.

- The Asia Pacific light duty vehicles market is expected to grow at the fastest CAGR during the forecast period.

- By vehicle, the passenger car segment dominated the market with a revenue share of 45.7% in 2024.

- By fuel type, the gasoline segment dominated the market with the highest revenue share in 2024.

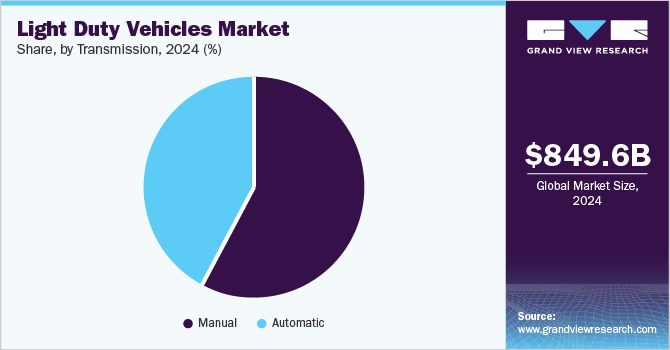

- By transmission, the manual segment dominated the market with the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 849.57 Billion

- 2030 Projected Market Size: USD 1,394.24 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As disposable incomes rise in various regions, more consumers can afford vehicle purchases. Alongside favorable financing options, this trend improves access to vehicle ownership, especially in developing markets experiencing rapid urbanization. Furthermore, the growth of the logistics sector driven by e-commerce has increased the demand for light-duty vehicles tailored for efficient last-mile delivery solutions.

Moreover, the increasing severity of emission regulations globally is fueling market expansion. Governments are enforcing stricter standards to lower vehicle emissions, which motivates manufacturers to innovate and create more fuel-efficient and environmentally friendly vehicles. The Council of the European Union has adopted a regulation under the "Fit for 55" initiative, establishing stricter CO2 emission performance standards for new cars and vans. The new rules aim for a 55% reduction in emissions for new cars and a 50% reduction for new vans by 2030 - 2034, ultimately targeting a 100% reduction by 2035.

Technological advancements are transforming vehicle performance and safety features, making new models more attractive to consumers. Innovations in fuel efficiency and electric vehicle technology are reshaping the automotive market, encouraging manufacturers to invest heavily in research and development. Together, these factors create a robust foundation for sustained growth in the light duty vehicles market over the coming years. For instance, Ford's 2023 Integrated Sustainability and Financial Report Summary outlines the company's commitment to sustainability and electric vehicle (EV) development. The report highlights Ford's plan to invest over USD 50 billion from 2022 to 2026 in EVs and batteries, aiming for a carbon-neutral transportation future while achieving significant production targets for electric vehicles.

Vehicle Insights

The passenger car segment dominated the market with a revenue share of 45.7% in 2024. This dominance can be attributed to several factors, including the increasing consumer preference for personal mobility solutions and the growing urban population that necessitates efficient transportation options. In addition, advancements in automotive technology, such as enhanced fuel efficiency and safety features, have made passenger cars more compelling to buyers. Furthermore, the availability of diverse financing options and government incentives for electric and hybrid vehicles is further driving growth in the passenger car segment.

The pickup truck segment is projected to grow at the highest CAGR during the forecast period. Pickup trucks cater to both personal and commercial needs, making them ideal for a wide range of activities, from daily commuting to heavy duty hauling. Their cargo space and towing capacity are valued by consumers who require functionality for work or recreational purposes. Moreover, the rise of e-commerce plays a crucial role, as pickup trucks are increasingly utilized for deliveries, especially in areas with limited infrastructure, further driving their popularity in the light duty vehicle industry. For instance, The Economic Times reported that during a recent festive season, Indian e-commerce companies saw a robust demand, with online retailers clocking about a 26% rise in sales compared to the previous year, totaling around USD 3.2 billion.

Fuel Type Insights

The gasoline segment dominated the market with the highest revenue share in 2024 due to its widespread use as the primary fuel for internal combustion engine (ICE) vehicles. Despite the growing interest in electric vehicles, gasoline remains the most commonly utilized fuel globally, particularly in regions where electric infrastructure is still developing. For instance, according to The U.S. Energy Information Administration (EIA), in 2022, petroleum products accounted for about 90% of total energy use in the U.S. transportation sector, with gasoline being the dominant fuel, comprising 52% of total energy consumption. The significant number of gasoline-powered automobiles on the road continues to drive demand, as consumers rely on gasoline for daily transportation needs.

The electric segment is projected to grow at the fastest CAGR during the forecast period. The decreasing total cost of ownership associated with electric vehicles (EVs), which includes lower fuel and maintenance expenses compared to traditional internal combustion engine vehicles is fueling the growth of this segment. Furthermore, advancements in battery technology have improved energy density and reduced costs, enabling longer driving ranges and making EVs more accessible to a broader audience. Government incentives and subsidies further encourage adoption by making electric vehicles more financially attractive. For instance, The Indian government has launched the PM E-DRIVE Scheme, aimed at accelerating the country's transition to electric mobility. With a budget of USD 1.3 billion, this initiative focuses on providing targeted incentives for electric vehicles and developing essential infrastructure. As consumer awareness of the benefits of EVs increases, coupled with a growing infrastructure for charging stations, the demand for electric vehicles is expected to rise significantly.

Transmission Insights

The manual segment dominated the market with the highest revenue share in 2024, owing to consumer preference for its driving experience. Many drivers appreciate manual transmissions' level of control and engagement, particularly in performance-oriented vehicles where precise gear shifting can enhance handling and responsiveness. In addition, manual vehicles often come at a lower purchase price than their automatic counterparts, making them more accessible to budget-conscious consumers. The simplicity of manual transmissions also tends to result in lower maintenance costs over time, benefiting a segment of buyers who prioritize practicality and cost-effectiveness.

The automatic segment is projected to grow at the fastest CAGR during the forecast period. There is an increasing consumer preference for convenience and ease of driving, particularly in urban environments where traffic congestion is common. Automatic transmissions offer a smoother driving experience, allowing drivers to focus on the road without the need to shift gears manually. Moreover, advancements in automatic transmission technology have led to improved performance. For instance, Toyota has introduced the 2025 GR Corolla, which features an 8 speed GAZOO Racing Direct Automatic Transmission (DAT) option, catering to both manual enthusiasts and those preferring automatic driving.

Drivetrain Insights

The rear wheel drive segment dominated the market with the highest revenue share in 2024, owing to its advantages in performance and handling characteristics. RWD systems are favored for their ability to distribute weight more evenly, enhancing traction during acceleration and improving stability, particularly in performance-oriented vehicles. This drivetrain configuration is often associated with sports cars and larger vehicles, resonating with consumers who prioritize driving dynamics and a more engaging driving experience. For instance, the Ford Mustang is renowned for its RWD configuration, its design allows for better weight distribution and traction during acceleration, which enhances its performance and handling characteristics. In addition, RWD vehicles typically offer better towing capabilities, making them attractive for both personal and commercial use.

The all-wheel drive segment is projected to grow at the fastest CAGR during the forecast period. As more consumers prioritize vehicles that offer better traction and stability, particularly in challenging weather conditions such as rain and snow, AWD systems are becoming a preferred choice for many buyers. The increasing popularity of SUVs and crossovers, which frequently include all-wheel drive (AWD), is notable. These vehicles are built to navigate different types of terrain and driving conditions. For instance, Ford's Intelligent AWD system automatically adjusts power between the front and rear wheels based on real-time data, which helps maintain control during sudden changes in road conditions, such as rain or snow.

Regional Insights

The North America light duty vehicles market dominated the global revenue with a share of 37.0% in 2024. The versatility and utility drive this demand for these vehicles for personal and family use. Moreover, the region benefits from a well-established automotive infrastructure, including extensive dealerships and service networks. Economic factors such as rising disposable incomes and favorable financing options further boost vehicle sales. The presence of major automotive manufacturers also ensures a diverse range of high-quality light duty vehicles for consumers.

U.S. Light Duty Vehicles Market Trends

The U.S. light duty vehicles market is characterized by a strong preference for larger vehicles, such as SUVs and pickup trucks, which dominate consumer choices. This trend is driven by lifestyle needs, where consumers prioritize space, versatility, and performance. Furthermore, favorable economic conditions, including rising disposable incomes and competitive financing options, have bolstered vehicle sales. The light duty vehicle industry is also witnessing advancements in vehicle technology, enhancing safety and connectivity features, which further attract buyers. As a result, the U.S. market remains robust and continues to evolve with changing consumer preferences.

Europe Light Duty Vehicles Market Trends

In Europe, the light duty vehicles market is significantly influenced by key countries such as Germany, France, Italy, and the UK. These nations have well-established automotive industries that drive innovation and production, particularly in the passenger car and light commercial vehicle segments. The light duty vehicle industry is adapting to stringent emission regulations, prompting a shift towards more fuel-efficient and low-emission vehicles.

Furthermore, countries such as Germany and France are at the forefront of adopting advanced driver assistance systems (ADAS) and investing in research and development. For instance, in July 2024, new EU regulations mandating the use of Advanced Driver Assistance Systems (ADAS) came into effect, requiring features such as autonomous emergency braking and intelligent speed assist in new vehicles. This regulation highlights Germany's leadership in automotive innovation and safety standards.

Asia Pacific Light Duty Vehicles Market Trends

The Asia Pacific light duty vehicles market is experiencing rapid growth, particularly in countries such as China, India, Japan, and South Korea. China leads the region as the largest automotive market, driven by rising urbanization and a burgeoning middle class seeking personal transportation options. The increasing demand for affordable vehicles reflects changing lifestyles and economic growth in these nations.

Moreover, Japan and South Korea are focusing on technological advancements to improve fuel efficiency and meet consumer expectations for modern features. For instance, in 2024, South Korea's Hyundai Motor Company announced plans to invest USD 7 billion in electric vehicle production and infrastructure development over the next five years. This investment aims to enhance its offerings in the growing EV market, reflecting consumer demand for advanced automotive technologies. As manufacturers expand their offerings to include a wider range of models such as compact cars, SUVs, and pickup trucks, the Asia Pacific region solidifies its position as a key player in the global light duty vehicles market.

Key Light Duty Vehicles Company Insights

In terms of market share, companies such as Toyota and Ford continue to maintain significant portions due to their extensive product lines and strong brand loyalty. The industry is also witnessing a shift towards electric and hybrid vehicles, driven by consumer demand and regulatory pressures for lower emissions. This transition is prompting manufacturers to invest heavily in research and development to stay competitive.

-

Ford Motor Company is a leading global automotive manufacturer known for its innovative vehicle technologies and commitment to sustainability. Ford has made significant strides in the light-duty vehicle market, particularly with its focus on electric and hybrid models. The company has recently adjusted its strategy in response to fluctuating demand for electric vehicles, emphasizing the development of hybrid options to cater to a broader consumer base while maintaining a strong presence in traditional vehicle segments.

-

Toyota Motor Corporation is a leading global automotive manufacturer recognized for its commitment to quality and sustainability. In the light-duty vehicle market, Toyota has established itself as a pioneer in hybrid technology with models like the Prius and continues to expand its offerings in electric vehicles. The company is dedicated to advancing environmentally friendly technologies and aims to achieve carbon neutrality by 2050, positioning itself as a key player in the future of the automotive industry.

Key Light Duty Vehicles Companies:

The following are the leading companies in the light duty vehicles market. These companies collectively hold the largest market share and dictate industry trends.

- BMW AG

- Daimler AG

- Stellantis N.V.

- Ford Motor Company

- General Motors Company

- Honda Motor Company, Ltd.

- Hyundai Motor Company

- Nissan Motor Company, Ltd.

- Subaru Corporation

- Toyota Motor Corporation

Recent Development

-

In February 2024, General Motors announced that its Chevrolet Silverado EV will begin deliveries, showcasing a fully electric pickup truck designed to compete in the growing light-duty electric vehicle segment. The Silverado EV features innovative technologies and a range of up to 400 miles on a single charge.

-

In April 2024, Subaru revealed the updated Outback, featuring advanced AWD technology that optimizes power distribution based on real-time driving conditions. This innovation aims to enhance handling and safety for drivers in challenging environments, reinforcing Subaru's reputation for producing capable all-wheel-drive vehicles.

Light Duty Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 922.21 billion

Revenue forecast in 2030

USD 1,394.24 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, Fuel Type, Transmission, Drivetrain, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa.

Key companies profiled

BMW AG; Daimler AG; Stellantis N.V.; Ford Motor Company; General Motors Company; Honda Motor Company, Ltd.; Hyundai Motor Company; Nissan Motor Company, Ltd.; Subaru Corporation; Toyota Motor Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Duty Vehicles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global light duty vehicle industry report based on vehicle, fuel type, transmission, drivetrain, and region:

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Car

-

Vans

-

Sports Utility Vehicle (SUV)

-

Pickup Truck

-

-

Fuel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diesel

-

Gasoline

-

Hybrid

-

Electric

-

-

Transmission Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manual

-

Automatic

-

-

Drivetrain Outlook (Revenue, USD Billion, 2018 - 2030)

-

Front Wheel Drive (FWD)

-

Rear Wheel Drive (RWD)

-

Four Wheel Drive (4WD)

-

All Wheel Drive (AWD)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.