- Home

- »

- Automotive & Transportation

- »

-

U.S. Automotive eCall Market Size, Industry Report, 2030GVR Report cover

![U.S. Automotive eCall Market Size, Share & Trends Report Report]()

U.S. Automotive eCall Market (2025 - 2030) Size, Share & Trends Report Analysis By Propulsion Type, By Trigger Type (Manually Initiated eCall (MIeC), Automatically Initiated eCall (AIeC)), By Vehicle Type (Passenger Cars, Commercial Vehicles), And Segment Forecasts

- Report ID: GVR-4-68040-611-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Automotive eCall Market Size & Trends

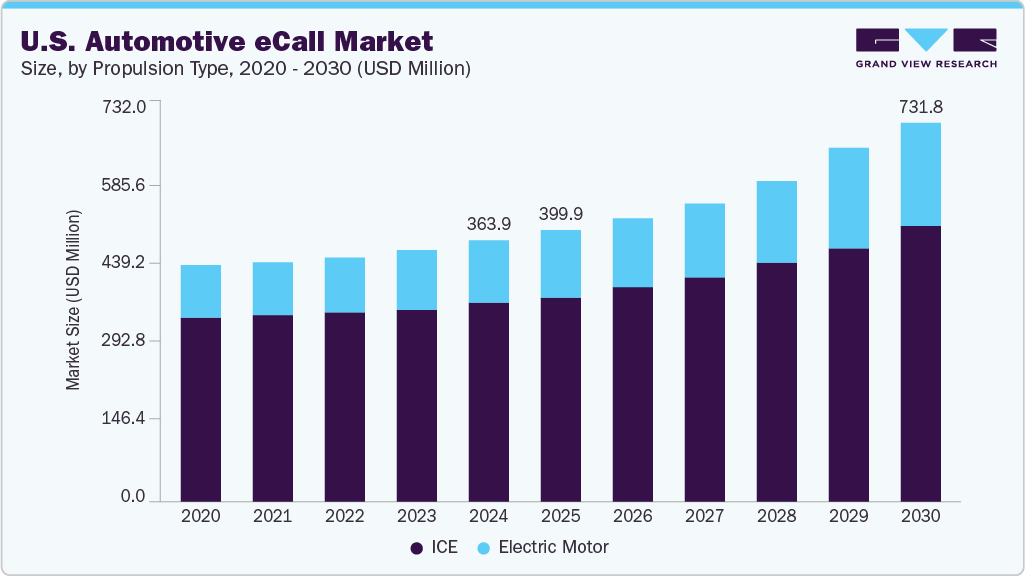

The U.S. automotive eCall market size was estimated at USD 363.9 million in 2024 and is expected to register a CAGR of 12.8% from 2025 to 2030. The market is experiencing growth due to several converging drivers, primarily linked to increasing safety demands and advancements in vehicle connectivity. One of the foremost catalysts is the growing emphasis on vehicle safety from both consumers and regulatory bodies. While there is no federal mandate for eCall systems, pressure from state-level authorities and organizations such as the National Highway Traffic Safety Administration (NHTSA) encourages automakers to enhance in-vehicle safety features. This push has expanded the adoption of advanced driver assistance systems (ADAS), which also integrate eCall functionalities, helping to accelerate market growth.

Consumer awareness and expectations for safety and security are also playing a pivotal role. More vehicle buyers are prioritizing safety in their purchase decisions, seeking features that can offer real-time assistance during emergencies. eCall systems, which automatically notify emergency services in the event of a serious collision, are increasingly viewed as critical components of vehicle safety. This heightened demand is further reinforced by public safety campaigns and media coverage surrounding road accident fatalities and the importance of rapid emergency response.

The relatively high rate of road accidents in the U.S. underscores the importance of rapid response capabilities. eCall systems, by automatically alerting emergency services with precise location and crash details, can significantly reduce response times and potentially save lives. This value proposition resonates strongly with consumers and policymakers alike, especially in densely populated and traffic-congested urban areas.

Original Equipment Manufacturers (OEMs) are also pushing the adoption of eCall systems as part of their product differentiation strategies. Many leading U.S. automakers have integrated eCall into broader safety and connectivity service packages, such as GM’s OnStar. These offerings are often bundled as part of premium trims or subscription-based services, adding to their appeal in the market. Additionally, the insurance industry is contributing to the growth of the eCall market by offering incentives such as reduced premiums for vehicles equipped with advanced safety systems. This aligns with the broader trend of usage-based insurance (UBI), which relies on telematics and enhances the utility of eCall systems.

Despite promising growth opportunities, the U.S. Automotive eCall industry faces several restraints that may limit its broader adoption and scalability. One of the primary challenges is the lack of a federal mandate, which leads to inconsistent implementation across vehicle classes and brands. Without regulatory enforcement, some OEMs may deprioritize the inclusion of eCall in lower-end models. Additionally, privacy and data security concerns are significant barriers. Since eCall systems rely on transmitting vehicle and location data in real time, many consumers are wary of potential misuse or breaches of sensitive information.

Propulsion Type Insights

The ICE segment dominated the target market and accounted for the largest revenue share of 69.5% in 2024. The continued preference for ICE vehicles in various vehicle classes, including sedans, SUVs, and light trucks, ensures sustained demand for safety enhancements like eCall systems. Many U.S. consumers still opt for ICE models due to factors such as longer driving ranges, lower upfront costs compared to EVs, and wider availability of refueling infrastructure. As automakers seek to improve the value proposition of their ICE offerings in a competitive market, integrating advanced safety features like eCall becomes a key differentiator.

The electric motor segment in the market is expected to witness significant growth at a CAGR of 15.4% over the forecast period. As EV adoption increases, automakers are placing greater emphasis on integrating advanced connectivity and safety features, including eCall systems, into electric models to enhance value and meet evolving safety expectations. Many new EVs are being designed with built-in telematics platforms, which facilitate seamless implementation of eCall technology.

Trigger Type Insights

The automatically initiated eCall (AIeC) segment dominated the market with a market share of 68.8%. This dominance reflects a strong preference for advanced, real-time emergency response systems that require minimal driver intervention, thereby enhancing passenger safety during severe accidents. Furthermore, many leading automakers in the U.S., including General Motors, Ford, and Tesla, have incorporated AIeC features into their connected vehicle platforms as part of broader safety and telematics offerings. These systems are often integrated with other advanced safety technologies, providing a comprehensive in-vehicle protection package that appeals to both consumers and insurers.

The manually initiated eCall (MIeC) segment is expected to witness significant growth over the forecast period. MIeC systems allow vehicle occupants to manually trigger an emergency call to response services by pressing a dedicated button, which can be critical in situations where an automatic trigger may not be activated, such as during medical emergencies, witnessing a roadside incident, or in non-collision-related distress. The rising adoption of connected car technologies in mid-range and entry-level vehicle segments is further contributing to the expansion of the MIeC market in the U.S.

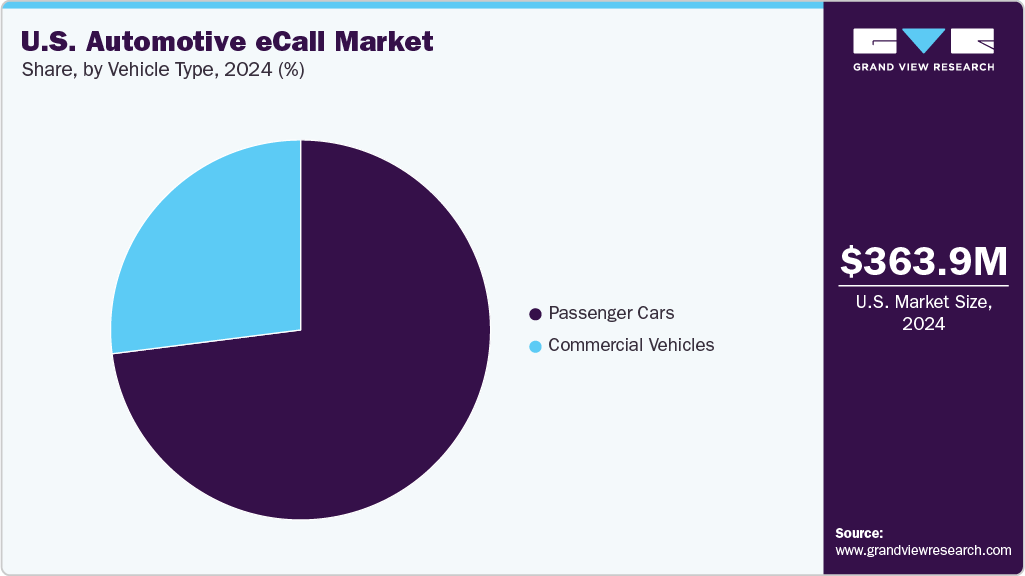

Vehicle Type Insights

The passenger cars segment led the market and accounted for more than 70% of the revenue in 2024. The widespread use of passenger vehicles for daily commuting, long-distance travel, and family transportation underscores the importance of equipping them with robust safety technologies. With continued advancements in vehicle connectivity and strong consumer interest in safety-enhancing features, the passenger car segment is expected to maintain its leading position in the market over the forecast period.

The commercial vehicle segment is expected to witness the fastest growth over the forecast period. Commercial vehicles often operate in high-risk environments, covering long distances and frequently navigating busy highways and urban areas. As a result, fleet operators and logistics companies are prioritizing advanced safety technologies like eCall systems to reduce accident response times and enhance driver protection. The integration of automatically initiated eCall (AIeC) systems in commercial fleets enables faster emergency notifications, minimizing downtime and potentially saving lives. Additionally, rising investments in telematics and fleet management solutions in the U.S. are accelerating the adoption of eCall in commercial vehicles. Insurance providers are also offering incentives for commercial fleets equipped with eCall, recognizing the technology’s potential to lower accident-related costs.

Key U.S. Automotive eCall Company Insights

Some of the key players operating in the U.S. automotive eCall market include Continental AG, Telit Cinterion, Thales, Robert Bosch GmbH, DENSO CORPORATION, Infineon Technologies AG, among others. These companies are making significant investments in research and development (R&D) to enhance the performance, reliability, and responsiveness of automotive eCall systems. Innovation efforts are focused on improving integration with telematics and vehicle connectivity platforms, as well as incorporating advanced technologies such as cloud-based communications and accurate geolocation services. Furthermore, these organizations are expanding their manufacturing capabilities and establishing strategic partnerships to meet the rising demand for eCall solutions across various regional automotive markets.

-

HARMAN International, a subsidiary of Samsung Electronics, is a prominent player in the U.S. automotive eCall industry, offering advanced telematics and connectivity solutions that enhance vehicle safety and emergency response capabilities. One of HARMAN’s major contributions to the market is the launch of its modular telematics platform, Ready Connect. This pre-integrated telematics control unit (TCU) is designed to support a wide range of connectivity needs, from 4G LTE and 5G to satellite-based communications. The platform enables automakers to accelerate the implementation of critical safety applications, such as automatic crash notifications and emergency calling (eCall), while also future-proofing their vehicle architecture for emerging connectivity standards.

-

Continental AG, a German multinational headquartered in Hanover, is one of the leading global suppliers of automotive technologies and components, including tires, braking systems, vehicle electronics, and powertrain solutions. Within the market, Continental plays a significant role by developing and delivering advanced telematics systems designed to enhance vehicle safety and emergency response. The company’s eCall solutions are integrated into its telematics control units (TCUs), enabling both automatic and manual initiation of emergency calls in the event of a collision. These systems transmit critical data, such as the vehicle's location and crash severity, to emergency services, facilitating faster and more effective assistance.

Key U.S. Automotive eCall Companies:

- HARMAN International

- Continental AG

- OnStar (General Motors)

- DENSO CORPORATION

- Robert Bosch GmbH

- Aptiv

- Telit Cinterion

- Visteon Corporation

- Infineon Technologies AG

- STMicroelectronics

Recent Developments

-

In March 2025, Telit Cinterion launched two new modules, the LE310 LTE Cat. 1 bis and the SL871K2 GNSS, targeted at compact, low-power IoT applications such as asset tracking, telematics, and wearables. The LE310 offers global LTE Cat. 1 bis connectivity in a small 15 x 18 mm form factor, optimized for space-constrained and battery-powered devices, and is available in regional and global variants. The SL871K2 GNSS module supports multiple satellite constellations (GPS, QZSS, GLONASS, BeiDou, and Galileo) and enables concurrent tracking with advanced features such as Assisted GNSS, 1PPS output, and TRAIM.

-

In October 2024, DENSO Corporation invested USD 100 million to expand its manufacturing operations in Athens, Tennessee. The expansion includes adding 54,560 square feet of new production space and renovating existing facilities, increasing the plant's total footprint to 879,000 square feet.

-

In April 2022, Robert Bosch GmbH expanded its eCall services by integrating them into eDriving’s Mentor app, in collaboration with U.S.-based technology firms Sfara and eDriving. This integration allows fleet drivers to access emergency assistance via smartphones, even vehicles lacking built-in eCall hardware. Sfara's collision detection technology enables the app to identify accidents or emergencies and automatically notify Bosch’s international emergency response centers, which operate in over 50 countries and support more than 20 languages.

U.S. Automotive eCall Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 399.9 million

Revenue forecast in 2030

USD 731.8 million

Growth rate

CAGR of 12.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion type, trigger type, and vehicle type

Key companies profiled

HARMAN International; Continental AG; OnStar (General Motors); DENSO CORPORATION; Robert Bosch GmbH; Aptiv; Telit Cinterion; Visteon Corporation; Infineon Technologies AG; STMicroelectronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive eCall Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. automotive eCall market report based on propulsion type, trigger type, and vehicle type.

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric Motor

-

-

Trigger Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manually Initiated eCall (MIeC)

-

Automatically Initiated eCall (AIeC)

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Frequently Asked Questions About This Report

b. The U.S. automotive eCall market size was estimated at USD 363.9 million in 2024 and is expected to reach USD 399.9 million in 2025.

b. The U.S. automotive eCall market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2030 to reach USD 731.8 million by 2030.

b. The ICE segment accounted for the largest market share of 69.5% in 2024 owing to the continued preference for ICE vehicles in various vehicle classes, including sedans, SUVs, and light trucks, ensures sustained demand for safety enhancements like eCall systems.

b. Some key players operating in the U.S. automotive eCall market include HARMAN International; Continental AG; OnStar (General Motors); DENSO CORPORATION; Robert Bosch GmbH; Aptiv; Telit Cinterion; Visteon Corporation; Infineon Technologies AG; STMicroelectronics.

b. The U.S. automotive eCall market is experiencing growth due to several converging drivers, primarily linked to increasing safety demands and advancements in vehicle connectivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.