- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Automotive Protection Films Market Size, Report, 2030GVR Report cover

![U.S. Automotive Protection Films Market Size, Share & Trends Report]()

U.S. Automotive Protection Films Market Size, Share & Trends Analysis Report By Material (Polyurethane, Polyethylene), By Application (Exterior, Interior), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-937-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

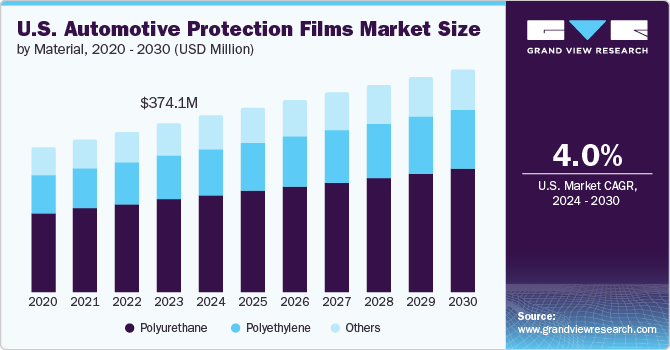

The U.S. automotive protection films market size was valued at USD 374.1 million in 2023 and is projected to grow at a CAGR of 4.0% from 2024 to 2030. The growing consumer awareness about the impact of maintaining aesthetics on the resale value of vehicles has fueled the adoption of protection films. These self-healing films are applied to a car’s painted surfaces, safeguarding them from bug splatters, minor abrasions, and stone chips.

In addition, automotive protection film manufacturers have consistently invested in research and development activities, which has led to the production of high-performing, durable products. For instance, as electric vehicles gain popularity, there is a rising demand for specialized protection films designed to meet their unique needs. These films are primarily made of polyethylene terephthalate (PET) installed in both the exterior and interior of automobiles. Such protection films provide high-voltage insulation and are compatible with the latest charging technologies.

Moreover, consumers are becoming more conscious of the benefits of using high-quality protection films for their vehicles. These films contribute to the longevity of automobiles by preventing paint damage and corrosion. Additionally, opting for a protection film is a cost-effective alternative to repainting or repairing minor paint damage caused by road debris or accidents.

Furthermore, the industry’s focus on sustainability and environmental consciousness is driving the development of eco-friendly protection films. Emerging companies such as Polifilm, STEK USA offer innovative films that provide outstanding performance and have reduced environmental impact, aligning with the growing sustainability.

Material Insights

Polyurethane (PU) films accounted for the dominant market share with 54.6% in 2023 owing to their excellent chemical and mechanical stability which provides ideal resilience for automotive protection. These films are widely used for surface protection against scratches, stone chips, and minor abrasions in car exteriors, including bumpers and lamp housings. PU films are also applied in car interiors including floors, hoods, and door panels. In addition, applying such protection films is cost-effective compared to repainting or repairing paint damage caused by minor collisions.

Polyethylene (PE) automotive protection films are expected to emerge as the fastest-growing segment during the forecast period. Manufacturers prefer PE materials in car applications due to their lightweight nature as they prioritize increased vehicle efficiency by reducing weight. Moreover, PE films are easy to process during the manufacturing process. This makes them cost-effective and efficient for large-scale production. They have remarkable sealing properties which ensure effective protection against environmental factors, such as moisture and dust. In addition, PE’s versatility allows it to be molded into various shapes and sizes, seamlessly fitting different vehicle components.

Application Insights

The exterior application secured the dominant share in 2023 owing to the rising emphasis of original equipment manufacturers (OEMs) on surface protection. Exterior automotive protection films play a pivotal role in maintaining personalization and safeguarding against wear and tear for passenger cars and light commercial vehicles (LCVs). In addition, severe weather conditions, including fragmented seasons, drive the adoption of high-quality protection films. These films applied to the exterior, safeguard vehicles from road debris, UV exposure, and scratches ensuring added safety and longevity.

Interior applications are expected to witness a steady growth at a CAGR of 3.7% over the forecast period. The increasing use of protection films in interior components such as consoles, dashboards, and door panels drive significant demand. These films shield against scratches, scuffs, and wear, preserving the aesthetics and functionality of car interiors. In addition, interior films contribute to noise reduction by dampening vibrations and minimizing resonance within the cabin. This caters to the increasing number of consumers seeking quieter, more comfortable rides as these films allow customization without compromising functionality. In addition, interior films protect against UV radiation, preventing fading and deterioration of upholstery, plastics, and electronics, and also offer heat insulation, enhancing comfort during hot weather.

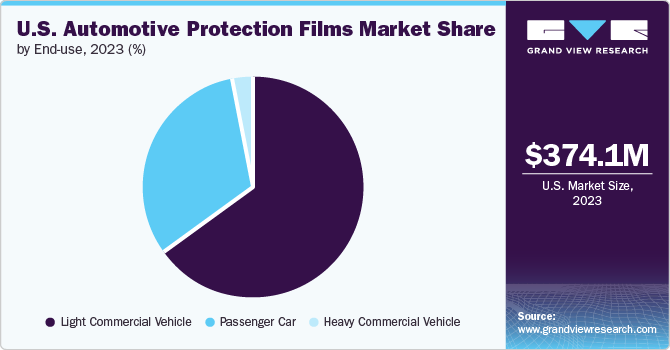

End Use Insights

Light commercial vehicles (LCV) secured the dominant market share with 65.4% in 2023. This can be credited to the exponential growth of e-commerce which fuels the need for efficient last-mile delivery services. As same-day and next-day delivery expectations rise, protection films become essential for preserving LCV exteriors during frequent stops and loading/ unloading activities. Moreover, due to the increasing environmental awareness, manufacturers invest heavily in developing electric LCVs. Government incentives further accelerate the adoption of electric light trucks that leads to the increased usage of protection films to safeguard their surfaces from scratches, UV exposure, and minor abrasions.

Passenger cars emerged as the fastest-growing segment during the forecast period. The surge in disposable incomes and increasing affordability of passenger cars has augmented considerable demand for automotive protection films. As consumers prioritize maintaining their vehicle’s appearance and resale value, these protective films have become rapidly essential. Additionally, the growing emphasis on reducing exhaust emissions and enhancing fuel efficiency has played a critical role in the adoption of automotive protection films.

Key U.S. Automotive Protection Films Company Insights

The U.S. automotive protection films market experiences intense competition due to the significant presence of multinational companies such as 3M, Saint-Gobain Performance Plastics Corporation, and Specialty Coating Systems Inc. These industry players operate across the entire value chain, including film production to distribution and installation services, and maintain extensive global production capacities.

-

3M operates across five key business segments. Within the Safety & Graphics segment, they provide automotive protection films alongside personal protection products, traffic safety solutions, commercial graphics systems, architectural surface solutions, and cleaning products for commercial establishments.

-

Saint-Gobain serves diverse markets, including aerospace, automotive, marine, construction, transportation, industrial, and energy. The company’s key products include flat glass and high-performance materials, widely applied in construction products, innovative materials, and building distribution.

Key U.S. Automotive Protection Films Companies:

- 3M

- Specialty Coating Systems Inc.

- Saint-Gobain Performance Plastics Corporation

- Choice Window Tint

- Elite Auto Films

- Star Shield Solutions

- Tint Pro/Platinum Auto Wraps

- Poli-Film America, Inc.

- TEKRA, LLC.

- Midwest Clear Bra

Recent Developments

- In November 2023, Star Shield Solution announced the collaboration with Mercedes Benz of Fairfield to introduce a pre-load protection film program, customized for each model and trim level.

U.S. Automotive Protection Films Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 494.3 million

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in thousand square meters, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end use

Country scope

U.S.

Key companies profiled

3M; Specialty Coating Systems Inc.; Saint-Gobain Performance Plastics Corporation; Choice Window Tint; Elite Auto Films; Star Shield Solutions; Tint Pro/Platinum Auto Wraps; Poli-Film America, Inc.; TEKRA, LLC.; Midwest Clear Bra

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Protection Films Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automotive protection films market report based on material, application, and end use:

-

Material Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Thousand Square Meters)

-

Polyethylene

-

Polyurethane

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Thousand Square Meters)

-

Exterior

-

Interior

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Thousand Square Meters)

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."