- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Automotive Wrap Films Market, Industry Report, 2030GVR Report cover

![U.S. Automotive Wrap Films Market Size, Share & Trends Report]()

U.S. Automotive Wrap Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Location (Exterior, Interior), By Application (Heavy Duty Vehicles, Medium Duty Vehicles, Light Duty Vehicles), And Segment Forecasts

- Report ID: GVR-4-68039-300-4

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Automotive Wrap Films Market Trends

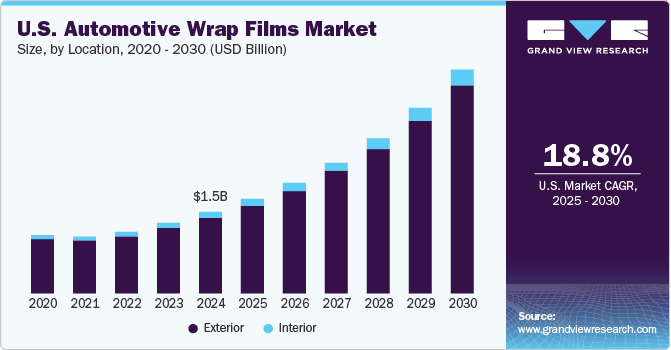

The U.S. automotive wrap films market size was valued at USD 1,496.2 million in 2024 and is projected to grow at a CAGR of 18.8% from 2025 to 2030. The market is experiencing substantial growth, primarily driven by the increasing demand for mobile advertising. In addition, the expansion of the automotive aftermarket industry is propelling market growth in the country.

Mobile advertising has emerged as a highly cost-efficient and effective strategy in recent years. By using automotive wrap films, any vehicle, whether a passenger car, bus, or truck, can be converted into a dynamic mobile billboard, enhancing daily brand visibility. Automotive wraps offer a more visually captivating and detailed form of advertising compared to traditional methods, capturing the attention of a broader audience. In addition, this approach reduces the cost per thousand impressions, providing a more economical advertising solution.

Taxis or wrapped vehicle advertising is the most immediately recognizable type of outdoor advertising and is extensively used by advertisers to make a significant impact on passengers, other drivers, and pedestrians. Consumers spend around 70% of their waking time outside their homes and about 18 hours per week on their vehicles.

A study by the Outdoor Advertising Association of America (OAAA) reveals that a local delivery van wrap generates 16 million impressions annually. Furthermore, JMR Graphics states that vehicle wraps have reached over 95% of the U.S. population. Each vehicle wrap is seen by between 30,000 and 70,000 people daily, with around 30% of mobile viewers making purchases based on outdoor ads. The volume of impressions contributes significantly to the return on investment. For example, a USD 20,000 investment in vehicle wrap advertising is expected to yield an average of 8.4 million impressions per year.

Moreover, automotive wrap films offer a cost-effective and efficient way to customize vehicles, providing protection for the original paint and helping maintain resale value. Unlike paint, vehicle wraps can be easily removed and reapplied, allowing for changes in color and texture. While wraps can be more expensive than paint for complex designs, they generally offer higher quality, resulting in a better return on investment for the user. In addition, the installation of automotive wraps is quicker, typically taking only a couple of days, compared to the weeks required for vehicle painting. Wraps also have a longer lifespan than low-quality paint and result in lower maintenance costs.

Location Type Insights

The exterior location segment recorded the largest market revenue share of over 92.0% in 2024 and is expected to grow at the fastest CAGR of 18.9% during the forecast period. This positive outlook is due to the growing interest in protective wraps to safeguard vehicles from scratches, fading, and other environmental damage. Exterior automotive wrap films are used to cover the outer surface of vehicles, providing both protective and decorative functions. They can be used for full vehicle wraps, partial wraps, or custom designs and are available in various finishes such as matte, gloss, and satin.

Interior automotive wrap films are used to decorate and protect the interior surfaces of vehicles, such as dashboards, door panels, and consoles. These films are typically applied to enhance the look of the vehicle's interior, offering a high-end finish at a more affordable price compared to custom interior designs or replacements. The growth of interior automotive wrap films is driven by the rising demand for vehicle interior customization and aesthetics.

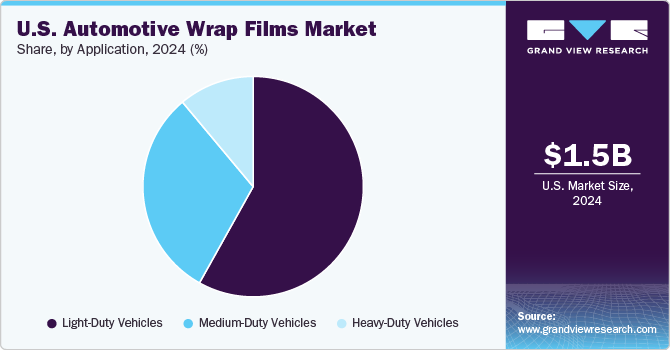

Application Insights

The light-duty vehicles segment recorded the largest market share of over 58.0% in 2024 and is anticipated to grow at the fastest CAGR of 20.9% over the forecast period. This positive outlook can be attributed to the growing consumer preference for personalization and vehicle aesthetics. Light-duty vehicles (LDVs) include personal cars, SUVs, and small commercial vehicles. These are the most common vehicles on U.S. roads and account for a large portion of the automotive wrap films industry.

The medium-duty vehicles segment includes vans, box trucks, and small buses. The wrap films used on these vehicles often combine aesthetics and practicality. Many businesses opt for wraps to showcase their brand while also protecting the vehicles' surfaces from scratches, UV rays, and dirt. The demand for automotive wraps in the medium-duty vehicle segment is primarily driven by the increasing adoption of MDVs for urban and regional logistics.

The heavy-duty vehicles (HDVs) segment includes large vehicles such as trucks, buses, and freight vehicles. These vehicles are primarily used for the transportation of goods and passengers over long distances. The demand for automotive wrap films in the heavy-duty vehicle segment is driven by the need for effective branding and advertising, as well as the increasing fleet operations across industries. The rise of logistics, e-commerce, and freight services has led to a growing number of HDVs on the road, providing ample opportunities for wrap film usage.

Key U.S. Automotive Wrap Films Company Insights

The U.S. automotive wrap films industry is dominated by major players, including 3M, Avery Dennison Corporation, and Fedrigoni S.P.A., which collectively hold a significant market share due to their established brand reputation and extensive distribution networks. The market also includes medium-sized players such as ORAFOL Europe GmbH and Hexis S.A.S., who maintain their competitive position through specialized product offerings and regional market strength. The remaining market share is fragmented among smaller local and regional manufacturers, who often compete by offering competitive pricing and customized solutions to specific market segments.

-

In September 2024, Spandex announced a partnership with KPMF to enhance its vehicle wrap offerings by introducing the KPMF VWS IV series, which features over 100 color options. This new range includes four distinct finishes, such as gloss, matte, metallic, and standard colors, alongside 13 over-laminate choices that improve both appearance and durability.

-

In March 2024, Arlon Graphics, LLC launched its VITAL Range, a new line of non-PVC graphic materials that emphasizes quality, durability, and sustainability. This is a premium cast polyurethane film designed for vehicle wraps and fleet branding. It incorporates FLITE Technology, which allows for easy application and repositioning, making it ideal for intricate designs and large panels.

Key U.S. Automotive Wrap Films Companies:

The following are the leading companies in the U.S. automotive wrap films market. These companies collectively hold the largest market share and dictate industry trends.

- Avery Dennison Corporation

- Arlon Graphics, LLC

- 3M

- KPMF

- Fedrigoni S.P.A.

- Vvivid Vinyl

- ORAFOL Europe GmbH

- Hexis S.A.S.

- JMR Graphics

U.S. Automotive Wrap Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,736.2 million

Revenue forecast in 2030

USD 4,110.0 million

Growth rate

CAGR of 18.8% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Location, application

Country scope

U.S.

Key companies profiled

Avery Dennison Corporation; Arlon Graphics, LLC; 3M; KPMF; Fedrigoni S.P.A.; Vvivid Vinyl; ORAFOL Europe GmbH; Hexis S.A.S.; JMR Graphics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Wrap Films Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automotive wrap films market report based on location and application:

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Exterior

-

Interior

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy-Duty Vehicles

-

Medium-Duty Vehicles

-

Light-Duty Vehicles

-

Frequently Asked Questions About This Report

b. The U.S. automotive wrap films market size was estimated at USD 1,496.2 million in 2024 and is expected to reach USD 1,736.2 million in 2025.

b. The U.S. automotive wrap films market is expected to grow at a compound annual growth rate of 18.8% from 2025 to 2030 to reach USD 4,110.0 million by 2030.

b. Light-duty vehicles dominated the U.S. automotive wrap films market with a share of over 58.0% in 2024. This high share is attributable to the rising demand for wrap films as a cost-effective solution compared to vehicle paint, especially for high-end vehicles such as Audi, Mercedes, Porsche, Volkswagen, and BMW.

b. Some of the key players operating in the U.S. automotive wrap films market include Avery Dennison Corporation, Arlon Graphics, LLC, 3M, • Fedrigoni S.P.A., ORAFOL Europe GmbH, VViViD Vinyl, and Hexis S.A.S.

b. Key factors driving the U.S. automotive wrap films market growth include the rising trend of advertising on automobiles coupled with the growing popularity of automotive wrap films for vehicle customization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.