- Home

- »

- Consumer F&B

- »

-

U.S. BBQ Rubs Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. BBQ Rubs Market Size, Share & Trends Report]()

U.S. BBQ Rubs Market (2025 - 2033) Size, Share & Trends Analysis Report By Brand (National, Private), By Distribution Channel (Foodservice, Supermarkets And Hypermarkets, Convenience Store, Online), And Segment Forecasts

- Report ID: GVR-4-68040-707-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. BBQ Rubs Market Summary

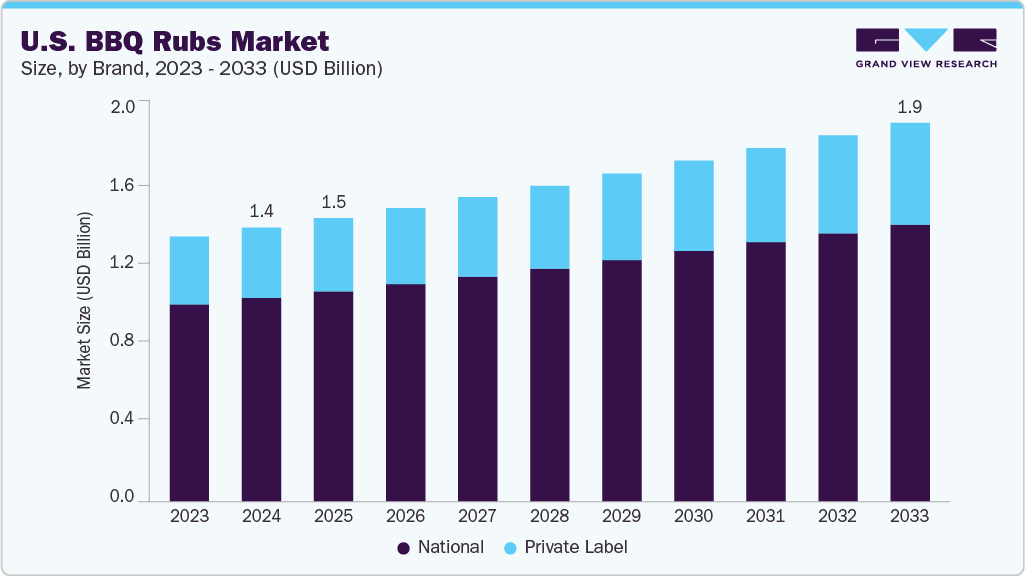

The U.S. BBQ rubs market size was estimated at USD 1.41 billion in 2024 and is projected to reach USD 1.96 billion by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The U.S. BBQ rubs industry is driven by increasing consumer demand for flavorful, convenient, and diverse grilling options.

Key Market Trends & Insights

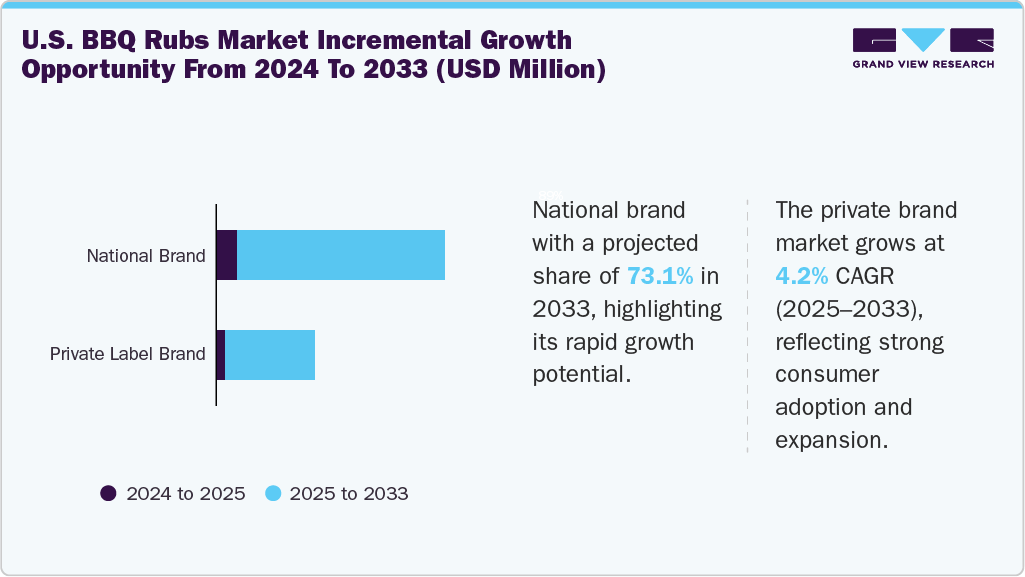

- National branded BBQ rubs held the largest share of 74.3% in 2024.

- The private brand market is expected to grow significantly at a CAGR of 4.2% during the forecast period.

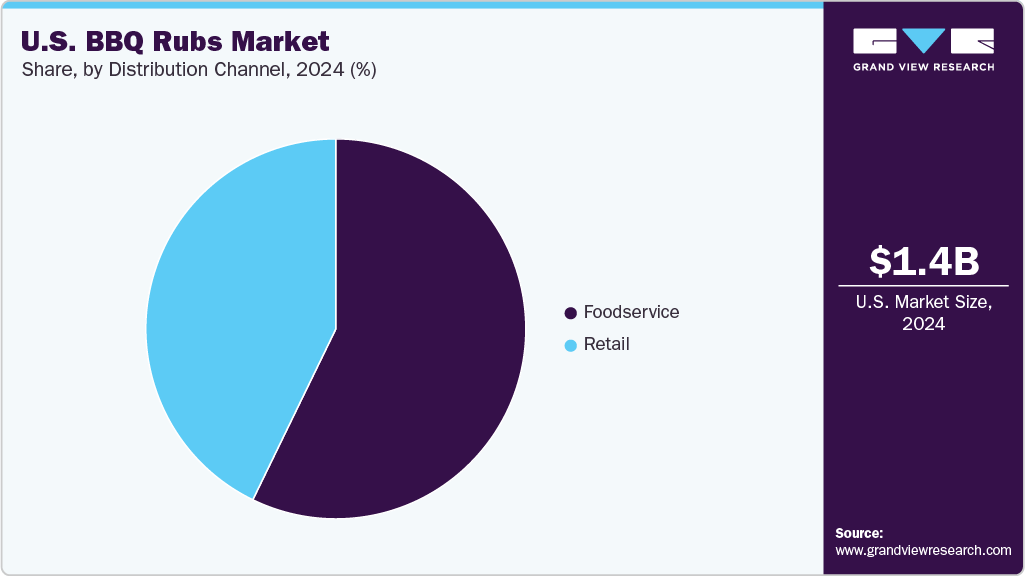

- By distribution channel, the foodservice segment held the largest share of 57.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.41 Billion

- 2033 Projected Market Size: USD 1.96 Billion

- CAGR (2025-2033): 3.7%

The industry is driven by growing consumer interest in outdoor cooking and grilling, especially during warmer months and holidays. There's a rising demand for bold, diverse flavors influenced by regional and global cuisines. Health-conscious consumers are also seeking dry rubs as a cleaner alternative to sugary sauces. Additionally, the popularity of food-related content on social media and cooking shows has inspired experimentation with BBQ rubs at home. The expansion of retail and e-commerce platforms has further made these products more accessible to a wider audience.

The market thrives on a growing appetite for authentic, customizable barbecue experiences among American consumers. Rising culinary curiosity is pushing demand for region-specific and globally inspired rub flavors. Busy lifestyles are also driving interest in quick, flavor-packed seasoning solutions that require minimal prep. The surge in backyard cooking culture and weekend grilling rituals further fuels consistent product demand. Additionally, the emergence of gourmet and organic rub options appeals to health- and quality-conscious shoppers.

Brand Insights

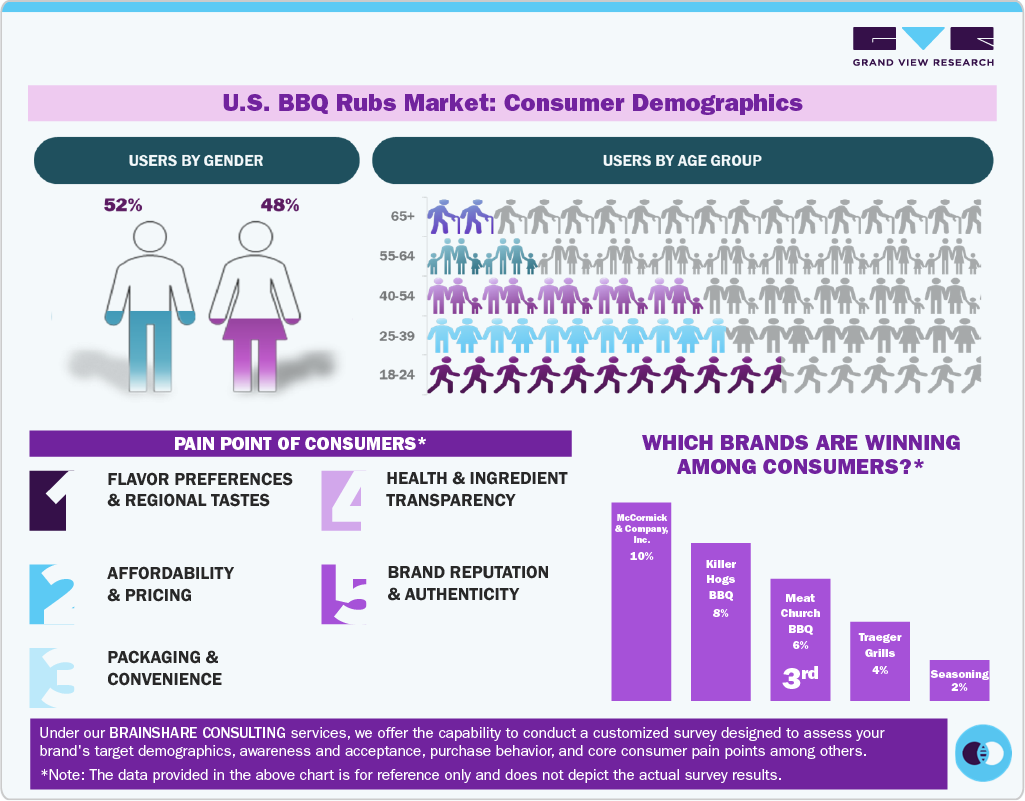

The national brand segment accounted for the largest share of 74.3% in 2024. National brands such as McCormick stand out as a dominant national brand in the U.S. BBQ rubs market, offering a wide variety of seasoning blends tailored to different regional and flavor preferences. With a legacy of quality and innovation, it maintains consumer loyalty and strong shelf presence across major retailers. The brand frequently updates its product line to reflect current flavor trends and dietary preferences. McCormick’s extensive distribution network ensures widespread availability both in-store and online. Its robust marketing efforts and trusted name continue to drive its leadership in the category.

The private brand segment is projected to grow significantly at a CAGR of 4.2% from 2025 to 2033. Private label BBQ rubs, such as those offered by Walmart’s Great Value or Kroger’s Private Selection, are gaining popularity due to competitive pricing and improved quality. Retailers are investing in better packaging, bolder flavors, and cleaner ingredient lists to appeal to health-conscious and value-driven shoppers. These store brands benefit from built-in shelf space and customer trust associated with the retailer. Many now rival national brands in taste and variety, appealing to everyday grillers. The rise of private labels reflects shifting consumer attitudes toward affordability without compromising flavor.

Distribution Channel Insights

The foodservice segment led the market with the largest revenue share of 57.2% in 2024. The foodservice channel is driven by the rising demand for BBQ dishes in restaurants, catering services, and fast-casual dining spots. Chefs and operators seek consistent, high-quality rubs that deliver signature flavors while saving prep time. The trend toward smoked and grilled menu offerings has boosted bulk purchases of seasoning blends. Suppliers also offer custom formulations to help foodservice brands differentiate their offerings. Convenience, flavor consistency, and culinary innovation are key motivators behind adoption in this channel.

The retail segment is projected to grow at the fastest CAGR of 4.1% from 2025 to 2030. Retail growth is fueled by increased consumer interest in home cooking and DIY grilling experiences. Shoppers are drawn to the variety of BBQ rubs available in grocery stores, specialty food outlets, and online platforms. Eye-catching packaging, clean-label ingredients, and seasonal promotions further influence purchasing decisions. Consumers also value the ability to explore new flavors and recreate restaurant-style BBQ at home. Expanding shelf space and product innovation are helping drive strong performance in this channel.

Country Insights

The BBQ rubs market in the U.S. is experiencing growth due to the rising popularity of regional and ethnic fusion flavors that reflect America’s diverse culinary landscape. Increased participation in food competitions, BBQ festivals, and grilling events has amplified interest in specialized rubs. Consumers are also drawn to storytelling and branding that emphasize heritage, craftsmanship, or small-batch authenticity. Growth in subscription food boxes and spice kits has introduced new audiences to BBQ rubs through curated experiences. Additionally, influencer marketing and user-generated content are playing a key role in educating and engaging consumers.

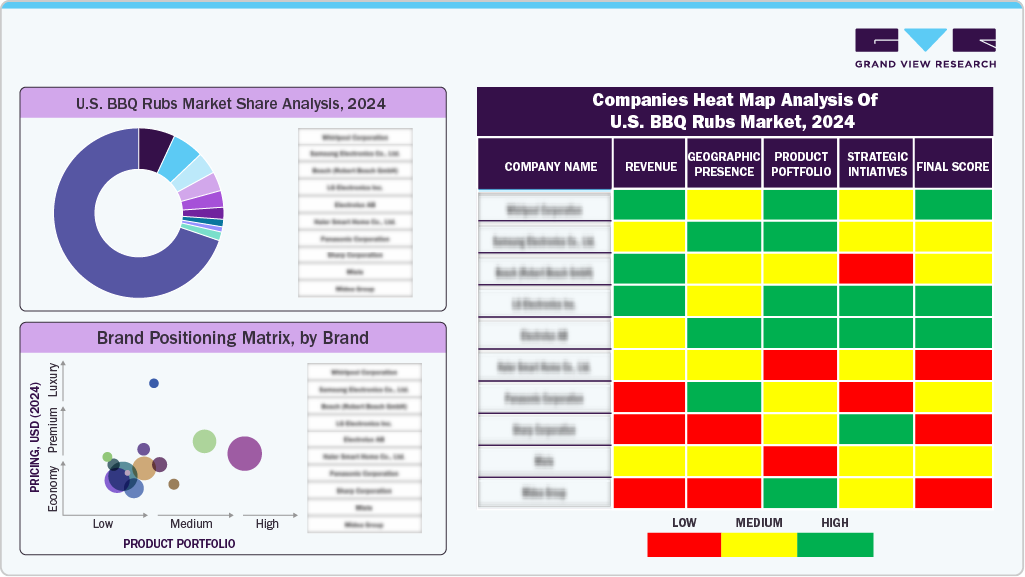

Key U.S. BBQ Rubs Companies Insights

Key players operating in the U.S. BBQ rubs market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. BBQ Rubs Companies:

- McCormick & Company, Inc.

- Kraft Heinz Company

- B&G Foods, Inc.

- Bad Byron’s Butt Rub

- Plowboys BBQ

- Meat Church BBQ

- Killer Hogs BBQ

- Spiceology

- Heath Riles BBQ

- Traeger Grills (Traeger Rubs)

Recent Developments

-

In May 2024, B&G Foods introduced the "Ranch Tested, Cowboy Approved" product line, featuring seasoning blends and BBQ blends inspired by the historic Four Sixes Ranch in Texas. This launch brought over a dozen authentic Texas ranch flavors to homes across America through online sales and select grocery stores, with plans for broader retail distribution.

-

In March 2022, RAPS introduced a range of BBQ rubs designed for easy application to a variety of dishes, reflecting the trend toward customization and culinary exploration.

U.S. BBQ Rubs Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 1.46 billion

Revenue Forecast in 2033

USD 1.96 billion

Growth rate

CAGR of 3.7% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Brand and distribution channel

Country scope

U.S.

Key companies profiled

McCormick & Company, Inc.; Kraft Heinz Company; B&G Foods, Inc.; Bad Byron’s Butt Rub; Plowboys BBQ; Meat Church BBQ; Killer Hogs BBQ; Spiceology; Heath Riles BBQ; Traeger Grills (Traeger Rubs)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. BBQ Rubs Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. BBQ rubs market report on the basis of brand and distribution channel:

-

Brand Outlook (Revenue, USD Million, 2021 - 2033)

-

National

-

Private

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Foodservice

-

Retail

-

Supermarkets and Hypermarkets

-

Convenience Store

-

Online

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. BBQ rubs market size was estimated at USD 1.41 billion in 2024 and is expected to reach USD 1.46 billion in 2025.

b. The U.S. BBQ rubs market is expected to grow at a compound annual growth rate (CAGR) of 3.7 % from 2025 to 2033 to reach USD 1.96 billion by 2033.

b. National brand accounted for a revenue share of 74.3% in 2024, driven by aggressive retail expansion, celebrity chef endorsements, and increased marketing through food TV and social media platforms.

b. Some key players operating in the U.S. BBQ rubs market include McCormick & Company, Inc., Kraft Heinz Company, B&G Foods, Inc., Bad Byron’s Butt Rub, Plowboys BBQ, Meat Church BBQ, Killer Hogs BBQ, and Spiceology.

b. Key factors driving growth in the U.S. BBQ rubs market include the expanding popularity of backyard grilling, rising demand for bold and diverse flavor profiles, and increased consumer preference for ready-to-use, all-natural seasoning options. Health-aware shoppers are seeking products with cleaner labels, lower sodium, and no artificial additives, while innovation in regional and gourmet blends, along with broader distribution through supermarkets, specialty stores, and e-commerce platforms, continues to propel market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.