- Home

- »

- Healthcare IT

- »

-

U.S. Behavioral Health Care Software & Services Market, 2030GVR Report cover

![U.S. Behavioral Health Care Software And Services Market Size, Share & Trends Report]()

U.S. Behavioral Health Care Software And Services Market Size, Share & Trends Analysis Report By Component (Software, Support Services), By Delivery Model, By Function, By End-use, By Disorder, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-283-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

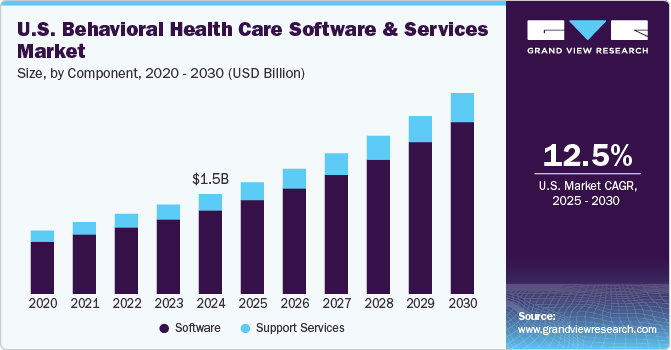

The U.S. behavioral healthcare software and services market size was estimated at USD 1.49 billion in 2024 and is projected to grow at a CAGR of 12.5% from 2025 to 2030. The emerging technologies for behavioral health management, rising awareness regarding substance abuse, and expanding reimbursement coverage contribute to market growth. The adoption of behavioral health care software by care providers is anticipated to improve the management of mental health issues and treatment prospects. For instance, in April 2024, Talkspace, an online behavioral health company, introduced its Behavioral Health Consortium, a network of specialty providers featuring Ria Health, Charlie Health, and Bicycle Health for treating substance use, alcoholism, and eating disorders.

The U.S. government is particularly concerned about high healthcare expenditures associated with the treatment of behavioral health-related disorders or mental diseases. For instance, according to a report published by Mental Health America, 21% of adults in the U.S. are experiencing a mental illness in 2023. Moreover, 16% of youth reported suffering from at least one major depressive episode in 2022. The prevalence of mental health problems is increasing significantly among children and adults in the U.S. This growing prevalence is resulting in high demand for behavioral health care software and services.

In addition, behavioral health care providers help reduce the costs related to substance abuse by providing value-based medicine programs and preventing hospital readmissions. For instance, according to American Addiction Centers, approximately 54.2 million individuals aged 12 and above needed treatment for a substance use disorder in 2023. Thus, there is a broad scope for improving care delivery of behavioral health care.

Growing public awareness, rising research activities, and various companies are introducing new and innovative apps in the market to aid individuals suffering from mental stress or disorders. For instance, in August 2024, researchers from Massachusetts, New York, and Pennsylvania conducted a study investigating the efficacy of self-guided CBT mobile health that incorporates user engagement features in alleviating symptoms of anxiety disorder.

Value-based medicine programs by behavioral health care providers help in reducing the costs related to substance abuse. For instance, in May 2022, the Department of Health and Human Services announced a nearly USD 15 million budgetary opportunity for a 3-year federal grant to create a Substance Abuse and Mental Health Services Administration program. This improves behavioral health care delivery to citizens of nursing homes and other long-term care facilities over the forecast period. This initiative construct a Center of Excellence for Capacity Building in Nursing Centers to Serve Patients with Behavioral Health Conditions, funded by the Centers for Medicare & Medicaid Services.

Moreover, behavioral health providers adopt integrated EHRs for effective practice management and cost savings. For instance, in May 2022, Osmind, a San Francisco-based firm, raised USD 940 million in Series B financing to expand its technology. The company is dedicated to developing e-health record software for the psychiatrist, and its EHR technology is aimed at novel therapies such as psychedelic drugs and neuromodulation treatments, including transcranial magnetic stimulation (TMS). The real-time monitoring system simplifies the communication between the care providers and patients. Integrating new technologies with other treatment approaches improves the effectiveness and productivity of care. Video conferencing is provided by telepsychiatry or tele-mental health, which helps care providers coordinate with patients from distant locations.

Market Concentration & Characteristics

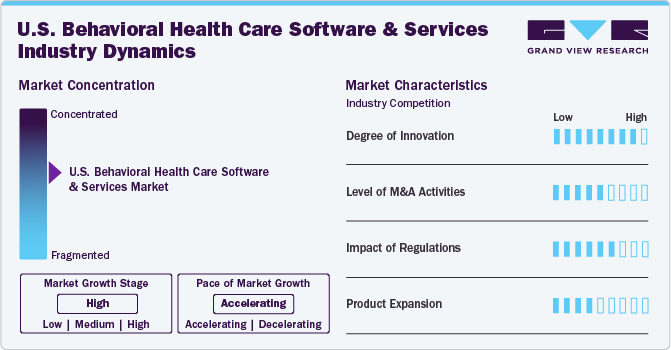

The U.S. behavioral health care software and services market is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary expertise, technologies, and distribution channels to capture a larger market share. For instance, in December 2021, Netsmart acquired Remarkable Health to improve behavioral health solutions utilizing AI and individuals with intellectual and developmental disabilities (I/DD).

Regulations significantly impact the U.S. behavioral healthcare software and services market by shaping compliance requirements and driving the adoption of technology solutions. For instance, HR 3331 bill—it amends a section of the Social Security Act to encourage the testing of government incentive payments to behavioral health practitioners who employ certified EHR technology (CEHRT). HR 3331's ultimate goal is to eliminate any existing digital division between behavioral healthcare and other care fields, such as primary care, where EHR use, health data interchange, and health data analytics are more prevalent and valued.

The U.S. behavioral health care software and services market is characterized by a high degree of innovation owing to growing smartphone adoption, enhanced internet connectivity, and launching new apps in the market. For instance, in December 2023, Ed can Help, an innovative app launched in the U.S. to manage stress, trauma, and anxiety while enhancing users' mental well-being.

Several market players are expanding their business by launching new solutions and expanding their product portfolio. For instance, in April 2024, Otsuka Pharmaceutical, Co. Ltd. collaborated with Click Therapeutics, Inc., and received U.S. FDA clearance for its Rejoyn (developed as CT-152), the prescription digital therapeutic authorized for treating major depressive disorder symptoms.

Component Insights

The software segment dominated the market with the largest revenue share in 2024 and is anticipated to grow with the fastest CAGR of 12.9% over the forecast period. Behavioral health care software provides care providers to design and choose the optimal treatment plan for a person suffering from mental illnesses such as depression, stress, anxiety, substance abuse, and addiction. Moreover, it designs treatment plans based on clinical evidence and related patient records. Growing awareness regarding the benefits of behavioral health care software such as consumer engagement & mobile services, workflow management & appointment scheduling, care coordination, and claims & billing further fuels the market growth.

The companies operating in the market are launching new platforms to aid market growth. For instance, in March 2022, NextGen Healthcare, Inc. updated its NextGen Behavioral Health Platform. The suite is the sector's first platform to integrate complete physical, mental health, human services, and dental care in one software solution, and it builds on the company's award-winning NextGen Enterprise e-health record and practice management system.

Delivery Model Insights

The subscription segment dominated the market with the largest revenue share in 2024 and is anticipated to register the fastest growth with a CAGR of 12.7% over the forecast period. Unlike larger hospitals, small-scale mental healthcare providers have limited financial resources to invest in technological solutions. Moreover, many of these practitioners are ineligible for incentives for meaningful use of EHRs due to the small size of their practices. Given the high upfront costs of such software, many small practices prefer subscription-based services as a more affordable alternative. For instance, Valant, a behavioral health care software provider, offers Behavioral Health EHR subscription-based software that provides mental health practices.

Moreover, the U.S. government introduced the Improving Access to Behavioral Health Information Technology Act in 2018. Under the act, mental healthcare providers such as psychologists, psychiatric hospitals, and community healthcare centers are eligible for financial incentives to implement the behavioral health EHR system. Large mental health facilities prefer purchasing and installing software solutions for smooth workflow management. Factors such as the type of Electronic Medical Records (EMRs), requirements of clinicians, and financial requirements are the factors to be considered while installing in-house mental wellness software. Thus, growing adoption and investments in installing behavioral health care software and services fuel market growth.

Function Insights

By function, the clinical segment dominated the market with a share of 51.0% in 2024. Large-scale psychiatry hospitals require the integration of clinical functions with their systems as they have a high patient inflow. Behavioral health care software provides clinical services such as claim filings, documentation, scheduling appointments, billing, and coding. For instance, Advanced Data Systems offers, a software development company, Behavioral & Mental Health EHR Software for all levels of care. Its features are as follows,

-

Behavioral & mental health EMR / EHR and clinical charting for behavioral health professionals

-

Software built for mental / behavioral health setting

-

Analytics, scheduling, and added efficiency.

The administrative segment in the U.S. behavioral health care software and services market is anticipated to witness the fastest CAGR growth over the forecast period. The segment comprises patient scheduling, documentation management, case monitoring, employee management, and business intelligence. Large hospitals and clinics require centralized scheduling systems to view multiple providers in one place. InfoMC, a software company, provides solutions for managed behavioral health, offering efficient end-to-end administrative and clinical workflows.

Disorder Insights

The anxiety segment dominated the market with a revenue share of 32.7% in 2024 and is anticipated to grow at fastest CAGR over the forecast period. With the growing prevalence of anxiety and depression, there is an increasing demand for behavioral health care software that supports individuals in coping with these conditions. Furthermore, researchers at NewYork-Presbyterian and Weill Cornell Medicine found that Maya, a self-guided cognitive behavioral therapy app, reduced anxiety in adults suffering from mental health issues.

The substance abuse segment in the U.S. behavioral health care software and services market is anticipated to witness significant CAGR growth over the forecast period. Factors such as supportive government initiatives and growing investments in treating substance abuse fuel the market growth. For instance, the President's fiscal year (FY) 2025 Budget proposal allocates USD 8.1 billion to the Substance Abuse and Mental Health Services, continuing to promote the President's Unity Agenda to tackle the nation's ongoing mental health challenges.

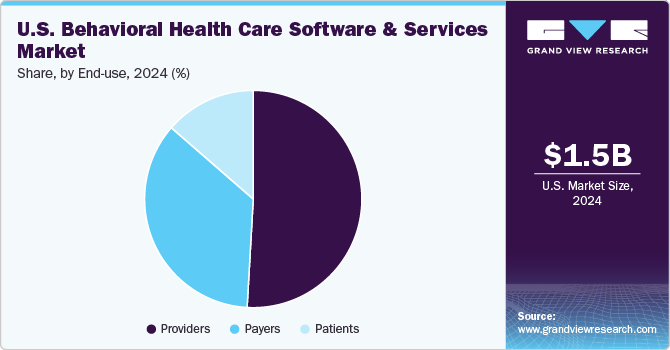

End-use Insights

The providers dominated the market with a revenue share of 50.9% in 2024. Factors include improving reimbursement policies for psychiatric treatment, growing government initiatives, and behavioral health care platform launches boost segment growth. For instance, in January 2024, California's Department of Health Care Services (DHCS) introduced two free behavioral health services applications for all families with kids, teens, and adults ages 0-25.

The payers segment in the U.S. behavioral health care software and services market is anticipated to witness the fastest CAGR growth over the forecast period. The reimbursement outlook for software for behavioral health is favorable in the U.S. Services covered under insurance include consultation fees, clinic visits, psychotherapy, medication management, and interactive audio & video sessions. Medicare offers coverage for telepsychiatric services. Approximately 39 states in the U.S. have enacted reimbursement policies for telehealth. Thus, such factors are anticipated to boost the segment growth.

Key U.S. Behavioral Health Care Software And Services Company Insights

Key participants in the U.S. behavioral health care software and services market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. Behavioral Health Care Software And Services Companies:

- Oracle (Cerner Corporation)

- Core Solutions, Inc.

- Epic Systems Corporation.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualifacts

- Welligent

- SimplePractice, LLC

- TherapyNotes, LLC.

- TheraNest

View a comprehensive list of companies in the U.S. Behavioral Health Care Software And Services Market

Recent Developments

-

In October 2024, the Center for Technology and Behavioral Health (CTBH) at the Geisel School of Medicine at Dartmouth collaborated with Boehringer Ingelheim to develop behavioral health care platforms to help providers and patients treat severe mental illness.

-

In January 2024, the Centers for Medicare & Medicaid Services selected eight states to launch behavioral health models to treat substance use disorders and mental health conditions.

U.S. Behavioral Health Care Software And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.66 billion

Revenue forecast in 2030

USD 2.99 billion

Growth rate

CAGR of 12.5% from 2025 to 2030

Historical data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, delivery model, function, end-use, disorder

Key companies profiled

Oracle (Cerner Corporation); Core Solutions, Inc.; Epic Systems Corporation; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualifacts; Welligent; SimplePractice, LLC; TherapyNotes, LLC.; TheraNest

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Behavioral Health Care Software And Services Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the U.S. behavioral health care software and services market report based on component, delivery model, function, disorder, and end-use:

-

Component Outlook (Revenue USD Million, 2018 - 2030)

-

Software

-

Integrated

-

Standalone

-

Support Services

-

-

Delivery Model Outlook (Revenue USD Million, 2018 - 2030)

-

Ownership

-

Subscription

-

-

Function Outlook (Revenue USD Million, 2018 - 2030)

-

Clinical

-

EHRs

-

Clinical Decision Support

-

Care Plans

-

E-Prescribing

-

Telehealth

-

Administrative

-

Patient/Client Scheduling

-

Document Management

-

Case Management

-

Workforce Management

-

Business Intelligence

-

Financial

-

Revenue Cycle Management

-

Managed Care

-

General Ledger

-

Payroll

-

-

Disorder Outlook (Revenue USD Million, 2018 - 2030)

-

Anxiety

-

Post-Traumatic Stress Disorder (PSTD)

-

Substance Abuse

-

Bipolar Disorders

-

Schizophrenia

-

Others

-

-

End-use Outlook (Revenue USD Million, 2018 - 2030)

-

Providers

-

Hospitals & Clinics

-

Community Centers

-

Payers

-

Patients

-

Frequently Asked Questions About This Report

b. The subscription segment dominated the market for behavioral health care software and services in the U.S. and held the largest revenue share of 63.0% in 2024. Due to limited capital available for investment, small-scale healthcare professionals opt for subscription

b. The clinical functions segment dominated the U.S. behavioral health care software and services market and accounted for the largest revenue share of 51.0% in 2024 as large-scale psychiatry hospitals require the integration of clinical functions with their systems due to high patient inflow.

b. The provider segment dominated the market for behavioral health care software and services in the U.S. and accounted for the largest revenue share of 50.9% in 2024 owing to the improving reimbursement policies for psychiatric treatment and high patient volume.

b. The U.S. behavioral health care software and services market size was estimated at USD 1.49 billion in 2024 and is expected to reach USD 1.66 billion in 2025.

b. The U.S. behavioral health care software and services market is expected to grow at a compound annual growth rate of 12.47% from 2025 to 2030 to reach USD 2.99 billion by 2030.

b. The software segment dominated the market for behavioral health care software and services in the U.S. and accounted for the largest revenue share of 84.1% in 2024 owing to increasing adoption of mental wellness software.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."