- Home

- »

- Agrochemicals & Fertilizers

- »

-

U.S. Biochar Market Size & Share Analysis Report, 2030GVR Report cover

![U.S. Biochar Market Size, Share & Trends Report]()

U.S. Biochar Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Pyrolysis, Gasification), By Application (Agriculture, Animal Feed, Health & Beauty Products), By State, And Segment Forecasts

- Report ID: GVR-4-68038-427-7

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biochar Market Size & Trends

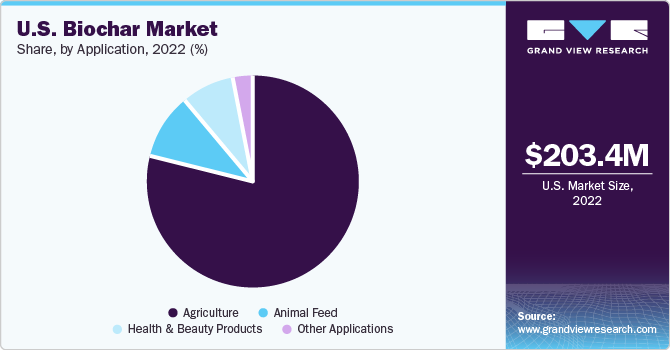

The U.S. biochar market size was estimated at USD 203.4 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.3% from 2023 to 2030. The growing requirement to improve crop yield in the United States has led to a high rate of utilization of fertilizers. This has driven up the acidity levels in the soil. Thus, the adoption of advanced farming practices is being promoted in the country, which has resulted in the proliferation of substitutes for generic inorganic soil improvement products. U.S. farmers are increasingly becoming aware of the benefits of organic products, including biochar. This has led to a substantial rise in awareness among product manufacturers, thus contributing to the market's growth across the economy.

Organic farming is anticipated to benefit greatly from biochar usage, as it nurtures crop quality by providing essential nutrients that are required for the growth of plants and helps circulate carbon dioxide in the atmosphere, which profits the process of photosynthesis. Organic farming in the United States has risen significantly in recent years, owing to rising health concerns due to the usage of synthetic chemicals. As per the USDA- National Agricultural Statistics Service- Surveys, the certified organic cropland acres in the country were boosted by 79% from 2011 to 2021, translating to 3.6 million acres. Thus, advancements in organic farming are expected to drive biochar demand in the U.S. during the projection period.

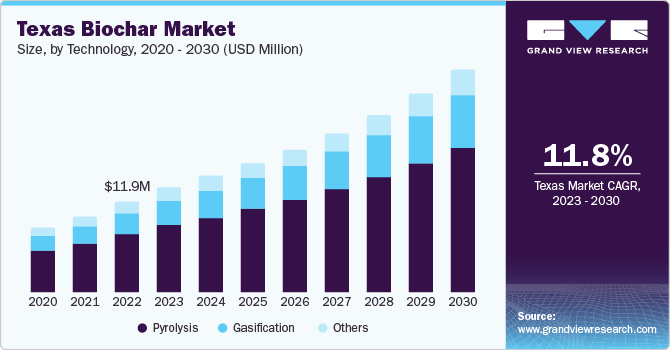

The state of Texas has emerged as one of the fastest-growing product consumers in the country with a growth rate of 11.8% in 2022. This is aided by the presence of a vast number of farms and land under agricultural use. As per the U.S. Department of Agriculture (USDA), farms in Texas rank 4th in terms of size in the country, and were responsible for generating a revenue of USD 24.9 billion in 2021. Additionally, the state leads the country with 247,000 farms and ranches, which covered around 126 million acres of land in 2021. In addition, the market benefits from the presence of a substantial number of manufacturers in the state. Texas is expected to witness the consumption of large quantities of biochar in animal feed as cattle accounts for over 50% of the agricultural economy.

Technology Insights

Based on technology, the pyrolysis segment dominated the market with a revenue share of 64.9% in 2022. This growth is attributed to the convenience factor and easy availability of equipment. Pyrolysis is a crucial process in biochar production and plays a vital role in the transformation of organic materials into biochar. This thermal decomposition process takes place in the absence of oxygen, aiding the organic matter to undergo a series of complex chemical reactions. Manufacturers utilize fast as well as slow pyrolysis processes on the basis of their requirements. In fast pyrolysis, the finely ground biomass is pyrolyzed within a few seconds while slow pyrolysis can bake large particles for a longer period, which results in better carbon sequestration.

Various companies such as Three-Dimensional Timberlands (3DT) have developed vacuum pyrolysis technology, which is capable of producing feedstock at 3 metric kilotons per hour. This technology is an intermediate pyrolysis process, having the ability to work on wood chips that are close to an inch. This gives a balanced output of biochar, non-condensable gasses, and bio-oil. Small manufacturing facilities majorly prefer pyrolysis technology for biochar production as the setup is less costly with low complexity compared to its counterparts. Other technologies include torrefaction, flash carbonization, and hydrothermal carbonization. Hydrothermal carbonization uses water and is expected to be one of the major technologies in the future. It is cost-effective and provides more yield than pyrolysis and gasification processes.

State Insights

California was a major consumer of biochar in the U.S., accounting for a revenue share of 15.7% in 2022. This demand is aided by the fact that in this state, agriculture is a significant economic component. California produces more than 400 types of cash crops, with notable products including avocados, almonds, rice, marijuana, grapes, and strawberries. The consumption of biochar is expected to be the largest in this state owing to increased yield and rising awareness among farmers.

The adoption of organic farming has boosted the consumption of the product in the state. As per the USDA, in 2021, California accounted for the highest number of certified organic farmers in the United States, with sales amounting to USD 3.55 billion. The state accounts for 90% of the country's organically grown nuts and almonds. Biochar has good water retention ability and thus, is used as a major soil additive in California as the country faces a major water crisis. California possesses an annual abundance of 9 million dry tons of agricultural residues and 14 million tons of forest residues, which hold the potential to be converted into low-carbon fuels and serve as a significant source of feedstock for biochar production.

Application Insights

Based on application, the agriculture segment dominated the market with a revenue share of 78.8% in 2022. Biochar is majorly used in agricultural farms as it enhances soil fertility, improves plant growth, and provides the required nutrition to crops. It is responsible for improving crop yields and enhancing overall agricultural productivity. Hemp farming which started in California in 1996 is currently gaining prominence as various medical practitioners are advising medical marijuana. States in the U.S. have started allotting acreage for the cultivation of hemp opening up a new market for biochar manufacturers. According to the NASS, total hemp production in the U.S. generated a revenue of USD 238 million in 2022. California is expected to remain the major state but is expected to face tough competition from Colorado and Montana.

Health & beauty products is another segment anticipated to witness good growth over the period. Biochar is an important substitute for microbeads that are used as exfoliants in nail polishes and soaps. This, along with the rising preference for natural ingredients in health and beauty items, is poised to boost product demand. The adsorption property of the product is majorly driving its consumption in cosmetic formulations. Further, odor control is another major application area that has been attracting a lot of interest from consumers, which can be attributed to the changing consumer needs and preferences.

Key Companies & Market Share Insights

The U.S. biochar market is consolidated with a limited number of players operating in it. Companies compete based on the quality of products offered by them and the technologies used for their manufacturing. The increasing focus of companies on new product launches and partnerships is expected to be a key trend in the market. For instance, in July 2023, a partnership consisting of Canadian and French companies, namely Airex Energy, Groupe Rémabec, and SUEZ, revealed their plans to invest $58.3 million in the construction of the largest biochar production facility in North America.

Key U.S. Biochar Companies:

- Black Owl U.S. Biochar

- Karr Group

- Aries Clean Technologies

- Pacific U.S. Biochar Benefit Corporation

- Advance Renewable Technology International (ARTI)

- Soil Reef LLC

- Avello Bioenergy

- Oregon U.S. Biochar Solutions

- New England U.S. Biochar

- Chargrow USA LLC

U.S. Biochar Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 233.3 million

Revenue forecast in 2030

USD 478.5 million

Growth rate

CAGR of 11.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, application, state

Key companies profiled

Black Owl U.S. Biochar; Karr Group; Aries Clean Technologies; Pacific U.S. Biochar Benefit Corporation; Advance Renewable Technology International (ARTI); Soil Reef LLC; Avello Bioenergy; Oregon U.S. Biochar Solutions; New England U.S. Biochar; Chargrow USA LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biochar Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biochar market report based on technology, application, and state:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pyrolysis

-

Gasification

-

Other Technologies

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Animal Feed

-

Health & Beauty Products

-

Other Applications

-

-

State Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

California

-

Texas

-

Kansas

-

Oklahoma

-

Idaho

-

Arizona

-

Other States

-

Frequently Asked Questions About This Report

b. In terms of revenue, the pyrolysis segment dominated the U.S. biochar market and accounted for a share of 64.9% in 2022. Biochar manufacturing is dominated by pyrolysis owing to its high-quality product and large production quantity.

b. Some of the key players in the U.S. biochar market include Black Owl U.S. Biochar, Karr Group, Aries Clean Technologies, Pacific U.S. Biochar Benefit Corporation, Advance Renewable Technology International (ARTI), Soil Reef LLC, Avello Bioenergy, Oregon U.S. Biochar Solutions, New England U.S. Biochar, Chargrow USA LLC.

b. The rising need for soil remediation and ascending demand for organic food are the key drivers for the U.S. biochar market.

b. The U.S. biochar market size was estimated at USD 203.4 million in 2022 and is expected to reach USD 233.3 million in 2023

b. The U.S. biochar market is anticipated to witness a revenue-based CAGR of 11.3% from 2023 to 2030 to reach USD 478.5 million by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.