- Home

- »

- Medical Devices

- »

-

U.S. Breast Conserving Surgery Market Size Report, 2033GVR Report cover

![U.S. Breast Conserving Surgery Market Size, Share & Trends Report]()

U.S. Breast Conserving Surgery Market (2025 - 2033) Size, Share & Trends Analysis Report By Procedure (Lumpectomy, Quadrantectomy, Segmental Mastectomy), By Product, By End Use (Hospitals, Ambulatory Surgery Centers), And Segment Forecasts

- Report ID: GVR-4-68040-660-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

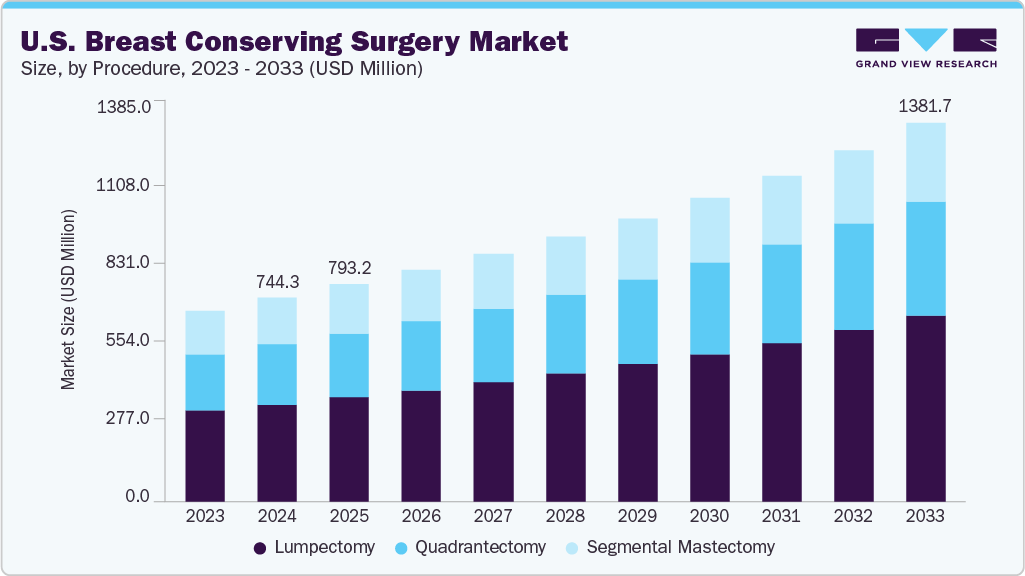

The U.S. breast conserving surgery market size was estimated at USD 744.32 million in 2024 and is projected to grow at a CAGR of 7.18% from 2025 to 2033. The market growth is attributed to the rising prevalence of early-stage breast cancer, supported by widespread mammography screening programs and patient awareness campaigns. These initiatives have led to an increase in early detection rates, making more patients eligible for breast-conserving procedures like lumpectomy and quadrantectomy. In addition, there is a strong preference for procedures that preserve breast appearance and function, especially among younger patients, which aligns with the principles of breast conserving surgery (BCS).

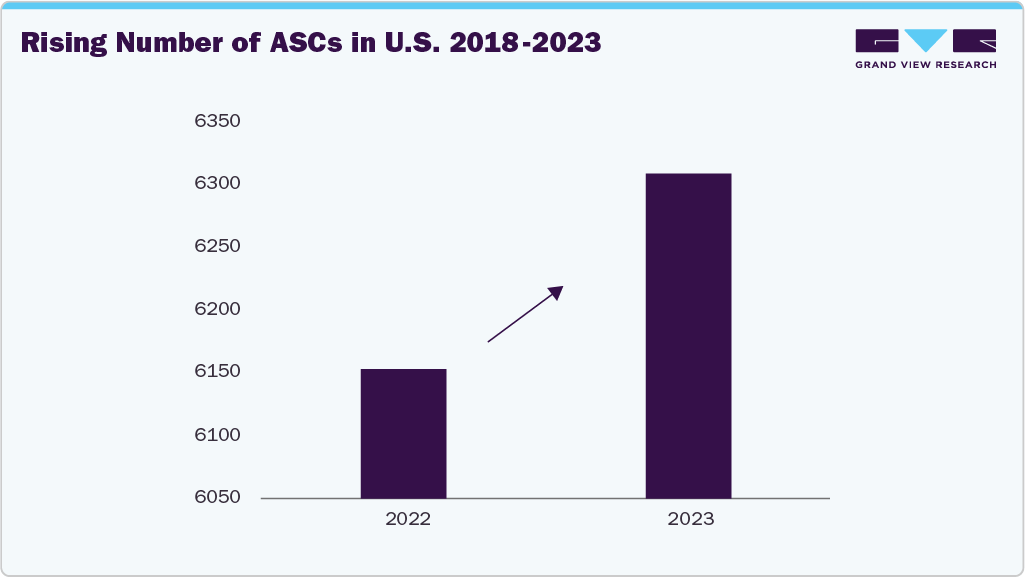

The growth of ambulatory surgical settings is a key driver of the U.S. market, offering a cost-effective, patient-friendly alternative to inpatient hospital procedures. These settings are increasingly equipped with advanced surgical technologies, experienced staff, and streamlined processes that make them well suited for procedures like BCS, which are typically less invasive and have shorter recovery times.

With rising healthcare costs and a growing emphasis on value-based care, both patients and payers are favoring ambulatory centers for their lower overhead, quicker turnaround, and reduced risk of hospital-acquired infections. For BCS specifically, outpatient settings provide a comfortable, efficient environment that supports early discharge, minimal disruption to daily life, and faster recovery, making the procedure more accessible and appealing. As the infrastructure and surgical capabilities of these centers continue to expand, their role in delivering breast-conserving treatments is expected to grow, significantly boosting the market.

Furthermore, advanced surgical technologies such as wireless localization devices, intraoperative margin assessment tools, and oncoplastic surgical techniques have been adopted, improving precision and cosmetic outcomes. The expanding network of ambulatory surgical centers (ASCs) and favorable reimbursement policies by Medicare and private insurers also enhance access and affordability. Coupled with the presence of leading medtech companies and robust healthcare infrastructure, these factors collectively drive the strong and sustained growth of the BCS market in the U.S.

Technological Advancements

Company Name

Product Launch

KOLs

Innoblative Designs

Innoblative Designs, Inc., a privately held medical device company focused on addressing unmet clinical needs in breast cancer treatment, has received Investigational Device Exemption (IDE) approval from the U.S. Food and Drug Administration (FDA). This approval allows the company to move forward with its U.S. feasibility study, which will assess the safety and effectiveness of the SIRA RFA Electrosurgical Device in patients undergoing breast-conserving surgery (BCS).

“I am thrilled to perform the first clinical case with the SIRA device and am impressed by its performance. It was extremely easy to use, and I was able to completely ablate the cavity post-lumpectomy without complications,” stated Dr. Yilmaz. “This is incredibly exciting as it allowed me to easily address residual cancer in the surrounding tissue at the time of the initial procedure, eliminating the need for my patient to undergo subsequent radiation therapy or reoperations. I believe this will be a game-changer with the potential to make breast conservation surgery a more palatable option for patients.”

Lumicell, Inc.

Lumicell, Inc. announced the U.S. commercial launch and first clinical use of its innovative LumiSystem, a technology designed to enhance breast cancer surgery. The system integrates two recently FDA-approved components: LUMISIGHT, an optical imaging agent that fluoresces in areas of suspected cancerous tissue, and the Lumicell Direct Visualization System (DVS), an advanced imaging device that offers real-time fluorescence-guided scanning of the breast cavity during lumpectomy procedures.

“Today, with LumiSystem’s commercial launch, we empower surgeons with a groundbreaking tool that detects cancer where and when it matters most, inside the breast cavity and in real-time,” said Howard Hechler, CEO of Lumicell. “This launch reflects Lumicell’s unwavering commitment to enhancing surgical outcomes for patients.”

Source: Innoblative Designs, Lumicell, Inc., Grand View Research

The rising prevalence of breast cancer is a key driver of the U.S. breast-conserving surgery (BCS) market, as it directly increases the number of patients requiring timely and effective treatment. According to a 2024 report by the American Cancer Society, an estimated 310,720 new cases of invasive breast cancer and 56,500 cases of ductal carcinoma in situ (DCIS) are expected to be diagnosed among women in the U.S. In addition, approximately 42,250 women are projected to die from breast cancer this year. There is a growing demand for surgical options that offer both oncologic control and preservation of breast aesthetics. Importantly, widespread screening programs and improved diagnostic technologies are enabling earlier detection of tumors, which are often suitable for breast-conserving procedures like lumpectomy. As more patients are diagnosed at Stage I or II, BCS is increasingly recommended as a standard of care, supported by clinical guidelines that demonstrate survival rates comparable to mastectomy. This shift toward less invasive, patient-preferred treatment is significantly propelling the adoption of BCS across hospitals and outpatient surgical centers nationwide.

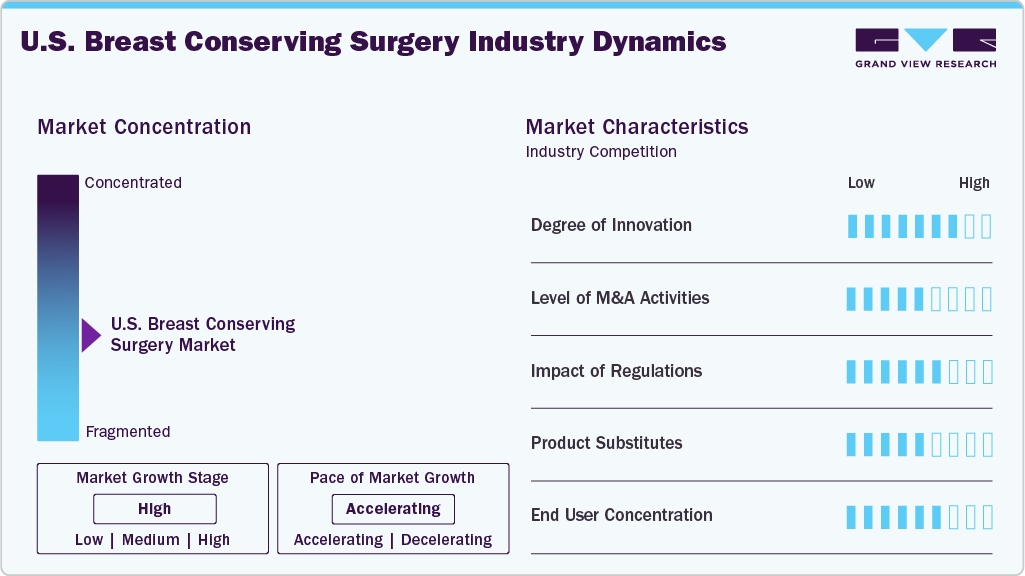

Market Concentration & Characteristics

The U.S. breast conserving surgery industry demonstrates high innovation, driven by ongoing advancements in surgical techniques, imaging technologies, and intraoperative guidance systems to improve precision and patient outcomes. One key example is the introduction of wireless tumor localization systems, such as magnetic seed markers and radiofrequency devices, which have replaced traditional wire-guided methods. These innovations offer greater surgical flexibility, reduce patient discomfort, and streamline workflow. In addition, technologies like AI-assisted intraoperative margin assessment and real-time fluorescence imaging systems such as LumiSystem are revolutionizing how surgeons identify and excise cancerous tissue while preserving healthy breast tissue. These tools significantly reduce the need for re-excisions and support superior cosmetic and oncologic outcomes.

Regulations play a critical role in shaping the market, ensuring the safety, effectiveness, and quality of surgical procedures and related technologies. The U.S. Food and Drug Administration (FDA) oversees the approval and post-market surveillance of surgical tools, tumor localization devices, and imaging systems used during BCS. Devices such as wireless localization markers, fluorescence imaging agents, and intraoperative margin assessment systems must meet stringent 510(k) or PMA requirements, which can affect the pace of innovation and market entry.

The U.S. market has witnessed a moderate to high level of merger and acquisition (M&A) activity, primarily driven by the need for companies to expand their technological capabilities, product portfolios, and market reach. Larger medical technology firms are actively acquiring startups and niche innovators that specialize in wireless localization, intraoperative imaging, and AI-powered margin assessment to stay competitive and accelerate time-to-market. These acquisitions allow for the integration of advanced, patient-centered solutions into broader surgical and oncology offerings. The market has also seen strategic investments and consolidations aimed at scaling operations, simplifying distribution, and enhancing service offerings across hospitals and ambulatory surgical centers.

In the U.S. market for breast-conserving surgery (BCS), product substitutes primarily include mastectomy procedures, percutaneous tumor ablation techniques (such as cryoablation and radiofrequency ablation), and in select cases, non-surgical therapies like neoadjuvant chemotherapy or radiation therapy. Mastectomy, while more invasive, is often preferred in cases of multifocal disease, genetic predisposition (e.g., BRCA mutations), or patient choice for complete risk reduction. Similarly, tumor ablation is emerging as a minimally invasive alternative for small, early-stage tumors, particularly among patients unfit for surgery.

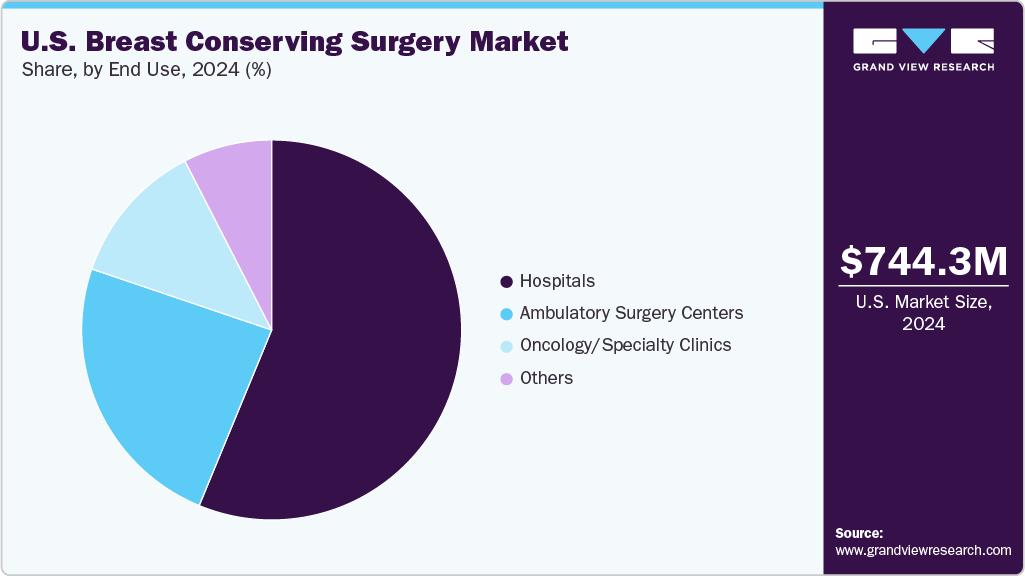

The U.S. market for breast-conserving surgery (BCS) shows a high level of end user concentration, with the majority of procedures performed in large hospitals, academic medical centers, and high-volume cancer treatment facilities. These institutions are equipped with the necessary infrastructure, such as advanced imaging systems, wireless localization technologies, and trained oncoplastic surgeons, to support the technical and aesthetic demands of BCS. Ambulatory surgical centers (ASCs) are also emerging as key end users, especially for early-stage cases, due to their cost efficiency and ability to perform outpatient procedures. However, the market remains concentrated among a relatively small group of healthcare providers who possess the capacity to adopt advanced surgical technologies and meet regulatory requirements. This concentration allows for more standardized care delivery but may also limit access to BCS in rural or under-resourced areas, where mastectomy may still be more commonly practiced due to infrastructure or expertise limitations.

Procedure Insights

Based on procedure, the lumpectomy segment held the largest share in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the high prevalence of early-stage breast cancer diagnoses, driven by routine mammography screening and growing awareness around breast health. Lumpectomy, which involves the surgical removal of a tumor along with a small margin of surrounding tissue, is the preferred first-line surgical treatment for patients seeking effective cancer control with minimal cosmetic disruption. It is widely accepted as an oncologically safe alternative to mastectomy for Stage I and II cancers, with equivalent long-term survival outcomes when followed by radiation therapy.

Furthermore, technological advancements such as wireless localization, real-time imaging, and intraoperative margin assessment tools have made lumpectomy more precise and efficient, reducing reoperation rates and improving outcomes. Its shorter recovery time, lower psychological impact, and compatibility with outpatient settings like ambulatory surgical centers also contribute to its broad clinical adoption, firming its position as the leading procedure in the U.S. breast conserving surgery industry.

Product Insights

The surgical excision devices segment held the largest share in 2024. This growth can be attributed to its essential role in performing core procedures such as lumpectomy and quadrantectomy. These devices, which include scalpels, electrosurgical units, ultrasonic dissectors, and radiofrequency ablation tools, are fundamental to tumor removal and are used in nearly every breast-conserving surgery. Their reliability, clinical familiarity, and compatibility with various surgical techniques make them indispensable in both hospital and ambulatory settings.

The tumor localization devices segment is expected to witness the fastest CAGR of 8.97% over the forecast period. This growth can be attributed to the increasing shift toward precision-guided, minimally invasive procedures. As early-stage, non-palpable breast tumors are detected more frequently through advanced screening methods, the demand for accurate intraoperative localization has surged. Traditional wire-guided localization, while still in use, is being rapidly replaced by wireless alternatives such as radiofrequency tags, magnetic seed markers, and radar-based systems that offer greater scheduling flexibility, improved patient comfort, and higher surgical accuracy. These next-generation localization tools enable surgeons to precisely target tumor sites while minimizing healthy tissue disruption, ultimately enhancing cosmetic outcomes and reducing reoperation rates.

End Use Insights

The hospitals segment dominated the market in 2024 in terms of market share. This can be attributed to their ability to offer comprehensive surgical care, advanced technologies, and access to multidisciplinary cancer treatment teams. Hospitals, especially large academic medical centers and specialized oncology facilities, are equipped with the infrastructure required to perform complex BCS procedures, such as lumpectomy with intraoperative imaging, oncoplastic reconstruction, and wireless localization.

However, the ambulatory surgical centers segment is projected to witness the fastest CAGR over the forecast period. This can be attributed to the rising demand for cost-effective, outpatient-based surgical care. ASCs offer several advantages, including shorter procedure times, reduced hospital stays, lower infection risks, and greater operational efficiency, making them an ideal setting for early-stage breast cancer surgeries like lumpectomy. The increasing adoption of minimally invasive techniques, along with advancements in wireless localization, real-time imaging, and enhanced recovery protocols, enables BCS to be performed safely and effectively in outpatient settings. In addition, favorable reimbursement frameworks, growing patient preference for same-day discharge, and the nationwide expansion of ASCs are accelerating this shift.

Key U.S. Breast Conserving Surgery Company Insights

Some of the key companies include Hologic, Inc; Argon Medical Devices; Merit Medical Systems; KUBTEC; Stryker, among others. They provide a broad range of breast conserving surgery solutions through their strong distribution and supply channels across the world. Leading companies are involved in new product launches, strategic collaborations, mergers & acquisitions, and regional expansions to gain the maximum revenue share in the industry. Mergers & acquisitions help companies to expand their businesses and market presence.

Key U.S. Breast Conserving Surgery Companies:

- Hologic, Inc

- Argon Medical Devices

- Merit Medical Systems

- KUBTEC

- Stryker

- Mammotome (Danaher)

- CairnSurgical Inc.

- Lumicell Inc

- Innoblative Designs

- Perimeter Medical Imaging AI

Recent Developments

-

In May 2025, Perimeter Medical Imaging AI, Inc., a commercial-stage medical technology company, announced that detailed results from its pivotal trial evaluating the next-generation B-Series OCT with ImgAssist AI 2.0 ("Perimeter B-Series") will be presented during the scientific session of the 26th Annual Meeting of the American Society of Breast Surgeons (ASBrS), scheduled to take place in Las Vegas, NV, from April 30 to May 4, 2025.

-

In January 2025, Lumicell, Inc. announced the U.S. commercial launch and first clinical use of its innovative LumiSystem, a technology designed to enhance breast cancer surgery. The system integrates two recently FDA-approved components: LUMISIGHT, an optical imaging agent that fluoresces in areas of suspected cancerous tissue, and the Lumicell Direct Visualization System (DVS), an advanced imaging device that offers real-time fluorescence-guided scanning of the breast cavity during lumpectomy procedures.

-

In April 2025, Innoblative Designs, Inc., a privately held medical device company focused on addressing unmet clinical needs in breast cancer treatment, received Investigational Device Exemption (IDE) approval from the U.S. Food and Drug Administration (FDA). This approval allows the company to move forward with its U.S. feasibility study, which will assess the safety and effectiveness of the SIRA RFA Electrosurgical Device in patients undergoing breast-conserving surgery (BCS).

U.S. Breast Conserving Surgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 793.22 million

Revenue forecast in 2033

USD 1,381.69 million

Growth Rate

CAGR of 7.18% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, product, end use

Country scope

U.S.

Key companies profiled

Hologic, Inc; Argon Medical Devices; Merit Medical Systems; KUBTEC; Stryker; Mammotome (Danaher); CairnSurgical Inc.; Lumicell Inc; Innoblative Designs; Perimeter Medical Imaging AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Breast Conserving Surgery Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. breast conserving surgery market report based on procedure, product, and end use:

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Lumpectomy

-

Quadrantectomy

-

Segmental Mastectomy

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tumor Localization Devices

-

Wire-guided localization

-

Magnetic seed localization

-

Radar-based localization

-

Others

-

-

Surgical Excision Devices

-

Electrosurgical units/devices

-

Scalpels/forceps/retractors/clamps

-

Vacuum-assisted biopsy systems

-

Others

-

-

Margin Assessment Devices

-

Intraoperative Imaging & Navigation Devices

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgery Centers

-

Oncology/Specialty Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. breast conserving surgery market size was estimated at USD 744.32 million in 2024 and is expected to reach USD 793.22 million in 2025.

b. The U.S. breast conserving surgery market is expected to grow at a compound annual growth rate of 7.18 % from 2025 to 2033 to reach USD 1.38 billion by 2033.

b. Lumpectomy segment dominated the U.S. breast conserving surgery market with a share of 47.66% in 2024. This growth can be attributed to the high prevalence of early-stage breast cancer diagnoses, driven by routine mammography screening and growing awareness around breast health.

b. Some key players operating in the U.S. breast conserving surgery market include Hologic, Inc; Argon Medical Devices; Merit Medical Systems; KUBTEC; Stryker; Mammotome (Danaher); CairnSurgical Inc.; Lumicell Inc; Innoblative Designs; Perimeter Medical Imaging AI

b. Key factors that are driving the market growth include the rising incidence of breast cancer and a growing emphasis on early detection and intervention. There is an increasing preference among patients for procedures that preserve both cosmetic appearance and breast function, driving demand for less invasive surgical options

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.